Wealth Management

Empower Your Wealth Management Platform with Embedded RegTech Solutions

Today, financial technology (FinTech) leaders prioritize robust compliance frameworks to navigate regulatory complexities. Embedded regulatory technology (RegTech) solutions revolutionize wealth management platforms, providing innovative tools and guidance to meet regulatory obligations efficiently.

This results in streamlined workflows, proactive risk mitigation, enhanced security, faster onboarding, and improved client satisfaction.

In this blog post, we'll explore the role of embedded RegTech in finance, its benefits, challenges, and practical tips to incorporate it into your business without extra hassle.

How to Implement Embedded RegTech in a Wealth Management Platform?

The rise of new technologies and innovations, such as RegTech, has put the spotlight on regulatory compliance within the global FinTech community, as these advancements offer effective solutions to address this issue. That also explains why the RegTech market is expected to triple in size from the previous year's figures and reach $19.5 billion by 2026.

But what lies behind the concept of RegTech and its role for global FinTech market participants?

RegTech & Its Role in the Wealth Management Platform

RegTech, short for regulatory technology, utilizes advanced technologies to address regulatory challenges and enhance compliance in industries like finance and wealth management.

RegTech software offers features such as automated risk assessments, KYC/AML checks, transaction monitoring, regulatory reporting, and data management. This feature set helps organizations automate manual tasks, analyze large volumes of data, monitor transactions, and ensure real-time adherence to regulatory requirements.

RegTech uses various technologies, including artificial intelligence (AI), machine learning (ML), data analytics, natural language processing, and blockchain. By combining these technologies, wealth management firms can proactively manage compliance, mitigate associated risks, and foster a culture of compliance across their operations without a need to create an entirely new open software system.

RegTech offers organizations significant value by enabling them to stay up-to-date with evolving regulations, successfully navigate complex regulatory shifts, and adapt to them quickly without risks and large investments.

Enhancing Compliance and Risk Management

RegTech's potential to improve compliance procedures and risk management is one of its main strengths. Due to ever-changing regulatory frameworks and increased scrutiny, compliance obligations can take a lot of work and effort to meet them.

RegTech compliance tools, on the other hand, speed up these procedures by automating processes such as Know Your Customer (KYC) verification, transaction monitoring, and anti-money laundering (AML) checks. This automation speeds up onboarding, lowers the likelihood of errors, accelerates onboarding, and ensures adherence to regulatory requirements.

Driving Efficiency and Accuracy in Regulatory Processes

Using advanced technologies such as AI, machine learning, and natural language processing, RegTech analyzes huge amounts of data and looks for patterns associated with potential compliance issues. Moreover, this automation does a double job: it not only increases efficiency but also improves the accuracy of regulatory processes, so manual overload and vulnerability to human error have become a thing of the past.

As such, RegTech's AI-powered solutions efficiently analyze regulatory requirements to ensure compliance and reduce manual labor. They help organizations proactively identify and resolve compliance issues, thereby reducing the risk of compliance violations and the potential penalties that come with them.

Improving Transparency and Auditability

RegTech software's ability to capture and record real-time data greatly enhance transparency and auditability. These solutions create a clear trail of activities that can be easily traced and validated for compliance purposes. In its turn, regulators can easily access the information they need. At the same time, organizations can easily demonstrate compliance, simplify audits, and minimize the time and effort required to conduct audits and inspections.

Moreover, RegTech's solutions provide robust reporting features that enable organizations to create comprehensive and regulatory-compliant reports. These standardized reports can provide insights into compliance, potential risks, and trends, allowing for a more informed decision-making process.

RegTech solutions play a crucial role in enabling compliant and efficient operations within the WealthTech space. For greater vision, you may also want to explore top wealth management trends that will change the future of 2023 WealthTech.

Understanding Embedded RegTech Solutions

If you're wondering whether embedded RegTech solutions are right for your wealth management firm, it's essential to understand what they're all about. We often get asked about the key components, benefits, and common considerations associated with embedded RegTech. In this section, we'll answer each question in detail.

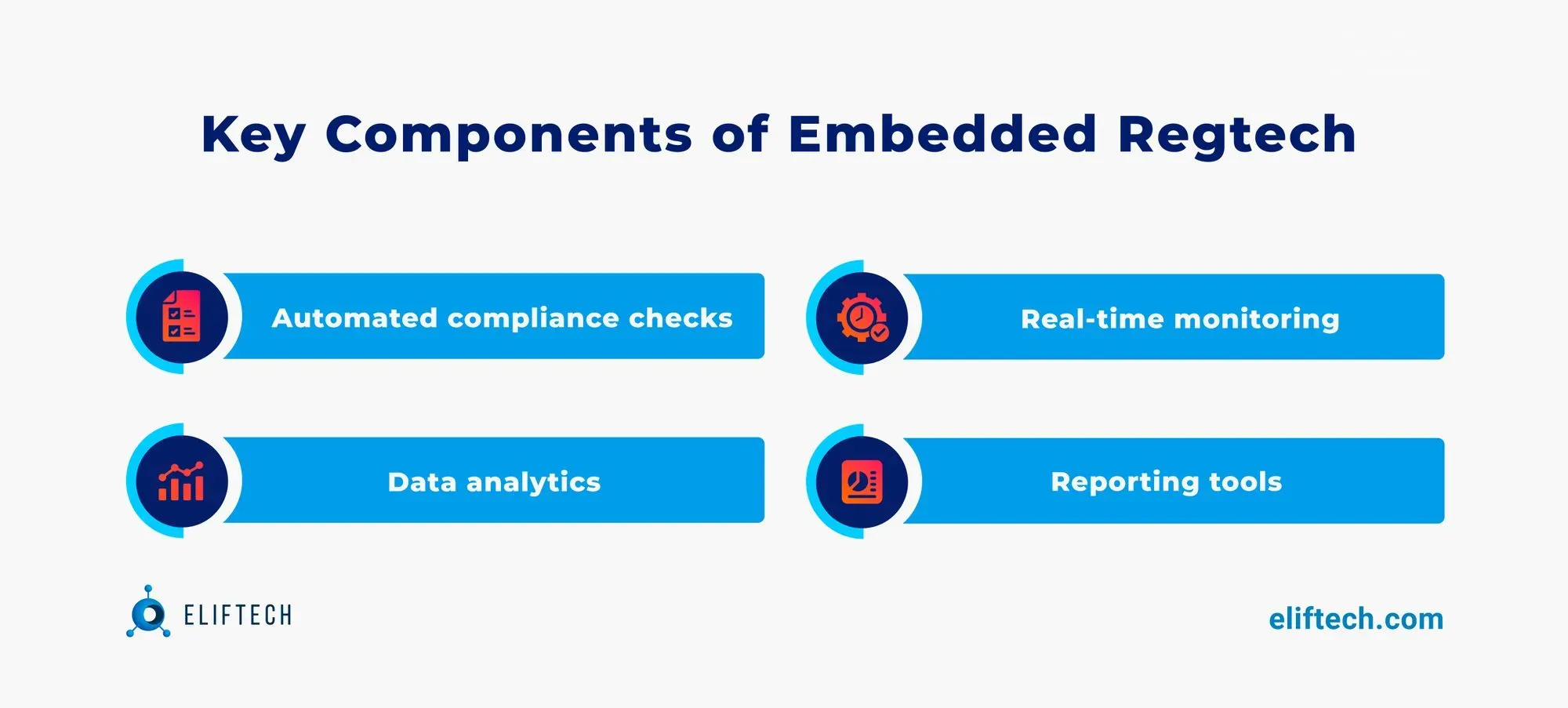

4 Key Components of Embedded Regtech

Embedded RegTech solutions comprise various components that work together to improve compliance and risk management processes. These components include:

- Automated compliance checks. Embedded RegTech solutions use advanced algorithms and machine intelligence to automate compliance checks. These technologies guarantee reliable and consistent regulatory compliance assessments without the need for manual effort.

- Real-time monitoring. Wealth management companies may track transactions, activities, and data in real-time using embedded RegTech solutions, which offer real-time monitoring capabilities. Quick identification of potential compliance issues results in proactive risk mitigation.

- Data analytics. Embedded RegTech uses data analytics to identify important patterns and insights from the massive scope of regulatory data. By evaluating this data, firms can better recognize trends in compliance, potential risks, and areas for improvement.

- Reporting tools. Firms can deliver detailed reports that comply with regulatory standards with the powerful reporting capabilities provided by RegTech's embedded solutions. These reports enable compliance reviews and provide transparency and auditability.

Benefits of Embedded Regtech in Wealth Management

We've mentioned how embedded RegTech can transform wealth management platforms, but what makes it valuable for businesses?

- Enhanced compliance - embedded RegTech solutions reduce manual efforts and human eros, allowing firms to consistently maintain a higher level of compliance.

- Real-time regulation monitoring - real-time monitoring of regulatory changes enables firms to stay up to date and promptly adjust their practices.

- Accelerated onboarding - simplified onboarding processes, including identity verification, regulatory checks, and risk assessment, speed up customer onboarding while ensuring compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations.

- Cost and time savings - automated compliance processes and minimized human efforts save both time and costs for wealth management firms. As a result of more efficient use of resources, employees can focus on high-value tasks.

- Proactive risk mitigation - real-time risk monitoring helps companies quickly identify and mitigate compliance risks, reducing potential violations and penalties.

- Consistent reporting - facilitated the generation of accurate and auditable reports, making it simple for firms to handle regulatory reporting processes.

- Informed decision-making - data analytics and reporting tools offer insightful information on compliance performance, facilitating wise decision-making and improving risk management.

- Stronger identity management - built-in advanced identity verification methods increase the security and integrity of customer information. This includes identity verification, biometric authentication, and other strong identity management measures.

- Transaction monitoring - real-time transaction monitoring helps identify all red flags, suspicious activities and comply with anti-money laundering regulations.

- Avoiding costly penalties - regulatory compliance helps companies avoid costly penalties and reputational damage.

Key Considerations Before Adopting RegTech

While embedded RegTech solutions offer significant benefits, their implementation can be challenging. Consider the points below to clearly understand what you should do to prepare before implementing RegTech into your infrastructure.

- Organizational change management. Implementing RegTech may require changes in processes, workflows, and roles within the organization. Consider employing proper change management strategies to ensure smooth adoption and minimize disruption.

- Cost considerations. Implementing embedded RegTech solutions involves upfront costs, including software licensing, integration, and training. Firms must carefully evaluate the return on investment (ROI) and long-term cost savings a solution can provide.

- Vendor selection. The successful implementation and maintenance of a RegTech solution require a vendor's expertise with well-established workflows, a proven track record, and a tech-savvy team. It is crucial to partner with top RegTech solution companies that can effectively handle the complexities of integrating and supporting the solution, ensuring its seamless operation within your organization. By choosing such a provider, you can be confident in the reliability and effectiveness of RegTech software to improve compliance, streamline processes, and improve the operational efficiency of your wealth management platform.

- Management and training. The management team must maintain effective communication and coordination between departments and fully understand the solution's capabilities. You should properly train your employees to get the most out of the solution.

Interested in delegating these preparation tasks to a vendor experienced in working with wealth management clients? Get in touch with ElifTech.

Embedded RegTech for a Wealth Management Platform: Main Challenges

When wealth managers decide to implement embedded RegTech solutions, it is important to be aware of the implementation challenges that may arise. By recognizing these challenges and finding effective solutions, firms can ensure a smooth integration of RegTech into their wealth management platforms.

Data Privacy and Security Concerns

Implementing RegTech solutions comes with a number of hurdles, one of which is security and data privacy concerns. Thus, the confidentiality and safety of sensitive customer information that wealth management companies work with is paramount.

Solution: To address these issues, it is important to partner with top RegTech solution companies that follow robust data protection practices, including encryption, secure data storage, access controls, and regular security audits. Maintaining data privacy and security requires careful review of provider security protocols and compliance with relevant data protection laws, such as the GDPR, as an example.

Regulatory Complexity and Compliance Risks

Wealth management firms operate in a highly regulated environment with constantly evolving regulatory requirements. Keeping up with regulations can take time and effort.

Solution: Embedded RegTech solutions offer the potential to streamline compliance processes. RegTech solutions can help companies stay on top of regulatory changes and proactively identify compliance issues using advanced algorithms and automation. But before, firms must also evaluate the regulatory scope and capabilities of the RegTech solution and ensure it meets their unique compliance requirements to address this challenge effectively. Continuous compliance management requires regular monitoring of changes in regulatory requirements and effective communication between the RegTech service provider and the company's compliance department.

Integration with Legacy Systems

Wealth management firms often have complex and interconnected systems, putting seamless integration at risk. Moreover, existing legacy systems often require system upgrades or customization to ensure further compatibility. For the integration process to run smoothly, your team must carefully plan, coordinate, and have the technical knowledge to get the job done.

Solution: To overcome this problem, it is important to choose a RegTech vendor that offers flexible integration options and has proven experience integrating a variety of legacy systems with innovative solutions. Choose a vendor with detailed documentation, APIs, and strong technical support to ensure a seamless integration process. You can detect and resolve any possible compatibility issues by conducting thorough testing and involving your IT and operations teams in the integration. This collaborative approach will help you achieve successful integration and get the most out of your RegTech solution.

Navigating Cross-Border Regulatory Requirements

Navigating cross-border regulatory obligations can be a big barrier for wealth management companies that operate across borders. Each jurisdiction may have its own unique set of regulations and compliance obligations.

Solution: RegTech compliance tools provide automated monitoring and reporting capabilities tailored to different jurisdictions that can help overcome these challenges. Important to note that firms should check that the chosen RegTech solution can enable compliance across numerous geographical locations and adapt to various regulatory regimes. The formula for success here is close cooperation between legal and compliance teams and constant monitoring of regulatory changes in each jurisdiction.

Best Practices for Implementation Embedded RegTech

So, what else do you need to know to join the ranks of successful RegTEch implementors? Let ElifTech share some real-world practices to help you effectively implement embedded RegTech into your wealth management platform.

Key Regulatory Requirements and Risks

Learn more about the unique compliance risks and regulatory obligations that apply to your wealth management organization. To do this, conduct thorough research and engage with industry experts to gain valuable insights into emerging regulatory trends and potential risks. With such a thorough understanding, you'll be able to pick an embedded RegTech solution that not only satisfies current regulatory requirements but also gets you ready for upcoming compliance challenges.

Seamless Integration with Existing Systems

Take into account the complexity of your existing systems and workflows when choosing an embedded RegTech solution. Consider factors such as data volume, system compatibility, and the need to synchronize data across multiple platforms. Work alongside reliable RegTech vendors to ensure efficient integration that minimizes disruption to your business operations.

Scalability and Flexibility in Regulatory Frameworks

Review regulatory changes and evaluate the scalability and adaptability of RegTech's embedded solution to changing regulatory environments. Look for systems that seamlessly incorporate updates and quickly adapt to new requirements. With this flexibility and scalability, your wealth management platform will be future-proof in the face of future changes, which will also help you keep up with changes in legislation.

Robust Data Management and Security Measures

Go beyond standard data management practices and prioritize advanced security measures.

Look for RegTech solutions that use cutting-edge technologies, including data anonymization methods, sophisticated access restrictions, and encryption algorithms. In addition, to improve the resiliency and integrity of your data management operations, consider technologies that provide secure data storage options, such as blockchain or distributed ledger technology.

Collaboration with Software Development Experts

Any new innovation or technological advancement is time sensitive and comes with a price or at least an intense effort. Every business representative understands that a lot is at stake, and you cannot risk your already established operations, especially the business performance itself.

So, the most optimal and risk-prone approach is cultivating strong partnerships with software development experts with deep domain expertise in the wealth management industry. Work together with experts to customize the embedded RegTech solution to meet your unique requirements. Leverage their knowledge in this area to improve the solution's usability, functionality, and integration with your current systems. This cooperative strategy will maximize the rewards of RegTech compliance and guarantee smooth software adoption.

Conclusion

The embedded finance industry is emerging, and with it comes the need for innovative solutions. Businesses should leverage these innovations and the power of technology to keep up with the times and mitigate the risks associated with compliance. And we are confident that embedded RegTech is the key to unlocking your wealth management platform's true potential.

However, at ElifTech, we're more than just regulatory compliance consultants. We are here to transform your wealth management operations and help your business take a big step forward in business growth. Our team of experts has extensive experience in developing and implementing tailored FinTech and RegTech solutions.

Contact us, share your pains, and we will figure out how to turn them into gains!