Logistics

Protect Your Data with Smart Fraud Detection

Introduction

In global supply chains, everyday business relies on documents, including invoices, contracts, bills of lading, and more, each of which is crucial for moving goods and facilitating payments. Companies process mountains of these documents, and every one needs verification for accuracy and legitimacy. Traditionally, this means teams of people manually checking paperwork, a slow and tedious process. Manual checks not only fail to keep up with large volumes but are also prone to errors. Studies show that people make mistakes at a rate of 18 - 40% when performing simple data entry tasks. Such fragmented, slow verification leaves gaps that fraudsters can exploit.

That's why we've automated fraud detection. An AI-powered document verification system can optimize these checks by doing the heavy lifting at digital speed. By automating verification, companies can speed up document processing, reduce errors, and detect signs of fraud that might slip past a busy team of employees.

Core Capabilities

An AI-driven document fraud detection system offers a toolkit of powerful capabilities. It can automatically identify the type of each incoming document, extract the key data inside, and then cross-verify that information for accuracy. Advanced AI algorithms analyze the content of invoices, contracts, and bills of lading, comparing details across documents and against trusted databases to catch any discrepancies. If anything seems off, from a mismatch in numbers to a suspicious alteration, the system flags it instantly for review.

Document identification

The system first recognizes each document’s type. Whether it's an invoice, a contract, or a bill of lading, AI can classify unstructured documents by looking at patterns in the text and layout. This automatic identification means no manual sorting; you can drop in a mix of files, and the AI knows what's what.

Key data extraction

Once identified, the platform pulls out important details from each document. Using advanced text recognition (OCR) and language understanding, it “reads” the content to capture items like invoice numbers, dates, line-item amounts, contract terms, or shipping details. Even if a document is a scanned PDF or has an unusual format, the AI can interpret the information inside.

Cross-document matching

Next, the system checks that everything lines up correctly. It compares data across related documents and cross-checks against your databases. For example, it will verify that an invoice’s amount and purchase order number match the corresponding purchase order, and that the shipment details align with the bill of lading. The AI agents work together here. A Database agent can instantly validate details against your ERP (enterprise resource planning) system or vendor records, while a CrossCheck agent compares fields between the uploaded documents. Inconsistencies are flagged immediately. In fact, the AI can perform two-way or even three-way matching and validate data against multiple sources (internal databases or external records) to detect any fraud.

Fraud and error flagging

Finally, the system spots red flags that humans might miss. It automatically looks for signs of tampering, missing information, or other anomalies. If a document has missing pages, altered figures, or a mismatched signature, the AI will catch it. Any discrepancy or suspicious pattern, no matter how subtle, triggers an alert. These flags let your team know exactly which documents need attention, instead of manually sifting through every file.

Why It Matters

Implementing smart fraud detection for document processing offers big benefits for supply chain operations.

Faster processing

Automated verification means documents that once took days of back-and-forth can be cleared in minutes. There’s no waiting on busy staff to review each page, the AI checks everything almost instantly. Faster processing keeps shipments moving and payments on schedule, which is vital in logistics where delays can be costly.

Fewer errors

By minimizing manual data entry and review, the system sagnificantly cuts down on typos, oversights, and reporting errors. You get more accurate records and avoid the domino effects of mistakes (like shipment delays or payment disputes caused by a mis-keyed number). In fact, organizations using AI document verification have seen a significant drop in verification errors and avoided millions in potential losses as a result. Fewer errors also mean less time and money spent fixing problems after the fact.

Reduced fraud risk

Perhaps most importantly, AI scrutiny makes it much harder for fraudulent or doctored documents to slip through. The system flags inconsistencies and unusual patterns that a human eye might miss, catching fraud early before it causes damage. For example, if someone tries to alter an invoice amount or submit an unauthorized document, the AI will detect the anomaly and alert you. This early warning can prevent costly fraud and protect your company’s reputation. It also helps ensure compliance with regulations, since any document that doesn’t meet standards is immediately brought to light. In short, automated verification adds a strong safeguard in supply chain transactions, giving you peace of mind that things are as they appear.

How You Can Use It

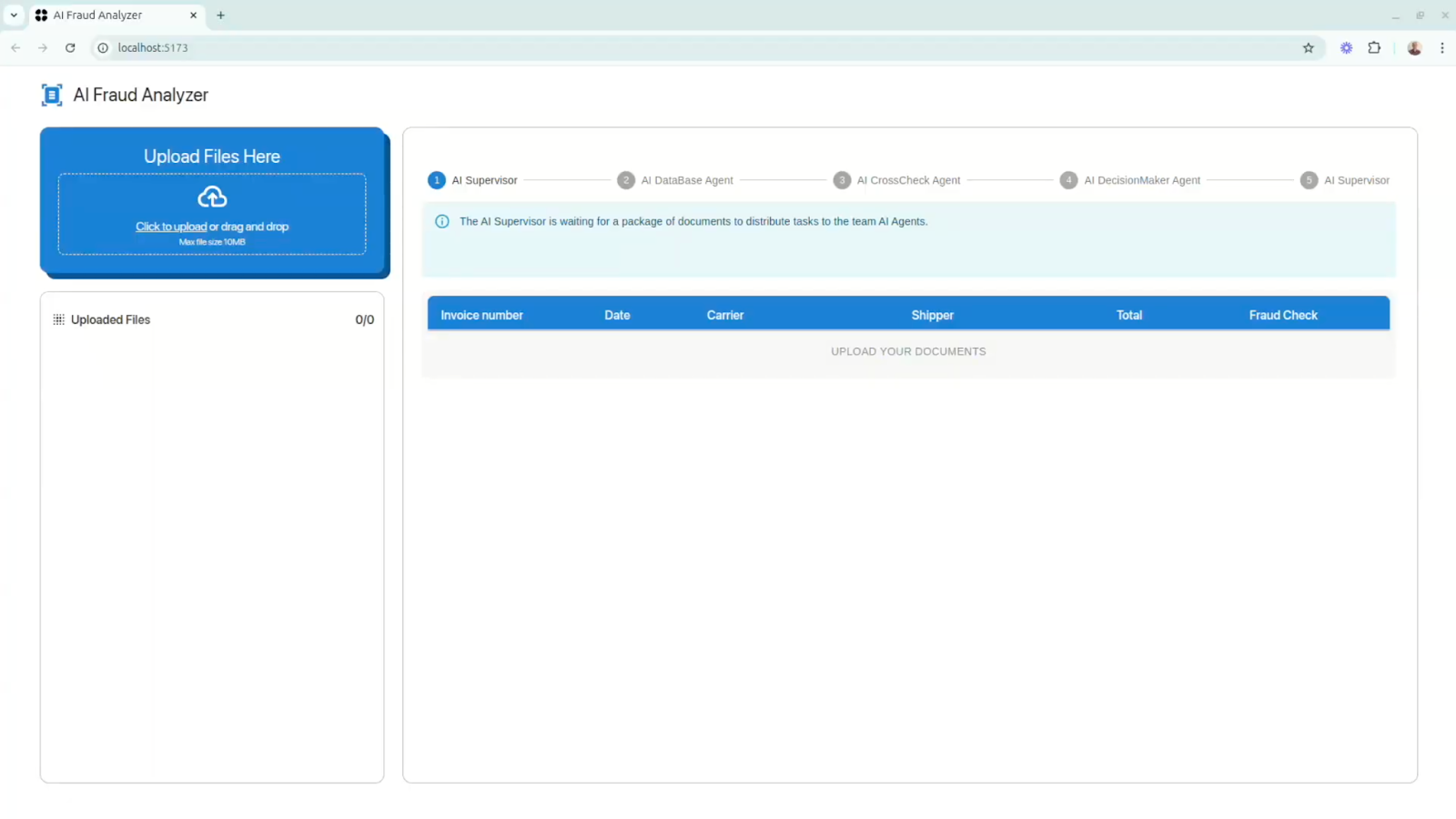

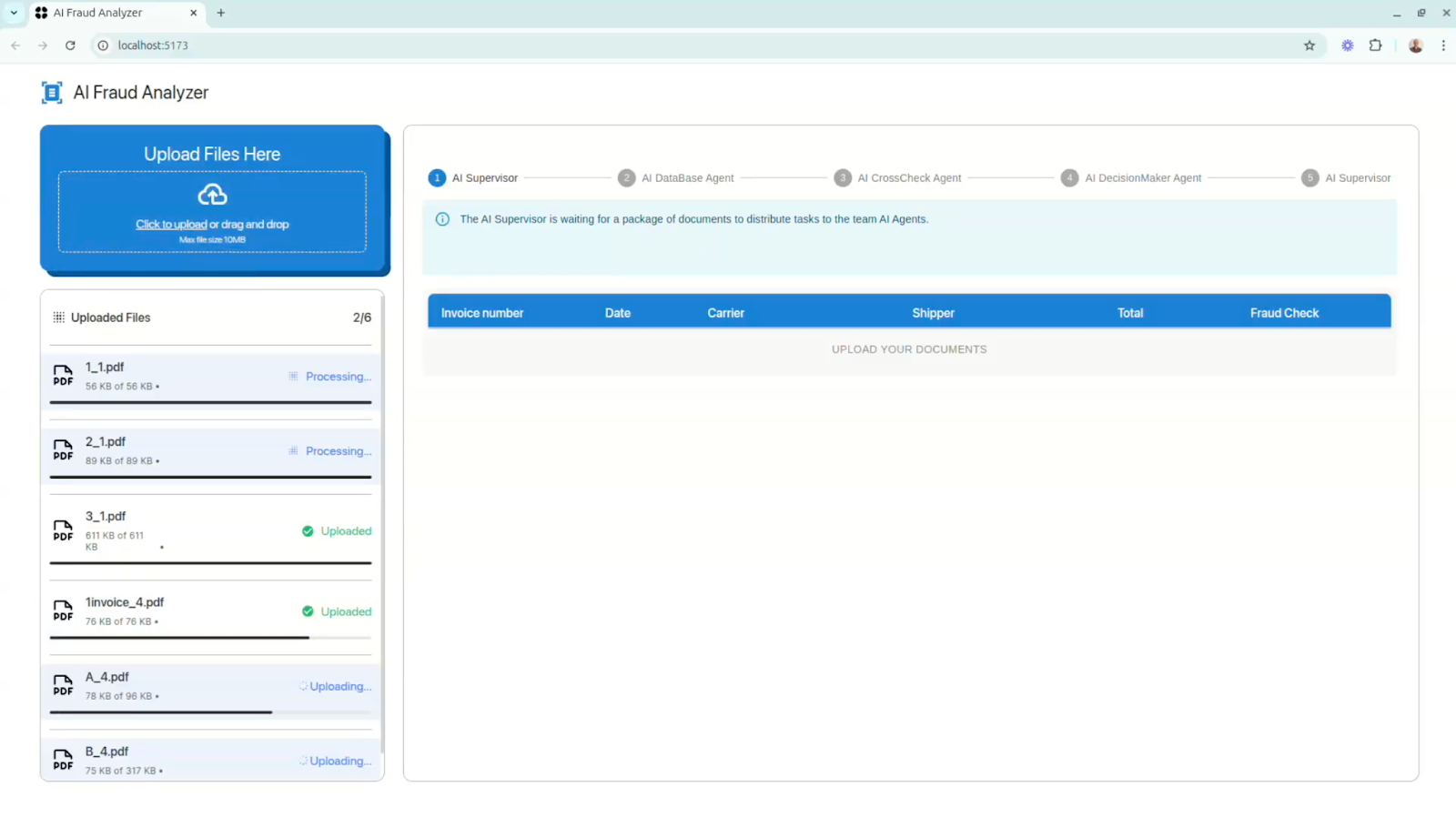

First, you gather the documents related to a transaction and feed them into the system. This could be a mix of files, an invoice, the corresponding purchase order or contract, and the bill of lading for a shipment. You can upload scans, PDFs, or digital documents through a secure portal or by email. The system’s Supervisor agent orchestrates the process in the background, ensuring each file is received and queued for analysis.

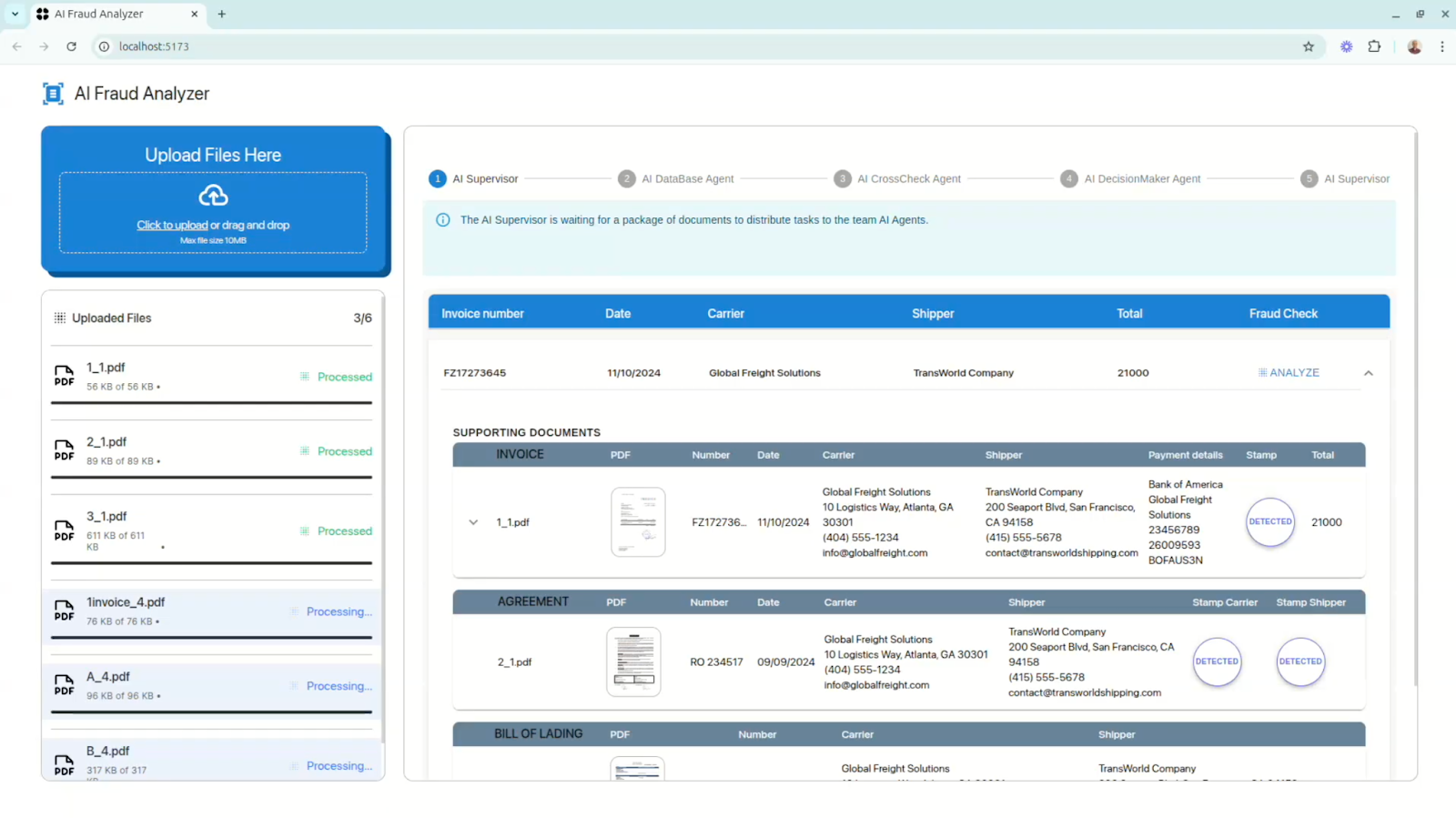

Once uploaded, the AI gets to work identifying and reading each document. It classifies each file by type (figuring out which one is the invoice, which one is the contract, etc.) and then extracts the key information. Using AI, the system scans the text and pulls out all the critical data points, for example, the invoice date, invoice number, vendor name, amounts due, line-item details, shipment destinations, contract terms, and so on. This happens quickly, without any manual data entry. The extracted data is neatly organized, ready for verification.

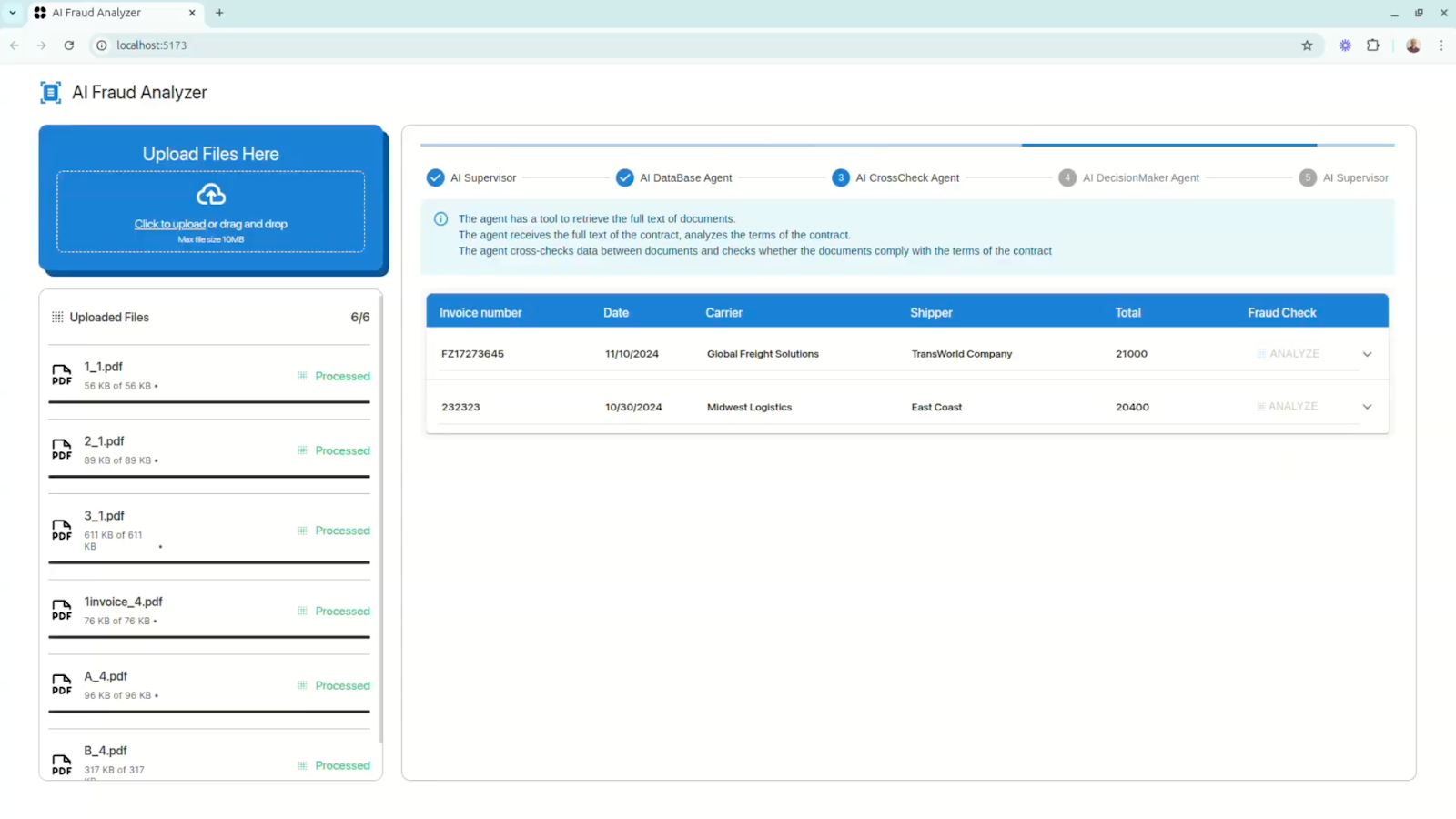

Now the real “brainwork” happens. The system’s AI agents validate the extracted information against each other and against your records. For instance, a Database agent might cross-check the invoice details with your internal databases, confirming that the vendor is in your approved supplier list, that the purchase order referenced is valid, and that the billed amount doesn’t exceed what was agreed. At the same time, a CrossCheck agent compares details across the uploaded documents themselves. It ensures the figures on the invoice match the quantities and products listed on the bill of lading, and that all documents refer to the same order or shipment. If any piece of data doesn’t match, say the contract specifies 100 units but the invoice is charging for 120, or the delivery date on the bill of lading doesn’t align with the invoice – the system will flag it. Throughout this step, the AI is essentially doing a comprehensive audit in seconds, far faster than a human could.

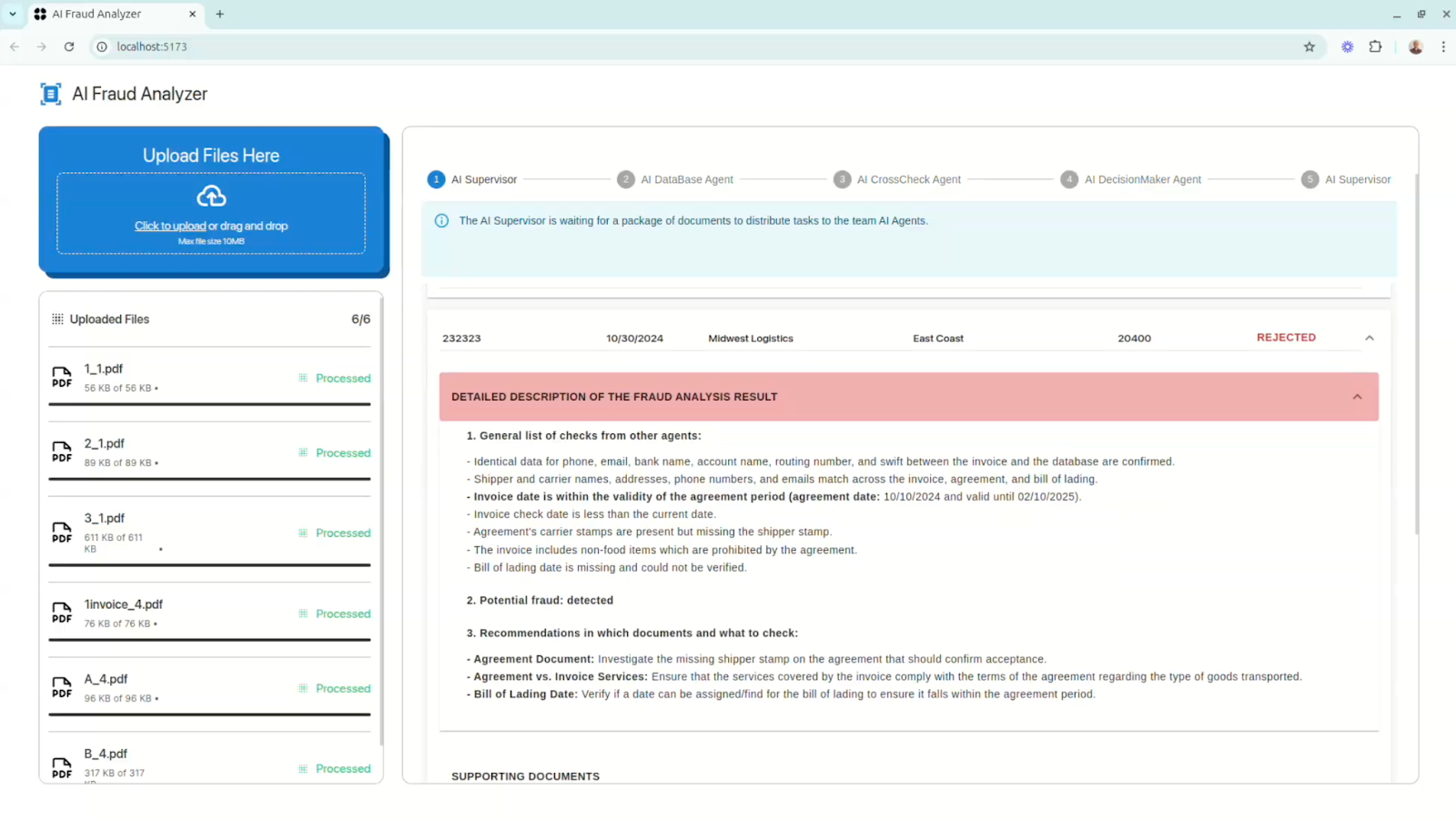

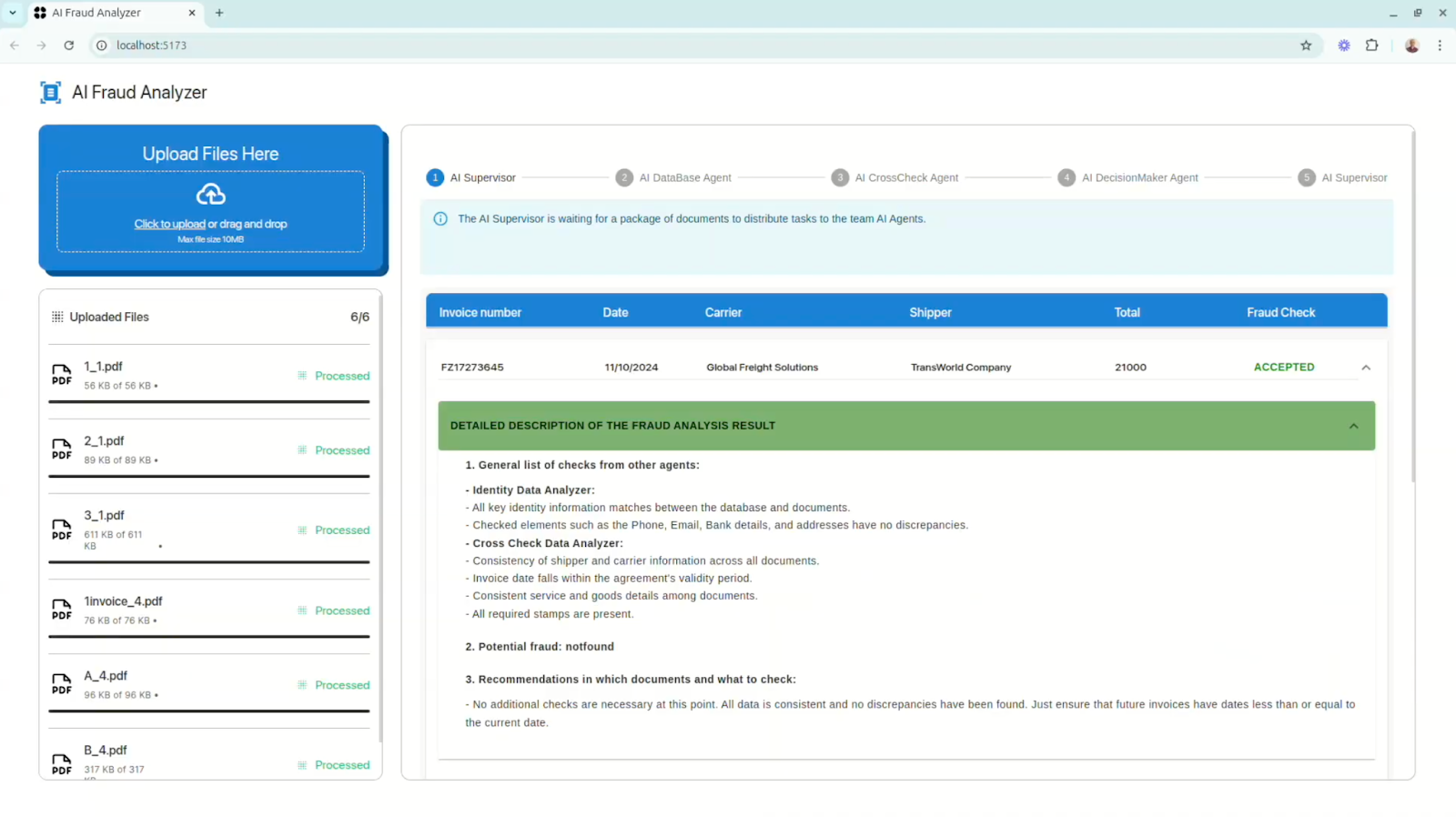

After crunching all the data, the AI (often in the role of a DecisionMaker agent) compiles the results. It determines whether everything checks out or if there are issues that need attention. The system then gives a clear verdict for the document set, typically an Accepted (everything is consistent and the documents pass verification) or a Rejected status (one or more issues were found). Along with this decision, the system provides a detailed report of its findings. This report highlights any problems (for example, “Invoice total does not match the purchase order” or “Bill of lading missing page 2”) so your team knows exactly what to investigate. If all is well, the documents can be processed confidently (e.g. approve the payment or release the shipment). If something is flagged, your team can review the reported issue and take action, such as contacting the supplier for clarification or performing a manual audit of the discrepancy.

Adapt to Your System

Every company’s workflow is a bit different, so a good AI verification solution is designed to be flexible. You can customize the system to fit your specific operational and compliance needs. For example, you might define your own verification rules and thresholds, maybe flagging invoices that exceed a certain amount, or requiring an extra check if a new vendor is involved. Leading AI platforms allow you to tweak settings and even modify the verification rules without needing to write code. This means you can fine-tune how the AI behaves, ensuring it catches what matters most to your business.

Integration is also key. The fraud detection system isn’t a standalone island; it can plug right into the software and databases you already use. Whether you rely on an ERP system (your central enterprise resource planning software), a warehouse management tool, or a vendor master database, the AI platform can connect via APIs to work with your existing infrastructure. n practice, this could mean the system pulls purchase order data from your ERP to verify an invoice automatically, or checks a shipment tracking application to confirm that a delivery document (bill of lading) matches the actual shipment status. By embedding AI verification into your current processes, you get real-time checks without disrupting your workflow.

Crucially, the solution can adapt over time. As your operations grow or regulations change, the AI can be updated to meet new requirements. If new document types or compliance rules emerge in your industry, you can train or configure the system to handle them. Modern AI verification tools even adjust to changing rules automatically, for instance, they can update validation logic when a new trade regulation comes into effect. This ensures you remain compliant across different regions and keep your fraud defenses strong as the landscape evolves. In short, the system is not one-size-fits-all, but rather a customizable toolkit that grows with your business. By tailoring it to your needs and integrating it with your systems, you gain a powerful, flexible ally in safeguarding your supply chain transactions.