Wealth Management

Wealth Management Solutions: Leveraging Technology for Better Investment & Portfolio Management

Post-pandemic studies on wealth and asset management revealed concerning trends. The dynamics between investors and advisors have shifted while looming tax regulations have caused widespread worry. This uncertainty has prompted investors to seek new avenues for generating returns and comprehensive financial planning.

A staggering 40% of investors have expressed the need for digital financial tools to effectively manage their wealth, with 89% specifically indicating a preference for mobile apps. This highlights the importance of implementing strategies for wealth management with robust software capable of meeting the diverse needs of stakeholders.

For this reason, we’re here to explore how today’s wealth management solutions can streamline advisory portfolio management, automate tasks and empower informed decisions.

Managing Investment Tracking & Portfolio Management with Wealth Management Solutions

The future of investment tracking and portfolio management is shaped by various factors, wealth management solutions being one of them.

According to KMPG, the future of wealth management is influenced by evolving client expectations, intense competition, and economic factors.

- Evolving client expectations: Clients seek high-quality, affordable services with personalized human interaction.

- Intense competition: The tech revolution disrupts traditional business patterns, leading to digital transformation, price-comparison tools, robo-advisors, and real-time investment data.

- Economic factors: Trends like a shrinking population and potential wage increases significantly impact the fintech industry, including wealth management.

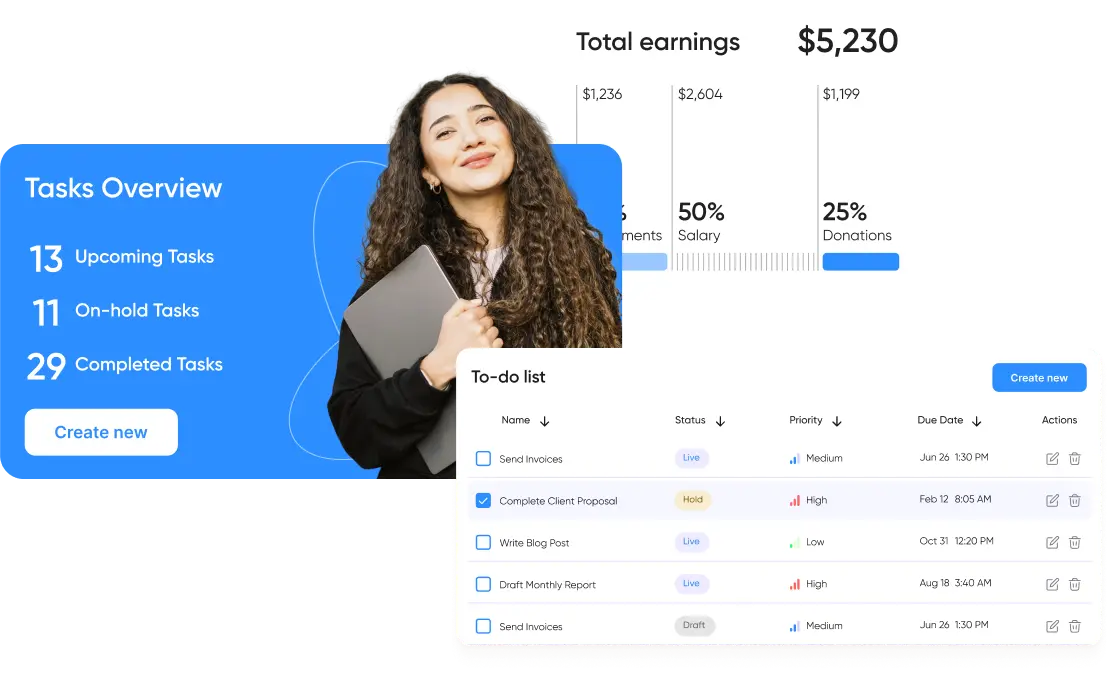

Overall, technology in wealth management practices is crucial for businesses to thrive in this era of wealth management digital transformation. The days of manual calculations and paperback spreadsheets are gone as wealth management now utilizes interactive dashboards with live analytics.

Investment Tracking and Portfolio Management: Key Features

A winning investment and portfolio management solution has to possess certain characteristics. Here is the overview of the key features that are implemented into top wealth management platforms:

Automated data aggregation. Using spreadsheets in investment management makes operations prone to mistakes. As the studies show, 88% of spreadsheets come with errors. A Canadian company TransAlta came into $24 million of damages after an error in spreadsheets. Instead, the software helps you aggregate financial data from multiple sources like brokerage, banks account, and investment platforms, saving time and ensuring accuracy.

Real-time portfolio monitoring. Tracking the progress of your investment portfolio contributes to timely decision-making, identifying inefficiency, and evaluating performance.

Performance analysis and reporting. With the growth of the portfolio, the risk of underperforming sectors increases. Detailed analysis and reporting help investment managers discover the elements; for example, a specific stock is experiencing challenges. Using that information, you can sell the stock and reallocate the funds.

Asset Allocation Optimization. This feature is all about enhancing your capabilities of diversification. Whenever you travel somewhere, you have clothes suitable for various weather conditions. The same happens with investments. You need to be prepared for the investment climate to change. With the algorithms and modeling techniques provided by the software, you can optimize the asset allocation based on the investment horizon.

Tax Planning and Optimization. The feature all wealth management fintech companies look for in software is tax optimization. The solution should help identify tax-loss harvesting opportunities and optimize capital gains/losses.

Implementing Wealth Management Solutions: Best Practices

Video calls, mobile apps, and websites are going to be the primary source of communication and conducting business for investors in the nearest future, according to Deloitte's research. It proves that the investment industry is going digital, and it is just the right time to equip your business with the top wealth management software products. Here are some tips and best practices you can follow to make the right decisions for your business.

Collaborating with Experienced Software Development Partners

What makes a company a good fit to be your tech partner? Both wealth management startups and established enterprises look for expertise. To be specific, the following categories of expertise:

- Software development. ElifTech has contributed to numerous projects across industries. Our software product development process is Agile and customer-oriented. If you have questions about MVP or the architecture of your wealth management solution, contact us for a consult.

- Financial Industry knowledge. We know how to develop goal-based investing software and ensure that all features you need are included. Our FinTech expertise allows us to consult and share the lessons learned from our previous projects. We continuously monitor and test new technologies on the market and know what fits best for specific industries.

- Project Management and Collaboration. Eliftech team’s mastered communication skills over the years of experience. We ensure smooth coordination with stakeholders throughout the whole development cycle.

Seamless Integration with Existing Systems and Processes

Seamless integration with the existing systems means convenience for all users of the platform, be they financial advisors or investors. Here are a couple of examples of when integration is necessary and beneficial:

- BlackRock, an investment company, offers an Aladdin platform that integrates with various internal and external systems, including trading platforms and risk management tools.

- Fidelity Investments, an asset management firm, introduced a wealth management solution that integrates with CRM. This way, advisors have access to clients' financial profiles and provide personalized recommendations.

- Charles Schwab, a financial services provider, introduced a solution that easily integrates with brokerage and investment management systems. The unified experience they deliver increases client satisfaction and reduces friction.

User-Friendly Interface Design and Intuitive User Experience

Ensuring a user-friendly interface provides data visualization. When complex financial data is visually engaging and digestible, users can understand portfolio performance and asset allocation as well as risk exposures easily. Graphs, interactive charts, and customizable dashboards help users explore data, see trends, and valuable insights to support investment decisions. An investor or an advisor should be able to access account information, review performance reports, and communicate via the platform. Eliftech is experienced in developing wealth management technology solutions that perfectly match the customer's needs.

Robust Security Measures and Data Protection

Thinking about robust security measures in wealth management technology solutions is important because of sensitive information, compliance and regulatory requirements, and cybersecurity risk mitigation. Prioritizing security for wealth advisors means establishing trusted partners in managing clients' wealth.

Maximizing the Potential of Wealth Management Solutions

Customized wealth management solutions grant more opportunities to their users. It's possible to maximize their potential and make them future-proof and durable. For example, making cloud-based wealth management software ensures scalability and flexibility of the platform and affordability in terms of further expenses. Besides, you can implement artificial intelligence and machine learning and design a mobile application to increase the success of your solution.

Leveraging Data Analytics and Artificial Intelligence

The AI market is growing strongly, and its current value is 100 billion U.S. dollars is expected to multiply by twenty by 2030. Data analytics and AI algorithms contribute to the development of wealth management solutions in numerous ways, one of them being market monitoring and real-time insights. Technology helps investors and advisors track market sentiment and analyze news articles, social media feeds, and other sources to recognize emerging trends and market opportunities early. With AI, your solution can be enhanced with the features like:

- Robo-advisory

- Intelligent risk assessment

- Natural Language Processing

- Fraud Detection and Compliance

- Predictive Analytics for Market Trends

Read more: AI and Machine Learning in Wealth Management: Use Cases & Opportunities

Incorporating Machine Learning for Smarter Investment Decisions

The market size of machine learning in FinTech is growing and will reach 49.43 billion U.S. dollars by 2028. Machine learning, along with AI, helps businesses process data quickly. The investment market is dynamic, and the secret to success is in making smart decisions at the right time. Hence, ML and AI are the tools that upgrade decision-making for investors and financial advisors. With the help of ML, you can get the following:

- Eliminate human error

- Monitor the market in real-time

- Introduce adaptive portfolio management

Expanding Access and Convenience with Mobile Apps

The number of mobile app downloads is stunning, and the forecasts say that it will only go up. 2023 is going to witness 229 billion downloads. Interesting to know that half of those are accounting apps. Businesses won't progress without mobile applications, and user engagement will suffer significantly. So, adding mobile access to your platform is not optional but necessary. The benefits of apps are the following:

- On-the-go access

- Better user experience

- Real-time alerts and notifications

Embracing Future Innovations in Wealth Management

While the tech world offers multiple business opportunities, not all are equally beneficial for FinTech. Particular attention is paid to blockchain, big data, predictive analytics, AI/ML, AR, and VR. Embracing these innovations transforms the way businesses communicate with clients, deliver their services, and of course, charge for them. Technology balances the quality of service and its price, making clients more satisfied and loyal to brands.

Blockchain in Wealth Management. Although the technology was first applied in banking and retail, wealth management found benefits in using it for real-time settlement models, single points of truth, and smart contracts. Deloitte research shows that applications of blockchain in wealth management specifically are vast and include:

- Digital assets and Tokenization

- Smart contracts and automated processes

- Streamlined cross-border transactions.

Augmented and Virtual Reality in Wealth Management. AR and VR can create immersive experiences for clients by visualizing their investment portfolios in a virtual environment. Interactive 3D presentations of clients' holdings, asset allocation, and performance metrics can be explored from any corner of the world. Visualization helps clients understand their investments better and make informed decisions.

Besides, AR and VR contribute to virtual communication and cooperation. Video conferencing participants can share documents, presentations, and other information in the virtual environment, ensuring that all stakeholders are well-informed.

Conclusion

Top wealth management software products revolutionize the way investments work. It enables the integration of various technologies that improve the efficiency of the investment portfolio in ways never known before. Wealth management solutions provide accessibility, real-time data insights, scalability, and enhanced user experience. Implementing these solutions allows companies to optimize investment tracking and client engagement, leading to better investment.

Whether you have an existing platform or want to design a brand-new product for your business, ElifTech has the skills and knowledge to guide you. You can incorporate AI/ML algorithms, build cloud-based platforms, or migrate to the cloud with us. Contact us and let us take care of all the tech aspects of your business so you can continue developing your business goals and strategies.

Browse our case studies and get actionable insights to drive your success

See more