Digital Wallet

How To Develop A Payment Gateway: Your Hands-On Guide

The development of a custom payment gateway can be challenging, but this system is really profitable and can be useful for many businesses. For example, it is beneficial for merchants that want to reduce payment service fees and abandoned carts or for startups that want to offer a gateway in regions where such services are insufficiently provided.

In this article, we will run you through all the details you need to know about the payment gateway development process.

Let’s Define Some Essential Terms Before We Begin

So, what is a Payment Gateway? Simply, it is a system that allows paying by card at online and offline stores. This technology securely encrypts the client’s data and transfers it from the customer to the acquirer bank.

There are 3 parties in this process: a person who buys goods, a shop, and a bank. Here shop acts as a payment portal and the bank as a payment processor. A great example of a payment gateway is the PayPal Commerce Platform, which gives you a payment gateway and payment processor. In the picture below, you can see how this technology actually works.

Moving to the other terms, we want to discuss the roles of payment service providers (PSPs), payment methods, payment instruments, and merchants in the payment gateways.

- Payment Service Providers (PSPs) – are third-party companies that provide payment services to businesses with online payment methods: credit cards, debit cards, e-wallets, cash cards, bank transfers, etc. For example, the most popular PSPs are Amazon Pay, PayPal, Stripe, and Square.

- Payment Methods – ways how the customers can pay for goods at merchants. For instance, consumers usually use credit and debit cards or e-wallets as payment methods.

- Payment Instrument – a physical or virtual material that allows making a transaction. It can be a check, credit card, e-money, etc.

- Merchant – in our case, merchants act as payment portals that allow customers to pay with different payment methods.

The payment gateways are secure, fast, time-saving, and automized. For this reason, they started to gain popularity:

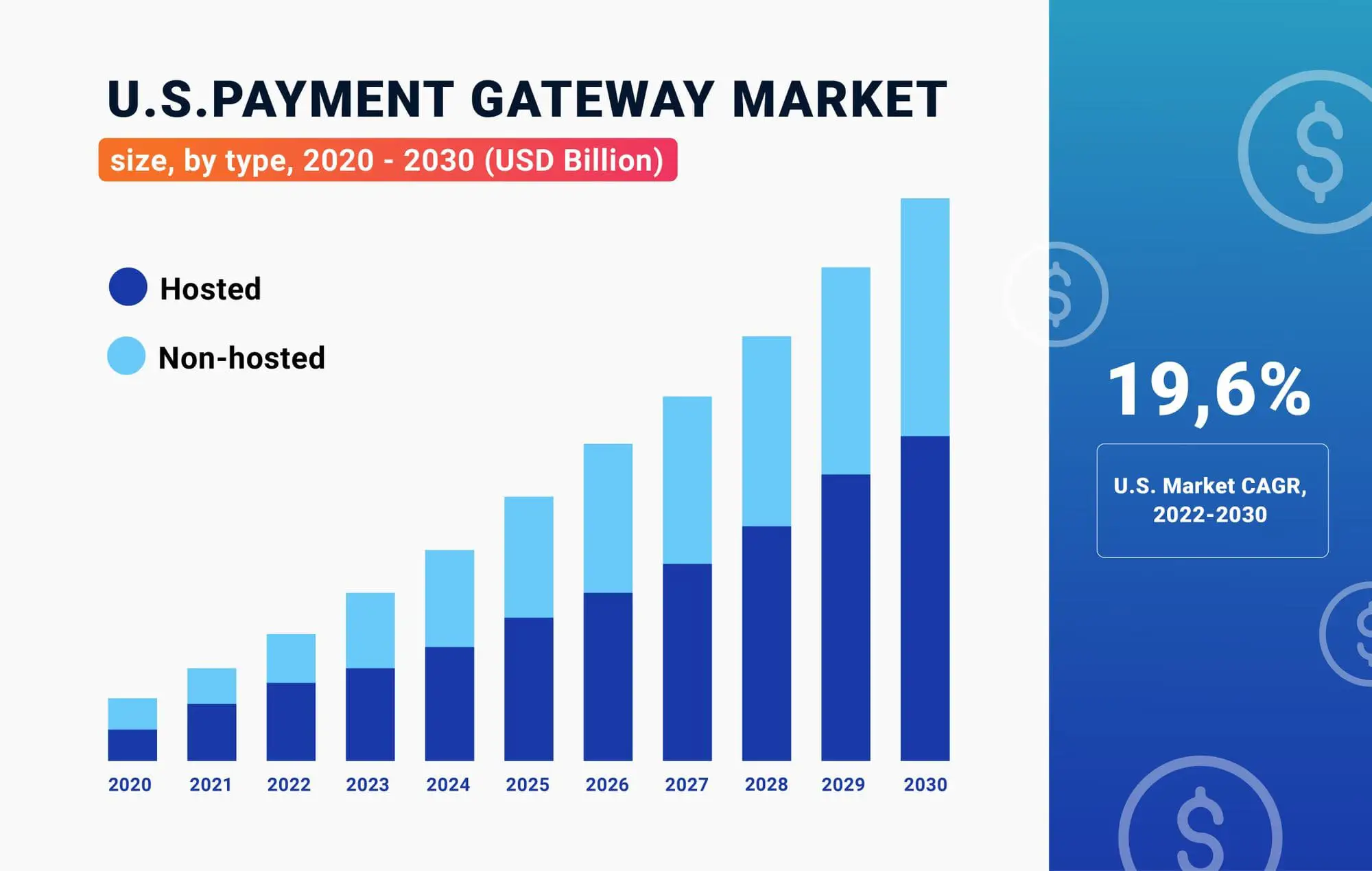

The statistic from Grand View Research shows that in 2021, the global payment gateway market size was valued at USD 22.09 billion and was expected to expand at a compound annual growth rate (CAGR) of 22.1% from 2022 to 2030.

How are Payment Gateways Beneficial?

After defining the terms, we need to understand how payment gateways are beneficial:

- They allow businesses expanding customer base by opening the business to a new market.

- The transactions are secure, and data is well protected, so the whole payment process will help businesses comply with privacy legislation.

- They help to achieve the best user experience as they are the fastest way to complete a transaction.

Uncovering the critical components of Payment Gateways

Here you can see the most important components of Payment Gateways:

Tokenization

Tokenization is a part of the security aspect of your payment gateway. It allows for the replacement of sensitive data with tokens so that every payment gateway transaction is highly protected.

Recurring Payments

It is crucial for your payment gateway to enable recurring payments so that users can easily and quickly pay for goods and services they use regularly. For example, monthly subscriptions on YouTube Premium, Spotify, and Netflix require recurring payments.

Seamless Payment Gateway Integration

From the customer's point of view, it allows them to choose the most suitable payment option. And from the merchant’s point of view, it will enable them to process all payments in one system.

Scalability

A scalable payment gateway can handle oncoming work that grows and develops every day. When a system is scalable, it will react and adjust accordingly to new challenges. It allows high functionality, increases the opportunity to show and test more unique features, and lowers the risks when a business changes.

Disputes Management

Disputes can occur on a different basis, but they usually arise when the transaction's validity is questioned. To make the dispute resolution process more accessible and to manage them on the stage when they occur, you can automate the reporting and management of typical disputes. Also, do not forget to create a dispute resolution interface – it will allow users to go through this complicated process smoothly and effectively.

Hosted Payment Gateways

It is a system redirecting the user to the payment service provider's page. Basically, the user will leave a website to complete a transaction, then be sent back to the website and finish the checkout process. Hosted payment gateways have many advantages, and the main of them are security, simplicity, and easy customization.

Of course, non-hosted payment gateways can provide a better user experience, but keep in mind that they are less secure.

Virtual Terminal

A virtual terminal is crucial for the functionality of your payment gateway. It is an application that processes credit and debit card payments and allows merchants to accept payments by phone, fax, or mail. For example, Pay Pal Virtual Terminal is widely popular in the world.

Working Hours (24/7)

As your payment gateway will be used in different countries at different timezone, ensure that it works 24/7 without interruptions. Payment gateway transactions are done every second, so many problems can occur if the system works incorrectly.

Factors to Consider During the Payment Gateway Development

There are many important factors to consider during the Payment Gateway Development:

Fraud Protection

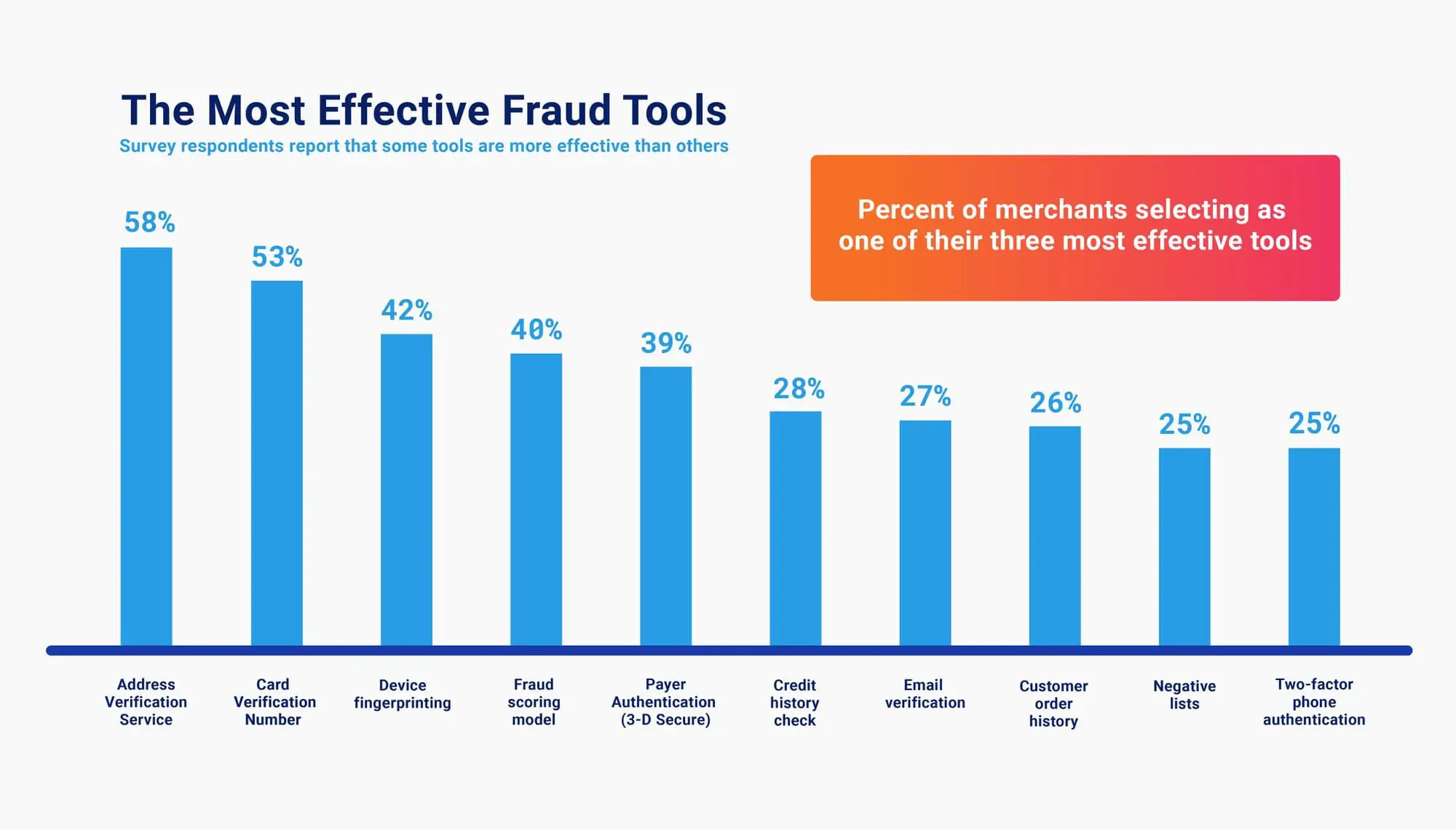

Payment services attract people interested in fraudulent activity, so ensure that your service has a well-developed fraud protection system. Here you can see the most commonly used fraud tools to identify the riskiest stages.

In Eliftech, we highly recommend using the following tools to protect your users and application from fraudulent activity:

- Account Verification Service (AVS) helps reduce risk by verifying the cardholder's billing address with the card issuer.

- Know Your Customer (KYC) – Describes the process of verifying the identity of customers. The KYC process is performed to prevent illegal activities such as money laundering or fraud and protects both the company and the client.

- Anti-Money Laundering (AML): This refers to the steps that financial institutions and other firms must take to prevent criminals from depositing or transferring funds earned illegally. In particular, AML regulations are designed to stop terrorist financing and prevent crimes like human trafficking.

Create an API

You should think about how your API can be implemented in other businesses.

Creating the APIs for internal use makes your payment gateway popular worldwide.

Here are the main factors that businesses consider when choosing a payment gateway API, so make sure to highlight the following aspects:

- Security

- Payout Time

- Easy and simple integration

- Customization

- Multiple currencies

- Payment methods

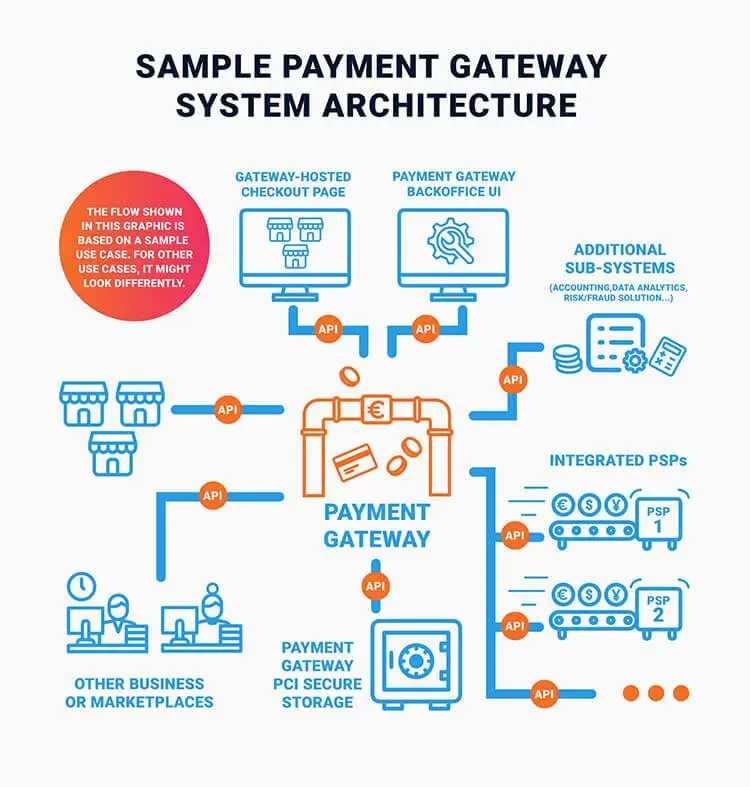

System Architecture

In the picture below, you can see the system architecture of the payment gateway.

Time to market

When you want to launch the product- you have 2 options here:

- The first one – is to launch the product as fast as possible. This option cannot be good for such complex systems as payment gateways because data breaches are risky.

- The second one – is to launch the product when it is completely finished. This way, user interaction with the product will be smooth and seamless.

Implementing Security Features of Payment Gateways

Any system has its own risks. When it comes to payment gateways – it’s usually fraud risks, data breaches, money laundering, or cybersecurity threats. To minimize them, you should ensure that the following aspects are implemented in your system during the payment gateway development process.

PCI DSS Compliance

Payment Card Industry Data Security Standard or PCI DSS – is a set of security standards and rules designed to secure credit and debit card transactions against data theft and fraud. Compliance with PCI DSS is obligatory for any business that processes credit or debit card transactions to minimize fraud risks and ensure security for your users.

There are 12 key requirements of PCI DSS compliance:

- Install and maintain a firewall configuration to protect cardholder data

- Do not use vendor-supplied defaults for system passwords and other security parameters

- Protect stored cardholder data

- Encrypt transmission of cardholder data across open, public networks

- Protect all systems against malware and regularly update anti-virus software or programs

- Develop and maintain secure systems and applications

- Restrict access to cardholder data by business need-to-know

- Identify and authenticate access to system components

- Restrict physical access to cardholder data

- Track and monitor all access to network resources and cardholder data

- Regularly test security systems and processes

- Maintain a policy that addresses information security for all personnel

Data Encryption

Data encryption is the most common and effective way to protect users' data and prevent leaks and breaches. This technology works by the following principle: the gateway collects users’ data and immediately turns the data into another form.

Secure Socket Layer

SSL or Secure Sockets Layer is a technology that allows keeping an internet connection secure and prevents criminal activity with sensitive banking and biometrical data.

Secure Electronic Transaction

Secure electronic transaction (SET) is a system designed by the major card schemes VISA and Mastercard to securely encrypt the data of credit cards. SET prevents fraudsters from accessing the information by concealing the personal details on the card and blocking merchants from seeing this sensitive data.

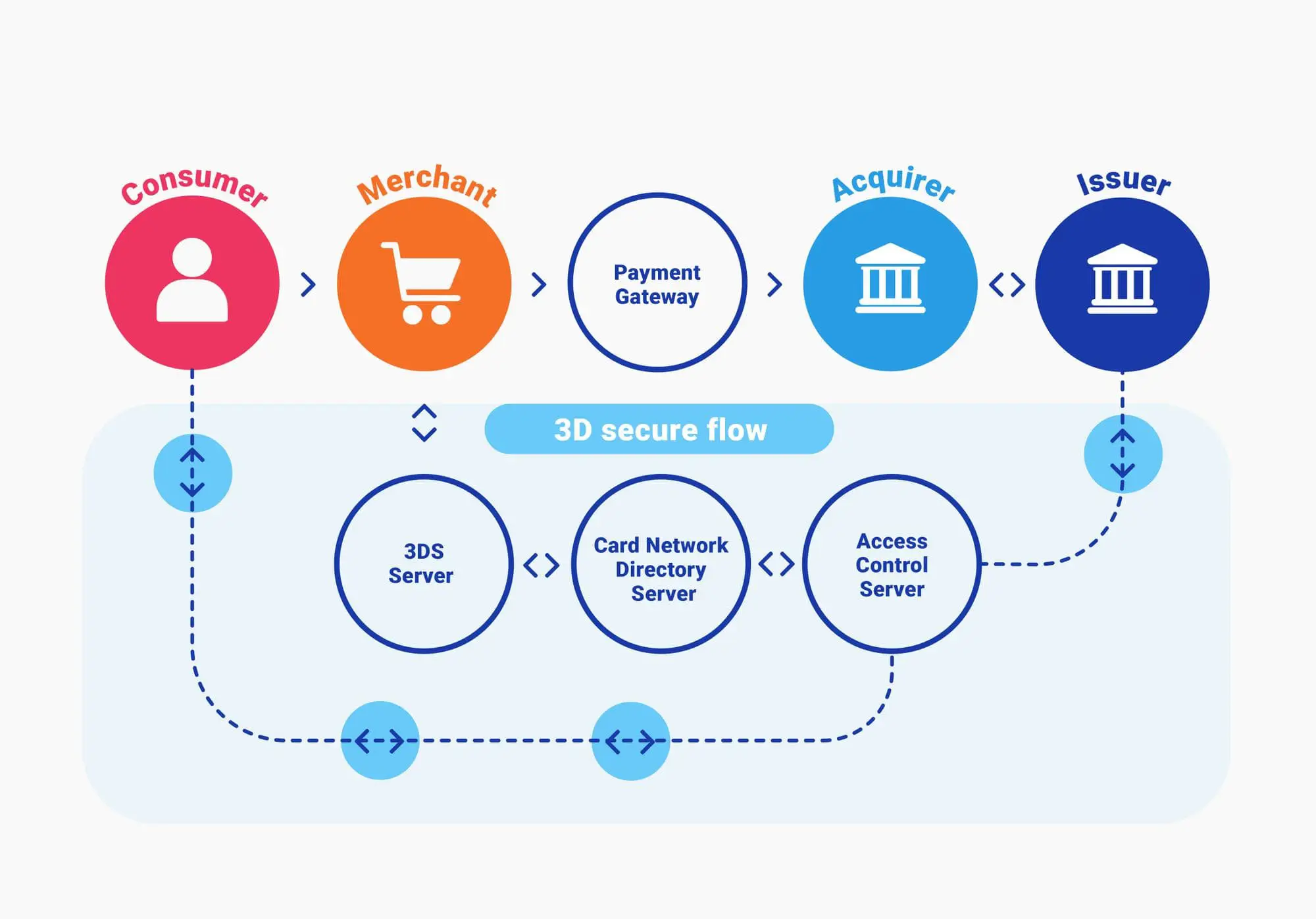

3d secure 2.0

3D Secure 2.0 provides the default mechanism with two-factor authentication to reduce fraud cases and enhance security in online card payments. The picture below illustrates the role of 3d secure 2.0 in a whole payment gateway system.

HSM

HSM stands for a hardware security module which is a physical device that securely stores cryptographic keys. The purpose of this hardware is to protect users’ sensitive data.

It can encrypt, decrypt, create, store and manage digital keys and be used for signing and authentication.

The Main Stages of Payment Getaways Development

After we have covered the main points of the payment gateways, we can move to the most important thing– the development process. Let's make a structured overview of the main stages and key moments of payment getaways development.

Choosing a team for the project

Before you start development, you should choose a team for a project. It’s easier, faster, and more effective to rely on an outsourcing company rather than to compose a team by yourself. Moreover, it is important to ensure that every team member who works on payment gateways is aware of the latest regulations, compliances, and security technologies.

Team training is an effective tool to inform everyone about crucial and new aspects of payment getaway development. This is a key for your product to fit the modern standards and overcome the competitors.

Coding and developing the solution

When you have a professional team, they can start the development process, right? Prior to this big step, the team will consult with you and discuss the roadmap, key moments of the project, its values, and many other important things. Finally, the project manager will divide this large project into smaller tasks and delegate them to team members to make our cooperation effective and smooth and to deliver results reasonably.

Product Launch Stage

Here is the moment everyone was waiting for: the launch of your product. At this stage, our team will make everything from the technical part, and you can promote your product on different platforms using its best tools!

Of course, before the app goes live, our team will ensure that everything works properly and prevent problems and bugs from occurring.

Operations and Maintenance

Technologies are growing dynamically, so it needs maintenance and support to ensure that your product fits the modern world standards and requirements. This stage allows your payment gateway to stay competitive and achieve high performance.

Conclusion

As we can see from the mentioned statistics, the payment gateway market size is growing rapidly. So, creating a great custom solution requires an understanding of crucial components of the payment gateway, like security features implementation, dispute management, APIs, regulatory compliance, and, of course, the main stages of the development process.

If you are interested in building your own payment gateway or need a consultation on that matter, do not hesitate to contact our team!