FinTech

Comprehensive Step-by-Step Guide on How to Create a Money Lending App

Ever wondered how our world is swiftly turning digital? From online dating to doorstep deliveries, it seems like there's nothing the digital age can't touch. Money lending is no exception.

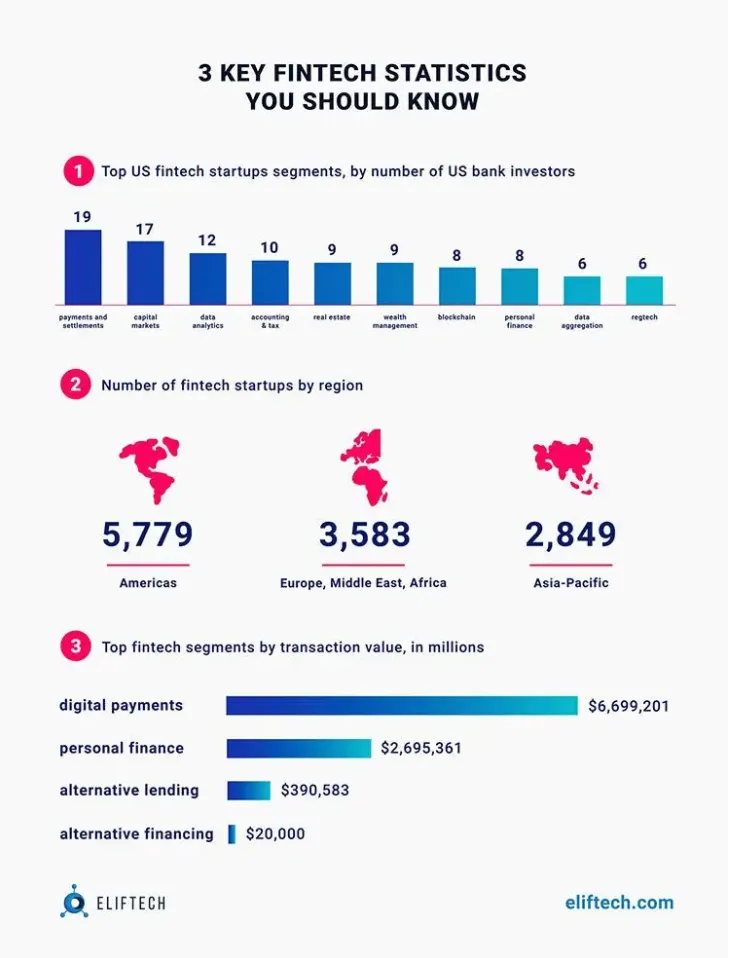

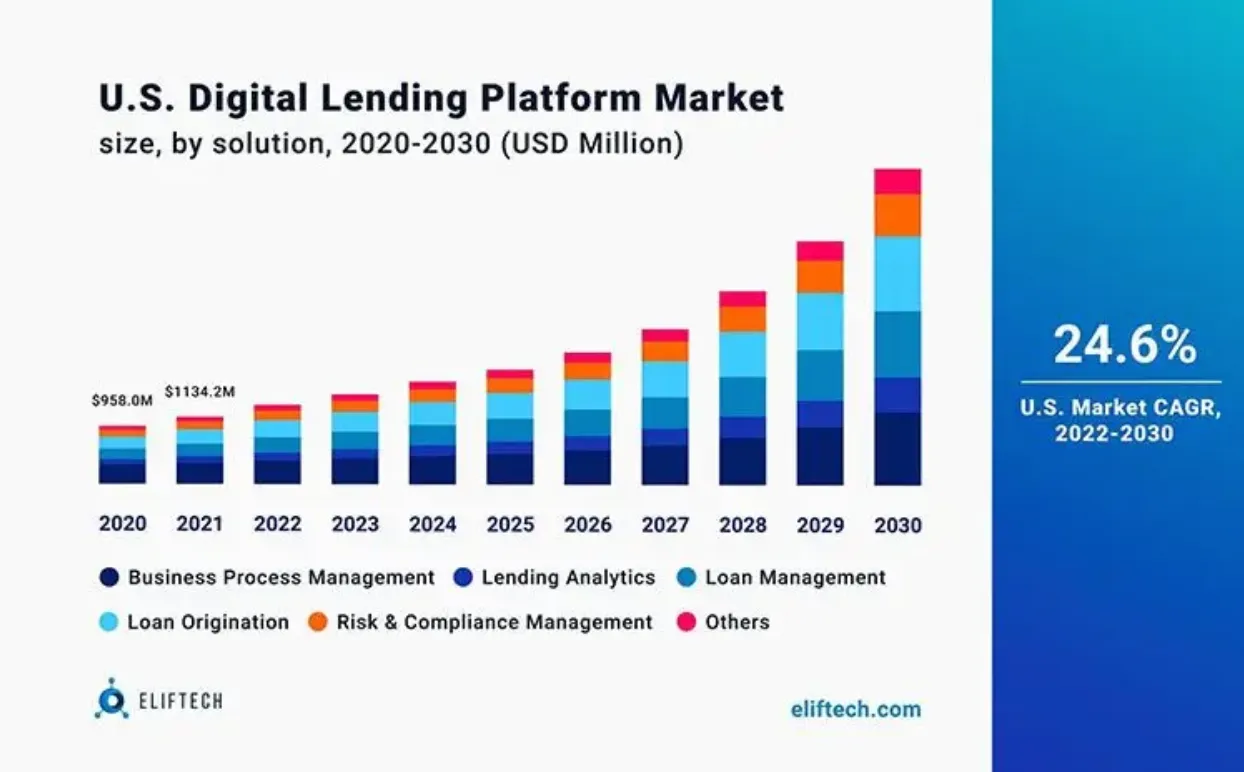

The Grand View Research states that the global digital lending platform market size is expected to register a compound annual growth rate (CAGR) of 25.9% from 2022 to 2030. With such a lucrative market, it's no surprise why businesses continue getting into the game of money-lending apps.

But what's the deal about those money-lending apps? Their greatest "flex" is speed speed and convenience available to both lenders and borrowers able to eliminate bureaucracy in half. Payments have never been easier – simply download a money lending app, complete the registration process, and submit your loan application.

Now, if you are here to learn how to create a money lending app, follow our next guide with details on the app development process, features, legal considerations, and development costs.

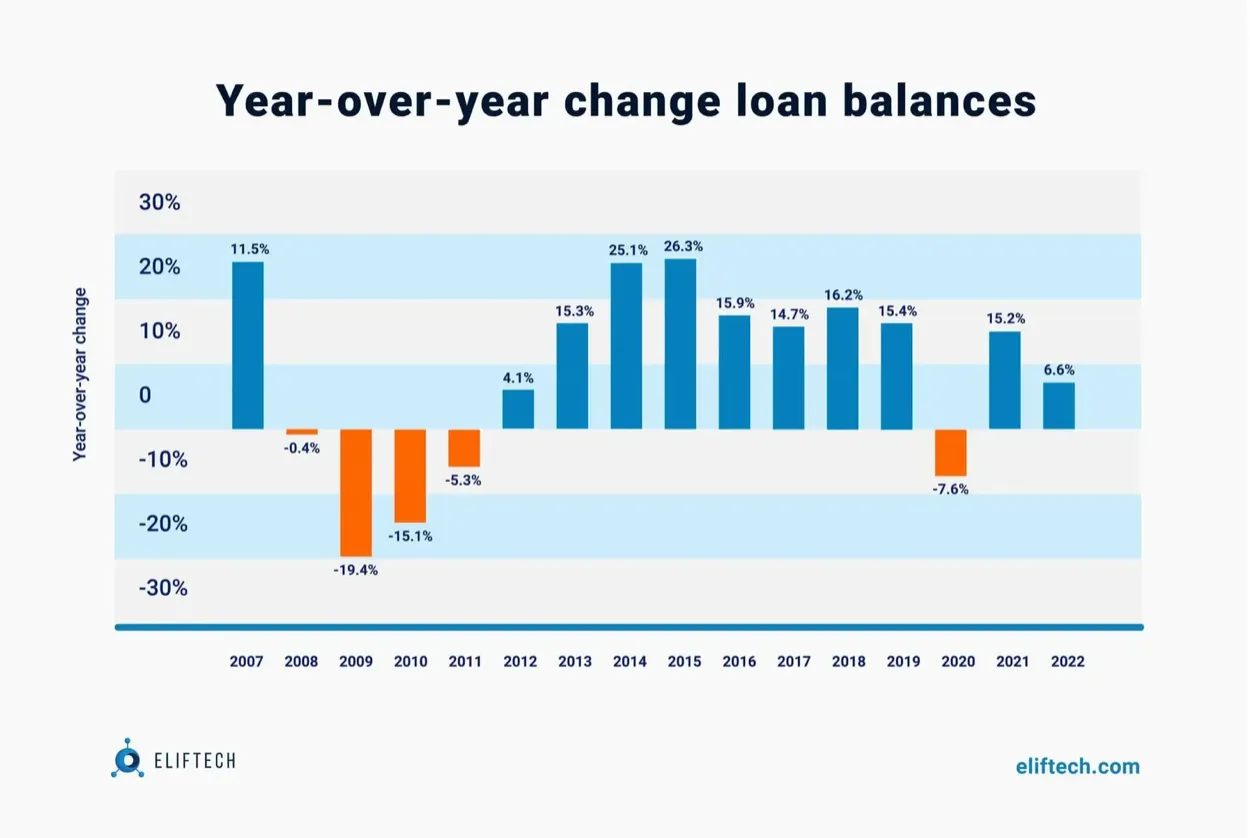

Before learning how to start a loan app, companies should know the figures behind the current market trends. Based on statistics in the microfinance sector, around 60% of loan companies have experienced consistent growth since 2016. This means more and more people opt for larger loans, and the number of microloans is increasing by 30% or even more each year.

How Mobile Lending Apps Work

Loan lending apps act as intermediaries between borrowers and lenders, offering a convenient and efficient borrowing process. They connect borrowers with different types of lenders, including:

- Banks: Traditional providers of financial products, banks develop mobile lending apps to automate processes, improve service quality, and expand loan offerings. The niche also includes financial API use cases, providing seamless integration between banking systems and third-party platforms.

- Credit Unions: Credit unions also participate in mobile lending, offering competitive rates and personalized service.

- Individuals: Peer lending apps enable individuals to become lenders investing in various projects or providing loans to others. These platforms often support charitable donations as well.

Mobile lending apps provide users with a range of loan options, including personal, business, car loans, and mortgages. Users can compare the interest rates allowing borrowers to find the most competitive rates for their specific loan requirements.

One great upside of such loan apps is the client's ability to get a loan just in a few clicks. It does not replace traditional loans but allows users to get conventional financial services avoiding bureaucracy. In addition, users can request loan money from lenders using the peer-to-peer lending app, and no intermediary body is required.

Real-Life Examples of Lending Apps

To illustrate how money lending via apps works, here's a list of the most well-known of today's money-lending apps:

- SoFi: Social Finance, Inc. was founded in 2011 by Stanford Business School students. Today, SoFi operates as an online lending solution specializing in unsecured personal loans within the United States. Borrowers can access loans ranging from $5,000 to $100,000, with repayment terms spanning from two to seven years.

- Brigit: Brigit has an option to secure $250 without requiring a credit check. What's more, once you submit a request, you can receive an interest-free cash advance in as little as 20 minutes. Brigit offers two plans to select from - Free and Plus plans. The Free plan provides valuable financial insights and tips, but it does not grant access to cash advances. Cash advances are available in the Plus plan.

- Chime: Chime offers users the convenience of receiving their paychecks up to two days in advance through direct deposit. Additionally, the app boasts the ability to detect unauthorized expenses. Chime accounts come at no cost to users and offer bank loans without any associated fees. The platform generates revenue through transaction fees charged to merchants.

- Earnin: Earnin is a personal loan app that tracks your completed working hours using a timesheet or monitoring your job location. Then, it lets you borrow money in advance of your paycheck.

- Dave: Every Dave user eligible for a loan must create an "ExtraCash" account to apply for a loan. The app offers the "Side Hustle" feature allowing users to find side jobs to earn more money.

- Empower: Empower money borrowing app offers cash loans, budgeting tools, and even bank accounts. The typical timeframe for receiving funds with Empower is one day but for a small fee, users may get the funds within an hour. In addition, the app has an automatic savings feature allowing clients to select a certain amount for the app to transfer from their checking to a savings account or "ask" the app to make automatic savings using AI.

- MoneyLion: MoneyLion goes beyond lending, providing users with a comprehensive suite of financial services, plus financial tracking and a credit-builder loan. MoneyLion allows for cash advances of up to $250. The "Instacash advance" option is accessible to anyone with a qualifying checking account. There may be an extra fee for those who need their funds quickly.

- Upstart: This money loan app features a unique risk calculation method based on artificial intelligence (AI). Upstart was one of the pioneers of applying AI to the industry. The technology allows rewiring the verification process and assesses the borrower's FICO score, credit and job history, etc. The system uses non-conventional variables at scale to improve debtors' access to a loan.

- Upgrade: The Upgrade app is part of a financial technology company focusing on accessible credits to everyday consumers. In addition to personal loans and credit cards, Upgrade offers free credit monitoring and educational tools. These resources empower consumers to gain a better understanding of their finances and improve their financial management skills.

Why Businesses Should Build a Money Lending App

Creating a money lending app offers several compelling benefits for financial businesses willing to invest in money lending app development. Let's break them down:

1. Streamlined Services: A money lending app consolidates all services in one convenient place. It caters to both clients and employees of financial institutions.

2. Enhanced User Experience: Clients gain access to essential loan-related features like calculators, personal details, and loyalty programs. The app streamlines loan issuance by automatically determining loan amounts and conditions through a complex algorithm.

3. Integrated CRM System: Implementing a built-in Customer Relationship Management (CRM) system is a must-have for loan management and accounting. The app facilitates data transfer between users, loans, repayment schedules, and databases. It can seamlessly connect with existing CRM systems used on websites and physical locations, creating a unified ecosystem.

4. Efficient Loan Management: Customized systems allow role assignments and access to the level control. Automated algorithms can be set up for charging late fees, generating reports, etc. Robust statistics collection simplifies loan management processes.

5. Speed and Convenience: Microcredit services benefit from fast loan approval and user-friendly navigation. Users can apply for loans in minutes, with a straightforward and intuitive interface. The app saves registration data, expediting future loan requests. And FAQs within the app reduce the need for customer support.

6. Essential Integrations: Integrations encompass authentication features like phone number and bank card verification. You will be able to synchronize the service with credit bureaus, card payments, multi-channel alerts, and optional chatbots or human support.

7. Data-Driven Insights: Continuous analysis and service improvement are vital for customer retention. The app allows integration with marketing tools to measure the impact of email campaigns and advertisements. User actions within the app provide insights, helping to identify and resolve any application bottlenecks.

8. Security Measures: Prioritizing security is crucial, involving multi-step authentication. User data protection through login credentials, SMS codes, and, where possible, biometrics like fingerprint or Face ID. Implementing anti-fraud and scoring systems powered by machine learning to detect and prevent fraudulent activities.

9. Personalized User Experience: Personalization extends to branded graphics, charts, calculators, and the overall interface. Push notifications, PDF contract downloads, and other features enhance the user experience compared to websites.

Key Features to Include in a Lending App

How to create a money lending mobile app when there are so great apps on the market?

No worries here. The needs of your users for the straightforward lending process are growing all the time. To build a mobile lending app that has a sleek interface is simple to use, and can win over your clients, you must choose its features carefully:

Onboarding: The onboarding page produces the first impression on your users, so ensure it works as smoothly as possible. To provide a great design to your clients, you can contact a team of professional UI/UX designers who create their products based on market research, competitor analysis, and many different aspects.

Registration: Registration is one of the essential features of many apps. In money lending apps, it plays a key role as during this stage, you collect your users' data that are needed for the app to perform its primary function. Therefore, user registration is one of the critical features of almost every application. However, to make your lending app stand out, be sure to:

- Allow users to browse the app and check its essential functions without registering.

- Allow your users to register and log into their account with the help of an Email ID, or phone number, or via social media handles such as Google or Facebook.

Remember that at this stage, a simple and frictionless user experience paves the way for higher user adoption.

Personal account: This feature allows users to edit and add their personal information:

- Name

- Contact number

- Email address

- Country of residence

- Place of work

- Marital status, if needed.

In a personal account, users can add and modify their profile details. The best practice among such apps is hiding the user profile details by default, but for the first-time user, you can add template info to all fields as a hint.

Loan Application Form: This element has to be the core of your money-lending app. With this, users should be able to create their loan application, choose the estimated payback period, communicate with lenders, and view the status of the application. Consider breaking the loan application procedure into distinct steps and guiding the users through the process to make it simpler for them.

Loan Calculator: Users appreciate it when they can quickly calculate their monthly installments/payments, down payment, interest rate, amount of interest, and loan fees. Instead of using a separate calculator, this feature manages the calculation work for loans.

Payment & Billing: Once a loan is funded, users will need a place to check all pending and completed EMIs. They would also need to view the remaining debt amount. Other than that, payment gateways integrated with the app offer users different payment tools and p2p lending platforms to facilitate fast and secure money transactions.

Collective lending: Collective lending will enable users to split the loan among several people.

Chatbot: A chatbot will help you better organize your employees' time and volume of work. In addition, with such a feature, your company will be providing its automated services 24x7. The article "Main Use Cases of NLP in Fintech" explained how to use AI in finance and how implementing NLP-based chatbots in the app can benefit any company.

Reporting and reminder system: Reporting will provide you with the needed information about users and will help you understand them better: you can see analytics on new users, the number of approved loans, transactions, etc.

EMIs: To repay the loan, a borrower must pay equated monthly installments (EMIs) covering both the interest and principal. When all the EMIs are paid, and the loan is returned, all transactions saved here serve for easy audit and further reference. EMI is a fixed amount of money that a borrower pays to a lender regularly. Usually, the clients pay every month. With each payment, EMIs are applied to the interest and principal. Therefore, users can pay the loan over the time they estimated.

Loan restructuring: Loan restructuring adds flexibility to your app. Users can change the loan terms, namely, the amount of money, interest rate, payment date, etc.

System of feedback and recommendations: With these features, choosing a lender/borrower will be very simple because users can leave comments, feedback, and suggestions about others.

User rating will simplify many processes in your money lending application. The data collected previously will form users' credit scores. In addition, the rating will be added to the borrower's profile, so lenders can decide whether to grant a loan to a particular person based on the rating.

Integration with various payment systems: To attract more users, ensure that your application integrates multiple payment methods: bank cards, e-wallets, PayPal, Stripe, Google Pay, etc. Some payment methods or their functions can be restricted in different regions, so some users may not be able to pay in the apps because of regional limitations. At the development stage, ensure that your money lending application offers alternative payment methods.

The following features can help make your money-lending app all the more attractive for your users:

- Transfers: to allow users to transfer funds to a bank account.

- Credit Score: integrate your app with a credit score service. It will help the users to check their loan eligibility.

- Reward points & ratings.

- Live chat support.

- Discounts and offers.

- Customizable reports for all parties.

P2P Lending: Main Features

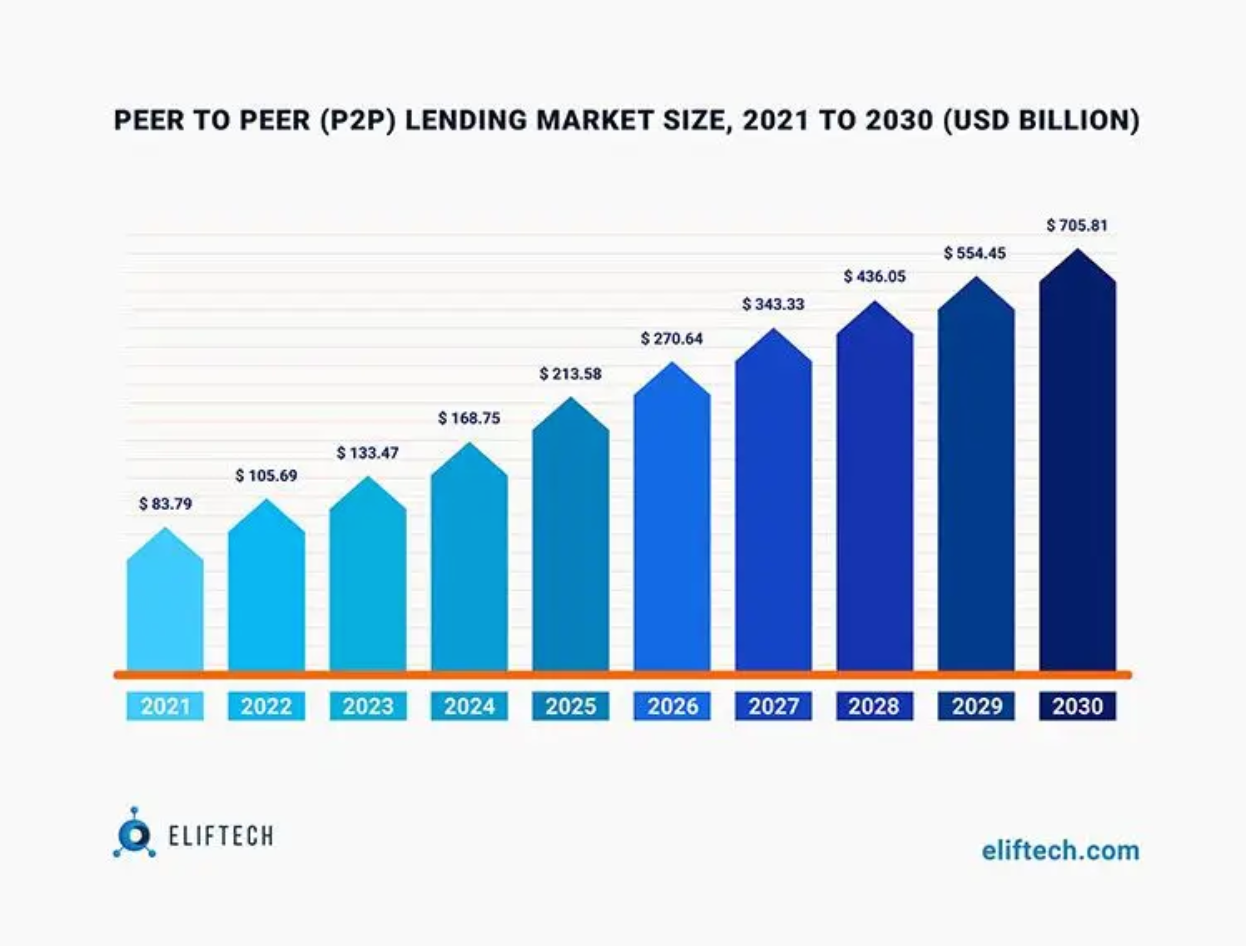

The financial sphere is closely related to information and its ways of processing. Therefore, the development of information technologies significantly impacts traditional finances. One of the most affected areas is banking. The peculiarities of conventional institutions are changing, new ways of organizing banking and the corresponding market participants are emerging, and all of these mean changes to banking. The greatest potential in this direction comes from P2P crediting, better known now as “P2P lending”.

The development of P2P became possible due to the advances in information technology. The first decentralized P2P lending platform was British Zopa, which started operations in 2005. Not only does P2P create additional opportunities for both borrowers and lenders, but it can also become a source of additional risks for the financial system. Therefore, P2P lending is relevant to the idea of decentralized lending. Even though P2P lending is relatively new, much attention is paid to it globally.

Unlike banks, the P2P platform is run only by the organizer of the lending process and not its direct participant. It brings together creditors and borrowers, assesses risks for P2P lending, and can offer a marketplace for it. However, loans are decentralized by some platform participants, and this is the main feature of P2P networks. Despite the absence of banks in the provisioning scheme, P2P lending loans perform the same functions. The transformation takes into account the amounts, terms, and risks. In addition, it decreases information asymmetry. Let's consider each of these aspects of lending in more detail.

Transformation by amounts is the simplest. Each loan within the framework of P2P lending is financed by several lenders, which makes it possible to finance even relatively large projects. It is worth noting that currently, the volume of loans remains modest by the standards of traditional banking - it is tens of thousands of dollars and not hundreds of millions, while the main borrowers act as natural persons, which imposes substantial restrictions on the maximum size of loans. However over time, the scale of P2P lending may grow.

Here are the steps that users take to use such an app:

- First, log in or register a new account.

- Then, enter the amount of money to borrow or lend.

- Next, choose the best interest rate.

- Finally, connect bank cards to the application.

How to Create a Money Lending App? 10 Main Stages

Stage #1: Analytics & Development of Technical Specifications

Everyone who wonders how to create a loan app should know that each project begins with creating a concept. Then, a comprehensive analysis of your business, niche, and competitors is carried out. All this helps to understand the target audience better and develop a strategy to attract it. Finally, the received data is used to create a technical brief for developing a money lending app.

Stage #2: Testing Your Money Lending App Concept

The first thing to do before loan app development is to test your idea. You need to study the market and products of your competitors and understand your target audience and their needs to create an app that will stand out. At first sight, this stage looks easy, but remember to perform it diligently to simplify your work at the later stages. Also, remember that you are creating the app for particular users, so you should consider their requirements.

Stage #3: Writing the Project Plan & Requirements

The next step of the "how to create a money lending app" plan is writing a detailed development plan for your product. This will allow you to organize every process and successfully create the app on time. We also highly recommend you write a list of requirements for your future product. Such a list will be a helpful tool during every stage. Usually, the requirement document includes such things:

- Full project overview

- Target audience

- Main needs and goals of the product

- Functional requirements

- Set of features to implement

- UI requirements

- Non-functional details

- Recommendations and prohibitions

- Questions

Stage #4: Selecting Your Software Development Partner

Selecting a reliable partner helps you bring your idea to life. At this point, a e-wallet development company typically proposes an introductory and consulting meetings to help you clarify the project. Here are a few ways of finding a dedicated development team:

- Rating sites. For example, you can find different teams and see their expertise on Clutch.

- Social networks. On LinkedIn, you can find profiles of design and development companies and their projects.

- Colleagues, friends, and partners. You can ask them about their experience working with development teams.

- Contact Eliftech. Our dedicated team has proven expertise in FinTech applications and knows how to create a money lending app based on specific client requirements.

Stage #5: MVP Development

MVP, or minimum viable product, is an app with enough features to attract some customers during the product development cycle. Creating a money lending app MVP will help you avoid different mistakes in the future and define and understand the target audience better. The technical part of developing an application for microcredit services depends on the platform on which you want to run it.

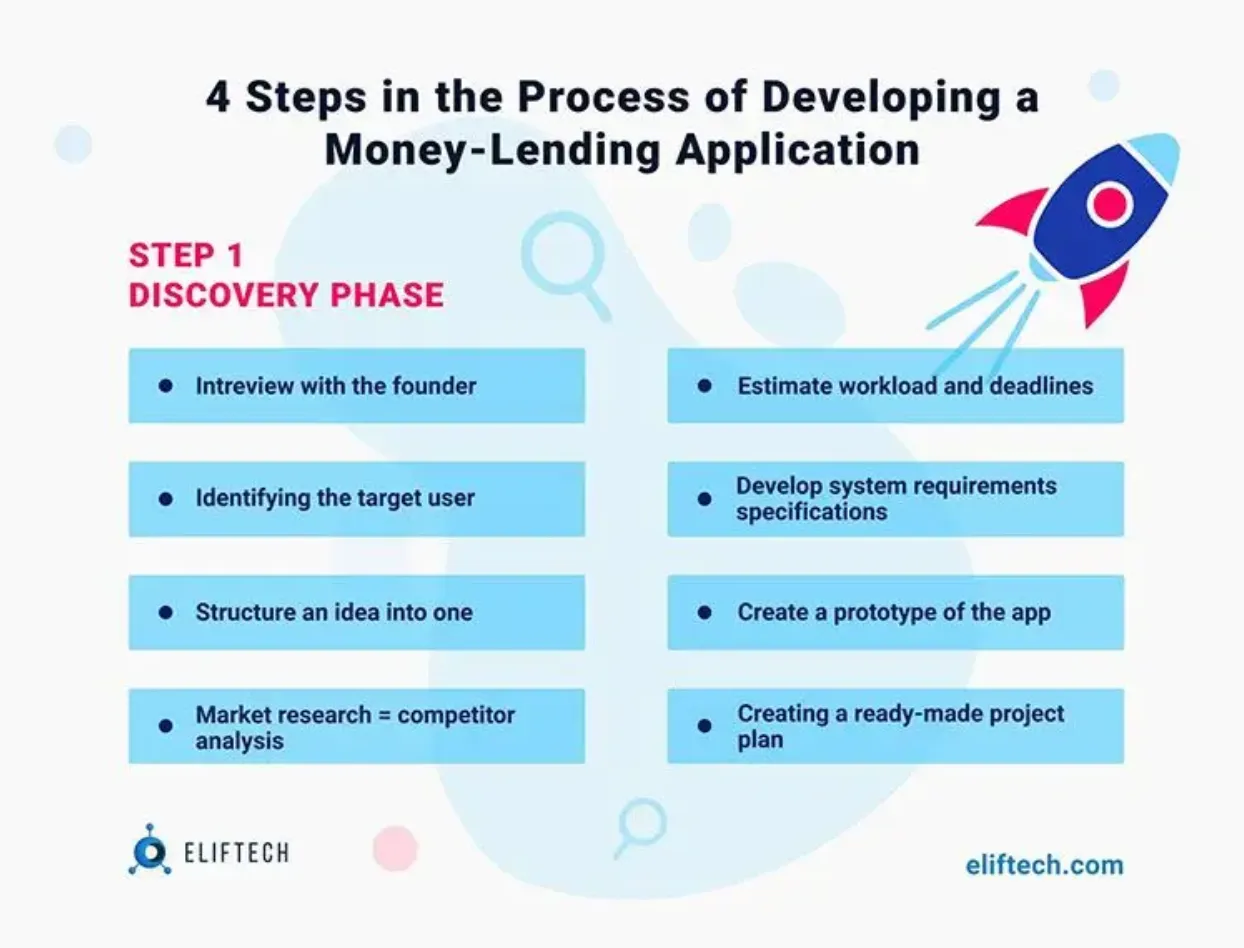

Stage #6: Product Discovery

This process will help you find the best solution for your users. The digital wallet discovery phase will help you analyze and define the main aspects of the project: the goals, scope, values, risks, and limitations. The more detailed your discovery phase will be, the better product you will build because the design and development team will better understand your requirements. During this phase, the team will consist of a project manager, a UI/UX designer, a system architect, and a business analyst.

Stage #7: UX and UI Design

Developing a microcredit application starts with creating a UI/UX layout. This is an interface framework based on user behavior analytics data. The next stage is the assessment of the functionality and layout of interface elements that lending apps clients will interact with. Finally, UI designers decide on the appearance of the application layout. Their job is to create a user interface that will make the application beautiful and understandable and lead to targeted actions. They are the ones who think through the customer's journey, add hints, autofill forms, and much more. In parallel with this, they create the application's design: they use successful combinations of branded colors for elements, draw graphic content, and so on.

UX design will provide meaningful and enjoyable experiences to your users. For example, an excellent UX is vital for building a user-friendly money-lending app. During this stage, designers will study the users, define scenarios and user flow, create a prototype, and test it! In addition, UI design aims at building an aesthetically pleasing app: it includes creating screens, buttons, toggles, icons, and other visual elements your clients will interact with when using the product.

Stage #8: User Testing

Before launching the application, fintech software development services also include checking it for stability and speed. The developers find and fix bugs that may interfere with application functions. You must test how everything works when your UX/UI is done. Testing will help you identify the problems early and fix them before users face them. It is a necessary step to prevent bugs and understand whether the design is enjoyable for users. Also, testing will help you know how understandable and convenient your design is.

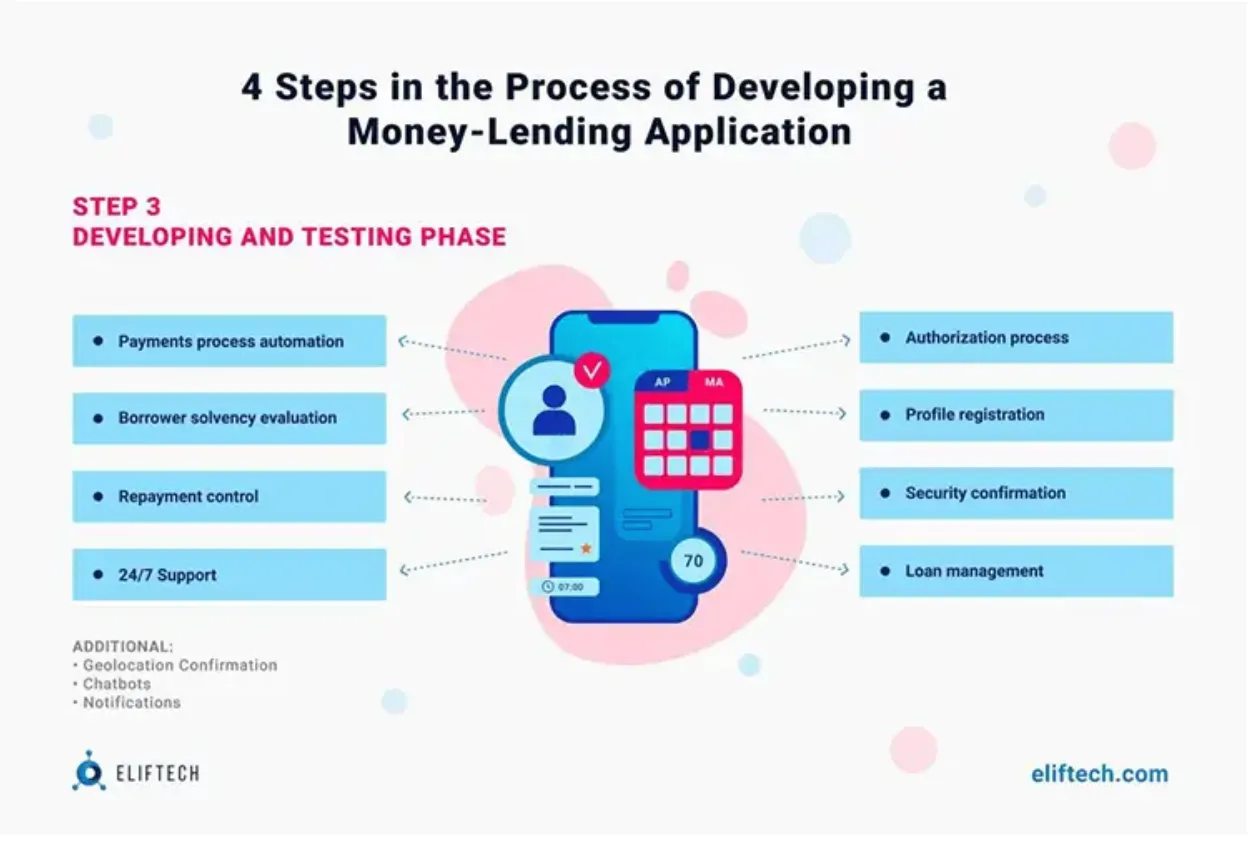

Stage #9: App Development (SDLC)

The development phase starts, and your beautiful design will turn into an actual product! During this phase, our dedicated team of developers will create technical documentation and build and test the application. All these steps will help us create a rich-in-feature app that will work smoothly.

Stage #10: Project Launch

This is the moment everybody was waiting for the world will see your app!

Now, you can choose the platform for launching and starting the marketing campaign. For this, you will need to identify the target audience of the advertising, create a unique product packaging, and do the competitors' analysis. After publication, you can refine the application, including fixing non-critical errors and adding new pages, sections, and options. In most cases, it is more profitable to quickly launch an MVP - an application with a minimum of functions needed for work - and gradually scale it up.

To meet the requirements of your users, the app will need maintenance. So, if any issue needs to be fixed or your money lending app needs any improvements, our dedicated development team will take care of it.

The Legal Side of Creating a Money Lending App

There are many legal aspects to remember while developing a money-lending app. But right now, we want to draw your attention to privacy legislation as your application will process your users' sensitive data, so you must ensure that all operations with your clients' data comply with the privacy legislation.

- GDPR Legal Compliance: GDPR, or General Data Protection Regulation, is a legal act that protects the fundamental rights and freedoms of natural persons and, in particular, their right to the protection of personal data, the territorial scope of which is the EU. Therefore, ensure that data collection and processing of EU residents comply with GDPR.

- CCPA Legal Compliance: The California Consumer Privacy Act (CCPA) is the legal act that protects the rights of California citizens. This legislation gives consumers more control over the personal information that businesses collect about them. So, if your audience is in the USA, ensure that the app is CCPA-compliant.

Remember that the laws in particular countries can be different, so pay attention to the national legislation.

Factors that Affect the App Development Cost

The cost of developing a microfinance app depends on factors like project complexity (including the number of pages and functions) and whether you opt for two native apps for iOS and Android or one cross-platform app.

The ElifTech team conducts thorough analytics before project initiation to provide a precise cost estimate, outlining the timeline for the entire project and individual features, and detailing the specific tasks performed by programmers, designers, testers, and other specialists to ensure transparency in pricing and project scope.

What is the Cost of Loan App Development?

It is hard to predict the final cost of a money lending app as many aspects affect the price: features, the app's complexity, and the country of development.

For example, here you can see the hourly rate for employing a professional in different countries:

- North America – $80- $150 /hr

- Eastern Europe – $40-$65 /hr

- Ukraine – $35-$50 /hr

As a Ukrainian software development company, ElifTech guarantees to deliver high-performance loan apps for affordable pricing. To calculate the precise cost for your app along with an approximate implementation plan, contact ElifTech for individual consultation.

Summary

Creating financial programs is a great way for a company to connect with its customers, offer unique tools and opportunities, and make budget management more efficient. Plus, it's a smart investment in the company's future.

A summary of how to build a loan app looks like this:

- Step 1: Decide on the features you want in your money lending app.

- Step 2: Test your app idea to make sure it's a winner.

- Step 3: Write a project plan and outline all the requirements.

- Step 4: Go through the discovery and development phases to bring your app to life.

- Step 5: Don't forget about the legal aspects of app development.

If you're ready to build a loan app, reach out to the ElifTech team. Our expertise and experience cover the FinTech sector, which means we can deliver a fully customized, and secure lending app with excellent user experience tailored to the most current FinTech industry trends.

Let's talk about the details and make it happen!

FAQ

Can I develop an app for an existing lending platform?

Yes, you can develop a mobile app for an existing lending platform. This can enhance user experience and expand your platform's accessibility, making it more convenient for borrowers to access loans and manage their accounts on the go.

What are the types of mobile lending apps?

Mobile lending apps come in various types, including personal loan apps, business loan apps, auto loan apps, mortgage loan apps, and peer-to-peer lending apps. The choice depends on your target audience and the specific lending services you want to offer.

What type of development model to choose?

The choice of a development model depends on your resources and goals. You can opt for in-house development if you have a skilled team and ample resources. Alternatively, you can consider outsourcing development to a specialized agency for cost-effectiveness and expertise. The choice ultimately depends on your project's scope and budget.

How much do mobile loan app development services cost?

The price to develop a loan lending mobile app for a microfinance organization depends on the project's complexity (number of pages and functions) and whether you will launch two native loan lending mobile apps for iOS and Android or one cross-platform app. The clearer a technical brief is, the more accurately the team will name the price.

How to attract and retain customers with the loan lending app development?

The loan lending mobile app development can connect marketing tools to track the effectiveness of advertising on different channels. You can also view users' actions in the application itself to understand, for example, at what stage of filling out an application they have problems.

How long does loan lending app development take?

The timeline for developing a loan lending app varies based on complexity and regulatory requirements. In general, it involves planning, research, design, development, testing, regulatory compliance, deployment, and ongoing maintenance. Typically, it takes several months to develop such a loan lending app.

How to protect customer data of lending apps?

Apps are connected to anti-fraud and scoring systems, and machine learning technology helps weed out scammers.