Digital Wallet

Digital Wallet for Business: 5 Effects on Retail Success

With most Millennials and Gen-Zers having one or more mobile devices at their disposal, the importance of a digital wallet for business is hard to overestimate. Consumers want to buy online, from their phones, in as few clicks as possible — and it’s up to forward-thinking businesses to satisfy this demand.

This has an impact beyond digital wallet companies — any eCommerce or retail business aiming to survive the recession needs to set up its payment system to accept digital wallets.

How should you prepare for the oncoming economic downturn? By securing a healthy bottom line and maximizing your revenues. And what’s the best way to ensure this outcome? Digitalizing your customer journey to provide a smooth mobile-first browsing and checkout experience. Indeed, Forrester forecasts 70% of retail sales will be digital-influenced by 2027.

This article explores the concept and features of digital wallets, their impact on eCommerce, the ways they affect customer behavior, and how custom digital wallet development helps maximize the benefits of a digital wallet for business. Without further ado — let’s dive in.

Revolutionizing Retail Transactions: The Power of Digital Wallets for Business

While this service is poised to become ubiquitous in the years to come, it’s useful to clearly understand what digital wallets are and their importance for your business.

Understanding the Concept and Functionality of Digital Wallets

Digital wallets are secure mobile repositories enabling customers to pay for goods and services on various sites without having to enter their payment details every time. The customer simply saves their credit card details to the wallet and no longer has to waste time on authentication or PINs for every transaction.

Outside of eCommerce, eWallets free customers from carrying around large sums of cash and help mitigate the risk of card details theft at ATMs or simple robbery. Should a device with access to a digital wallet be lost or stolen, the access can be easily revoked from any other device a user has access to.

These features have made digital wallets one of the most popular payment choices for consumers around the world. And businesses should react fast.

Why are Digital Wallets Crucial for eCommerce Businesses?

Integrating digital wallets with your checkout page helps address several concerns and improves your customer conversion rates. It allows:

Improving the mobile checkout experience

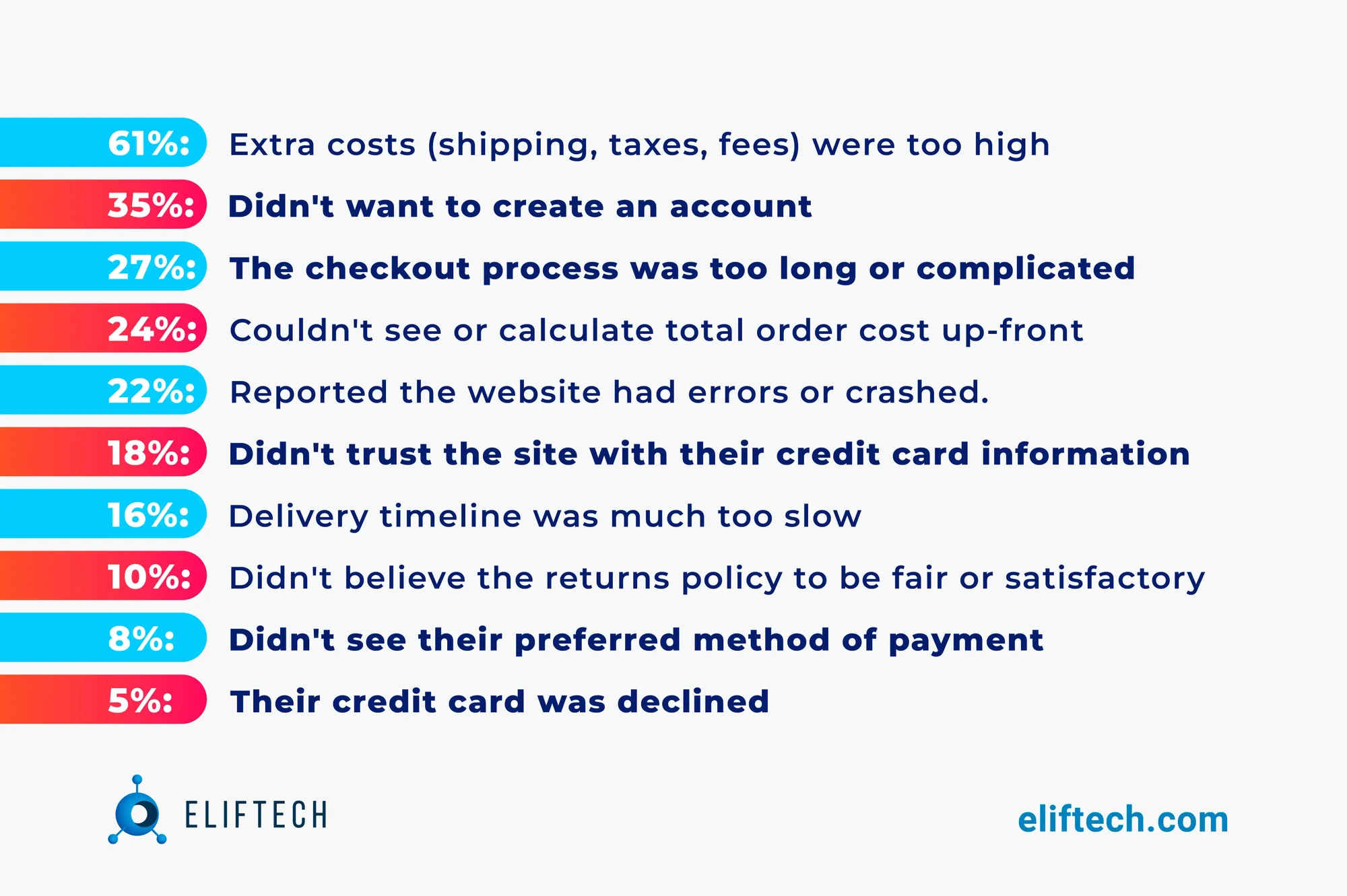

According to a SaleCycle report, around twice as many customers abandon their carts on mobile devices. Often this is down to a clunky checkout process with multiple fields for data input and user authentication/authorization. Adding a digital wallet option, like PayPal or Amazon, allows your customers to accomplish the transaction in a couple of clicks with banking data and the shipping address already stored in the app.

Facilitating user authentication

Some of the main reasons for shopping cart abandonment at checkout are the need to create an account, pay extra for delivery, or a long and complicated checkout process.

Digital wallets have a significant impact on revenue growth, tripling it by allowing visitors to complete purchases without the need to create an account or go through payment authentication processes. All their banking information is already with the digital wallet providers that store it securely within the app.

Increasing authorization rates

With GDPR and PSD2 coming into effect, issuing banks expect a much more significant degree of security from eCommerce websites when handling online purchases. 3D Secure payments involving SCA (Strong Customer Authentication) rely on something only a customer knows (PIN code, password), has (token), or biodata (Touch ID, Face ID, retina scans, voice patterns, etc.). Digital wallets often have this data by default, meeting the 3DS requirements and increasing payment authorization rates by the issuer banks.

All in all, there are multiple benefits to using a digital wallet for merchants. And even putting the technical part aside, there are behavioral advantages too.

How Digital Wallets Influence Consumer Behavior

Let’s see how having a digital wallet for business as a payment option can help grow your revenues from a psychological standpoint.

Convenience and Accessibility

Digital wallets are useful beyond paying for goods on eCommerce websites. Digital wallets are used to pay for goods in online shops, subscription services, pizza orders, Uber, booking lodging at an Airbnb or tickets. This is what makes it a “preferred” means of payment.

Offering customers a payment method they are accustomed to and have confidence in is much likelier to result in a purchase than methods that require them to enter billing details and go through an authentication process. Besides, digital wallet providers’ services are mobile-friendly by default, so they can be accessed from any mobile device with ease.

New Shopping Habits

The pandemic brought about new consumer habits and patterns that are here to stay. People are now accustomed to and confident in buying online. However, as multiple eCommerce and retail platforms flourished during the pandemic, consumers have little incentive to remain loyal to a single brand or vendor.

This means that ensuring a fluent and streamlined digital shopping experience is paramount to ensuring your one-time visitors turn into paying customers.

Impulse Buying and Spontaneous Purchases

The key difference between eCommerce and brick-and-mortar shopping is not having to carry around cash or credit cards. People simply browse the internet, and if they find something that catches their attention, they hit that “Add To Cart” button, often without giving it much thought. This results in impulse buying or spontaneous purchases.

Leading your visitors to this purchase is a marketing, UX, and eWallet design challenge. But ensuring the purchase is ACTUALLY just a couple of clicks away is a task for the checkout page. This once again emphasizes the need for a digital wallet for business — to make completing purchases a breeze for customers.

Customer Engagement and Loyalty

Digital wallet providers for eCommerce and retail allow your website visitors to shop reliably and securely from the comfort of their devices. After all, online shopping where the checkout works smoothly results in better engagement and customer satisfaction with the process.

What’s more, digital wallets are hubs for multiple purchasing patterns and subscriptions, which makes them ideal platforms for cashback, discounts, and eWallet loyalty programs. Customers love cashback, and when they can apply their coupons and loyalty points to get a discount at your store, they are more inclined to shop with you.

As you can see, businesses should combine technology and psychology to maximize customer satisfaction and conversion rates — and increase revenue as a result. Now, let’s talk about the other important aspects of using digital wallets for your eCommerce or retail business.

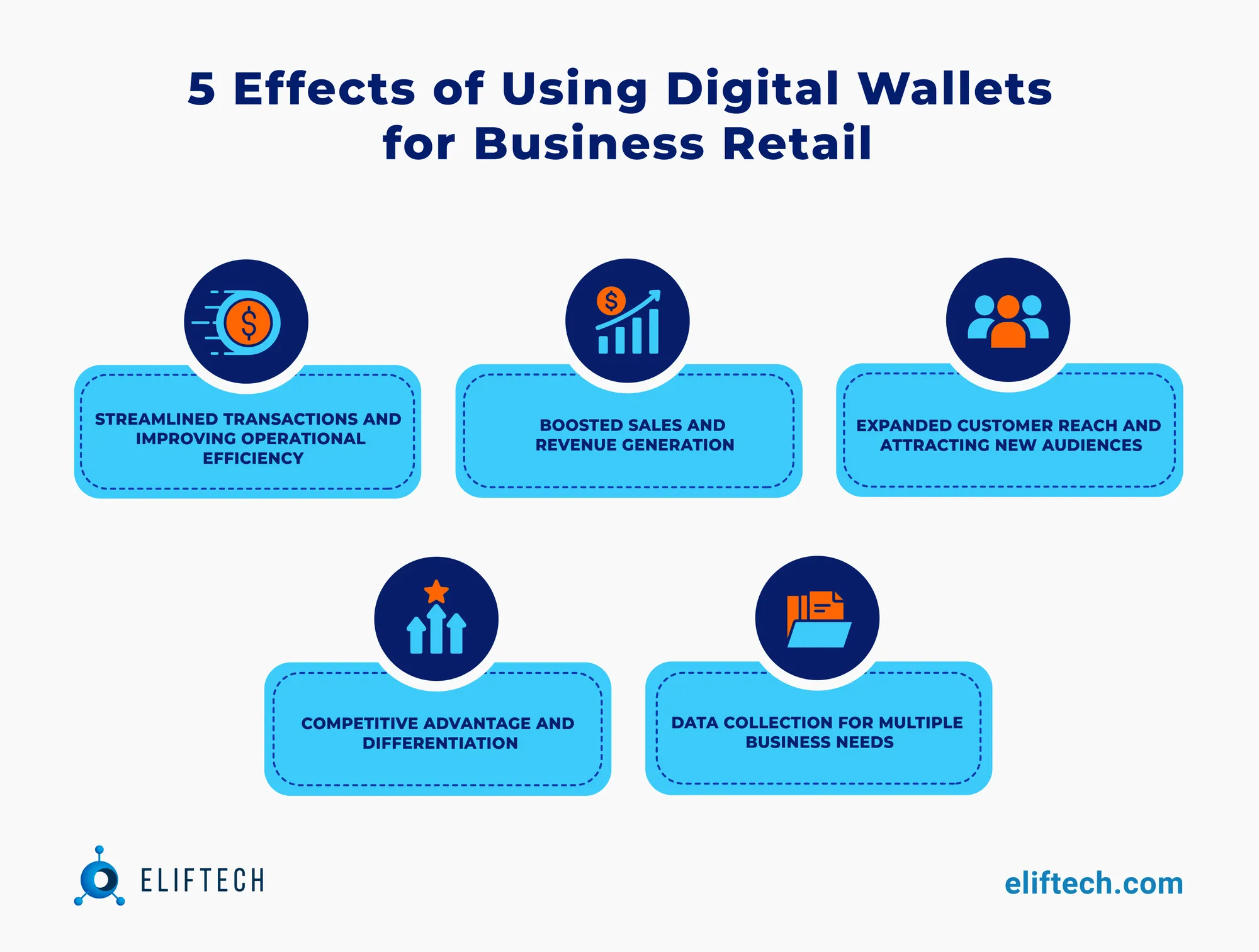

5 Effects of Using Digital Wallets for a Retail Business

While securing a healthy bottom line is essential, it’s just one of the five major benefits of using a digital wallet for business. They include:

Streamlined Transactions and Improved Operational Efficiency

Simpler authentication, streamlined authorization, built-in security, and the liability shift to digital wallet providers are all excellent drivers for improving operational efficiency. When visitors don’t file tons of chargeback claims due to a clunky checkout process, your business gets a much more predictable and transparent cash flow.

Boosted Sales and Revenue Generation

As explained above, providing visitors with convenient access to their preferred means of payment ups the chance of them completing planned — or spontaneous — purchases at your eCommerce shop. As a result, online retail platforms can see an up to 35% increase in their conversion rates, significantly boosting their revenue generation capabilities.

Expanded Customer Reach

According to Payments Dive, nearly 60% of abandoned carts are caused by the absence of a customer’s preferred checkout method. So if your checkout enables your customers to use their preferred means of payment in a couple of clicks, you get a completed order — and then another one.

When an online store proudly advertises that it accepts payments with familiar digital wallets, customers are happy to shop there. Familiarity creates comfort, and comfort attracts others. Where one person has used Apple Pay, many more may join.

Competitive Advantage and Differentiation

An eCommerce website that supports multiple digital wallet companies is far more convenient than one that only accepts Visa, AmEx, or Maestro. The more wallets for merchants you have, the wider the audience you can serve worldwide. If your competitors are lagging in this area, then you’ll definitely have an advantage.

Data Collection for Multiple Business Needs

Integration with digital wallet providers like Google Pay enables easy implementation of various analytical features. Both Google Analytics and other marketing tools like heatmaps, survey forms, and chatbots can help gather statistics on the customers’ journey, like:

- Tracking when the customers go to the checkout page

- Determining the most commonly selected options

- Measuring how long it takes them to complete the payment

- Monitoring whether they come back once they abandon the cart

- Calculating the average session time

- Identifying the most viewed FAQ articles, and so on

Collecting and analyzing this data helps adjust your eCommerce or retail website to ensure maximum efficiency of operations and increase your revenue.

Why Consider Custom Digital Wallet Development?

Although we believe that digital wallets offer significant benefits to both retail businesses and their clients, there are also some disadvantages of wallets in online commerce. However, they are few and not severe:

- Each integration is charged on a monthly subscription basis, and some additional fees might apply (integration, maintenance, payment processing fees, etc.). All of this adds up over the years.

- While most digital wallets for a business come with extensive developer documentation on their API integration, their capabilities are strictly limited to predefined options.

- Combining marketing data from different digital wallets can be challenging, as they all have separate tools for data analytics.

This makes custom digital wallet development a viable alternative to off-the-shelf solutions offered by major digital wallet providers. Developing a custom digital wallet for your retail business allows addressing these challenges.

Observe:

- By developing a proprietary digital wallet solution, you only pay digital wallet companies for integration and payment processing, saving on other fees in the long run.

- You can include only the necessary features for your MVP digital wallet development to minimize its time-to-market and adjust the platform according to your evolving business needs.

- A centralized eWallet platform provides much better data collection and analytics capabilities as compared to disparate components from multiple vendors.

ElifTech has more than ten years of software development experience under our belt. We can cover all aspects of software delivery for startups and enterprises alike. Digital wallet development is one of our domains of expertise, and we can solve any challenges in this field.

Are you ready to future-proof your business, increase revenues and optimize operational experiences by integrating a digital wallet for business with your website? Contact ElifTech, and we will help you achieve your business goals.

Browse our case studies and get actionable insights to drive your success

See more