Wealth Management

How Financial Calculators and Tools Enhance Wealth Management Platforms

What does it take for top wealth management platforms to offer clients a personal financial organizer tailored to their unique financial goals and investment preferences?

With financial calculators and other tools, WealthTech startups and companies can provide comprehensive solutions beyond traditional approaches. Financial calculators and tools emerge as crucial assets built to deliver invaluable investment management and financial planning insights. These tools can easily address each client's needs, from retirement planning to investment projections and tax optimization.

Now, let's delve deeper into how calculators and financial tools can revolutionize the wealth management landscape.

Revolutionizing Wealth Management: Financial Tools & Calculators to Elevate Your Platform

Research and statistics demonstrate the significant impact of advanced financial tools on top wealth management platforms. The paradigm shift in the industry is driven by changing demographics, generational wealth transfer, and the rapid expansion of digitalization.

Financial Tools in 2023 Wealth Management: Key Statistics

- The Capgemini Research 2023 states that today’s customers now demand a wider array of investment options and an improved service experience.

- The 2023 Global Wealth Research Report by EY Canada discovered that investors seek products, services, and advice they need to navigate the complexities of the investing world.

- Finally, Forbes highlights the significance of digitally savvy financial advisors and digital financial advice in 2023. Wealth management firms that embrace both aspects are better positioned to win over investors and convert them into profitable, long-term clients.

But the growing complexity of financial planning and investment management can make it difficult for individuals to navigate their finances without assistance.

Financial calculators and tools provide way more automation to calculations of retirement savings, budgeting, and investment portfolio analysis. Visual interpretation in graphs helps clients understand complex financial metrics more efficiently, while real-time data updates keep them up-to-date with their financial performance.

Here are a couple of examples of existing financial calculators incorporated into managed wealth financial platforms:

- Fidelity's Planning & Guidance Center: Users can enter their goals and financial information into the center and then receive a comprehensive financial plan. This service offers a range of tools, such as retirement calculators, investment check-ups, and budgeting planners, to offer personalized solutions to the user.

- Portfolio Watch by Vanguard Group: This service provides clients with personalized portfolio analysis, including risk assessment, diversification, and performance measurement, to help clients make informed decisions about their investments.

The Role of Financial Tools in Top Wealth Management Platforms

Improved User Experience & Engagement

Financial tools play a crucial role in improving user experience. These features enable clients to track their financial goals, evaluate portfolio performance, and make well-informed investment decisions. By providing a user-friendly and engaging UX & UI design, wealth management platforms can effectively attract and retain clients, fostering long-term relationships.

What can enhance UX and engagement in wealth management platforms?

- Customizable dashboards;

- Real-time data updates;

- Interactive tools and simulations (investment simulators, risk assessment calculators, and goal trackers);

- Collaboration and communication channels;

- Educational resources;

- Mobile access;

- Social integration;

- Goal-based planning;

- Performance analytics;

- Security and privacy measures.

Enhanced Decision-Making & Investment Strategies

Financial calculators play a key role in improving decision-making and developing personalized investment strategies for clients. For example, risk assessment calculators evaluate clients' risk profiles, guiding advisors in selecting suitable investments and asset allocations. Asset allocation tools enable effective portfolio diversification, balancing risk and return. Scenario analysis modules allow clients to simulate different market conditions to help them assess the potential impact on their investments and make well-informed decisions.

Overall, top wealth management platforms prioritize these tools to build trust and satisfaction among clients by tailoring investment strategies that align with their goals and risk tolerance.

Streamlined Financial Planning & Reporting Processes

Wealth management involves complex financial planning and extensive reporting requirements. To simplify these processes, platforms offer automated report generation, budgeting tools, and cash flow analysis modules. These features streamline financial planning and provide clients with accurate and up-to-date financial information.

Clients can generate comprehensive reports that provide a holistic view of their financial status, including detailed breakdowns of their budgets, analysis of investment performance, and cash flow projections. By ensuring the accuracy and consistency of financial information, wealth management platforms offer clients valuable insights into their financial health while saving time and effort in financial planning and reporting.

Accurate & Reliable Data Analysis

Financial tools have advanced data analysis capabilities that improve the accuracy and reliability of wealth management activities. Through efficient data aggregation and sophisticated analytics algorithms, they gather and analyze data, providing valuable insights into client portfolios, market trends, and investment opportunities.

With portfolio performance trackers, advisors can monitor investments in real time and make informed decisions based on current information. Investment calculators help analyze potential returns and risks of different investment options, supporting the development of well-informed strategies. Tax calculators ensure accurate tax planning and compliance while optimizing financial outcomes.

By using these features, wealth management platforms can harness the power of data analysis, make data-driven decisions, and offer reliable financial advice to their clients.

Regulatory Compliance

Wealth management platforms must comply with strict regulations, and financial calculators and tools play a crucial role in ensuring regulatory compliance. They can help with tax calculations, risk assessments, and following financial regulations.

Tax calculators calculate taxes based on income, investments, and deductions. They ensure clients meet their tax obligations and optimize their financial outcomes. Other risk assessment tools help advisors evaluate clients' risk profiles and align investment strategies with regulations to ensure portfolios stay within regulatory boundaries.

By integrating regulatory compliance modules, wealth management companies can mitigate risks and safeguard client data. These modules include features like data encryption, secure storage, and compliance reporting, ensuring platforms operate with the highest security and compliance standards.

Types of Financial Calculators and Tools in WealthTech Platforms

To cater to the diverse needs of clients, top wealth management platforms offer a range of financial calculators and tools:

- Retirement planning calculators—help clients determine their retirement savings goals, estimate future income needs, and assess their overall readiness for retirement. They consider current savings, expected investment returns, and desired retirement lifestyle.

- Investment calculators—assist clients in evaluating potential investment returns, understanding their risk tolerance, and developing appropriate asset allocation strategies. These tools consider investment time horizon, expected returns, and risk preferences.

- Tax calculators—aid in calculating tax liabilities, deductions, and capital gains. They help clients optimize their tax planning strategies by considering income sources, deductions, and tax brackets.

- Mortgage & loan calculators—help clients assess mortgage affordability, estimate loan payments, and explore refinancing options, including loan amount, interest rate, loan term, and down payment.

- Portfolio performance trackers—provide clients with real-time data on the performance of their investment portfolios. These tools enable clients to monitor their investments, analyze performance trends, and make informed decisions based on accurate and up-to-date information.

- Cash flow analysis tools—help clients analyze their income and expenses to optimize their cash flow. These tools enable clients to understand their spending patterns, identify potential savings opportunities, and maintain a healthy financial position.

- Savings calculators—assist clients in determining their savings goals, estimating the required time frame to reach those goals, and projecting potential returns on investment. These tools consider desired savings amount, investment duration, and expected rate of return.

Which financial tool is the most important for wealth management platforms? The answer may vary depending on individual business needs. The mentioned ones would cater to different aspects of financial planning and investment management, although all of them are essential tools to enhance informed decision-making.

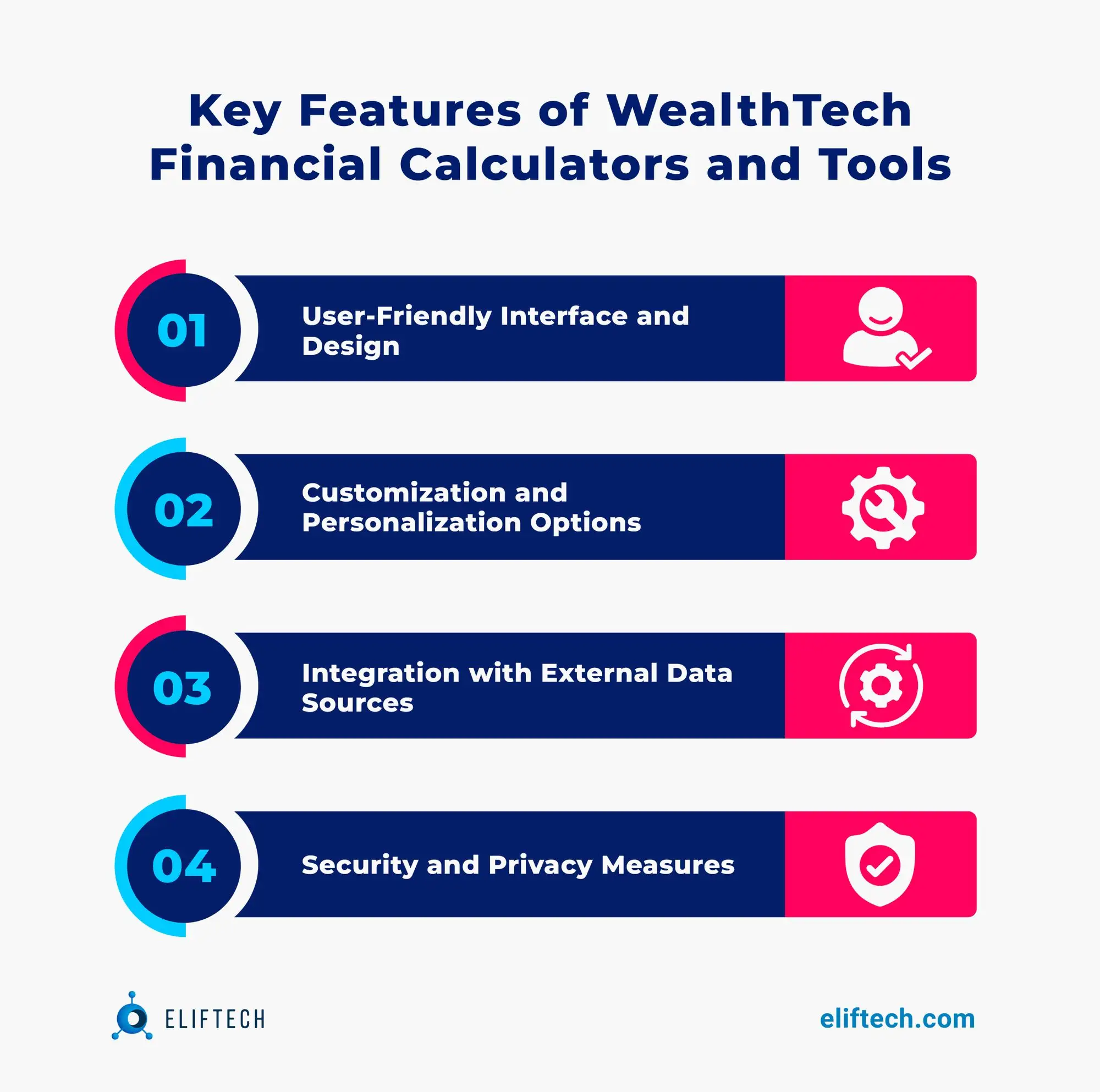

Key Features of WealthTech Financial Calculators and Tools

To optimize the use of financial calculators and tools in top wealth management platforms, it is vital to prioritize the next features:

User-Friendly Interface and Design

For clients to easily navigate and make the most of the financial tools, it’s important to incorporate intuitive and user-friendly interfaces. Clear visualizations, interactive charts, and customizable dashboards enhance the user experience, making it easier for clients to track their financial progress and make informed decisions.

Customization and Personalization Options

Financial calculators and tools should be customizable to meet the unique needs and preferences of individual clients. Personalized features such as goal-based planning, risk assessment, and investment preferences ensure clients feel valued and understood.

Integration with External Data Sources

Wealth management platforms must integrate with external data sources to provide accurate and comprehensive insights. This includes market data, financial news, and client-specific data from various sources.

To provide comprehensive insights, wealth management platforms must integrate external data sources, including financial news and market data, and client-specific data from various sources. Platforms leveraging personal finance management APIs and data integrations can ensure real-time data updates and informed decision-making. Integration with external data sources provides instant data sharing allowing them to quickly adjust clients’ investment strategies to the market changes.

Security and Privacy Measures

Wealth management platforms handle sensitive financial information. That’s why they should implement proper security and privacy measures, including encryption, two-factor authentication, and secure data storage protocols. These measures protect client data from cyber threats and data breaches, ensuring client trust and preserving the integrity of the wealth management platform.

Incorporating the above-mentioned features contributes to the platform’s functioning, client retention, and personalization, which ultimately helps clients achieve greater financial goals.

Top Wealth Management Platforms: 9 Best Practices

To maximize the benefits of financial calculators and tools, wealth management platforms should adhere to the following best practices:

- User research and testing. Conducting user research and implementing iterative testing processes enable platforms to tailor their tools to meet clients' expectations and provide genuine value. User feedback should be actively sought throughout the development process to ensure the tools are intuitive and considerate of client needs.

- Effective data visualization. Platforms should prioritize clear and intuitive visual representations, such as charts, graphs, and tables, to help clients better understand complex financial information. Visualizing data in a user-friendly manner enhances the user experience, making it easier for clients to analyze their financial situations.

- Collaboration and communication. Financial calculators and tools should offer features to share information, communicate updates, and provide personalized feedback. This fosters a collaborative relationship and allows clients to seek advice, share insights, and receive guidance from their wealth management team.

- Mobile compatibility and accessibility. Mobile accessibility allows clients to monitor their finances, track performance, and make informed decisions on the go. This flexibility enables clients to stay engaged with their wealth management activities and access information conveniently from their smartphones or tablets.

For this reason, you should learn how to create a financial app in a wealth management niche from A to Z.

- Goal-based planning. It allows clients to define their financial objectives, such as retirement savings, education funds, or purchasing a home. By setting specific goals and tracking progress over time, clients can gain a clear understanding of how their financial decisions align with their objectives, thereby empowering them to make proactive adjustments when necessary.

- Comprehensive risk assessment. Financial calculators and tools should include robust risk assessment capabilities that consider investment risk tolerance, diversified portfolios, and potential returns. This helps clients evaluate the potential risks associated with their investment strategies and make informed decisions about asset allocation.

- Adequate support and resources. Platforms should offer tutorials, help guides, and readily available customer support channels to empower clients to utilize the tools effectively. Clear and concise instructions, examples, and best practices can help users navigate the tools and gain deeper insights into their financial situations.

- Regular updates and maintenance. To stay competitive and meet evolving client expectations, wealth management platforms should prioritize regular updates and maintenance of their financial calculators and tools. This includes incorporating client feedback, implementing new features, and staying up-to-date with the latest wealth management trends and technological advancements.

- Compliance with regulatory standards. Wealth management platforms must adhere to regulatory standards to protect client data and maintain trust. Compliance with regulations such as GDPR, SEC, and FINRA is critical. Conduct regular audits, implement data protection measures, and prioritize security to ensure regulatory compliance.

Conclusion

Integrating advanced financial calculators and tools as a part of your wealth tracking app or goal-based investing software simplifies complex calculations, improves decision-making, streamlines processes, and ensures compliance for wealth management companies. This enables them to deliver outstanding user experiences and achieve optimal financial outcomes.

Wealth management platforms can position themselves as industry leaders in financial technology by following the discussed best practices and partnering with a reliable software development company like ElifTech.

ElifTech's expertise in developing personal finance FinTech solutions and commitment to cutting-edge technology make them the ideal partner for enhancing wealth management offerings. With the right approach and a trusted partner, platforms can elevate their capabilities, provide exceptional user experiences, and stay ahead in the rapidly evolving financial technology landscape.

Contact ElifTech today to embark on this journey of growth and innovation.

Browse our case studies and get actionable insights to drive your success

See more