FinTech

The Top 6 FinTech Challenges and How to Solve Them with Software

Entrepreneurs and senior executives in finance industries grapple with a host of FinTech challenges. They must protect customers’ personal data from hackers and contend with a complicated regulatory environment. In addition, FinTech software solutions must be designed to withstand heavy usage and support numerous third-party integrations.

Overcoming the challenges of FinTech is no small feat, especially for startups. Failing to act is not an option either unless you’re willing to risk your reputation and revenue. You may also fall behind your competitors if you don’t innovate. However, the right software can help FinTech organizations address these problems.

In this article, we'll examine the top challenges of the FinTech industry in 2023. Then, we'll discuss technologies that can address the challenges and create new business opportunities.

Overcoming Top 6 FinTech Challenges with Software Solutions

FinTech is defined as user-centric financial technology that enhances B2B and B2C financial services. It encompasses feature-rich online banking, instant loan generation, automated insurance, and regulatory compliance software.

Any successful FinTech business must understand the current FinTech technology and process requirements. So, let’s take a step back to look at the industry.

The FinTech Industry: Market Overview & Software Requirements

- The FinTech market is expanding. In particular, FinTech’s global market value will grow from $194.1 billion in 2022 to $492.81 billion by 2028. Some of the factors driving market growth include adopting digital payments, open baking, and cryptocurrency.

- Global funding for FinTech is growing. Compared to the last quarter of 2022, FinTech funding rose by 55% in the first quarter of 2023 worldwide. In addition, early-stage deals (like venture capital) accounted for 72% of the investment.

- Many aspects of financial technology are evolving. The Global FinTech Market Outlook showed that the market is segmented into many technologies and applications. An array of software technologies, including artificial intelligence (AI), data analytics, and blockchain, are evolving in tandem.

- Cloud-based software solutions have the highest market share. The DealRoom FinTech Q1 2023 report states that B2B software as a service (SaaS) solutions attracted 44% of the FinTech funding in Q1 2023. The share exceeds 70% if you count Stripe’s products and services.

Ongoing digitization and large-scale funding of FinTech initiatives create many opportunities, even for small and medium-sized organizations. However, the opportunities come with a number of challenges.

Top 6 FinTech Challenges to Know About in 2023

Some problems in FinTech get worse from year to year, and some remain unchanged. As we navigate 2023, six key challenges stand out.

Challenge #1: Data Security and Privacy

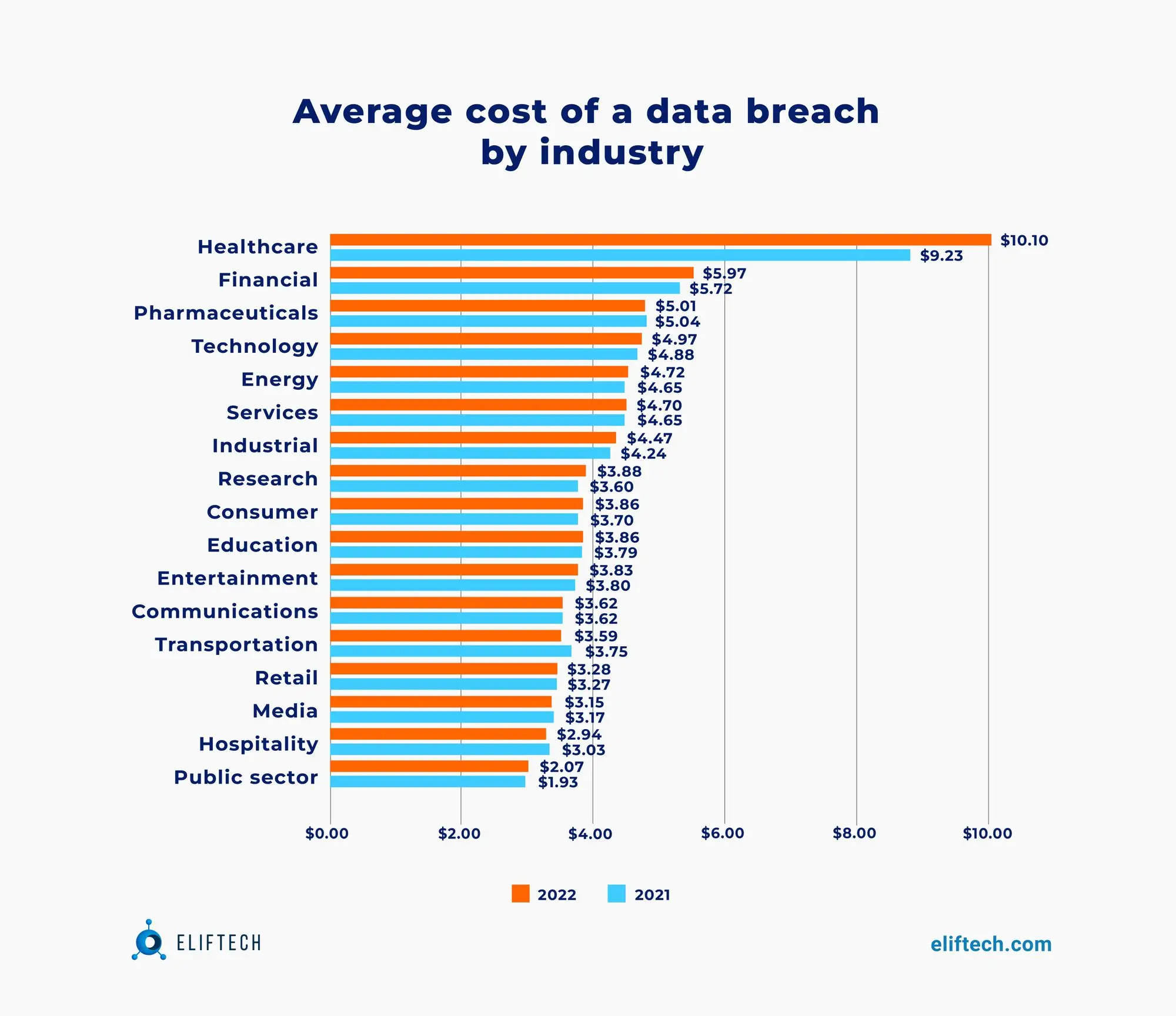

Between 2020 and 2022, the financial sector witnessed a tripling of compromised data incidents. The recent Check Point Q1 2023 report reveals that approximately 1 in 31 organizations globally faced ransomware attacks on a weekly basis. The cost of a typical data breach for FinTech organizations amounts to an average of $5.97 million, ranking as the second highest among industries.

Proactive protection against cyber threats is challenging because threats constantly evolve. Criminals use increasingly advanced persistent threats (prolonged combinations of infiltration attacks) and AI for malicious gains. A recent novel attack method involves hackers using ChatGPT to generate code that makes it easy for less-skilled bad actors to launch cyberattacks.

Although data security and privacy protections are challenging to implement, they are imperative. Leakage of personally identifiable and confidential information can be particularly devastating because if customers don't feel their data is sufficiently protected, their trust in your company will diminish, along with your reputation.

Challenge #2: Regulatory Compliance

The financial industry is highly regulated. Laws vary depending on the location of your company and your clients. Constantly changing regulations within and across jurisdictions make this FinTech challenge a moving target.

Noncompliance with laws and regulations can result in hefty fines, lawsuits, and other legal issues. You may also be penalized if you inadvertently offer financial services to a sanctioned person. For example, authorities collected nearly $1 billion in 17 major actions in the first half of 2021. These were three of the biggest noncompliance fines levied that year:

- Dutch bank ABN Amro was fined €480 million ($520 million) for failing to identify and prevent money laundering activity.

- UK Bank NatWest was fined a £264 million ($334 million) penalty for not taking action against suspicious transactions that indicated money laundering.

- US brokerage firm JPMorgan was issued a $125 million fine for failing to preserve written communications about securities that employees transmitted on their personal devices.

In addition to customer privacy, regulators worldwide are ramping up their oversight of new technologies. According to Deloitte’s 2023 banking and capital markets outlook, regulators increasingly focus on cost transparency, particularly in technologies that enable crypto markets, dark pools, and other alternative trading systems.

Challenge #3: Integration and Interoperability

Deloitte’s 2023 market outlook highlights that all types of customers demand bundled financial services to simplify their life. To address this customer need, FinTech software developers have to connect their apps with other systems that enhance the customer journey. For example, financial service apps must have the ability to interact with banks, payment gateways, chat systems, and CRM platforms.

Lack of interoperability is a critical FinTech industry challenge. Current banking systems don’t have common standards for data exchange. Third-party integrations provide clients with an effortless experience across systems. Their absence can lead to a loss of business because customers may decide to replace your services with those of a competitor who offers better integration.

Challenge #4: Scalability and Performance

FinTech companies must maintain stable performance amidst an increasing volume of integrations and transactions. Poor system performance, especially during peak usage times, leads to customer dissatisfaction and revenue loss.

As Deloitte’s report suggests, market infrastructure providers are increasingly prioritizing low-latency operations. Latency and performance issues prevent many companies from migrating critical workloads to cloud platforms.

Another challenge lies in scaling operations without disrupting service. This requires thoughtful CPU, storage, and application management, as well as a robust infrastructure that can handle high transaction volumes without degrading performance.

Challenge #5: Customer Satisfaction and Retention

According to Zendesk’s 2023 report on Customer Experience Trends, 70% of customers prefer companies with personalized and customizable user experiences. Data from Zendesk’s 2022 report show that 60% of clients may stop using your services after a single bad interaction. Overall, 60% of business leaders say that positive customer service improves customer retention.

These figures are relevant to FinTech companies that place customer convenience at the heart of their business model. The challenge lies in meeting customer expectations consistently — customer demands constantly shift, after all. This requires a deep understanding of customer needs and the ability to deliver the experience they want across all touchpoints.

Challenge #6: Rapid Technological Innovation

Deloitte predicts that accelerated digitalization will remain the key to unlocking future sources of value. It’s, therefore, paramount to follow the latest digitalization trends and means to stay competitive in FinTech. This requires that your business dedicates a portion of its human resources and investment to technological innovation initiatives.

Resistance to change hinders innovation. Companies need to step out of their comfort zone and experiment with new technologies. Sometimes that requires persuading your stakeholders and employees about the potential of new, disruptive FinTech technologies.

Now that we’ve unpacked the biggest challenges, let’s focus on the solutions.

The Role of FinTech Software Solutions in Driving Successful Businesses

Software solutions and practices are the secret weapons of successful FinTech companies. This section explores how they help overcome the most prominent challenges.

Cybersecurity Tools and Practices

Cybersecurity provides a safety net against a variety of threats. The essential technologies, policies, and practices to adopt include the following.

- Encrypted communication. The secure socket layer (SSL) protocol encrypts data transmitted between your servers, employees, and end-users. This safeguards sensitive information, financial transactions, and login credentials from malicious actors.

- Automated threat detection and response. Intrusion detection and prevention systems (IDPS) can respond to threats in real-time to reduce attack vectors on your system.

- Continuous monitoring tools. As highlighted by Deloitte, the fast pace of FinTech operations requires companies to transition from periodic reviews to continuous monitoring of risks, controls, and key performance indicators.

- Penetration testing software. Testing frameworks like Metasploit and Nmap can help FinTech organizations simulate cyberattacks to discover vulnerabilities before they’re exploited by hackers.

- Zero trust policy. Software tools like Okta and Perimeter 81 enforce a “never trust, always verify” policy, which requires every user to authenticate and be verified before they can access an organization's applications or resources.

- SASE framework. Secure access service edge (SASE) platforms combine network and security functions into a centralized cloud-delivered service that scales up and down based on business needs.

By investing in software that embraces these technologies, companies can improve their security posture, maintain customer trust, and reduce the severity and cost of a data breach.

Automated Compliance Software

Online identity verification — including Know Your Customer (KYC) guidelines — is critical for security and regulatory compliance in FinTech organizations. Document verification tools, biometrics, and continuous monitoring allow you to definitively identify customers and monitor for suspicious activity.

Anti-money laundering (AML) rules are mandated by both national and international authorities. Implementing AML compliance tools helps predicate offenses for illegal financing and losses resulting from illegal transactions.

RegTech (regulatory compliance technology) deserves special mention. This technology uses multiple regulatory compliance checking tools, like KYC, and AML, to help financial companies meet changing regulatory requirements. RegTech automates reporting and notifies about critical law changes, which prevents violations and lowers the cost of your compliance processes.

Scalable Software Infrastructure

To maintain system performance, companies should invest in cloud computing, microservices architecture, and containerization.

- Cloud computing. Cloud platforms like Amazon Web Services (AWS), Azure, and Google Cloud provide the infrastructure that automatically scales according to your business needs. Deloitte expects expanding the use of cloud-based infrastructure to be a top priority through the year 2028.

- Microservices. Microservices architecture, which involves breaking applications into smaller independent services, lets FinTech organizations quickly scale resources vertically and horizontally. Bringing new technologies to cloud-enabled microservices is a primary focus of large enterprises (based on Deloitte’s outlook).

- Containerization. Container technologies bundle all components of an application in a package that can be deployed in isolated, portable, and easily scalable environments. Containers can be orchestrated by tools like Kubernetes to automate the provisioning, management, and load balancing across clusters of nodes.

Investing in harnessing these software-based technologies facilitates a seamless user experience, even as transaction volume increases. They also reduce downtime, further improving customer satisfaction.

Intuitive User Experience

FinTech apps need an intuitive user experience to improve customer engagement. Here are some software tools that can help you achieve this:

- UX/UI design software. Tools like Sketch, Figma, and Adobe XD help designers and developers work together to craft engaging user interfaces.

- User testing platforms. Applications like Lookback and Usertesting allow companies to test application design and usability on real users.

- Low-code tools. Low-code tools and platforms use visual interfaces and pre-built templates to build digital products and minimize hand-coding.

These tools help create better user experiences and involve more nontechnical people in development. In addition, user testing tools can increase your understanding of your users so you can build products based on their feedback.

Integration technologies

Adopting application programming interface (API) standards, integration tools, and data exchange platforms help you achieve interoperability.

- API standards. Standardized APIs provide a common vocabulary for diverse financial systems to deal with interoperability challenges in FinTech. Currently, organizations like Europe's PSD2 facilitate access to client data by requiring banks to use accessible APIs.

- Data integration tools. Tools like Talend and Informatica enable FinTech applications to collect, standardize, and integrate data from third-party sources.

- Data exchange platforms. Organizations like the Financial Data Exchange (FDX) promote a common standard for data sharing to help financial organizations effectively exchange data across platforms.

These solutions can greatly improve your ability to integrate data across organizations.

Advanced Data Analytics

Data analytics and business intelligence software collect and transform raw data into actionable insights.

- Big data platforms. Apache Spark and Hadoop consolidate financial, customer service, and employee data to provide businesses with critical insights on demand.

- Data visualization tools. Platforms like Tableau and PowerBI create reports based on performance indicators so companies can more easily visualize and understand information.

- Predictive analysis software. Tools like SAS and IBM SPSS use historical data to predict future trends, helping companies make data-driven decisions.

Data analytics technologies help you predict future market trends that can drive business growth and support intelligent decision-making.

AI-powered Technology and Blockchain

AI, machine learning (ML), and blockchain can help overcome FinTech challenges by automating tasks, enhancing security, and improving customer experience.

- AI. AI software can streamline repetitive processes and analyze vast amounts of data to detect patterns that might indicate sales opportunities or detect fraud. FinTech companies deploy AI technology to automate processes like KYC verification, trade reconciliation, and loan transactions.

- ML. ML is a type of AI technology that learns from historical data to make predictions. Some examples outlined in the Deloitte report include ML tools that provide a holistic view of a company's regulatory obligations and real-time monitoring for financial crime.

- Blockchain. Blockchain is a distributed ledger that decentralizes peer-to-peer digital asset trading, making transactions more transparent and reducing operating costs by eliminating intermediaries. According to Juniper Research, blockchain technology could save up to $10 billion in cross-border settlement transactions by 2030.

- Asset tokenization. Tokenization enables a frictionless and instantaneous transfer of collateral assets. For example, JPMorgan Chase bank uses blockchain to conduct intraday repurchases or short-term repo borrowings from late 2020.

By embracing these software solutions, you can stay at the forefront of the industry.

Custom Software Development: Addressing FinTech Challenges

Challenges in the FinTech sector are quite dynamic and multifaceted. However, the right software solutions can transform even the biggest problems into opportunities for growth. The trick is knowing which technologies are most beneficial based on your business goals and customer needs.

This knowledge mostly comes down to experience, and we at ElifTech have plenty. Our company specializes in FinTech software outsourcing and bespoke development. ElifTech can help you integrate solutions that not only address your pain points but also enhance your business’s success.