AI

Understanding AI in FinTech: A Deep Dive into Future Trends

Money is a sensitive topic, hence, FinTech is, too. Money loves security. FinTech loves AI. Is that a conflict? That depends on how the AI in FinTech is implemented; artificial intelligence does have its inherent risks when it comes to security, and it can also greatly enhance said security. As we take our hats off to the pioneering AI FinTech startups, let’s analyze what makes artificial intelligence for finance a real player, how the industry is being reshaped, and what use cases there are to note (Spoiler: there are quite a few, and it’s not just about startups – established companies are adopting the technology even though they could have theoretically ignored it – but chose not to).

The Role of AI in FinTech

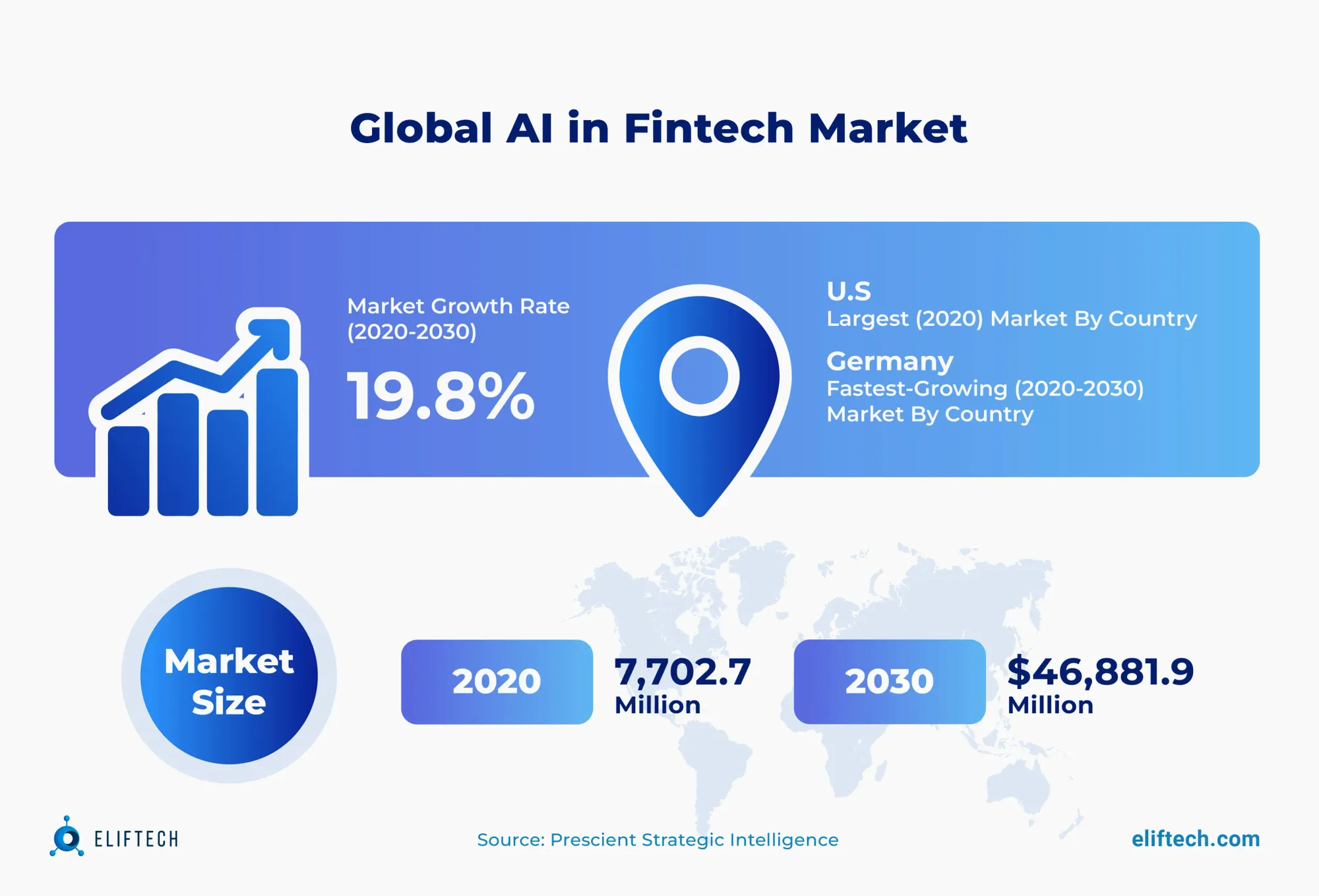

Even a few years ago, 85% of financial firms reported they were currently using AI. Meanwhile, according to market insights from Mordor Intelligence, the global artificial intelligence fintech market is poised to reach an astounding $22.6 billion by 2025. Artificial intelligence and finance seem to be a perfect pairing, every other LinkedIn guru “shipping” them together.

At the same time, no one except maybe a few was truly prepared for the rapid ascent of AI in the fintech realm a few years ago. It is a seismic shift that is reshaping how financial services are delivered, consumed, and optimized. From burgeoning investments to emerging players, the landscape is that of an industry on the cusp of change.

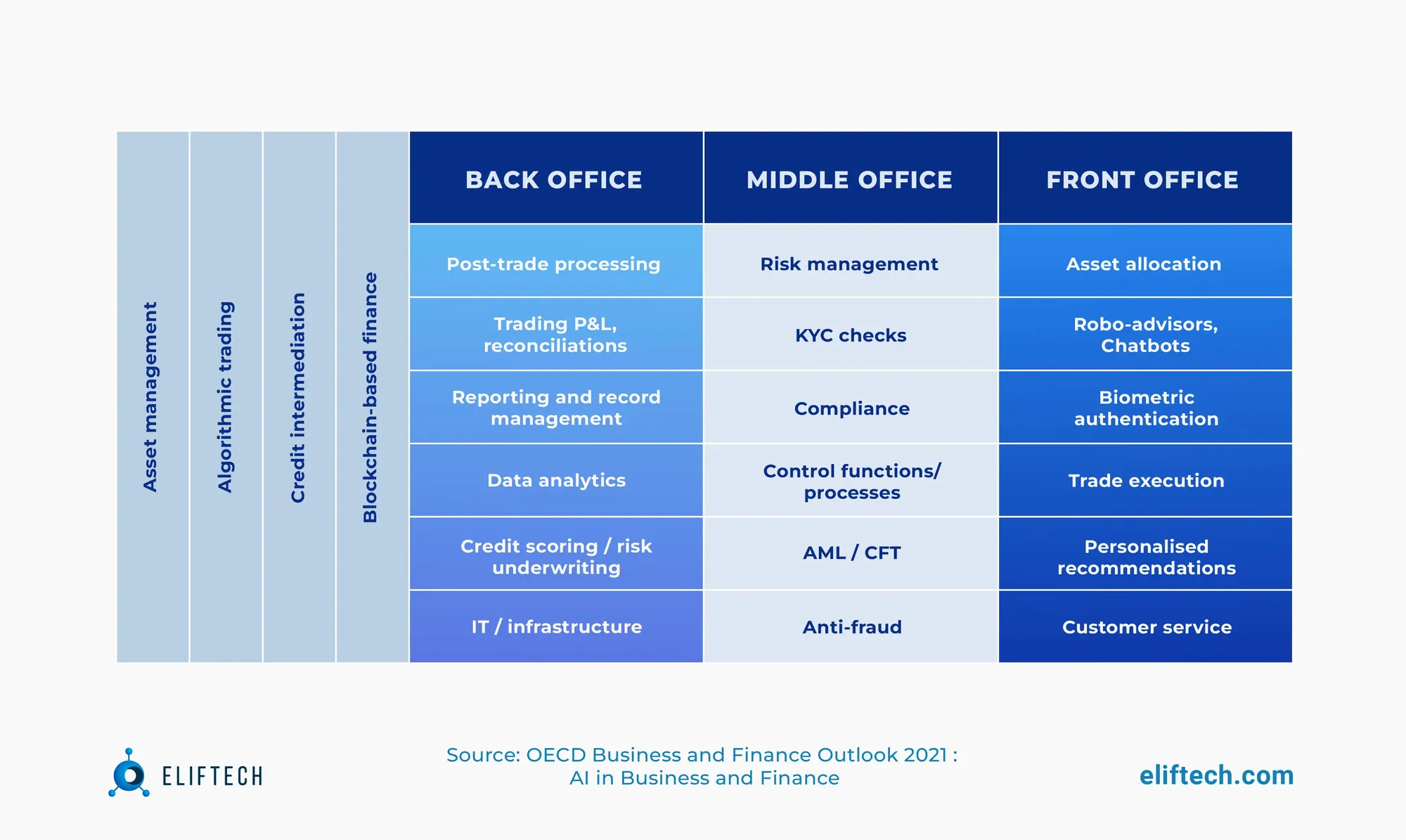

As AI continues to permeate every facet of the fintech landscape (and every actually means every here, if you care about the case studies below), its impact is felt across multiple domains. From enhanced fraud detection and risk management to personalized customer experiences and algorithmic trading, the ripple effects of artificial intelligence in FinTech are transforming the traditional paradigms of financial operations.

Why Adopt AI for Financial Services?

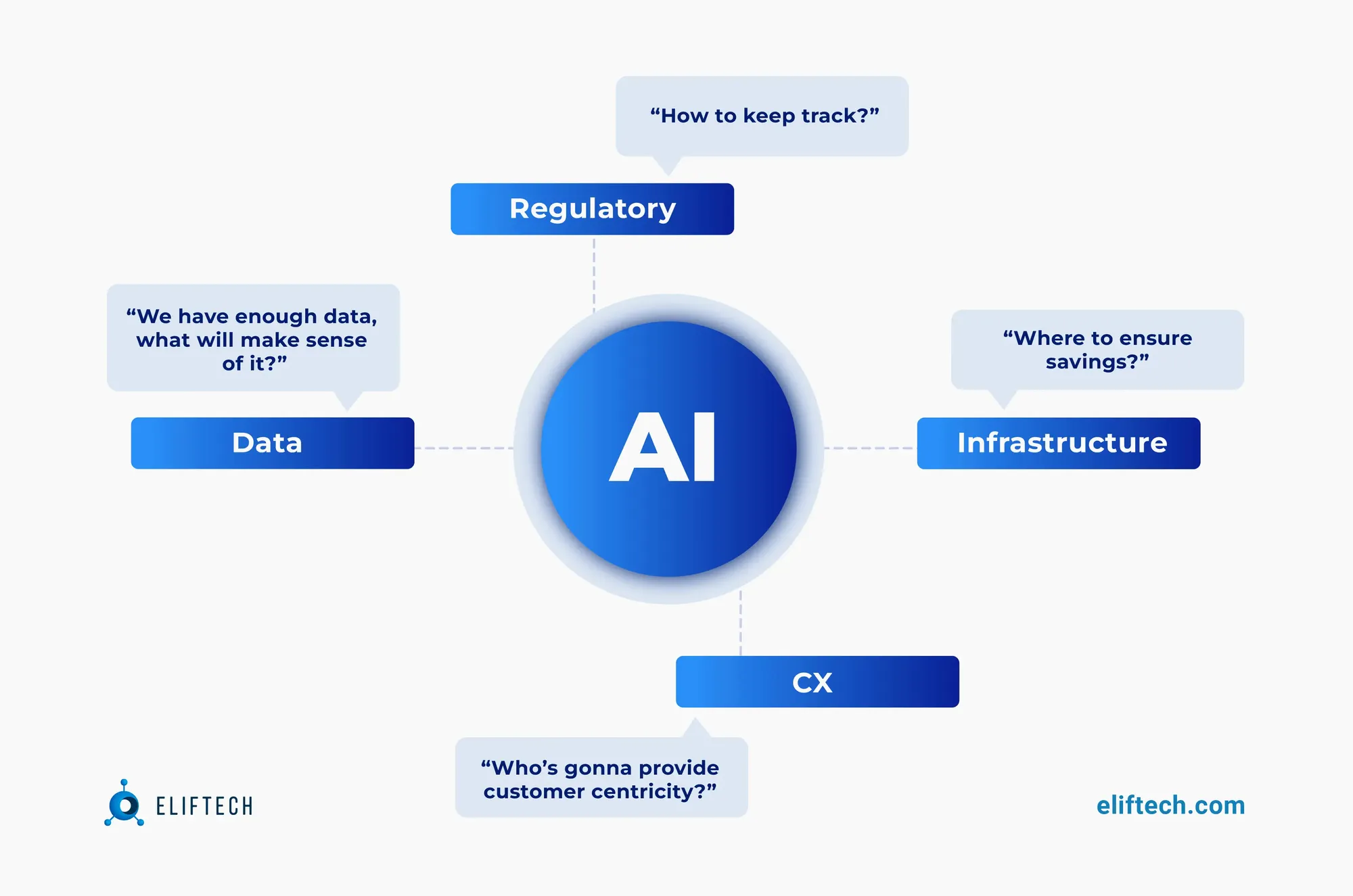

There are, in fact, several factors that make AI finance real, and understanding these motivations is pivotal for organizations navigating the intersection of finance and technology.

1. Who’s Gonna Handle Big Data? (Transforming Insights into Action)

Humans are kinda lazy when it comes to data, and prone to biases. Meanwhile, financial figures aren’t: at the core of the financial sector's embrace of AI lies the vast ocean of data, often referred to as Big Data. Financial institutions deal with colossal amounts of data daily – transaction records, customer information, market trends, and more. AI's prowess in swiftly processing and analyzing this massive volume of data unlocks the potential to derive actionable insights. From predicting market trends to identifying potential risks, AI in FinTech transforms data into a strategic asset, empowering financial institutions to make informed decisions in real time.

2. Infrastructure (We Improve Because We Can)

The adoption of AI in financial services is also fueled by the advancements in computing infrastructure. The "because we can" ethos (however resented by some) encapsulates the idea that, given the current state of technological capabilities, financial institutions have the opportunity to harness AI for complex computations, predictive modeling, and automation at a scale previously unimaginable, saving the human effort for the areas where human judgment is necessary. The current question is, of course, which of the different areas are “too human” to be trusted to robots” – a few years ago, credits were deemed “too sensitive”, but now they aren’t, because human biases undermine empathy and understanding of motives.

3. Regulatory: Navigating Compliance and Security Challenges

The regulatory landscape in the financial sector is complex and ever-changing. AI offers a robust toolkit to navigate this intricate web of regulations. From ensuring compliance with data protection laws to enhancing cybersecurity measures, AI in FinTech becomes a strategic ally for financial institutions seeking to not only meet regulatory standards but also stay ahead of emerging compliance challenges. The ability of AI to automate regulatory processes and provide real-time monitoring aligns seamlessly with the industry's need for rigorous and adaptive compliance frameworks.

4. Competition: Staying Ahead in a Fiercely Contested Arena

In the competitive realm of financial services, the adoption of AI for finance is not just a choice but a necessity for those aiming to stay relevant. As competitors leverage AI to enhance customer experiences, streamline operations, and introduce innovative products, financial institutions embracing AI gain a competitive edge. The ability to offer personalized services, make quicker and more accurate decisions, and adapt swiftly to market changes positions AI adopters as leaders in a fiercely contested arena.

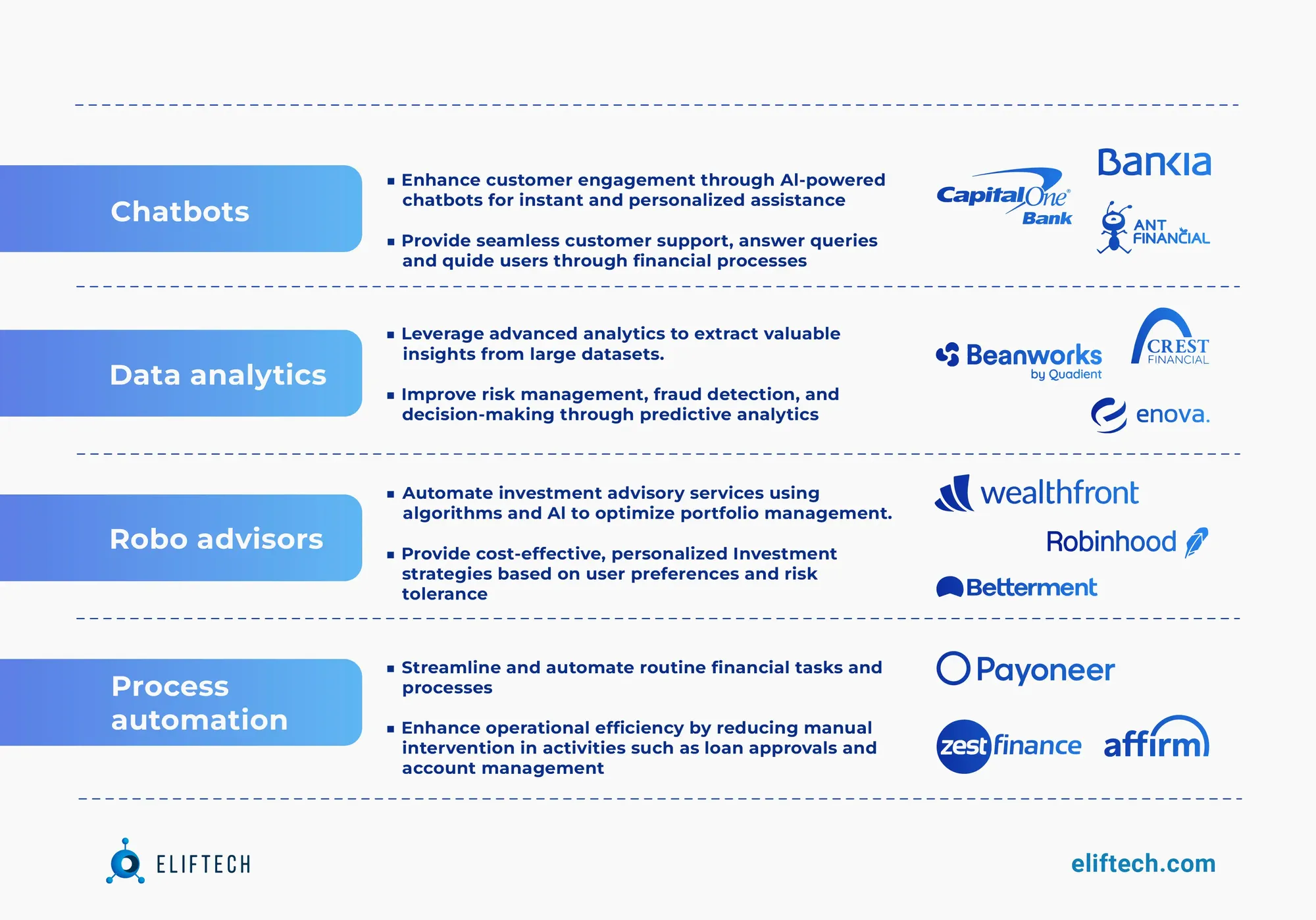

Real-World Examples of AI in FinTech

By now, it’s nearly impossible to provide a full list of all financial companies using AI in some form or another, but here are some of the cases that deserve attention, from both established firms and startups. The distribution is somewhat arbitrary, since in some areas (e.g. credit underwriting) both categories tend to use AI for FinTech quite extensively. Meanwhile, established businesses typically utilize the technology to facilitate data entry and provide conversational CX (think chatbots), while startup fintech artificial intelligence companies focus more on things like cybersecurity and niche interaction types.

How is AI used in fintech?

ZestFinance

This Los Angeles-based company is using artificial intelligence in financial services to enable a transparent and fair credit underwriting process. Utilizing machine learning algorithms, ZestFinance analyzes diverse data points, including utility payments and social media activity, providing a more comprehensive view of an individual's creditworthiness. This technology also aids lenders in minimizing default risks by adapting to new information and maintaining transparency through its ZAML platform.

Enova

Enova, a leading lending platform, has pioneered the Colossus platform, integrating artificial intelligence and machine learning to deliver advanced financial analytics and credit assessment. With a focus on non-prime consumers, enterprises, and banks, Enova's goal is to facilitate responsible lending and extend credit to individuals often underserved by traditional financial institutions. Through the Colossus platform, Enova employs artificial intelligence for FinTech purposes, namely to swiftly evaluate a borrower's creditworthiness, considering diverse data points such as credit history, income, and employment status. This streamlined process enables Enova to efficiently process loan applications, reducing approval times and ensuring timely fund disbursement to borrowers.

Payoneer

Payoneer, the global payment processor, has significantly enhanced its document processing efficiency and fraud prevention measures through the integration of AI-powered detection and prevention systems. Partnering with Resistant AI, Payoneer implemented cutting-edge fraud detection capabilities tailored to address the challenges of document forgery. Customized hyper-granular verdicts, boasting 99.2% accuracy, were tailored to Payoneer's risk appetites, streamlining document acceptance and decline workflows. With over 82% of document fraud decision-making supported by Resistant AI and only select cases escalated for manual review, Payoneer has markedly expedited its customer onboarding process while maintaining a robust defense against fraud.

Beanworks

Beanworks, a provider of accounts payable (AP) automation solutions, has introduced SmartCapture, an AI-driven data capture functionality aimed at significantly enhancing the speed and accuracy of customer data entry. The company asserts that SmartCapture achieves over 99% accuracy, completing AP processes within minutes and reducing accounting teams' data entry time by more than 80%, particularly when combined with its SmartCoding technology. An enhancement to this AI-backed suite is Line Item Capture, a tool that further streamlines invoice data entry by extracting line item details with over 99% accuracy, including descriptions, unit costs, and quantities.

Crest Financial Group

Crest Financial, a US leasing company, has successfully integrated artificial intelligence into its operations by leveraging the capabilities of the Amazon Web Services platform. By incorporating AI applications, specifically for risk analysis, Crest Financial experienced notable improvements in its processes. Notably, the adoption of Amazon Web Services AI allowed the company to circumvent the deployment delays typically associated with traditional data science methods. This shift reflects the efficiency and immediacy brought about by AI technology, positioning Crest Financial at the forefront of financial services companies embracing innovative solutions for enhanced risk analysis.

Notable AI Fintech Startups

While established financial companies use AI to solve particular challenges, there is a pleiad of what we can now call artificial intelligence fintech companies – that is, the ones that make AI their central technological capacity.

Affirm

Affirm stands out in the consumer finance landscape with its innovative use of multiple machine-learning algorithms for credit underwriting, enabling swift and accurate credit decisions, particularly crucial for time-sensitive online transactions. Securing an exclusive partnership with Amazon as their buy now, pay later partner, Affirm allows customers to conveniently split payments over time. The platform prioritizes customer experience by offering transparent pricing, avoiding hidden fees, and providing a user-friendly mobile app.

SesamM

French startup SesamM secured €35 million ($37 million) in funding a while ago to support its international expansion. SesamM specializes in aiding financial firms and corporations in aligning with their environmental, social, and corporate governance (ESG) goals. Leveraging natural language processing (NLP), Sesamm extracts insights from digital content, including news portals, NGO reports, and social networks. Its flagship product, TextReveal, allows businesses to track textual data across the web, providing actionable insights. SesamM offers various access points, such as an API for integration into clients' systems and a web-based dashboard for data analysis and visualizations.

Bud Financial

Bud Financial Ltd, initially founded in 2015 as an education platform to enhance financial wellbeing, has evolved into a business-to-business firm using machine learning (ML) to decipher complex transactional data. The company's focus is on helping global financial institutions make informed decisions and build better services for their customers. Leveraging Google Cloud's technology, Bud ensures scalability, compliance, and security for its fast-paced operations with global banks. The platform assists clients in identifying and supporting customers facing financial difficulties, offering personalized insights into spending behavior to foster financial resilience. The company utilizes DataStax Astra DB on Google Cloud to handle vast and variable data volumes efficiently, allowing developers to focus on banking data services rather than operational database tasks.

Kasisto

Kasisto, the creators of the leading digital experience platform KAI as their own artificial intelligence for the financial services industry, has introduced KAI-GPT, the world's first banking-specific large language model (LLM) tailored to address the financial sector's unique requirements for accuracy, transparency, trustworthiness, and customization. Powered by KAI-GPT, Kasisto's new generative AI application, KAI Answers, offers a human-like conversational experience, delivering quick and contextually relevant responses for bank employees on the front lines of customer care. KAI-GPT, the first LLM purpose-built for banking, ensures accuracy, transparency, trust, and customization.

Vectra

Vectra, a cybersecurity startup, employs AI to fortify the defenses of financial institutions against cyber threats through its platform, Cognito. This AI-powered cyber-threat detection system stands out for its ability to automate threat detection, uncover hidden attackers, expedite post-incident investigations, and identify compromised information. Vectra's advanced machine-learning algorithms play a crucial role in detecting subtle patterns in network traffic and user behavior, particularly effective in identifying hidden attackers targeting financial institutions. The platform's automated threat detection ensures real-time responsiveness without the need for human intervention, significantly reducing response times and enhancing the overall effectiveness of cybersecurity operations for financial institutions.

AI Applications in Fintech

From customer interactions to risk management, the potential applications of AI and ML in fintech are both diverse and transformative.

Customer Engagement and Personalization

One of the standout use cases for artificial intelligence for fintech is the ability to enhance customer engagement through personalized experiences. AI algorithms analyze vast amounts of customer data to understand preferences, behaviors, and financial habits. This enables the creation of tailored offerings, personalized recommendations, and targeted communication, fostering a deeper connection between financial institutions and their clients.

Fraud Detection and Security

The robust analytical capabilities of AI make it an invaluable tool in the fight against fraud. Fraud detection using ai in banking can detect anomalies in transaction patterns, identify potential security threats, and provide real-time alerts. Machine learning models can be trained on past transactions to recognize potential fraud. For instance, AI can continuously scan through large streams of transactional data and recognize patterns associated with fraud. By flagging these irregularities, timely actions can be initiated to prevent significant financial losses.

Algorithmic Trading

In the realm of investment and trading, AI-powered algorithms have become instrumental. These algorithms analyze market trends, historical data, and real-time information to execute trades at optimal moments. The speed and accuracy offered by AI-driven algorithmic trading systems contribute to more informed investment decisions, reduced risk, and increased efficiency in financial markets.

Credit Scoring and Underwriting

AI is transforming the traditional credit scoring and underwriting processes. By analyzing a diverse set of data points, including non-traditional sources such as social media activity and utility payments, AI algorithms can provide a more comprehensive and accurate assessment of an individual's creditworthiness. This opens up access to credit for underserved populations and facilitates more informed lending decisions.

Chatbots and Virtual Assistants

AI-powered chatbots and virtual assistants are revolutionizing customer support in the fintech space. These intelligent assistants can handle routine queries, provide account information, and even guide users through complex financial processes.

As various institutions continue to explore and integrate AI in FinTech market, we can anticipate a future where the convergence of artificial intelligence and financial technology redefines the industry, making it more efficient, secure, and user-centric.

Data Collection and Analysis

AI algorithms have the capability to gather and analyze financial data from myriad structured and unstructured sources. For example, intelligent systems can extract financial data from a company's datasets, online news publications, and social media platforms to generate comprehensive reports. AI can identify patterns, trends, and insights that might be missed by humans. This is particularly crucial for highlighting risk factors, performance indicators, or growth predictions, offering valuable insights to decision-makers.

Forecasting and Predictive Analysis

Historical financial data is a treasure trove for AI and machine learning models. Companies like IBM and Microsoft use these technologies for predictive financial analytics services. They can generate future financial forecasts, such as cash flow predictions and profitability projections, helping businesses make informed strategic planning and budgeting decisions.

Automating Financial Reporting

AI in financial reporting can streamline the process of financial report generation. By automating the compilation of financial statements, quarterly reports, and other financial documents, inaccuracies due to manual entry are minimized. Furthermore, the time saved from automation allows financial professionals to focus on more strategic tasks.

AI can enable real-time financial reporting, a game-changer in the financial management sector. For example, AI-powered financial dashboards can provide live updates of key financial metrics, supporting instantaneous decision-making based on real-time data.

Personalized Advisory

AI-powered robo-advisors are revolutionizing the financial advisory sector. Robo-advisors like Betterment and Wealthfront generate personalized financial reports and investment strategy recommendations. This is based on individual risk profiles, financial goals, and investment timelines, making individualized financial management accessible to more people.

By automating, optimizing, and personalizing financial reporting, AI is reshaping the finance industry, adding significant value to financial institutions and their clients.

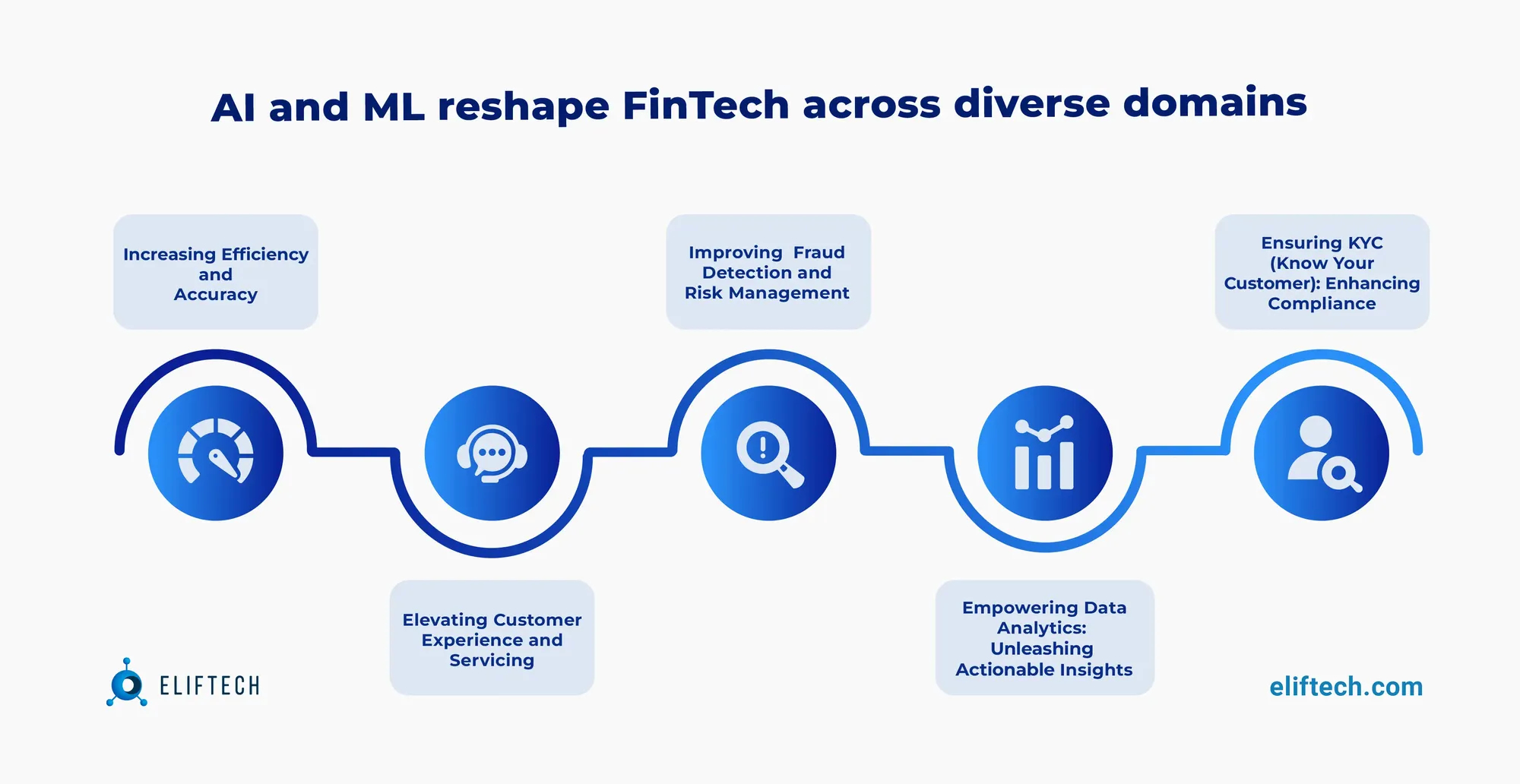

Benefits of AI in FinTech

As revealed by market insights, 37% of financial services firms globally are adopting AI primarily to reduce operational costs. However, it’s far from just letting the bots do what humans are doing in less time for less money. Let's explore the advantages of AI and machine learning in FinTech, ranging from enhanced efficiency and accuracy to revolutionizing customer experience and fortifying risk management.

1. Efficiency and Accuracy (Streamlining Operations)

At the forefront of AI's impact on FinTech is the ability to streamline operations, leading to increased efficiency and accuracy. Automation of routine and voluminous tasks allows financial institutions to optimize their workflows, reducing the risk of errors and minimizing operational costs.

2. Improving Customer Experience and Servicing

AI empowers FinTech companies to elevate the customer experience by delivering personalized services at scale. By analyzing vast datasets, AI algorithms gain insights into individual preferences and behaviors, enabling the customization of financial products and services.

3. Fraud Detection and Risk Management

The prowess of AI in fraud detection and risk management is a pivotal benefit for FinTech. Advanced algorithms analyze patterns in transactions and user behavior, swiftly identifying anomalies that may indicate fraudulent activities.

4. Data Analytics: Unleashing Actionable Insights

The adoption of AI in the FinTech market unlocks the power of data analytics, allowing institutions to extract actionable insights from vast datasets. This capability enhances decision-making processes, providing a data-driven foundation for strategic initiatives.

5. KYC (Know Your Customer): Enhancing Compliance

AI plays a crucial role in automating and enhancing Know Your Customer (KYC) processes, ensuring compliance with regulatory requirements. By leveraging AI algorithms for identity verification and risk assessment, FinTech firms can streamline onboarding procedures while maintaining the highest standards of security and compliance.

Future Trends and Predictions

What to predict? As the synergy between Artificial Intelligence (AI) and financial technology (Fintech) continues to evolve, the future is probably not as much about AI replacing humans or AI startups replacing established companies, as it is about collaborations. For example, AI is unlikely to fully replace humans in:

- Relationship management – where the human touch is needed for client interactions (while it can facilitate initial steps and trivial interchanges as of now).

- Complex decision-making – requiring human intuition and experience.

- Creativity – essential in designing novel financial products and strategies (again, it can already provide the necessary data and suggestions, but as of today, human strategic heuristics matter more).

Even with these areas of human dominance, with artificial intelligence FinTech is expected to play an increasingly integral role in shaping the landscape of financial services, with predictions pointing towards enhanced efficiency, innovation, and customer-centric solutions.

However, amid the promise of progress, potential challenges loom on the horizon. Ensuring the ethical handling of the risks of artificial intelligence in financial services, addressing concerns related to data privacy, and maintaining regulatory compliance will be paramount. Striking the right balance between innovation and responsible implementation will be crucial for fostering trust among stakeholders and customers alike.

Conclusion

Looking ahead, predictions for artificial intelligence in the finance industry envision a landscape of enhanced efficiency, innovation, and customer-centric solutions. Yet, in this promising future, challenges loom, demanding a vigilant approach to ethical AI use, data privacy concerns, and regulatory compliance. Striking the delicate balance between innovation and responsibility will be pivotal in fostering trust among stakeholders and customers alike. The AI-FinTech frontier is dynamic, promising, and laden with potential, inviting industry players to navigate this transformative journey with foresight, responsibility, and a commitment to shaping a future where finance and technology converge seamlessly.

Our team at ElifTech is working on the intersection of FinTech and AI technologies, with a special focus on the individual needs of every digital ecosystem we’re enhancing. You can get a first-hand account of the most recent cases from our experts and learn how to start implementing AI for your own organization by contacting us.