ML

How AI helps to create a “human face” for modern Fintech

At the end of 2019, only 4% of mid-sized banks were using chatbots, but in 2020 this figure increased to 13%. Such a jump was due to the pandemic — banks resorted to interacting with customers through self-service channels. The pandemic has provided an unprecedented impetus for digital banking transformation, yet 68% of executives, according to Arizona, are seeing an exponential increase in customer engagement difficulties. In this article, we are going to research how AI helps to create a "human face" for modern Fintech.

Today, the customer acquisition cost (CAC) in banking is at an all-time high of $500. But often, a new client does not bring profit to the bank for two years. These problems are exacerbated by banks' rejection of the services of large technology companies that offer financial products. This forces banks to invest in improving the quality of customer service to increase their retention rate.

Reducing customer churn implies minimizing the time it takes to respond to requests and find bank AI solutions, personalizing banking services, and creating a unified experience at all interaction points. There is also a constant need to optimize costs and improve employee efficiency. To achieve this, leading banks are completely overhauling their functionality to be AI-first. 81% of bank IT managers believe AI in banking customer service will clearly identify the winners and losers.

The paradox is that almost 81% of bank executives are concerned about the transformation's speed, complexity, and cost. Fortunately, combining chatbots and artificial intelligence gives financial institutions more opportunities to communicate with customers with greater reach and return on investment (ROI) than traditional chatbots. Moreover, this tandem is a cost-effective way to join the AI in banking transformation, as AI in banking customer service chatbots help achieves success in the short term across multiple lines and touchpoints.

How can chatbots based on artificial intelligence improve customer experience and help keep customers?

There is no doubt that artificial intelligence banking is a competitive advantage that can increase the consumer support index (NPS-Net Promoter Score) and the Customer Lifetime Value. In addition, these Shi bots (a multipurpose bot that gets constantly updated Features Category) transform the traditional roles of bank employees, allowing employees to develop in operating positions as highly qualified multidisciplinary specialists. As Accenture's Banking Industry Report shows, this can lead to an increase of 34% in profits and an increase in bank employment by 14%, creating a win-win situation for both banks and their customers.

Rising customer expectations: What do customers want, and why do they want it now?

As AI in banking customer service decision-making tools proliferates, account managers can more accurately and consistently help customers with better personal finance products and services.

Chatbots based on artificial intelligence exceed traditional chatbots. For example, Bank Chat Botta from the AI in banking customer service makes both text and voice teams. The fake intelligence bot uses natural language processing, machine learning, accounting management, language recognition, and contextualization. This provides a complete dialogue, unlike limited scenarios of a simple chatbot, which cannot process non-standard situations. Shi-Chatbots remember customers' preferences, using the history of previous interactions to recommend products and services, providing invaluable assistance to the banking departments of sales. They are used for consistent communication with clients and are integrated at all interaction points, including websites, smart columns, call centers, and voice helpers.

How can artificial intelligence be improved and help to keep customers?

Chatbots with artificial intelligence simulate human interaction, quickly automating tasks and dismissing the bank's employees to work on complex requests, which increases loyalty and profits. The AI chatbot can forward the client to a chat with a support operator to solve problems beyond its capabilities. Bank customers save about 4+ minutes, while the bank saves $0.50-0.70 for each interaction. Artificial intelligence conversational chatbot does not require much time to start. It is better integrated and updated as the bank and webpage database is updated, which contributes to rapid scaffolding.

Onboarding & Know Your Customer: Improvement of bank client experience with an AI

Bank chatbots with artificial intelligence, ready to ensure the client throughout the path, build bridges between marketing, sales, and consumer service. They provide clients with intellectual, personalized interaction and contribute to the strengthening of loyalty. About half of the customers who leave you do it within 90 days after the account is opened. SI-Chat-bot, integrated at the registration stage, can ask intuitive questions, provide information, provide smooth adaptation, or process new applications, helping to keep the consumer. For example, DBS Bank Digibot processes customers' applications for a loan. Financial consultants do not interact with clients initially and can focus on using their experience to increase profits.

Manual Know-Your Customer can be a slow and complex process. It is also a weak place with a high risk for control and sales departments. Verification chatbots accelerate the process and can reduce the number of false works by 80%, reducing the risks, improving compliance with regulatory requirements, and giving more time to control department employees, so they can focus on organizational risks. In addition, automatic authentication allows clients to view their transactions and receive help chatbot to make changes to the account. This further increases employees' productivity by reducing the number of applications with common issues.

A recent HubSpot survey has identified five main issues related to customer service. The first two: are expectations on the line (33%) and information repeated when the request is transferred from one bank branch to another (33%). The slow response time and the inability to solve online queries also cause frustration. Bank chatbots based on artificial intelligence have unlimited opportunities, available 24/7, and are constantly being improved.

Increasingly human-like formats: Trends of AI use in banking customer service banking

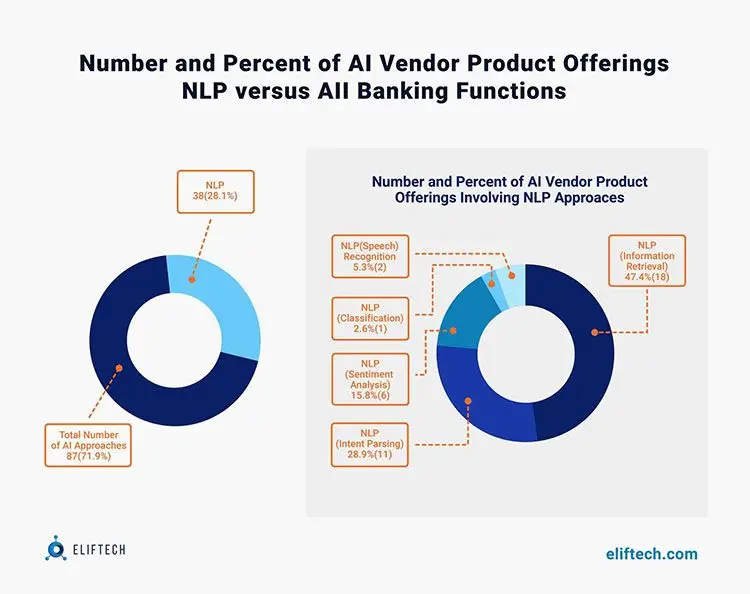

1. NLP, also known as “Spoken AI” in banking customer service, will help consumers make better financial decisions: The financial and banking industries are complex and highly competitive in retail and MMSB segments. At the same time, finding a bank that understands your needs and is ready 24/7 to provide consultations and services that are not implemented in a mobile application can quickly be able to form a credit rating and make an offer. Some banking institutions began to respond to these challenges, giving their clients bank AI solutions with the possibility of starting relationships, deepening them, or even choosing a partner's bank. One of these decisions is NLP. This technology helps you get information about the customer or potential customer needs and recommend the best next step to achieve financial goals. This personalized approach reduces the number of available interaction steps, options, or suggestions. As a result, the number of steps, offers, and products decreases, the client is provided only relevant, and the optimal client's way is built there.

2. Technology is designed to strengthen and support employees rather than to replace them: earlier, we mentioned that some tasks would be able to perform by a virtual assistant with AI, but that does not mean that people will be unnecessary. On the contrary, companies that use automation and spoken technologies do this to expand their employees, increase their productivity, remove routine tasks, save time and money, and improve the support of customer service teams, work in IT support and HR teams. In addition, this support can help increase the efficiency and moral spirit of the team and strengthen the examination of team members and the productivity of the entire company.

3. NLP in banking customer service eliminates unnecessary and provides a more holistic client experience: companies such as Amazon and Netflix are leaders in their own directions, as they carefully teach their employees to be consistent, focused, and involved in each interaction with the client. Unfortunately, this forced other companies in different industries to catch up and meet the same expectations. For example, clients often interact in banking through ATMs, branches, call centers, and mobile and online banking programs.

However, banks and financial companies should provide up-to-date information and relevant and interesting content regardless of the interaction channel. Fortunately, this is exactly what the AI in banking customer service has spoken about. Through a phone call, email, text message, survey, or online banking, "spoken" AI in banking customer service can help answer questions, solve problems, provide relevant information, and even decorate the product for the client 24/7.

Automation to maximize effects

A recent HubSpot survey revealed the top 5 customer service challenges. The first two are: waiting in line (33%), and information is repeated when the request is transferred from one bank branch to another (33%). Slow response times and the inability to resolve queries online are also frustrating. However, banking chatbots based on artificial intelligence have unlimited capabilities, are available 24/7, and are constantly being improved.

AI in banking customer service bots with advanced reporting tools enable data-driven decision-making and improve marketing and sales processes. They collect the following information: duration of communication with the bot and live operator, customer rating, and the number of allowed or unclosed chatbot sessions. Sometimes services such as mortgage adjustments or investment advice require an in-person meeting. An AI in banking customer service chatbot can help book such an appointment by suggesting dates and times and making appropriate changes to the calendar. In addition to improving CX, they increase the satisfaction of contact center operators because they free them from routine tasks and allow them to improve their skills by handling complex and interesting requests.

AI-bank of the future: Can banks meet the AI in banking customer service challenge?

Artificial intelligence can be a transformative change factor in fintech that can solve the complexity of working with large databases and improve the banking sector's customer experience. However, business leaders must first solve a really difficult task: how to be people in the age of digitalization.

The financial crisis allowed banks to understand what they were wrong about - they put profit before customers. Artificial intelligence will enable you to correct errors. Providing financial services that meet the needs of a diverse and demanding clientele is neither easy nor cheap. But artificial intelligence offers banks and financial service providers the tools to deliver the highest level of customer service, both at speed and at scale.

Artificial intelligence is a combination of computer linguistics and informatics that solves the following:

- Problems of formalization of issues and tasks that resemble tasks performed by a person;

- Complex software systems that are not only able to act according to the program laid down by a person but also to learn effectively by themselves;

- Can perform actions not laid down by the programmer at the initial stage.

According to the Financial Review, UBS Bank has created a digital avatar of the company's chief economist, Daniel Kalt, and soon the clone will begin meeting with private clients in Zurich. The digital copy works based on artificial intelligence, designed as part of the UBS Companion project. "Digital Daniel" will be able to communicate with customers, but he cannot go beyond predetermined boundaries and will only answer questions related to those areas to which he will have access, provided by the real Daniel. To create the clone, 120 professional HD cameras were used, which recorded the movements of Daniel Kalt for some time. In addition, artificial intelligence analyzed how Daniel interacted with customers. As a result, according to the work's authors, the clone's behavior is now difficult to distinguish from the original.

The investment bank says the project, known as UBS Companion, is not about replacing highly paid economists with machines but "an attempt to find the best combination of human and digital expertise." Therefore, the technology will also allow UBS to analyze customer issues to improve service and provide efficiency, given that staff knowledge can be stored in an avatar, protecting the bank from personnel attacks by competitors.

Final Thoughts: Shining future of human-centric AI in banking

The introduction of NLP in banking customer service allows customers to interact and communicate with their banking institutions. With the help of virtual assistants from AI, voice assistants, employees, mobile applications, or other access points, clients can receive appropriate personalized tips and information. NLP in banking customer service helps to overcome the gap between technology capabilities, communication, and customers' desire to have a customized experience, regardless of the channel.

Benefits for customers

Below are some significant benefits that customers receive from using Know-Your Customer in banking customer service when interacting with the bank:

- Availability 24/7 - customers no longer need to wait for your question from a bank employee or go to the branch. AI in banking customer service virtual assistants is ready to support and process typical financial requests. And even more, they can provide certificates, assist new or extend the existing client products and offer the best decision to the client.

- High-quality service - by attracting virtual aides with AI, potential errors are much faster, and practical bank AI solutions are easy to provide. This minimizes the number of contacts and improves the impression of the first treatment. In addition, companies can teach their virtual assistants with AI in banking customer service easy-to-answer typical questions.

- Active involvement - proactive communication with clients helps them get instant support and decision. This increases the level of customer customers and maximizes loyalty.

Benefits for banks

There are some significant advantages to the use of NLP in banking customer services for financial institutions:

- Economic efficiency-using AI in banking customer service. Virtual assistants can help handle various customer requests to reduce operating costs by optimizing employees' attraction and reducing the load on the department and contact centers.

- Improving the security level for employees and customers. In the conditions of war and pandemic, quality remote service has become a basic condition for normalizing cooperation between the bank and the client. Currently, virtual AI assistants in banking have the potential to maximize the level of safe customer service.

- Minimize the mistake. Manuallity always has the potential for errors that can create even greater problems later. Integration of NLP in banking customer service can guarantee flawless services and eliminate potential complications and penalties/sanctions from the regulator.

- Easy scaling. Virtual assistants can dynamically increase or decrease their participation in the process depending on your business process, peak hours, peak season, and more. As a result, they can process large amounts of input and communicate without increasing business costs.

If you are considering an “AI level-up” for your financial enterprise, contact our team for a consult!