Open Banking

Embedded Finance Trends: What Is Embedded Finance and How Is It Revolutionizing Financial Services?

Embedded finance in 2023 is a groundbreaking concept transforming the financial industry as we see it in real-life cases. This technology smoothly integrates financial services into everyday business operations from eCommerce platforms like Amazon and ride-sharing apps like Uber.

For businesses, embedded finance opens up new revenue streams and improves customer experiences. Such platforms offer the opportunity to seamlessly and swiftly engage with financial transactions anytime and anywhere.

This article is a comprehensive overview of the embedded finance trends, technologies, benefits, examples, and use cases surrounding embedded finance in 2023.

Embedded Finance Trends: Shaping the Future of Financial Services

Embedded finance 2023 is driven by evolving technology, changing consumer expectations, and regulatory developments. It integrates financial products and services into non-financial platforms, creating a seamless user experience and increasing accessibility to a broader audience.

This democratization of financial services removes barriers and challenges associated with traditional banking, benefiting underserved customers. It is particularly valuable in emerging economies with limited banking access.

This growing trend shapes the future of financial services. Juniper Research predicts that embedded financial services revenue will surpass $183 billion worldwide in 2027, driven by non-financial businesses incorporating embedded financing options.

However, there are specific FinTech technology solutions that you can’t use interchangeably. To avoid confusion, let’s make things clear and analyze key differences between embedded finance, banking-as-a-service, and open banking concepts.

Embedded Finance vs. Banking as a Service

Embedded finance

Embedded financial platforms integrate financial services into existing customer touchpoints such as eCommerce platforms (e.g., Amazon Pay, Shopify Payments), taxi apps (e.g., Uber, Grab), or social media platforms (e.g., WeChat, Facebook Pay). It enables users to access financial services like loans, payments, or insurance without leaving the platform.

This integration provides a seamless user experience and expands the reach of financial services to a broader audience. For instance, ride-hailing applications with in-app purchasing capabilities or digital wallets with access to a range of financial services.

Banking as a Service (BaaS)

BaaS enables non-bank companies or fintech businesses to provide banking services to their customers. It offers a white-label infrastructure, enabling these organizations to incorporate banking services seamlessly. This infrastructure includes banking licenses, regulatory compliance, and APIs.

BaaS allows companies to offer services like account opening, 2D payment gateways, and loans without spending money on the expensive process of obtaining a bank license. As an illustration: a fintech startup partnering with a licensed bank to offer digital banking services under its own brand.

To summarise the above - the key difference between Embedded Finance and Banking as a Service is that the former integrates financial services into non-financial platforms. In contrast, the latter provides infrastructure for non-bank entities to offer banking services.

Open Banking vs. Embedded Finance

Open banking

With consumer permission, open banking allows third-party financial service providers to access bank customer data. This information helps create cutting-edge financial services, applications, and solutions. It encourages competition and provides consumers access to broader financial services that meet their needs. For example, a personal finance application may collect information from various bank accounts to give a detailed overview of a user's finances.

Embedded finance

By incorporating financial services into non-financial platforms or businesses, embedded finance goes one step further. That creates a seamless user experience by eliminating the need for customers to leave the platform to receive financial services. Thanks to embedded finance, businesses can offer value-added services and monetize their current user bases. For example, during checkout, an e-commerce platform can provide customers with fast point-of-sale financing options.

To summarise the above - Open Banking focuses on data sharing and access, allowing third-party providers to build innovative financial services based on customer data. In contrast, Embedded Finance focuses on integrating financial services directly into non-financial platforms.

Are you in the banking industry? Explore our collection of insights and discover open banking app ideas to revolutionize the financial landscape today!

Key Components of Embedded Finance

Below we break down the key components of embedded financial platforms:

- Non-financial platforms. Embedded finance relies on non-financial platforms or businesses as the primary interface for delivering financial products and services. These platforms can be social media sites, e-commerce websites, ride-hailing apps, or any other digital platform with many users.

- API integration. API integration is essential in embedded finance. The data exchange, transactions, and delivery of financial services within the platform are made possible thanks to APIs that provide seamless communication between the non-financial platform and the financial service provider.

- User experience. Embedded finance prioritizes providing a smooth and convenient experience on a non-financial platform. It intends to remove the requirement for users to receive financial services outside the platform. This entails improving the user interface, simplifying routine tasks such as making payments or opening an account, and providing customized financial solutions.

- Financial service offerings. The term "embedded finance" refers to the wide range of financial services and products that can be included in non-financial platforms. These offers may consist of digital payments, loans, insurance, investment opportunities, budgeting tools, and any other financial services that meet the requirements of platform users.

- Data integration and analysis. Embedded finance uses user data within the non-financial platform to personalize financial services and make data-driven decisions. To do this right, user data must be securely integrated and analyzed to understand user financial behavior, preferences, and demands. Data insights help customize financial solutions and enhance user experience overall.

- Compliance and security. Embedded finance must adhere to regulatory and safety standards to protect user data and ensure compliance with financial regulations. Strong security measures, data privacy rules, and compliance with relevant financial industry requirements like KYC (Know Your Customer) and AML (Anti-Money Laundering) standards are all part of this.

- Monetization strategies. In embedded finance, monetization is essential. Non-financial platforms can make money by adding fees, commissions, or interest on financial transactions or by providing additional services. For an integrated financial effort to be profitable and sustainable, it is critical to develop robust monetization methods.

- Scalability and flexibility. Embedded finance solutions must be scalable to handle an increasing user base of non-financial platforms and flexible enough to meet changing client requirements. That requires a solid technological infrastructure to handle large-volume transactions and the adaptability to integrate with new services or adjust to shifting regulatory requirements.

Businesses can successfully implement embedded financial solutions that offer convenient and tailored financial experiences within their non-financial platforms by combining these eight pillars, unlocking new revenue streams, and increasing consumer satisfaction.

Benefits of Embedded Finance for Businesses & Consumers

Embedded finance offers a win-win situation for both businesses and consumers. Let's explore killer reasons why investing in embedded finance is worthwhile, considering its distinct benefits to businesses and consumers.

Benefits of embedded finance for businesses:

- Revenue growth. This approach blurs the lines between industries and creates new revenue streams. Businesses can easily earn transaction fees, commissions, or interest charges, increasing profitability.

- Closer cooperation between traditional financial institutions and non-financial companies. Through this partnership, the financial know-how of banks and the intuitive user interfaces of non-financial platforms come together to provide seamless financial services that promote trust and compliance. The result is mutually beneficial growth that reshapes the market and offers customers innovative, easily accessible, and secure financial products.

- Higher customer retention. Companies retain customers by offering personalized financial solutions and providing a seamless user experience, ensuring they don't switch to competitors.

- Data analytics. Embedded finance utilizes user data to collect valuable insights about consumer behavior, preferences, and financial needs. Based on collected insights, businesses can make well-informed decisions to improve their offerings, fine-tune marketing campaigns and create new financial products.

Benefits of embedded finance for consumers:

- Convenience and accessibility. With built-in finance, users can directly access financial services on their existing platforms. As a result, there is no need to switch between multiple applications or logins, making various financial products and services convenient and accessible.

- Enhanced user experience. Users can easily access and control their financial activities without leaving the platform. Streamlined transactions such as payments, transfers, and account management make it easier and more convenient to use.

- Financial inclusion. As we mentioned earlier, embedded finance expands underserved communities' access to banking, payments, and other financial solutions. It promotes financial inclusion by bridging the gap between traditional banking and those with limited access to physical banks.

Use Cases and Applications of Embedded Finance

Businesses must determine whether the time and financial resources invested in innovation will bring positive returns and prevent future losses. The experience of global companies in numerous verticals can show us how embedded finance solutions work in practice.

Robinhood & PayPal

Let’s start with an example of FinTech platforms like Robinhood and PayPal. Embedded finance integrates financial services such as banking, investment, and payments into the app’s user interface.

For example, the Robinhood app offers stock trading services that allow users to buy, trade, and monitor their financial assets in real-time. In PayPal, embedded finance operates through the seamless integration of payment processing services into eCommerce platforms. This integration allows users to transact and manage their finances within the PayPal ecosystem securely.

Klarna

Speaking of the eCommerce niche, integrating embedded finance into applications can offer users financing options, or installment plans directly within their checkout process. For example, Klarna partners with online retailers to offer “Buy Now, Pay Later” options, providing flexible payment terms within the eCommerce platform.

Booking.com & Airbnb

Another example is the travel and hospitality sector, where integrating embedded finance solutions can simplify payments and booking procedures. As such, users can pay directly on the platform for accommodation, travel-related services, and flights. Companies like Booking.com and Airbnb are connecting 2D secure payment gateways, keeping transactions secure, and giving customers a seamless experience from browsing to booking and payment.

Uber

The ride-hailing and transportation industry is another example of embedded finance platforms proving their worth. It works simply: in the app, users can link their payment options, allowing for automatic transactions at the end of a trip. Integration of features such as split rates or reward points may also be available. For example, Uber allows users to pay for a ride in the app after adding a credit card or eWallet.

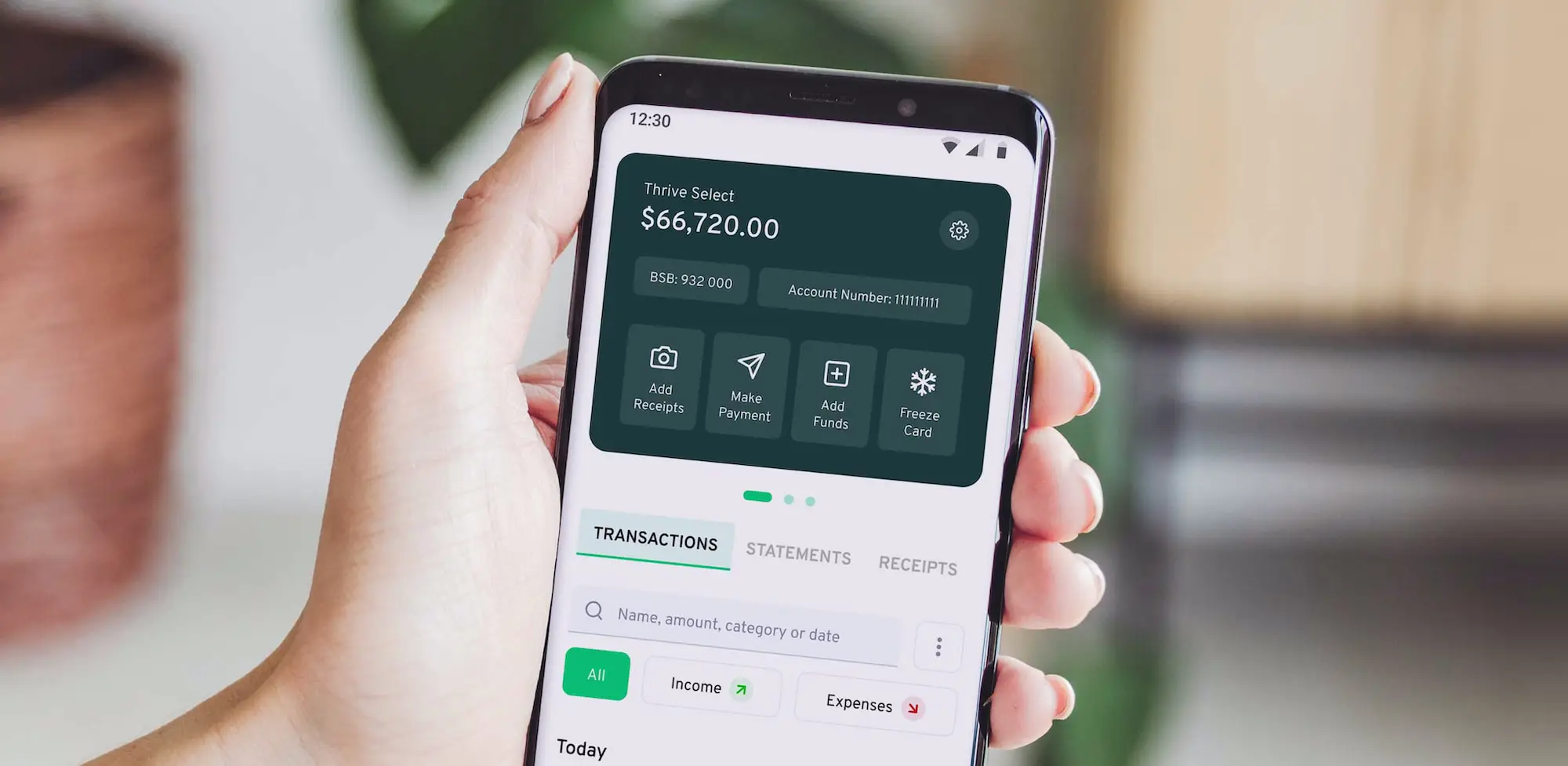

Revolut

The following embedded finance examples that offer comprehensive financial services in one place are digital banking apps. In such apps, users can create bank accounts, apply 2D payment gateways, track spending, and even invest. These apps serve as a central hub for money management and offer a streamlined and consistent banking experience. For example, the Revolut app has multi-currency accounts, budgeting tools, and investment options.

These are just a few examples demonstrating the versatility and pervasiveness of embedded finance across industries. We can expect to see even more advanced applications and use cases that improve the integration of financial services across other platforms and industries as this trend continues to grow.

Top Trends for Embedded Finance in 2023: Shaping the Future

Navigating the hype around embedded finance, we can expect the demand for embedded finance platforms in deposit accounts, lending, payments, and issuing.

According to latest McKinsey’s Global Banking Revenue Pool, embedded finance products may make up 50% of all banking revenue streams in the coming years. Keeping these statistics in mind, the ElifTech team has compiled a list of the top embedded finance trends for the year ahead:

- A massive boom in B2B embedded finance in 2023. This trend will skyrocket this year as it offers value-added financial services tailored to the specific needs of B2B transactions. It provides seamless financial transactions, supply chain financing, secure financial interactions, and streamlined invoicing and payments.

- Artificial Intelligence (AI) and Machine Learning (ML). AI and ML technologies still redefine embedded finance, enabling personalized customer experiences, fraud detection, risk assessment, and data analytics for better decision-making.

Useful reading: ML in banking: Your implementation roadmap - Consumer-oriented digital payment products and BNPL. Consumer-facing digital payment systems that provide a seamless, useful, and secure payment process will develop further in the embedded finance space. Some well-known embedded finance examples are mobile wallets (e.g., Apple Pay, Google Pay, and Samsung Pay), contactless payments (e.g., Visa payWave, Mastercard Tap & Go), peer-to-peer payment platforms (e.g., Venmo, Cash App, and PayPal’s Venmo), and innovative payment solutions (e.g., Stripe).

Another trend that falls into this category is the Buy Now, Pay Later (BNPL) method. This is a form of embedded lending that shoppers are more likely to choose and stay with your business if you provide them with this payment solution. - Decentralized Finance (DeFi) and Web3. The rise of decentralized finance (DeFi) and the Web3 movement keep disrupting traditional financial systems. DeFi and Web3 can offer multiple benefits to your embedded finance platform, from inclusive financial services like lending to borrowing, decentralized exchanges, and yield farming.

- Open APIs and integration. Multiple FinTech products offer services via APIs, and this trend will keep growing. Today’s mainly retail, eCommerce, and transportation companies can easily choose the services from different providers they’d like to combine and offer to their customers, allowing for secure data sharing, streamlined workflows, and collaborative ecosystems.

These technological developments highlight the transformational potential of embedded finance by improving financial services and user experience, spurring industry innovation.

How ElifTech Can Empower Embedded Finance Solutions

ElifTech can support different embedded finance initiatives with our proven expertise in software development, FinTech experience, and technology consulting.

Our expertise and specialized knowledge allow us to understand the unique requirements of the financial industry and develop tailored solutions that align with the business goals and tech requirements. Visit our website to explore our services, case studies, and client testimonials to get specific insights into our capabilities.

Moreover, we have flexible engagement models, allowing businesses to scale their development efforts as needed. Whether you need a dedicated product engineering team to work on your unique products or services full-time or hand over specific tech tasks to seasoned IT specialists under the team extension model - we have all of it covered at affordable rates.

As the tech industry never stands still, our team is always up to date with the latest technology and embedded finance trends and ready to bring AI, blockchain, open APIs, and more into your innovative embedded finance solutions.

Due to each business having unique requirements and workflows, we work closely with CEOs and CTOs to gather specific needs and preferences. That’s why we create custom-tailored embedded financial solutions that solve your problems, provide a competitive advantage and bring the desired results in terms of quality and within an affordable budget.

Reach out to us and embark on a transformative journey toward financial excellence. We have everything you need to keep your business ahead of the curve.

Conclusion

As technology and regulations evolve, embedded finance continues to transform financial services worldwide, fostering innovation and improving financial well-being. In this rapidly changing landscape, staying ahead is no longer optional but essential.

With embedded financial tools, you can revolutionize your offerings, deliver customized experiences, and elevate customer satisfaction. Our expert team will develop cutting-edge solutions tailored to your needs, unlocking your business's untapped potential. The future of finance is within reach—it's time to seize it.

Partner up with ElifTech to make financial magic together!