Wealth Management

Investor Relationship Management Software: More than Just a CRM

In the realm of financial management, Investor Relationship Management Software (IRM) stands as a formidable force, transcending the limitations of conventional CRM tools. Far more than a mere upgrade, IRM represents a robust and multifaceted solution, empowering organizations to navigate the complexities of expanding their teams and investment portfolios.

In this blog post, we'll look closely at IRM software and its exclusive capabilities compared to traditional CRMs. We'll explore the essential features it offers and how businesses use this software to address wealth management challenges and enhance investor relations.

What is Investor Relationship Management Software, and How Does It Differ From a Traditional CRM?

Similar to how sales and marketing departments rely on dedicated CRM tools, an effective IRM should cater to the unique requirements of investment teams in managing their valuable lead funnels. That’s how a wealth management CRM solution has emerged, offering a comprehensive set of tools and functionalities tailored to the unique needs of startups and businesses that rely on investor capital, investor relations firms, or institutional investors.

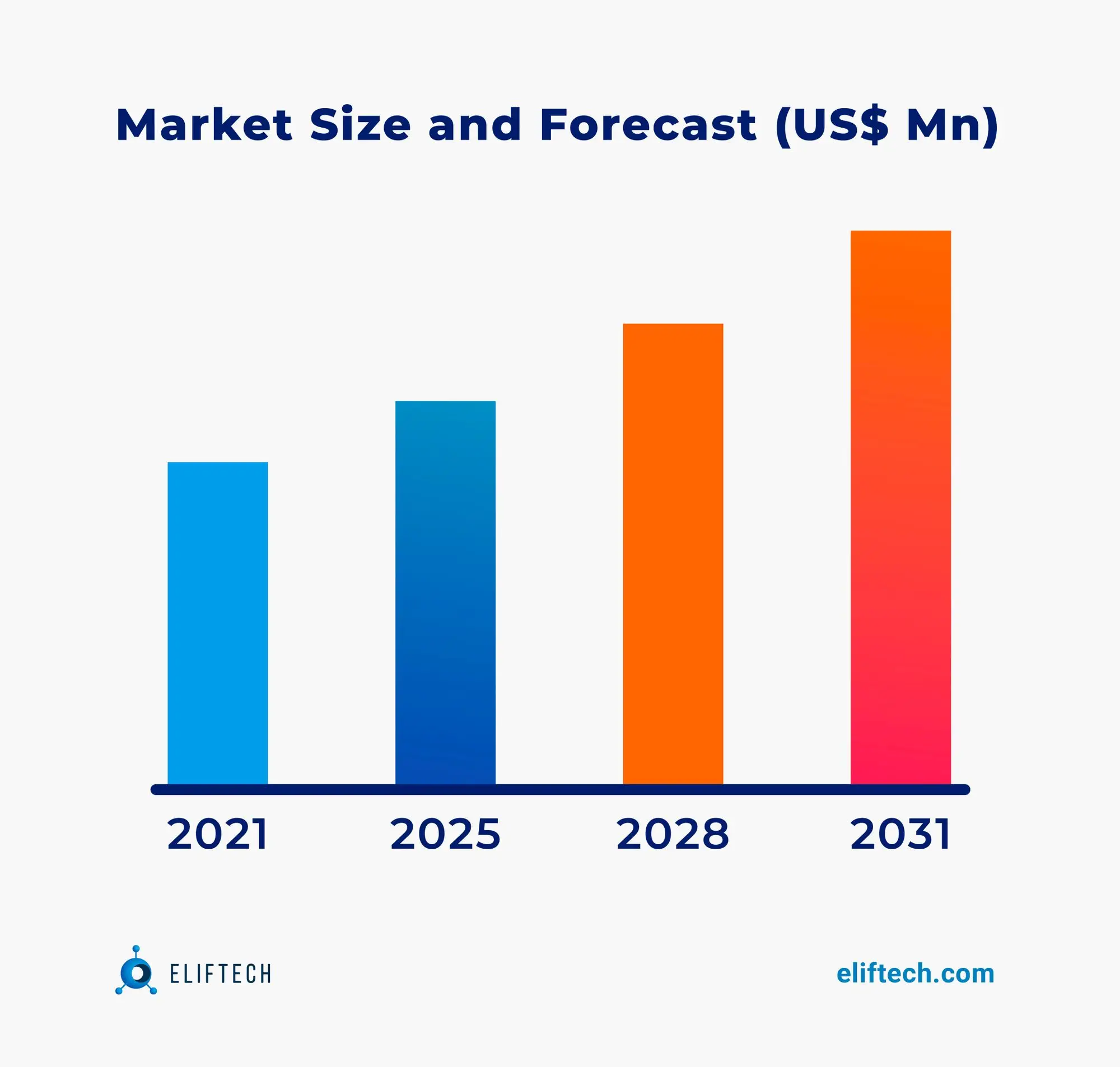

Recent studies have shown that adopting investor relations solutions is expected to increase during the forecast period 2021-2031. The key drivers in this process are the emerging needs of various financial institutions.

So what specific needs might these wealth management companies have?

Firstly, they face the need to track communications with investors effectively. CRM for investor relations offers a consolidated platform where businesses can track and manage all investor communications, including emails, phone calls, meetings, and documents. This comprehensive record makes historical data easily accessible and facilitates communication with investors in a personalized and informed manner.

Secondly, financial firms are required to analyze investment trends on a daily basis. Investor relations CRM allows firms to track and evaluate investor behavior, preferences, and communication patterns. Using advanced data analysis tools, wealth management companies can gain critical insights into investor sentiment, spot new trends, and make data-driven decisions to improve their investment strategies.

Thirdly, companies need automated reporting capabilities because creating various reports requires much time and effort. A wealth management CRM solution provides customizable reporting templates. These enable businesses to develop comprehensive reports on many aspects of investor interactions, including fund performance, investor demographics, and legal compliance. In addition to helping companies meet reporting requirements, these reports provide a holistic view of their investor base, which is vital for strategic planning and performance measurement.

While traditional CRMs are more generic and offer basic customer management functionalities applicable across various industries, an wealth management CRM solution takes a tailored approach to investor relations.

One of the most valuable standout benefits IRM provides is the ability to enhance investor engagement. By centralizing all investor contacts and information in one system, firms can speed up communication, provide individualized updates, and quickly respond to investor concerns. As a result, this strengthens relationships, fostering attraction and retention.

Another distinguishing benefit is a dedicated focus on compliance specific to the wealth management sector. Unlike traditional CRM software, it offers features to enforce compliance rules, automate compliance workflows, and create compliance reports.

So, these distinctions of IRM software encourage firms to have this system in place, as capital is their most valuable asset, and investor relations are key to raising it further.

Users of Investor Relations CRM in Wealth Management

A wealth management CRM solution is poised to facilitate the work of professionals like portfolio managers, financial advisors, and the investors themselves, as well as all people who are primarily responsible for driving and maintaining strong relationships with investors, ensuring effective communication, and providing relevant investment data.

Portfolio managers. Investor relations professionals act as a bridge between the firm's portfolio managers, financial advisors, and investors. They collaborate closely with portfolio managers to acquire performance data, investment insights, and updates. This information is then organized into an investor relations CRM system to ensure easy access and retrieval when communicating with investors.

Financial advisors. A wealth management CRM solution also makes working together easier for investor relations professionals and financial advisors. They can collaborate to answer investors' questions, solve their problems, and offer comprehensive support by exchanging investor-specific data and insights. Through this partnership, the company's seamless communication and investment strategies can directly meet investors' expectations.

Investors. Using this software, investor relations specialists interact with investors, providing timely, personalized information about their investments. This includes performance reviews, fund updates, market changes, and other relevant data. This way, the wealth management CRM solution is a central hub for managing investor preferences, tracking communications, and interacting with investors.

Challenges Wealth Management Firms Face in Managing Investor Relations

When it comes to managing investor relations, wealth management poses some complex challenges for firms. Addressing these challenges requires a proactive mindset, timely reaction, and a deep understanding of effective strategies to overcome them. So, we’ve prepared a so-called cheat sheet for you to make this task easier.

Challenge #1. Lack of constant communication

Maintaining effective communication with a diverse investor base can be challenging with the rise of numerous digital communication channels and expectations for real-time updates. As a result, businesses face the challenge of managing multiple platforms, supporting one-to-one communication, and balancing automation and human interaction.

Solution: Our recommendation is to explore the implementation of investor relationship management software. This will help centralize large volumes of investor data, track communications, and personalize messaging for enhanced investor engagement.

This platform allows firms to automate workflows and provide segmentation capabilities for targeted and timely communication.

Challenge #2. Complex data management

Wealth management firms process large amounts of investor data, including personal data, investment preferences, and transaction history. Accordingly, it can be difficult to manage and analyze this data to gain valuable insights. Ensuring data privacy, accuracy, and utilizing advanced analytics technologies is not a simple task.

Solution: Wealth management companies can benefit from implementing an investor relationship management or centralized data management system. It enhances overall data management through standardized data entry procedures, streamlines data management by centralizing investor information, and provides higher data accuracy through regular data cleansing and validation processes. The system can also be integrated with other systems to improve data integrity and facilitate smooth data flow.

Challenge #3. Regulatory burden

The finance industry is highly regulated. For wealth management organizations, complying with a variety of regulatory obligations is a challenging process. Different jurisdictions may have different compliance requirements, including complex reporting, KYC/AML processes, and ongoing monitoring. Staying up-to-date with regulatory changes and ensuring compliance throughout the firm can be challenging.

Solution: There are two options: you can proactively implement compliance measures through internal audits or implement technology solutions that provide built-in compliance features to automate KYC/AML checks, track regulatory changes, and generate compliance reports. Here, the software reduces your efforts to maintain accurate and up-to-date investor records.

Challenge #4. Market volatility and economic uncertainty

Wealth management firms must cope with market volatility and economic uncertainty, which can affect investment performance and investor sentiment. Ensuring clear communication during market downturns, managing risk effectively, and adjusting investment strategies to changing market conditions are the challenges these firms often face.

Solution: Investor relations CRM is the most efficient way to automate communication workflows, generate real-time investment performance reports, and provide investors with timely updates on market conditions. This platform facilitates the efficient dissemination of timely market updates, allowing investors to keep abreast of market trends and adjust their investment strategies accordingly.

Challenge #5. Failure to meet personalized investor expectations

Wealth management companies must collect and analyze large amounts of data to understand the preferences of individual investors and offer specialized investment advice and services. This requires advanced analytics, technology integration, and a skilled workforce.

Solution: One solution for these firms is to utilize data analytics and investor profiling to gain insights into investor preferences. An alternative solution is to let your investor relationship management software handle these tasks for your team. This allows investors to be segmented based on their profiles and preferences, providing targeted communication and customized services.

Why a CRM is Essential for Investor Relationship Management

There are six key reasons why CRM is crucial for efficient investor relationship management.

- A centralized hub for investor data. CRM for investor relations serves as a centralized repository for all investor-related information. This allows wealth management companies to track investor profiles, contact information, investment history, preferences, and communication in one secure location and learn more about their investors.

- Enhanced communication. The functionality of CRM software for investor relations allows for tracking and managing investor interactions, including emails, calls, meetings, and notes. This feature ensures that every communication is recorded and accessible when needed. In turn, wealth managers can have an overview of past messages enabling them to continue conversations in a more personalized and informed manner.

- Targeted marketing and personalization. For firms implementing personalization strategies in their investor relationships, this platform enables them to segment their investor base and customize their marketing activities accordingly. As such, businesses can send customized marketing campaigns and messages to investors, categorizing them based on their investment preferences, risk tolerance, demographics, and other factors.

- Facilitated task and workflow management. The IRM system provides task and workflow management functionalities, ensuring that essential investor-related tasks and follow-ups receive proper attention. Reminders, notifications, and automated workflows help streamline procedures, complete tasks on time, and focus on other business-critical tasks.

- Data analytics and reporting. CRM systems for investor relations often include robust analytics and reporting features. Direct access to it helps firms gain valuable insights into investor behavior, investment trends, performance metrics, and other key indicators for data-driven decision-making and improving investment strategies.

- Raising capital. By effectively managing investor relations using CRM data, firms can demonstrate their track record, performance, and individual investment opportunities. This allows them to attract potential investors and secure the capital needed for their investment portfolios.

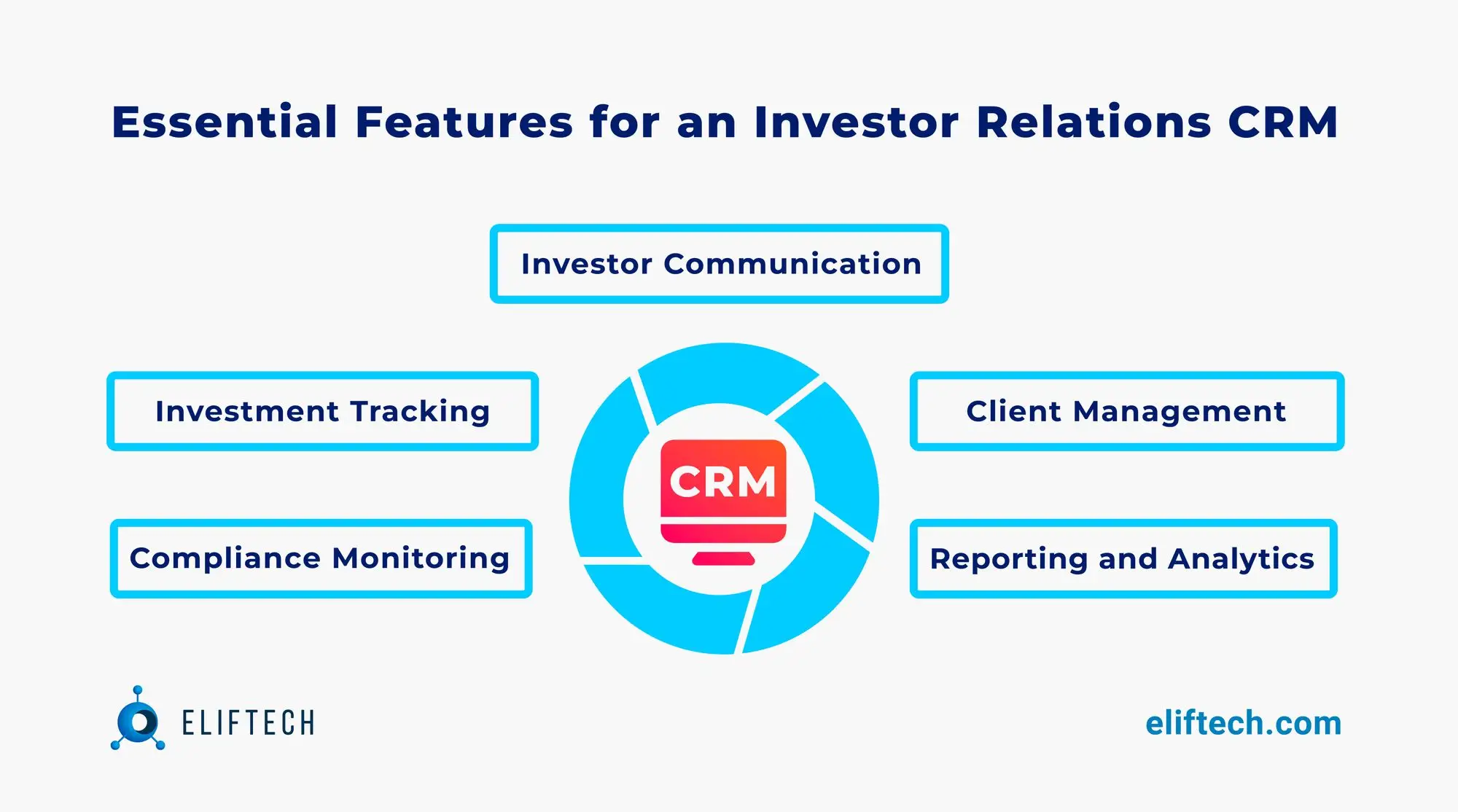

Essential Features for an Investor Relations CRM

Investor Relations CRM software is a powerful tool to help businesses meet multiple challenges and support investors through the different fundraising stages. We’ve compiled a specific list of features and revealed how they help manage investor relations to achieve your business goals.

Investor Communication

Today, building new relationships with investors can’t only rely on cold email campaigns and phone calls. A CRM for investor relations supported with advanced technologies can help those communications warm up and prove that your team is worth the investment.

This platform provides tools to keep track of emails, calls, and meetings with investors. It consolidates all communication history in one place, allowing asset managers to access previous conversations and personalize future interactions. This ultimately leads to timely and personalized communication, stronger relationships, and increased investor satisfaction.

Investment Tracking

At a particular stage, every emerging business reaches a point where it needs to switch from using Excel spreadsheets and invest in advanced technology solutions to analyze vast amounts of customer data effectively. This especially applies to financial firms involved in investor management.

The investment tracking feature built into investor relationship management software provides real-time data on investment performance, asset allocation, and transaction history. By analyzing this data, which generates reports and visualizations, wealth managers can learn about portfolio performance and trends. This allows them to evaluate investment plans, identify opportunities and make informed decisions.

Compliance Monitoring

Instead of wasting time on regular compliance audits, the compliance monitoring feature ensures that companies automatically comply with internal and external policies. Some features CRM for investor relations offers are identity verification, document management, and automatic compliance alerts. It streamlines compliance procedures, maintains critical records, and notifies managers of compliance deadlines. This reduces compliance risks by helping businesses meet regulatory obligations.

Client Management

Investor relationship management software uses specific tools, helping firms to actively engage and nurture client interactions throughout their journey with the company.

It has an embedded client management system where businesses can store and organize client information. This ensures quick access to crucial details such as contact information, purchase history, investment preferences, and communication records. Also, it allows wealth managers to update client information, track interactions, and segment clients based on different criteria. This provides a complete view of client relationships.

With this information at hand, companies may customize their strategy and offerings to suit the needs of particular investors. This way of management streamlines client servicing and helps build trust, loyalty, and a sense of value as customers feel heard and appreciated.

Reporting and Analytics

A wealth management CRM solution offers customizable options and provides key metrics analytics, investor dashboards, and performance reports. It collects and analyzes data to provide meaningful insights into investment performance, investor behavior, and market trends. Having this knowledge, wealth managers can evaluate performance, identify new opportunities, and provide timely information to investors.

The Importance of a Custom-built CRM Solution for Investor Relations in Wealth Management

Comprehensive relationship management software can make a big difference, particularly for smaller investment teams or family offices without a specialized investor relations (IR) team. Instead of relying on specialized staff, these teams can rely on a platform that provides the necessary support and functionality to manage investor relations effectively.

By focusing on the specific needs of these firms, a customized wealth management CRM solution can bring several core benefits:

- This system is equipped with tailored features for the efficient management of investor data, leading to improved operational efficiency.

- Personalized and tailored communication through this platform has a positive effect on attracting investors and helping to build long-term relationships and trust.

- At the same time, the core benefit for the finance industry is the ability to ensure adherence to regulatory requirements, reducing the risk of non-compliance and associated penalties through the use of compliance features and automated alerts coming along with this platform.

ElifTech understands the needs of wealth management firms and offers expertise and capabilities to help you fully reap the benefits of utilizing the best CRM for investor relations:

- Understanding what wealth management firms need. At ElifTech, we recognize the importance of financial software solutions that can evolve with businesses and adapt to their changing needs, as we have already tried our hand at it. Our team understands their pains by actively listening to clients' challenges and requirements in managing investor relations, continuously learning from real-world cases, and staying updated with industry trends and changes.

- Proven track record in building FinTech applications. We have extensive experience building innovative applications for the financial industry, which makes us well-suited to address the unique challenges wealth management companies face.

- Customized CRM development for wealth management firms. We engage in thorough discussions to understand wealth management firms' unique requirements and goals. Setting a focus on developing tailored CRM systems, we ensure businesses can accommodate future growth and changing industry dynamics.

Looking to optimize investor relations in wealth management? Contact us to discuss your specific needs and start maximizing the benefits of a wealth management CRM solution.