FinTech

Digital Wallet App Development: Must-have Features and Stages of Wallet App Development

The relentless pace of technological evolution finds its epitome in the digital wallet app development. With the imminent shift towards a cashless global economy underscored by Research and Markets' prediction—1.5 trillion non-cash transactions by 2025—it's evident that digital wallets have ascended to the forefront of financial transacting.

It’s easy to see why mobile wallets are so popular: they offer a convenient payment process that works on any device and lets users buy any product or service from their smartphones in a few clicks. Additionally, mobile wallets have fewer fraud risks because they secure user payment information by adding biometric authentication features like face ID, Touch ID, etc., setting strong passwords, and multi-factor authentication.

If you are planning to develop a mobile wallet app for your business, here we gathered information about the must-have features and stages of wallet app development and shared some tips on the security of your app.

The expansion of the digital wallet app market

Electronic wallets started to gain popularity at the beginning of the pandemic, being the most hygienic way to pay for goods and services. And now, they are not only the most hygienic but also the easiest to use. This tool allows consumers to access information and the history of their transactions in a few clicks.

Mobile wallet applications are no longer just a trend; they have become a need of time.

A digital wallet is simplifying financial transactions and operations. In such apps, users can send and receive money, buy anything in offline or online shops, and use their debit and credit cards, loyalty cards, and coupons. Compared to physical ones, digital wallets are safer and have more features.

Such a system can store information about transactions in one place to make life easier by giving users quick access to their payment information from anywhere. The most commonly used forms of e-wallets are mobile payment apps, but they also exist in desktop versions or other forms.

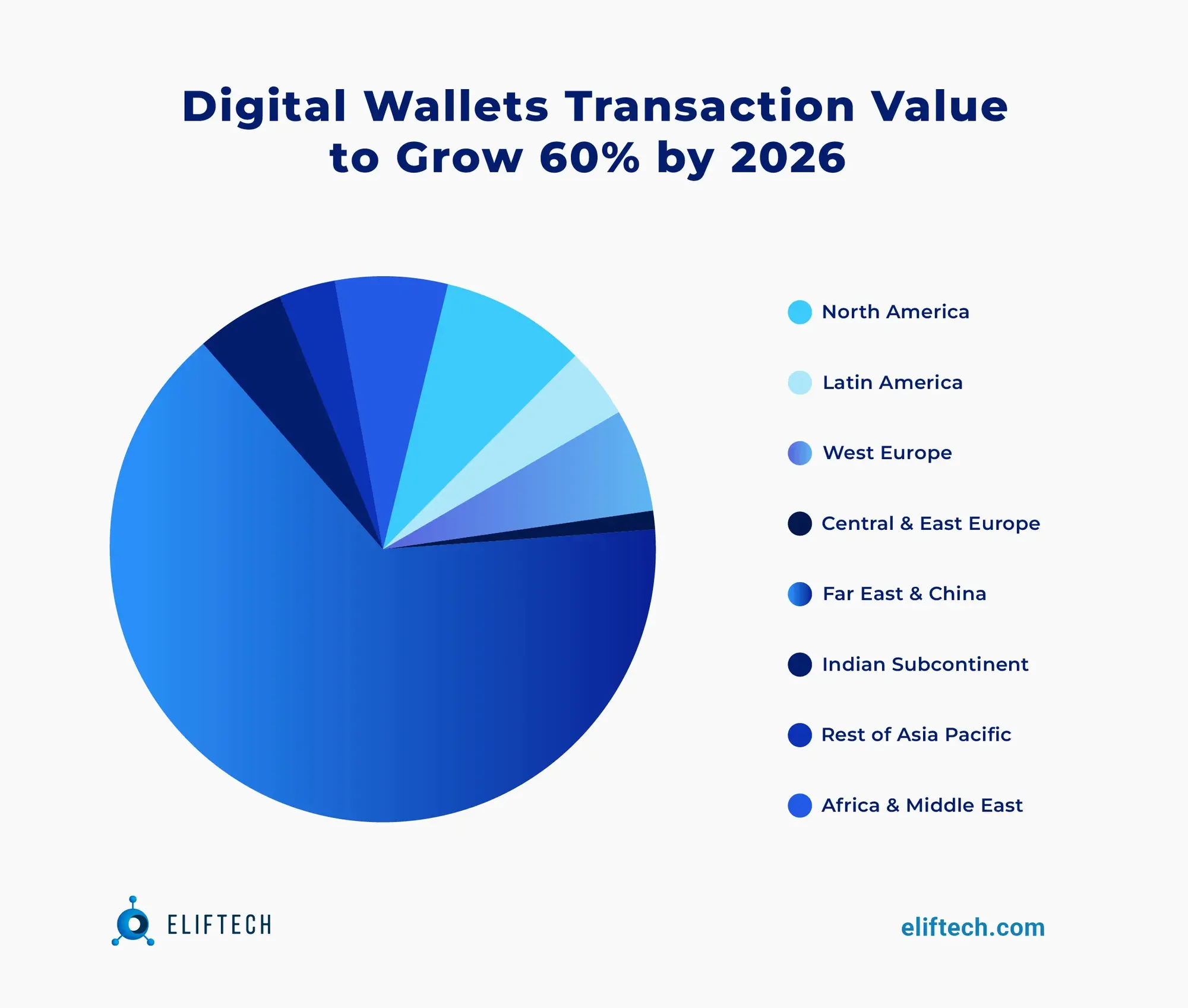

According to Juniper Research, the value of digital wallets transactions will increase 60% by 2026:

Why are digital wallets better than physical ones?

- They reduce fraud cases: the data stored in mobile wallets are highly protected and encrypted.

- They are easier to manage: no need to carry cash or credit cards. All the financial information about transactions is stored inside the app. Some e-wallets allow you to store coupons, gift cards, concert tickets, and insurance cards.

- They save time. Users don't have to type card numbers when shopping online. They have to remember only one password to the digital wallet space instead of many. You can use such wallet applications to make digital payments and in-store purchases, pay bills, transfer money, and make deposits.

Curious about wallet app development cost? Read more: The Real Cost of E-Wallet App Development: How Expensive Is It?

Digital wallet technologies

Different digital wallets use various technologies to complete transactions:

- QR codes – These are machine-readable barcodes that can contain information about the item to which it is attached. Users can scan the QR with the smartphone’s camera and pay. For example, with a PayPal app, you can generate a QR code that enables your account to pay for an item in a store.

- NFC (Near Field Communication) – This technology connects the two NFC-enabled devices to transmit payment information if they are close to each other. For instance, Apple Pay and Google Pay use NFC for transactions. It’s important to mention that to enable NFC mobile payments, merchants must have the right equipment. But all the modern payment terminals include embedded NFC technology and chip readers, so equipment is not a problem.

- MST (Magnetic Secure Transmission) – It generates a magnetic signal similar to that of a traditional payment card when swiped, providing the added convenience of being able to pay quickly on the go without reaching for your wallet. This technology is used for Samsung Pay.

- UPI (Unified Payment Interface) – This real-time payment system allows one to complete peer-to-peer inter-bank transactions through a single two-click factor authentication process. It eliminates the need to enter sensitive data (like CVV code, PIN, etc.) each time a customer initiates a transaction. UPI technology is used in Google Pay, Amazon Pay, and many other apps.

The aforementioned examples can be used with the right equipment at any store or merchant. It's called an open e-wallet. Also, there are closed digital wallets that are made to be used at specific stores only. A great example of this is the Starbucks app.

Industries that benefit from mobile wallet development

Not only users can benefit from e-wallets. Such technologies can be helpful to many industries, especially:

- Healthcare

In a customized medical digital wallet, patients can accommodate their medical records, all past, and present treatments, vaccination records, medicine intake, and much more.

- Retail and Commerce

In this industry, especially ecommerce for small businesses, popular digital wallet apps can help users to store important information about their sales and to gain benefits from payments with loyalty cards, rewards, coupons, etc.

- BFSI (Banking Financial Services and Insurance)

Banks and financial institutions are now more accessible than ever. Adding an ewallet app can simplify many procedures in the BFSI. Offering a digital wallet could give banks access to personal information, making it easier to conduct customer checks and other regulatory actions.

- Telecommunication

As technology progresses, consumers expect all services to be more flexible. Now, telecoms have become more responsive to their users’ needs. Telecommunication companies are the major players in the financial segment, so the digital wallet has become a great solution to their customers’ changing needs.

Types of digital wallets

There are many types of e-wallets:

- Closed wallets. When a company that sells goods or services creates its wallet for its users only, it’s called a closed wallet. This type of wallet enables customers to use the funds stored to perform transactions only with the issuer of the wallet. A great example of this technology is Amazon Pay.

- Open wallets. Open wallets allow users to buy products or services, withdraw money from ATMs or banks, and transfer funds. It’s important to mention that only banks or institutes partnered with other banks can issue an open wallet. The most popular example of an open wallet is PayPal.

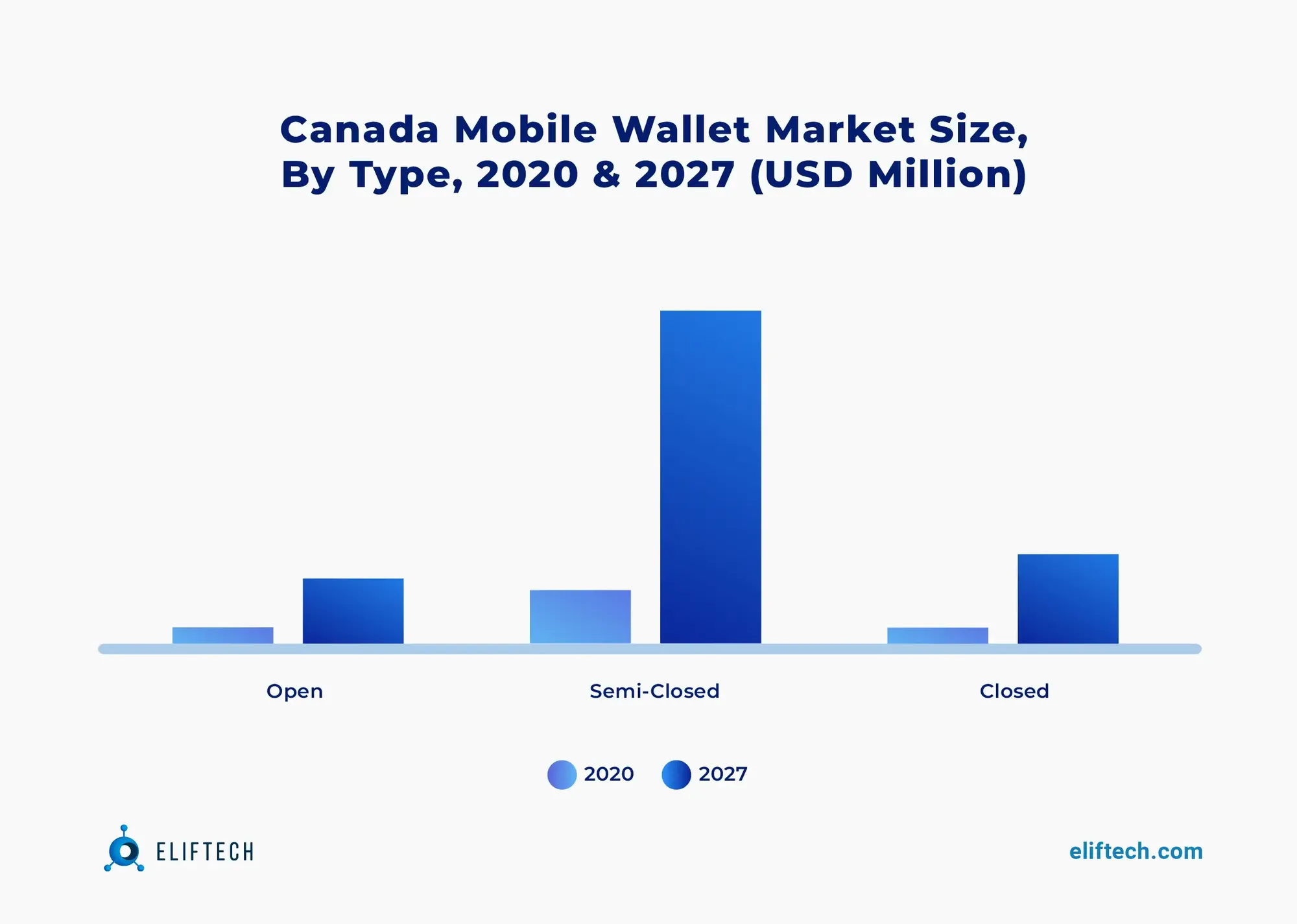

- Semi-closed wallets. A semi-closed wallet enables users to make transactions with available listed sellers and locations offline and online. Nevertheless, merchants should sign an agreement with the issuers to accept payments from mobile wallets. Since non-financial institutions offer semi-closed wallets, the only limitation is that users withdraw cash directly.

However, the chart below shows that semi-closed wallets are and will be the most commonly used among the above mentioned types.

With these wallets, users can store and manage their cryptocurrencies.

- IoT wallets. Mobile payments are no longer limited to just mobile applications. The evolution of payment solutions allows us to perform transactions from wearable devices and appliances.

Must-have digital wallet features to include in your app

Here are some basic and advanced features that will help your product stand out in the market:

- User Registration

- Card authorization

- Transaction history

- Bill payments

- The option to add and check account balance

- Push-notifications

Other good-to-have features in ewallet app development:

- Loyalty cards

- Bill splitting

- Loyalty reward offers

- Gift cards

- Geo-targeting

- Exclusive offers

- Membership cards/discounts

How to build an eWallet app

The digital wallet development process always consists of several stages. Digital wallet apps are complex payment systems so they should be made in 2 phases: the Discovery stage and the Wallet Development stage.

1. Discovery stage and Prototype

The Discovery phase helps you clarify the project goals, identify the risks, and get to know your users. The Discovery team typically consists of:

- a business analyst who will analyze the business domain;

- a system architect who will create and define the software architecture, and

- a UX/UI designer who will make the user-centered design to make your app user-friendly and, therefore, competitive on the market.

In our team, we know that professional UX/UI design is the key to success. Designers will help you achieve the perfect user experience for your ewallet app and create an easy-to-use interface to make interaction with the app as smooth as possible. For a good user experience, it’s crucially important to understand and predict some usability issues at this stage to avoid and fix them before the development phase. To achieve this and meet consumers’ needs, our professionals define a product, do research and competitors’ analysis, then make a prototype and design your application.

2. Conduct Market Research. Why is it important?

To successfully manage a business, it’s crucial to conduct proper market research. The more informed you are of customer expectations and needs, the better you will be at building a relationship with those clients. Without market research surveys, it would be nearly impossible. By creating and analyzing effective research, companies can obtain key insights about the target audience, such as what products will be popular, what features the app must have, and how many people are willing to use them.

Basically, market research helps to understand consumer needs and requirements before launching new products on the market. This process predicts how the application will perform in the real world. By gathering data from the perspective of consumers and competitors, research will provide you with general feedback on the current marketplace.

3. Wallet development and testing

During this stage, our mobile developers will write code to bring a design from a previous step into an app. This process consists of building parts of the app that are visible to users and those that are not visible but still important. In this phase, our specialists will ensure the security of your app. Also, regular security audits should be a priority for digital wallets to prevent data leaks and breaches.

In order to minimize and prevent defects in your app, our Quality Assurance engineers will seek and fix the issues. QA and testing encompass all activities that help ensure a product meets quality standards and requirements.

4. App Launch and Promotion

When the previous steps are completed, you can show and promote your app to the world. During the promotion, you can set up paid and targeted ads and use App Store optimization tips, influencers, or celebrity endorsements to reach your consumers. Keep in mind that the quality of users you attract to your app is more important than the quantity. Ensure that you know your target audience and make your advertisements accordingly.

5. Maintenance

Developing and launching an app isn't the end. Technologies make progress every day, so your app needs maintenance to fit into the modern world's standards. Users always want the latest and flashiest app features. Apps require a lot of maintenance to uphold their quality standard.

Therefore, maintenance becomes one of the most essential phases of the digital wallet app development lifecycle.

Technology stack to build a digital wallet app

During the application development process, our professionals will use this stack of technology:

- For Mobile Development: Flutter, ReactNative for cross-platform wallet applications; Kotlin and Swift for native mobile wallet apps;

- For Web Development: (if you want a web version of your app or “hybrid” version - Progressive Web Application):

- For modern & fluent UI/UX frontend: Vue.JS, React.JS, TypeScript, HTML5

- For fast and robust backend: Golang, Node.js

- For Backend Development: Node.JS, Angular.JS, Java, Ruby, Python, PHP, Django, MongoDB;

- For Database: MongoDB, DynamoDB, Postgres/MySQL, Redis, ElasticSearch.

- For QR Code Scanning: ByteScout BarCode, ZBar Code Reader, etc.

- For Analytics: Amazon Kinesis, Apache Kafka, etc.

- Cloud Services: Amazon Web Services, Google Cloud, Azure, etc.

- To enable Push Notifications: Amazon SNS, Firebase Cloud Messaging, etc.

- For Geolocation: Google Maps API

- Payment Gateways: PayPal, Stripe, QuickPay, etc.

Team composition for developing digital wallet applications

To bring your idea to life, the whole team of specialists will work on your application. Typically, the team composition consists of the following:

- A Project Manager is a person responsible for managing the whole development process to help organizations achieve their goals. They plan, execute, and delegate responsibilities so that projects are completed in a reasonable time period.

- A Business Analyst analyzes data and requirements to deliver data-driven recommendations and reports to stakeholders and executives. The role of a business analyst is to ensure that all business models and processes are properly defined, documented, and implemented.

- A UX/UI designer is responsible for providing the design of your app based on research, usability tests, and interviews with users.

- A Mobile Developer is a software developer specializing in building applications for mobile devices and specific operating systems.

- AWS Certified DevOps engineer uses CI/CD methodologies to create and implement wallet software systems

- A Front-end developer (if you want to make a website) builds the part of the website that users actually see and interact with.

- A Back-end developer writes code that forms the backbone of websites and apps. They build and maintain the mechanisms that process data and perform website actions. Their work is often invisible to users, but it's critical for digital wallet applications to function correctly and minimize the risk of data leaks.

- A Quality Assurance engineer’s job is to find and fix bugs in a product before it goes live. This process is necessary for e-wallets because it prevents bugs and security issues from happening.

Mobile wallet app development: Things you need to consider

Security. Your digital wallet app can be successful only when the customers can rely on the security structure. The e-wallets require storing sensitive information like biometric and card information. Ensuring secure data transmission is a top priority for our company, so we use advanced technology methods to comply with standards and requirements.

Important aspects of e-wallet security:

- Tokenization – the process of exchanging sensitive data for nonsensitive data called "tokens" that can be used in a database or internal system without bringing it into scope.

- Two-factor authentication – one more layer of protection used to ensure the security of accounts beyond entering just a username and password. This type of protection works by the following principle: it uses two unrelated authentication methods to secure an account.

- P2PE (Point to Point Encryption) – is the standard for all cardholder information required by the PCI SSC (Payment Card Industry Security Standards Council). The standard aims at immediate encryption of cardholder information after it is read.

- PCI DSS (The Payment Card Industry Data Security Standard) - is a set of security standards created by Visa, MasterCard, American Express, JCB, and Discover payments system. Those standards are designed to ensure that all companies that conduct payment processing, storing, or transmitting credit card information maintain a secure environment.

- SSL (Secure Sockets Layer) – a protocol for encrypting data transferred between two computers in a secure manner.

Location-based service. A location-based service (LBS) collects and processes the geodata of the devices. LBS is commonly used for mobile notifications, information filters, personalized suggestions, and fraud prevention.

Examples of the most popular e-wallet apps

There is a variety of digital wallet apps. Here we pointed out some of the most popular in the world:

- Google Pay

- Apple Wallet

- PayPal One Touch

- AliPay

- Amazon Pay

- Samsung Pay

- Fitbit Pay

- Garmin Pay

- Venmo

Interested in digital wallet app development services?

If you're looking for a digital wallet development company, it's important to find a company that has experience with mobile payment solutions. Our offerings include:

- Seamless, secure transactions within a user-friendly digital wallet app.

- Adherence to industry standards.

- Extensive experience in developing mobile applications for both Android and iOS platforms.

- Effortless navigation, and swift transactions for maximum user satisfaction.

- Continued excellence via regular updates, maintenance, and support.

See it in action. Take a moment to peruse our case study on an e-wallet solution that cuts expenses and makes it much easier and more convenient for education organizations to manage their cash flow. The platform has quickly gained popularity and is in demand among its users, with a customer renewal rate of 98,9%.

In a somewhat noisy market, we’re your trusted wallet app development company that complies with the standards in the FinTech industry. Contact us to carve your niche in the fintech landscape with our digital wallet app development services.