Wealth Management

White Label Robo Advisors: Revolutionizing Wealth Management for the Digital Age

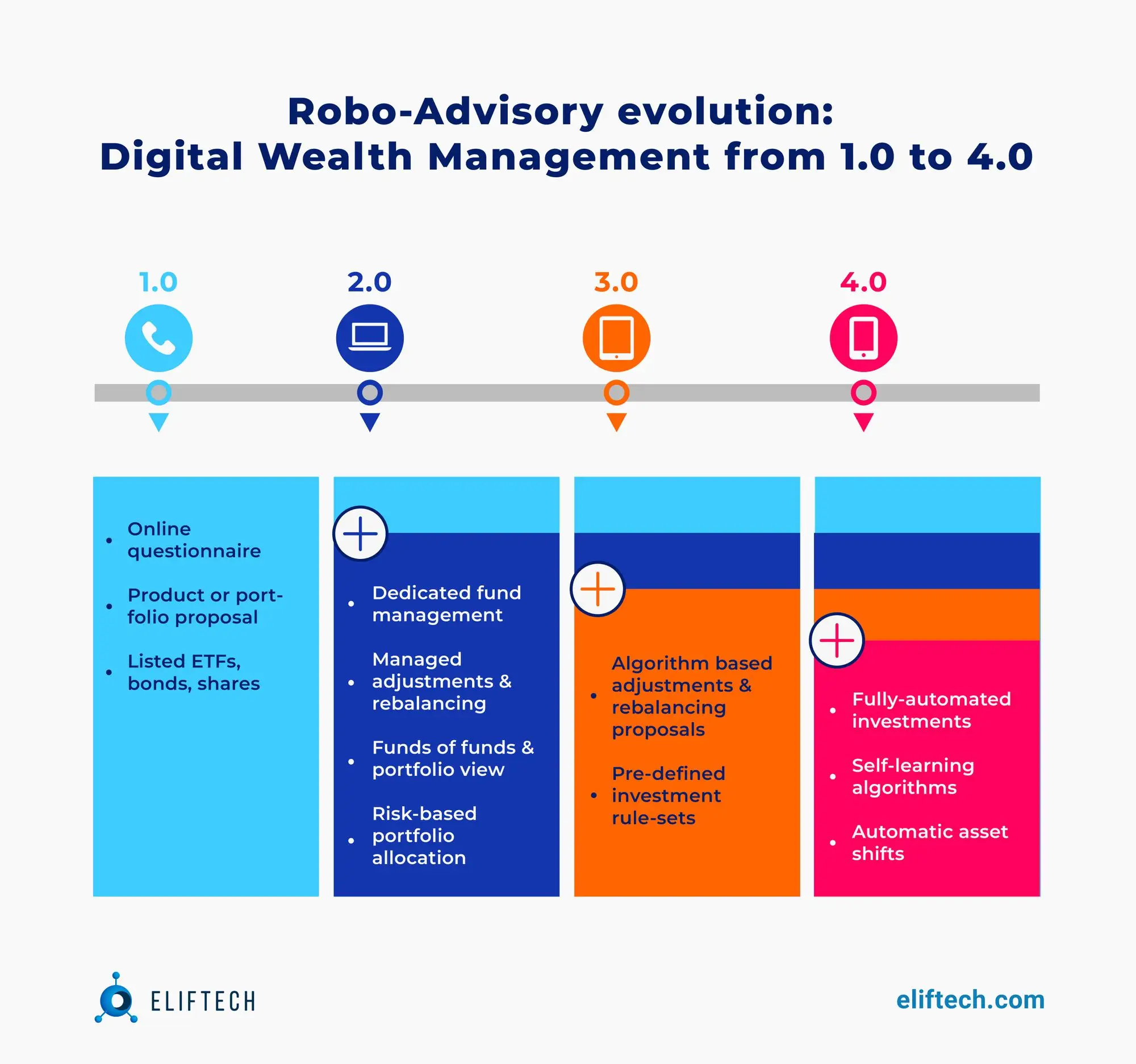

Real financial opportunities in the digital age already go hand in hand with robo advisors. That’s why traditional wealth management practices are no longer in demand since the robo advisors emerged. Combining data analytics and AI, these algorithm-driven platforms offer customized investment solutions at reasonable costs to individuals of all backgrounds.

But what is a robo advisor? How do these digital advisors work, and why are they gaining such rapid popularity today?

In this article, we provide an overview of white label robo advisors, explore their origins, the benefits they bring to the table, and the potential implications they hold for the future of finance.

Whether you’re a seasoned investor optimizing portfolios or a beginner stepping into the financial markets, this guide is your ready-to-follow roadmap to reach financial goals with ease and confidence.

White Label Robo Advisors in Wealth Management: Current State

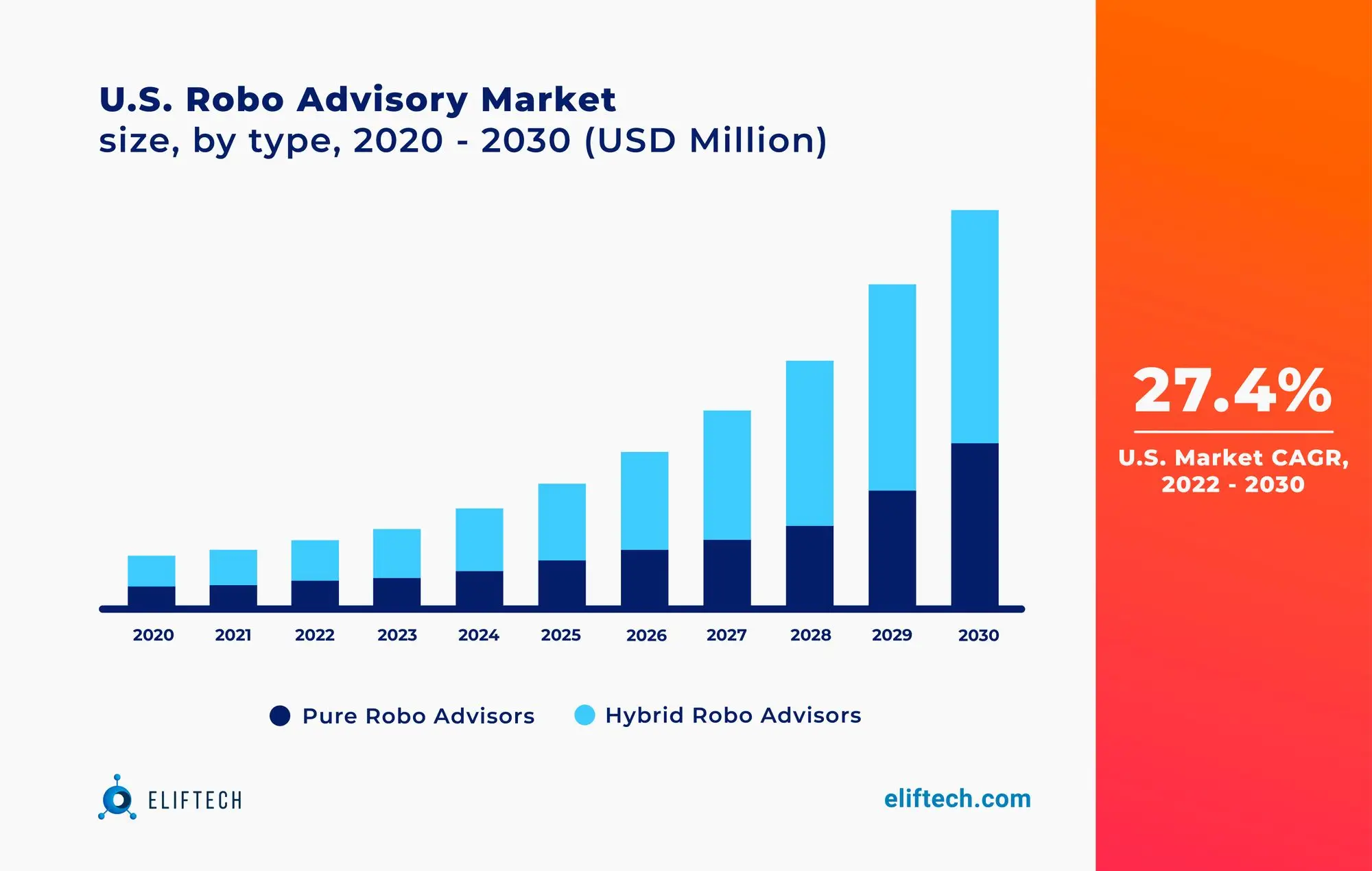

In recent years, the global robo advisory market is experiencing rapid growth and widespread adoption. According to Statista, a market value of robo advisory services is projected to reach an impressive $4.5 trillion by 2027. This rise of robo advisory services can be attributed to its lower costs, personalized recommendations it offers, and increasing integration within the financial sector.

The current landscape witnesses the integration of robo advisory services within traditional financial institutions. Many banks and wealth management companies (e.g., Moneyfarm, Deutsche Bank, Ally Bank, Credit Suisse Digital, etc.) have created custom robo advisors or teamed up with existing robo advisers. That helps them increase accessibility for their clients and accelerate the rapid growth of the financial services market.

Moreover, hybrid models are emerging, combining human expertise with automation. By mixing the simplicity of robo advisory platforms with the experience and trust of human consultants, these hybrids seek to strike a balance between algorithmic advice and personalized guidance.

So, the current state of white label robo advisors is apparent: these platforms continue to transform the industry by providing individuals and organizations with affordable and sophisticated investment solutions.

How Robo Advisors Work

Robo advisors work through a series of steps to provide users with personalized investment strategies and automated wealth management. For greater clarity, we will consider this process in a detailed breakdown.

Step 1. User profile creation

The process begins with creating a user profile, where individuals provide information about their financial goals, risk tolerance, investment horizon, and other relevant data. This data serves as the basis on which the robo advisor understands the user's investment preferences and adapts its recommendations accordingly.

Step 2. Algorithmic analysis

By using advanced algorithms and data analytics, robo advisors evaluate the user's profile and available market data. These algorithms consider various variables, including risk tolerance, investment goals, fluctuations in the market, and prior robo advisor performance, to create tailored investment strategies.

Step 3. Portfolio construction

Based on the analysis, the robo advisor forms a diversified investment portfolio that meets the user's goals and acceptable risk. A portfolio often contains a variety of asset classes, including stocks, bonds, exchange-traded funds (ETFs), and other assets. The distribution is set up in a way allowing for minimizing risk while maximizing reward.

Step 4. Automated rebalancing

As market conditions and asset prices fluctuate, the initial portfolio allocation may deviate from target percentages. Robo advisers use automatic rebalancing techniques to align the portfolio with the desired distribution. This ensures that the investment strategy stays on track and aligned with the user's goals.

Step 5. Monitoring and adjustments

Robo advisers monitor the user's portfolio and modify it as needed. They consider adjustments to the user's investment decisions and changes in their financial and market conditions. Thanks to this proactive monitoring, portfolio performance is maintained and aligned with evolving user goals.

Step 6. User interface and access

A user-friendly interface allows users to track their investments, view robo advisor performance reports, and add or withdraw funds from their accounts.

Step 7. Customer support

Robo advisers automate many aspects of the investment process, but they also often offer support channels to resolve user questions or concerns. Users may have access to customer service agents or financial advisors who can provide advice and answer all related questions.

Are there still gaps in your understanding of certain concepts? Reading we recommend: FinTech and WealthTech in a Nutshell: What's the Difference?

Robo Advisors vs. Human Advisors: Advantages of White Label Robo Advisors in Wealth Management

Robo advisors vs. financial advisors are two different approaches. The former has emerged as a compelling alternative to traditional human advice. While human advisors have long been essential to guiding investors, robo advisors provide several distinct advantages, especially appealing to digitally savvy Gen Z investors.

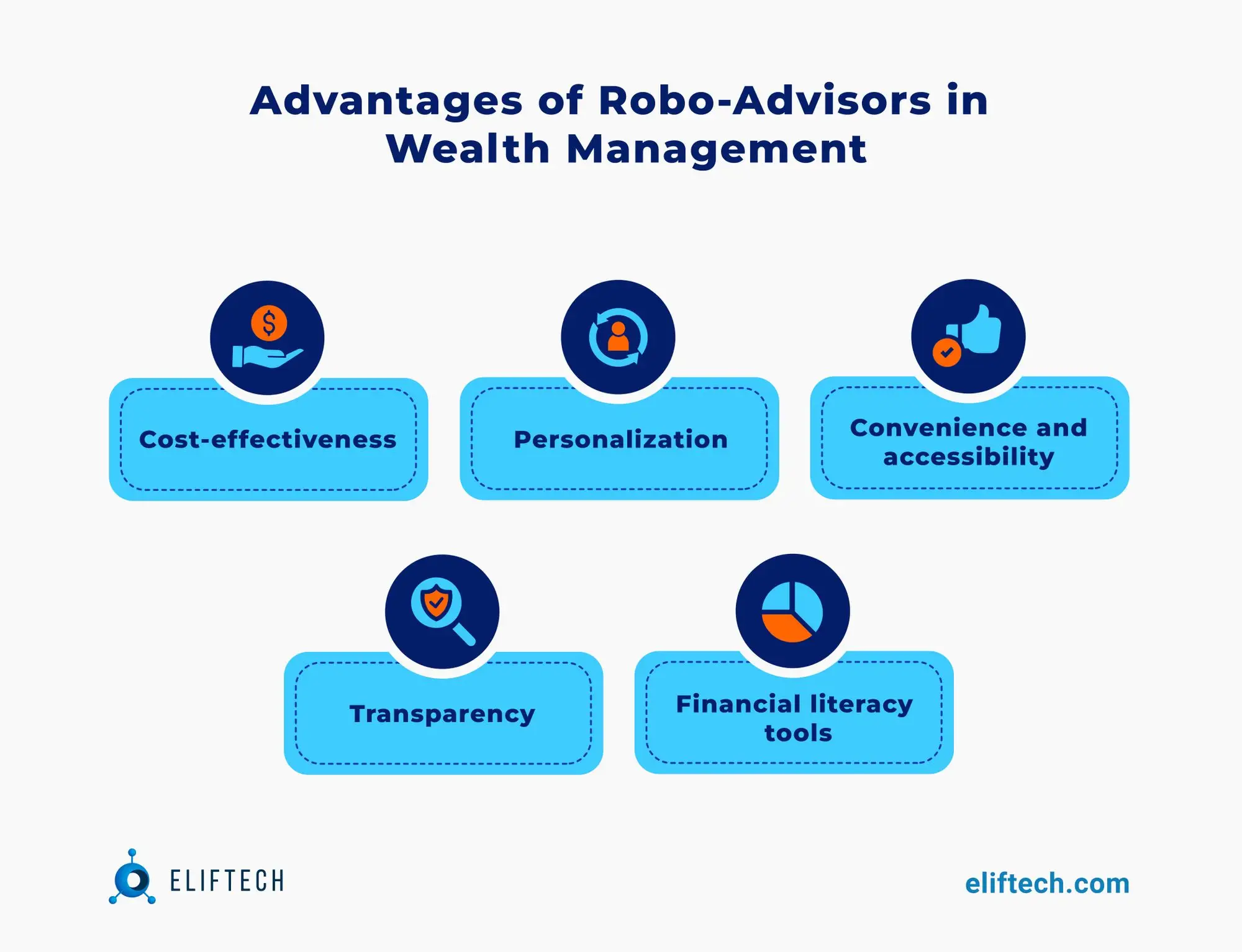

- Cost-effectiveness. Traditional human advisors with high fees and minimal investment requirements make them out of reach for many investors, especially those starting with small amounts. That’s why the cost-effective nature of robo advisors is more appealing to a broader range of investors, from millennials and Gen Z investors entering the market to wealthy individuals who need effective portfolio management. Thanks to their automated operations, robo advisory platforms offer lower costs.

- Personalization. This is another significant benefit that robo advisors provide. With the blend of advanced algorithms and data analysis, these platforms offer customized investment recommendations based on risk tolerance and financial objectives. By matching investments to specific circumstances, this tailored strategy increases the likelihood of achieving targeted results.

- Convenience and accessibility. Another advantage of robo advisors over human advisors is user-friendly interfaces and 24/7 availability. These features allow investors to easily access their accounts, track performance, and make investment decisions conveniently. Moreover, this flexibility resonates well with Gen Z investors accustomed to digital solutions and prefer autonomy to manage their finances on their own terms.

- Transparency. Another advantage is the transparency and objectivity of robo advisers. Algorithms don’t have the potential biases and conflicts of interest that human consultants can have because their decisions are based on data-driven analysis. This transparency fosters trust and ensures investment decisions are based on objective criteria.

- Financial literacy tools. In addition, robo advisors offer tools and educational resources to help investors, especially Gen Zers, improve their financial literacy. These platforms provide educational content, interactive tools, and insights to help users understand investment ideas and make informed decisions. It promotes a sense of power and confidence in managing wealth.

While robo advisors have many benefits, it’s crucial to remember that human advisors still provide unique advantages. A holistic approach, comprehensive financial planning, and emotional support are essential, especially during market fluctuations. For investors looking for a balanced strategy, an attractive alternative could be a hybrid model that combines the best features of both worlds - robotic advisors for effective investment management and human advisors for detailed advice.

Key Features of Robo Advisors in Wealth and Asset Management

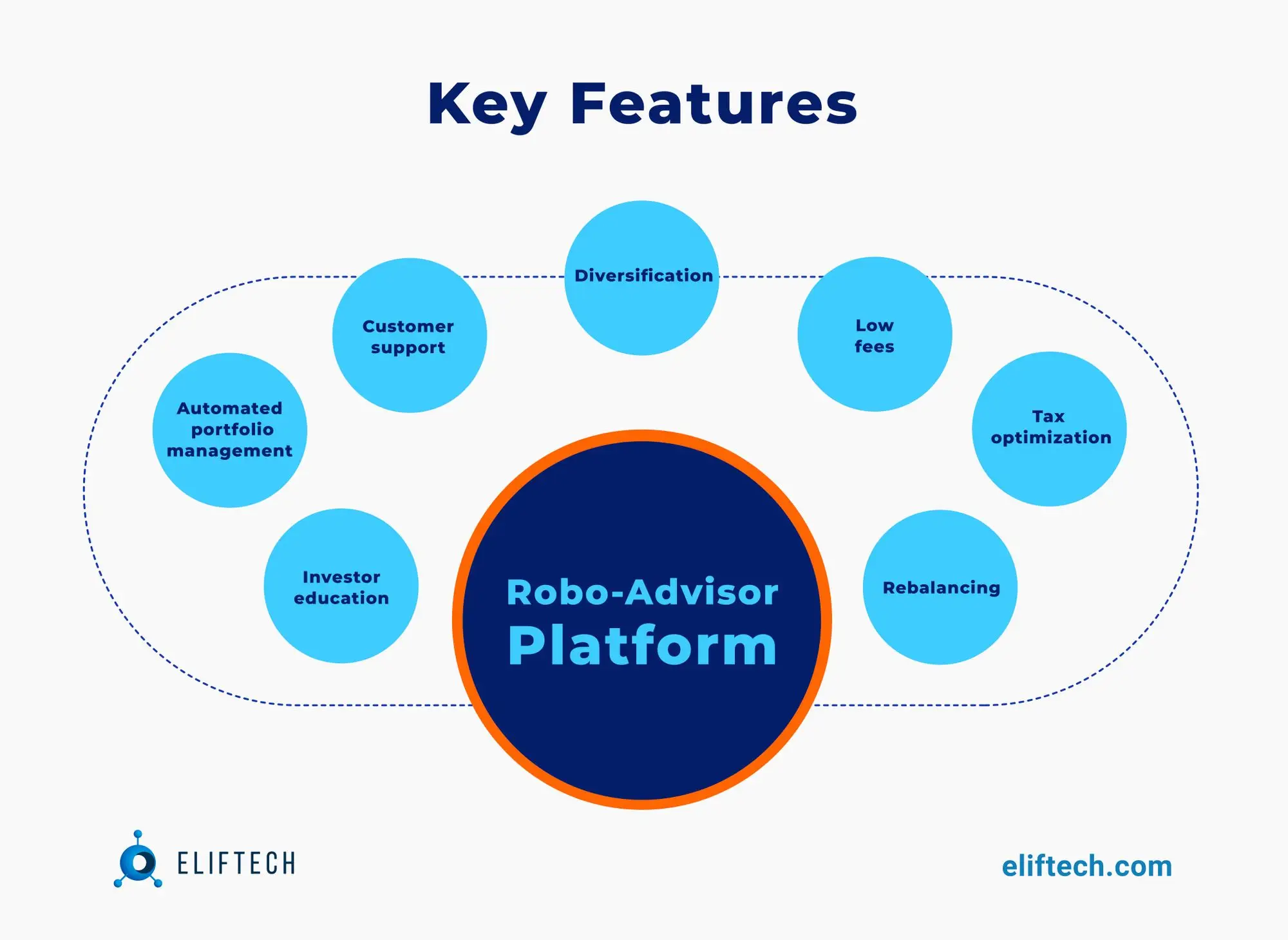

Robo advisors have changed the wealth and asset management industry by providing several key features that improve the investor experience. These features include:

- Self-registration

It’s vital to let users enter their personal information and investment or wealth management goals via a simple questionnaire. Basic robo advisors will analyze the input data regarding investors' ability and willingness to take risks, determine their risk aversion profile, and recommend the most suitable securities. More advanced versions can include dynamic questionnaires, perform AML and KYC checks, and collect data from external resources such as banks for more accurate risk assessments.

- User-friendly dashboard

A user-friendly interface and intuitive dashboard are paramount for a positive user experience. Whether you build a web-based or mobile app, the platform should be intuitive, easy to navigate, and offer clear and concise information about portfolio performance, asset allocation, and fees.

- Automated portfolio and wealth management

A key feature is the ability to automatically create a variety of investment portfolios depending on user preferences, risk tolerance, and financial goals. Empowered with advanced algorithms, this automation helps handle portfolio rebalancing, dividend reinvestment, and other routine wealth management tasks, saving users time and effort.

- Risk tolerance assessment

Incorporating robust risk assessment tools and techniques is essential. Robo advisors evaluate an investor's risk profile and suggest an appropriate asset allocation for effective risk management. To ensure the desired risk level is maintained over time, they regularly review portfolio and robo advisor performance and use automated rebalancing procedures.

- Customization options

With built-in customization options, customers can tailor their investment portfolios to meet their unique needs. Providing choices for industry preferences, ESG considerations, or investment-specific exclusions increases user satisfaction and adds to personalization.

- Reporting tools

Providing clear and comprehensive quarterly, yearly, or monthly reports gives users a clear view of the investment goal progress. Since robo advisors record each interaction, they enable easy access to the relevant analytics in charts or dashboards form, demonstrate transaction history, and performance benchmarking.

- Monitoring system

Implementing a robust monitoring system that tracks portfolio performance, market trends, and related financial data is critical. Users should be informed well before any significant changes to the system, including recommended portfolio adjustments.

- Investment education manuals

Numerous robo advisors offer educational materials, including articles, videos, and interactive tools. Educational content is valuable (especially for digitally savvy Gen Zers) in successfully helping early-stage stakeholders enter financial markets. Such manuals improve financial literacy and provide insights into investment concepts to make sound decisions.

- Customer support

Reliable customer support channels are essential for users to have assistance when needed. At ElifTech, we often implement live chats to make it easier for our clients to provide technical support, explain investment strategies, or resolve related issues.

Ready to experience the power of automated wealth management? Your wealth is just a click away! Let us support you on your investment journey. Leave a request.

Preparing for the Transition to Automated Investing Platforms

There are a few specific considerations for professionals in the investment management industry to prepare for the transition to an automated investing platform.

Step 1. We recommend keeping up-to-date with the latest advancements in technology and automation. Understanding the capabilities and benefits of automated platforms will help you make informed decisions. By staying informed of technology, you can also consider adding revolutionary new features such as gamification or education block to make your services stand out.

Step 2. You should pre-assess how automated investing platforms can integrate with your existing systems and processes. Here, you can look for white-label robo advisors or build a custom solution to seamlessly integrate with your company’s infrastructure, ensuring a smooth transition and minimizing disruptions.

Step 3. It’s vital to consider the scalability requirements to allow your business to grow in the future without compromising quality.

Step 4. Understanding the regulatory landscape is the following consideration step. The platform you build must comply with relevant regulations (e.g., KYC, AML, SEC, FINRA, GDPR, etc.) and provide robust security measures to protect user data and maintain compliance standards.

Step 5. A smooth transition to automated investment platforms is possible if your organization has an innovative culture. We recommend encouraging brainstorming with your team members to explore new opportunities and take advantage of automation in investment management.

How to Choose the Right Robo Advisor for Your Wealth Management Needs

When choosing the right robo advisor for your wealth management needs, typically, there are several options:

- Develop a robo advisor in-house

- Purchase an existing white-label robo advisor

- Use an open-source platform

- Collaborate with a reliable technology partner to build a custom robo advisory platform.

While the first three options require significant time, resources, and technical expertise to work effectively with these platforms, you can outsource the development work to professionals with proven experience in FinTech and software development.

ElifTech has established a strong reputation in the industry. Through years of experience, we bring our deep understanding of the wealth management landscape and the technology required to deliver robust robo advisor solutions.

Every client that comes to us has unique needs, goals, and industry scale. So, we work with individual businesses and large-scale financial institutions to provide a solution catering to specific wealth management requirements. This way, we’ve gathered a track record of successful implementations and satisfied clients who validated our ability to deliver effective robo advisor solutions.

For all incoming projects, we offer expertise and proficiency in the latest technologies, including artificial intelligence (AI) and machine learning (ML), used to power robo advisor platforms.

We also strongly emphasize the user experience and visual components of robo advisors. Our talented UI/UX designers on board incorporate the latest top design practices to ensure a seamless and engaging user experience and develop simple, intuitive, and user-friendly interfaces.

Since we deal with the FinTech industry, we are committed to providing robust security measures to protect user information and ensure adherence to regulatory requirements.

Share your needs to experience the benefits of partnering with ElifTech!

Trends and Predictions for Robo Advisors in Wealth Management

Today, convenience, accessibility, tech-enabled analytics, and lower fees offered by robo advisors appeal to a broader range of investors, particularly millennials and Gen Z. Robo advisors play a pivotal role in democratizing access to efficient and personalized investment services.

The global robo advisory market will grow and the rapid shift from traditional investment services to robo advisory investment services also fuels these statistics.

Another prediction is the rise of hybrid models. This strategy offers the best of both worlds - personalized guidance from human advisors alongside the efficiency and scalability of robo advisors.

Thanks to advanced analytics and artificial intelligence (AI), robo advisory services are expected to undergo further transformation. ML algorithms will make a more precise risk assessment, asset allocation, and portfolio optimization possible, creating space for customized investing strategies.

In addition, robo advisors are expected to grow their services beyond investment management. To align investors’ investment decisions with their values, such platforms can include tax optimization, retirement planning, environmental, social, and governance (ESG), and socially responsible investing (SRI).

The use of gamification and educational tools will shape the robo advisor space further. Gamification elements will help make investing more fun, interactive, and engaging. Educational tools will help investors learn the nuances of investing and financial planning.

These trends and predictions show how robo advisors continue to change asset management. They continue to offer accessible and tailored investment options to a growing number of investors.

Conclusion

Simplicity, lower fees, and customized investment strategies offered by robo advisors redefine wealth management and how individuals and organizations invest. The sector is expanding rapidly, attracting Gen Zers and millennials looking for simple and effective investment strategies. Hybrid models, advanced analytics, and evolved service offerings will shape the future of white label robo advisors.

ElifTech is ready to become your trusted technology provider to capitalize on these advancements. Contact us to learn how our experience in developing wealth management solutions can help you integrate white label robo advisor that fits your needs.