FinTech

FinTech App Development: Why Choose Flutter?

If you are looking to develop a new mobile app for your business that will allow you to provide various financial services for your clients, such as investment advice and other related financial issues, then it requires speedy processing and quick responses. In this regard, Flutter is one of the best options to build a fast app on Android or iOS.

In this article, we’ll dive into why Flutter is the go-to choice for your fintech mobile app development. We’ll explore its super-fast performance, ability to work across platforms, and how its robust UI framework makes it a market winner. We'll also give you crucial insights from professional designers about how Flutter makes it possible to create aesthetically pleasing yet user-friendly interfaces. Continue reading to learn how it could change the path to success for your company.

Fintech App Development: The Power of Building a Financial App on Flutter

Few will deny that the thunderous advance of technology has ushered in the transformation of various sectors, including the financial industry. Mobile devices aren't merely tools for communications anymore – they've adopted an enticing new role as virtual wallets, revolutionizing the way consumers approach personal finance.

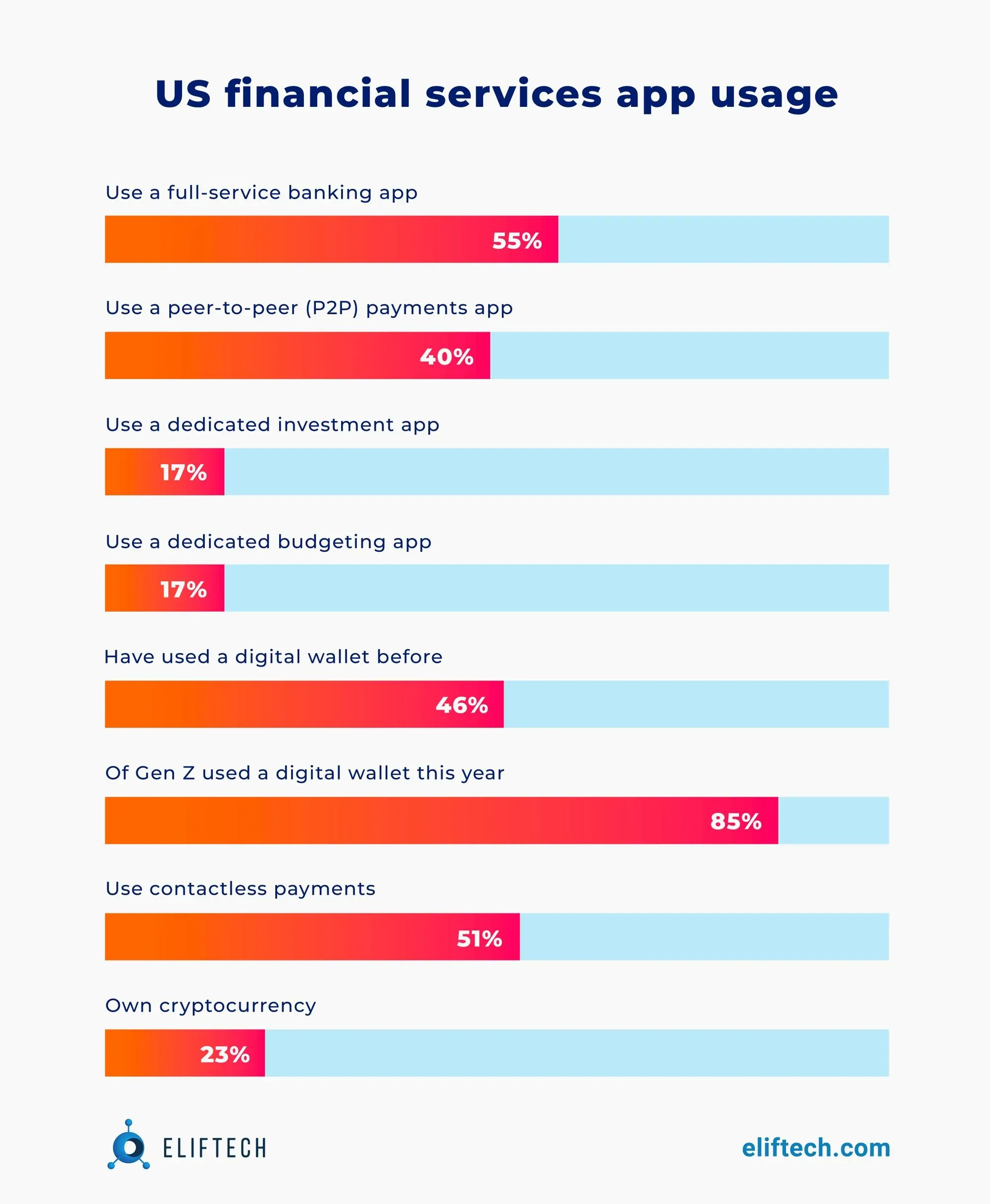

According to a report by Deloitte, "US Financial Services: Super Apps", financial app usage is widespread across different age demographics in the US. The report highlights various services that these apps offer - from full-fledged banking to peer-to-peer payments and even investment and budgeting solutions. Key findings also focus on the increasing use of digital wallets and the rise of contactless payments and cryptocurrency ownership, particularly among the younger, tech-savvy generations.

Echoing this trend, Forbes reports a steady increase in mobile banking usage, attributing it to the ease and accessibility that mobile financial services offer. Today's users can manage their finances, engage in banking, make investments, handle payments, and manage budgets through a few taps on their devices.

Beyond simple convenience, fintech applications serve as catalysts for a comprehensive shift within the financial sector. Autonomous, efficient, and sharply focused on consumer needs, these digital finance tools are reinventing traditional modes of interaction in banking and investment. From peer-to-peer lending's democratic approach to robo-advisors' specialized financial advice, fintech pushes the envelope of 'business as usual' in finance.

Underpinning this paradigm shift is an array of cutting-edge technologies – Artificial Intelligence (AI), Machine Learning (ML), blockchain, Non-Fungible Tokens (NFTs), cloud computing, and Low-code/No-code platforms. These technologies aren't just stirring up the conventional financial practices - they're radicalizing it, reshaping the landscape into a secure, user-friendly, and highly intuitive version of itself.

Read more on personalized banking: Exploring How Personalized Banking Is Changing the Industry: A $20 Trillion Breakup Opportunity

But although there is no shortage of financial apps on the market today, not all financial apps are created equal. In fact, some of them may not even be that secure or offer a satisfactoty user experience (UX). This is where the selection of the right technology stack comes to play.

The technology framework used to develop the fintech app determines not only its functionality and user experience but also influences critical aspects like security and adaptability. Hence, selecting the appropriate technology is vital for ensuring the app's competitiveness and longevity in the market.

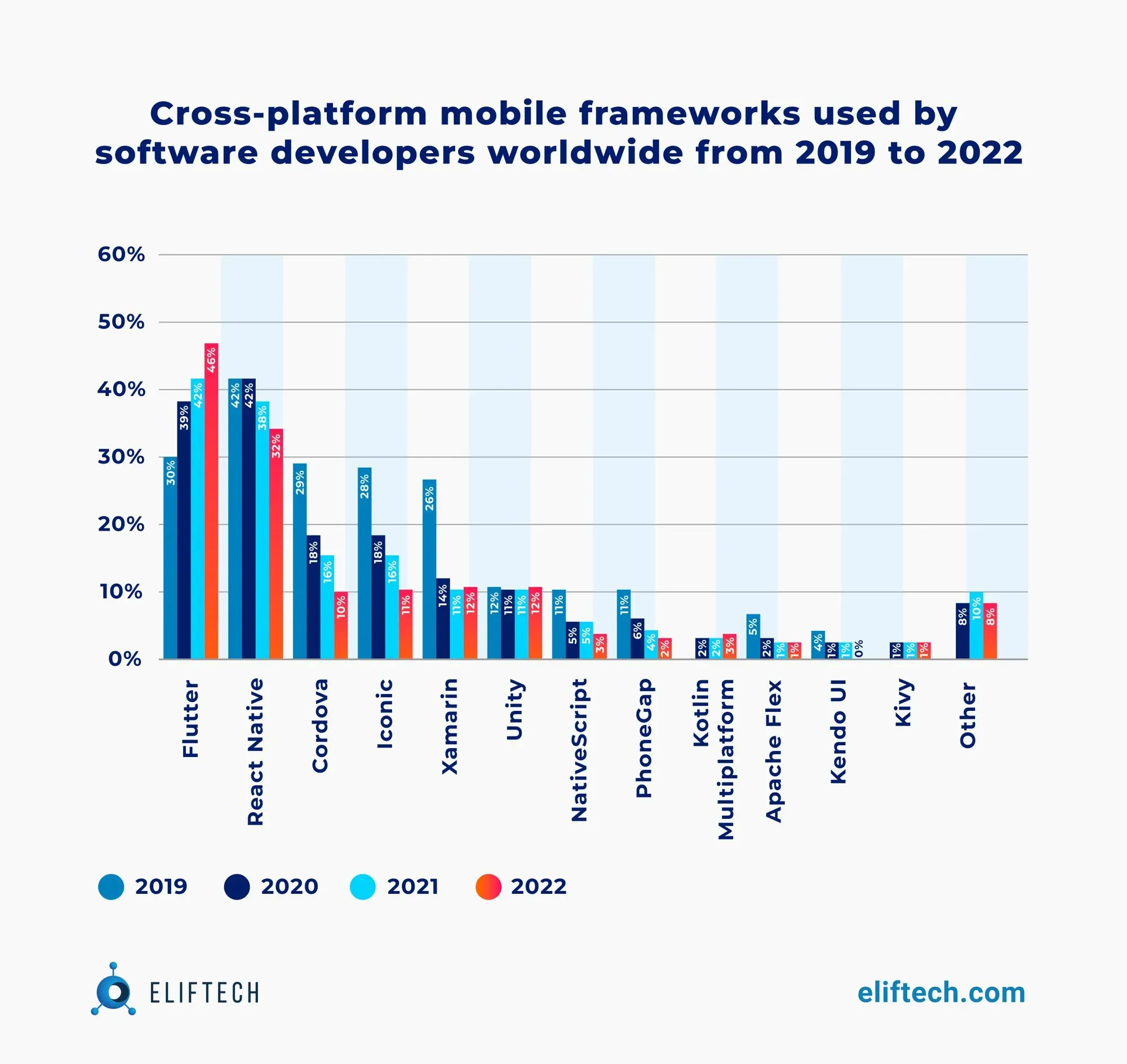

In this regard, Flutter emerges as the ideal choice. Recent statistics show that Flutter is the most popular cross-platform mobile framework used by developers globally. Based on a developer survey conducted in 2022, 46% of software developers worldwide use Flutter. This highlights the growing popularity and adoption of Flutter as a technology stack for fintech app development.

Flutter's cross-platform compatibility, rapid development capabilities, excellent performance, customizable UI, compatibility with cutting-edge technologies, and growing community support make it the perfect technology stack for building competitive and successful fintech apps.

Unlocking the Possibilities of Flutter Framework for Fintech App Development

Google has developed Flutter - an open-source UI software development kit (SDK). It provides a framework for building high-quality, cross-platform mobile (IOS and Android), web, and desktop applications using a single code base. The latter allows developers to write code once and deploy it across multiple platforms, saving time and money.

Flutter apps are built using Dart, a language specifically designed for high-performance mobile app development. A wide range of customizable widgets allows developers to design user interfaces that are visually stunning and simple to use.

In the table below, we provide a clear overview of the most prominent features of Flutter based on aspects that businesses should consider before choosing an application framework.

By considering these aspects and the offerings of Flutter in each regard, we attribute Flutter as the framework that aligns best with the unique project's goals, technical requirements, and long-term vision.

What Are the Benefits of Using Flutter for Fintech App Development?

All related discussions on developers' forums and conferences about the Flutter UI framework are absolutely justified. Flutter is a great choice for building apps across numerous industries. In particular, Flutter is a lifesaver when it comes to developing fintech apps because it allows businesses to create high-quality apps and save resources and developers’ efforts. Today’s Flutter ecosystem is already mature enough to offer handy development and design features to suit any project need.

Cross-platform support

The banking and fintech sectors are constantly evolving and changing. Rapid development and testing of new features and modules for all devices simultaneously have become essential for modern financial institutions. Fintech apps on Flutter meet these specific requirements directly.

In addition to cross-platform capabilities, Flutter offers desktop and web development support. By targeting desktop and web browser users, fintech entrepreneurs can reach a wider audience and extend their app experience beyond mobile devices.

Native-like performance

While many businesses still consider the native approach to have more solutions and libraries to build high-efficient apps, Flutter has much to offer. The use of Dart language and a rendering engine (Skia) enables high-performance fintech app development, resulting in native-like performance. This translates into a seamless user experience, which is critical for fintech applications requiring fast response times and real-time updates. As a result, Flutter's architecture and rendering engine eliminates typical bottlenecks associated with cross-platform frameworks.

Easy maintenance

A single codebase reduces the time and effort required for updates, bug fixes, and feature enhancements on all platforms at once. Thanks to its hot reload feature (~hot restart for the web apps), developers can quickly make changes to the code and instantly see the results in the app, making the development process more efficient and productive. Moreover, this feature is particularly beneficial for agile development teams working on frequent updates and iterations.

Our developers consider the jobs associated with live code debugging and updates as a piece of cake. In this way, they can always ensure that downtime is reduced and the application is kept up to date. This advantage makes Flutter an advanced tool for optimizing app development at any stage, from MVP and PoCs to maintenance.

Cost efficiency and development productivity

It’s a common scenario for businesses to face hesitations between two choices: whether to choose native app development or go the cross-platform route. The advantage of such apps is that they are cheaper than native apps, especially those built with Flutter.

With a native approach, you will have to hire two separate teams (IOS and Android developers) to write their own codebase for each platform separately. This results in high fixed costs and reduced flexibility in deploying new functionalities.

In turn, Flutter provides simultaneous development of banking and financial applications for Android, iOS, desktop computers, web and wearable devices. In other words, Flutter reduces the need for custom development, optimizing development efficiency. Our team always takes advantage of the shared codebase and extensive libraries of reusable components. This winning combination speeds up development and allows us to meet our client's often tight deadlines.

Multi-module approach

Companies with existing native fintech applications might greatly benefit from Flutter apps by implementing a multi-module strategy within the software architecture. Developers may simply incorporate cross-platform modules into already-existing native applications thanks to Flutter's multi-module approach. This makes it possible for fintech businesses to quickly test or adopt new services, such as cryptocurrency, Buy Now Pay Later, quick payments, etc. In this way, companies can use Flutter to efficiently implement, test and improve new features far ahead of their competitors.

Integration with Backend Services and APIs

Flutter easily integrates with back-end services and APIs through its powerful networking libraries, including Dio and HTTP. These libraries manage API communication, making finding data and interacting with back-end systems easy. Flutter platform channels provide easy integration with platform-specific features and existing native libraries, bridging the gap between your Flutter app and native code.

Security Considerations

Fintech companies developing mobile applications should always put security first. So, they should focus their efforts on identity management, data security, cybersecurity, and regulatory requirements, such as KYC, GDPR, FCA, etc, as well as ensure code security. In this regard, Flutter also wins extra points, thanks in major part to the Dart language.

Native apps are receptive to hackers who can reverse engineer the source code, even after code obfuscation (~ difficult to understand machine code). However, Flutter takes a different approach. Dart, the language used in Flutter, is compiled directly into machine code, making it significantly more difficult to develop reverse engineering tools. Unlike native programming languages like Java for Android, reverse engineering in Dart is relatively unexplored. As a result, Flutter code, including any Flutter fintech app, is less vulnerable to reverse engineering.

Flutter enables developers of banking software to take full advantage of native platforms' features. With native APIs like the iOS Keychain services and the Android KeyStore system, they can increase security. In addition, Flutter apps can incorporate biometric authentication (Face ID, Touch ID, fingerprint scanners) and leverage the latest library implementations of popular data encryption algorithms.

Third-Party Libraries and Plugins

Flutter's vibrant ecosystem of third-party libraries and plugins opens up a world of possibilities for fintech developers. With ready-to-use components for analytics, charts, payments, authentication, and more, they can improve a fintech mobile application without reinventing the wheel. This not only saves significant development time, but also provides access to constantly improving tools with first-class support and documentation.

Custom UI Components

Talking about the crucial value of Flutter capabilities for app design is hard to imagine without a real opinion on this matter from our in-house designer, Alla Vyelihina.

As we dive deeper into the digital age, the importance of intuitive and visually striking UI/UX design in app development cannot be overstated. Particularly within fintech, a sector that demands fluid interaction for consumers to manage their most valuable assets: their money. Flutter shines in this challenging environment. Flutter's true strength lies in its potential to deliver high-performance and native-like user experiences for cross-platform financial applications, making it a competitive choice for UI/UX design in the ever-evolving world of fintech. As the technological landscape rapidly evolves, Flutter emerges as the front-runner and the go-to framework for developing visually appealing, easy-to-use, high-functioning fintech applications.

In particular, we highlight several key Flutter UI capabilities that empower designers to create visually stunning and consistent user interfaces across different platforms.

- Accessibility and localization. It’s important to create applications with accessibility and localization in mind to attract more users. Flutter has thankfully covered this. Developers can make their apps accessible to people with disabilities by enabling accessibility features. In addition, Flutter's support for localization and internationalization makes it easy to translate your app's user interface into other languages and regions.

- Widget-based architecture. Flutter's widget system enables designers to create complex user interfaces swiftly. Widgets are customizable and reusable user interface elements that can be nested for efficient organization.

With powerful theming options, Flutter ensures consistent visual aesthetics across the app. Designers can use the theme system to define color schemes, typography, and more. Additionally, Flutter supports various styling options for widgets, such as padding, margins, shadows, and borders.

- Responsiveness. Flutter offers powerful responsive design support, making it easy for UX/UI designers to create apps that adapt to different screen sizes and resolutions. This adaptability ensures an engaging user experience that is visually consistent when accessed on a smartphone or tablet. Designers can create a great app design and use it optimally on any device using Flutter's responsive design features.

- Animation system. Flutter's animation system empowers designers to craft captivating and dynamic interfaces. Designers can use its impressive capabilities to craft custom animations that dynamically respond to user interactions, including actions like button presses and screen transitions. This improves the app's engagement and the user experience as a whole.

Specifically, Flutter supports such animation tools as Lottie Animation, Rive, and the Lottie Animation Plugin for After Effects. Designers can create unique animations and use various animation techniques using these robust tools to create aesthetically pleasing interfaces that enhance the user experience.

Considerations and Limitations

Like any possible technology has its advantages and limitations, the Flutter framework is not an exception. Being aware of these limitations is crucial in making an informed decision regarding using the Flutter framework for fintech app development.

Limited platform-specific features. The cross-platform nature of Flutter means that it may not have immediate access to all of the platform-specific features and functionality offered by native development. While Flutter's extensive widget catalog and plugins help fill this gap to some extent, there may still be instances where certain platform-specific capabilities are unavailable.

Performance nuances. While Flutter is known for being highly efficient, some complex animations or heavy computations may require additional optimization compared to natively developed apps. Hence, extensive research needs to be done to ensure that the software works seamlessly across various platforms and devices. However, Flutter continues to optimize performance with each release and offers ways to optimize application performance through code and package optimizations.

Limited IDE support. Compared to some other frameworks, Flutter currently offers less support for Integrated Development Environments (IDEs). Some IDE-specific features and plugins that developers often use may not be available despite having official Android Studio and Visual Studio Code plugins.

As mentioned earlier, it's important to note that these restrictions are constantly being removed and improved to make things easier for developers. In any case, cooperating with a professional agency that specializes in providing Fintech app development services using the Flutter framework can ease any worries.

Conclusion

We believe choosing the Flutter UI framework for FinTech development projects is a smart decision. Its fast development lifecycle, reduced costs, and powerful dev and design capabilities allow FinTech businesses to build high-quality, competitive apps and face the challenges of the dynamic financial industry directly. So, the only thing we can recommend is to try Flutter for your next project and experience the full power of this framework for yourself.

Have a fintech app development idea to discuss? Get in touch with us!