Wealth Management

Introduction to Wealth Management App Development: An Overview

Thanks to the advent of wealth management apps, individuals and businesses can now manage their wealth quickly and conveniently. Using these powerful tools, users can handle finances and take control of their financial goals through easily accessible and user-friendly platforms. From detailed portfolio tracking to personalized financial planning and investment recommendations, we aim to shed light on how these apps cater to the unique needs of users seeking to grow and protect their wealth.

In this article, we will explore the world of wealth management app development and unravel the secrets behind their success. We will provide a comprehensive overview of the process, functionalities, and benefits to discover how these apps can transform your financial journey.

Wealth Management App Development: The Rise of WealthTech Apps

Recent years have seen a sharp increase in the popularity of wealth management apps, capturing the attention of seasoned investors and individuals new to the finance world.

According to Allied Market Research, the wealth management software development industry is a promising niche projected to reach $1,576.86 million by 2027. The growth of market size can be attributed to the rise in the need to track and manage finances, the digitalization of financial services, and the growth in mobile users worldwide.

In addition, Google found that 6 out of 10 users prefer to use mobile financial apps to manage their accounts and assets. This growing trend can be attributed to the convenience and accessibility these apps offer. Users no longer need to be tech-savvy to track and manage their finances. Instead, wealth management apps are easy to use and allow users to access portfolios, track investments, and make informed decisions on the go.

Moreover, customer satisfaction with wealth management applications has also skyrocketed. An overwhelming majority of users report high levels of user experience and functionality. According to the recent study by J.D. Power U.S. on wealth management mobile app satisfaction, the average score for wealth management mobile apps on a scale of 1,000 was 858.

Keeping these figures in mind, it’s evident that wealth management apps have not only revolutionized how we manage our wealth but have proven to be indispensable tools in achieving financial success.

Understanding Wealth Management App Development

Nowadays, defined by digital innovation and financial autonomy, wealth management app development has emerged as a key to enabling financial empowerment for individuals and businesses. However, to realize the full potential of custom financial software development, it’s crucial to understand the nuances and intricacies of this iterative process.

From conceptualization and design to back-end development and testing, each step should be well-planned and managed to develop a successful and high-quality financial tool. Moreover, understanding this process allows stakeholders to learn the complexities involved and how to collaborate effectively with development teams and set realistic expectations.

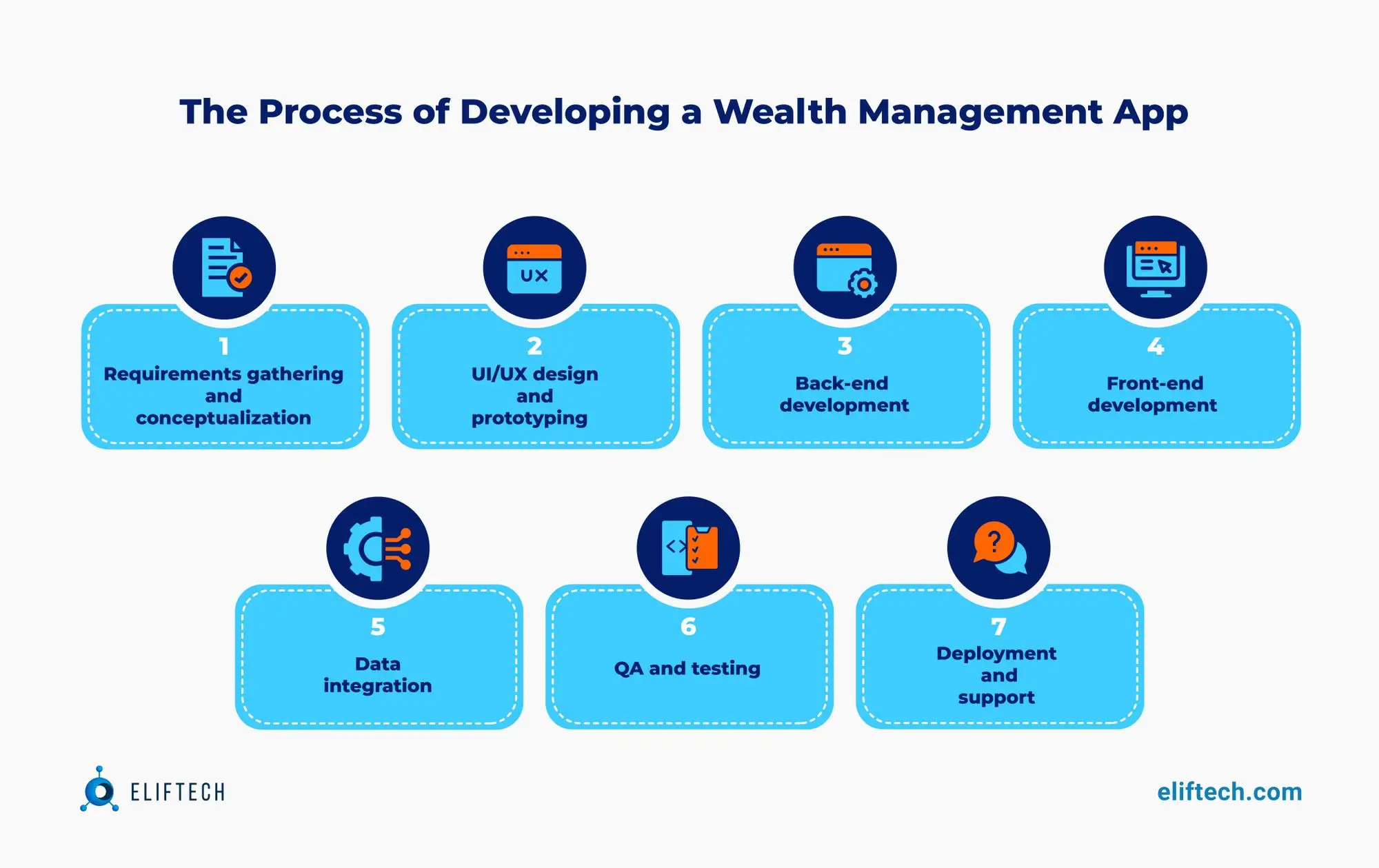

The Process of Developing a Wealth Management App

ElifTech is a leading software development company specializing in FinTech application development services. We follow a systematic and iterative process that combines technical expertise, user-centric design, and robust functionality. Here's a quick overview of our personalized approach:

STEP 1. Requirements gathering and conceptualization

We start the process by initiating a discovery call with our clients to understand their specific requirements, target audience, and business goals. We analyze the information gathered during collaborative workshops to come up with a single vision of the project scope and iterations to take.

This step flows smoothly into conceptualizing the app's purpose, target audience, and key features. This may involve thorough market and user research to help us shape the app's unique value proposition.

STEP 2. UI/UX design and prototyping

Our team understands UI/UX mobile app design plays a definitive role in attracting and retaining users and driving competition in the market. That’s why our skilled design team focuses on delivering an intuitive, simple, and visually appealing design that enhances the user experience.

We assign 2-4 designers to start working on creating wireframes and interactive prototypes, visualizing the app's layout, navigation, and user flows. Our designers create well-designed customer journey maps that give a clear picture of how users will interact with your product and achieve their primary goal: wealth management. Several sketches go further to testing with real users so we can make required updates and minor fixes.

STEP 3. Back-end development

Our expert back-end coders start preparing the wealth management app’s infrastructure that will support the app's core functionalities, e.g., portfolio tracking, investment analysis, financial planning, etc. At this step, we take care of such development tasks as data management, integration with financial institutions, and implementing complex algorithms for portfolio analysis and performance tracking.

We implement required APIs and business logic and employ the best security measures to safeguard financial user data.

STEP 4. Front-end development

Our front-end development team creates responsive and interactive user interfaces powered by innovative technologies. At this step, our front-enders convert the designed screens into functioning user sides. This involves coding the app's visual elements, optimizing for various devices, and ensuring a seamless user experience.

STEP 5. Data integration

Wealth management applications rely on real-time data from market channels, financial institutions, and user accounts. So, we prioritize integration with trusted data sources to provide accurate and up-to-date information for investment tracking and analysis.

STEP 6. QA and testing

While the development undergoes, our QA engineers simultaneously conduct rigorous testing to identify bugs, glitches, or usability issues. Our QAs plan tests to verify the wealth management app's usability, performance, acceptability, and functionality. In turn, quality assurance helps us ensure the app performs flawlessly, offers a smooth user experience, and adheres to industry standards.

We document the testing results in bug reports and hand over work to developers to fine-tune the app and make fixes if needed.

STEP 7. Deployment and support

We help our clients deploy their apps to app stores, handle the submission process, and ensure a smooth launch. Once launched, we provide ongoing support, maintenance, and updates to keep the app secure and optimized and make enhancements based on user feedback.

Wealth Management App Development: Key Features

As we delve deeper into wealth management app development, below, we highlight innovative features that make them a must-have for individuals seeking to optimize their financial strategies.

Multi-factor authentication

Since we deal with FinTech development, we prioritize security when it comes to user authorization. To use the wealth management app, users must sign in and provide personal information about their expenses, income, and bank details. Therefore, we adopt best practices (2FA, biometrics) to prevent illegal access to consumers’ financial accounts.

Account aggregation

Users may access their complete financial picture in one place thanks to the app’s integration with various financial accounts. Wealth management apps should comprehensively overview bank accounts, investments, credit cards, and other financial items.

Portfolio tracking

Users should have access to complete information on asset allocation, performance, and historical data, as well as the ability to track their investment portfolios in real time. Thanks to this feature, users can keep an eye on their finances and make informed choices.

Goals setting and planning

Users should be able to set financial goals for the day, month, quarter, or year to reach such goals, e.g., supporting school, buying a home, or saving for retirement. The goal-setting feature can also allow them to create personalized plans, track progress, and receive guidance on achieving those goals.

Budget and expense tracking

With wealth management apps, users can create budgets, track expenses, and classify transactions. Your optimization should visually represent spending patterns, overspending alerts, and financial optimization recommendations.

Expenses categorization

To let users understand and track their spending patterns better, including expense categorization in your feature list is essential. It works simply: once a user makes a transaction through a personal account, these expenses fall into a specific category: housing, transportation, education, subscriptions, etc.

Robo-advisory services

Many wealth management apps offer automated investing features. These algorithms analyze user preferences, risk tolerance, and financial goals to provide customized investment offers and automatically execute trades.

Reporting and analytics

Simple data visualizations, reporting, and analytics are essential to facilitating user interaction with the app. Users can easily manage their finances and save money by maintaining an accurate record of their financial transactions. Users can obtain daily or annual reports to analyze income or expenses, evaluate forecasts, and more through well-organized data.

Notifications and alerts

Innovative alert systems help users stay informed and take timely action. Such apps should be able to send real-time notifications and alerts regarding market trends, portfolio performance, account activity, and upcoming bill payments.

Financial coaching

Some applications contain educational materials to improve the financial literacy of users through articles, videos, or webinars. This functionality allows users to improve their financial literacy and make more informed financial decisions.

Curious about the key features your wealth management application should have? Contact us today to discuss how we can collaborate and explore key functionalities to include in your app.

Technologies Used in Wealth Management App Development

When it comes to bringing wealth management solutions to life, it’s vital to choose the instruments, tools, and technologies wisely. The wealth management app’s reliability, scalability, and flexibility largely depend on the chosen technology stack.

The technologies and tools our team uses to cope with tasks within custom financial software development are:

Using the right combination of cutting-edge technologies and frameworks mentioned above allows the ElifTech team to build secure, scalable, and feature-rich applications that empower users to manage their wealth effectively.

Advantages of Custom-Built Wealth Management Apps

When it comes to wealth management, one size does not fit all. Our team has an extensive and proven experience in custom financial software development that offers many advantages over off-the-shelf solutions. Our skilled team of developers, designers, and domain experts collaborates closely with you, leveraging our industry knowledge to create a personalized and exceptional app tailored to your needs.

Here are the main advantages we offer in terms of wealth management app development:

- Tailored to your requirements. When our clients contact us, they all have unique goals, preferences, and business requirements. So, our team works closely with you to gather information and create a custom-built wealth management application with the features and functionality that matter most to you.

- Seamless integration. Thanks to our experience with external financial systems, including banks, payment gateways, and market data providers, your application will seamlessly integrate with the tools and services you need. This ensures transaction security, real-time data updates, and a complete understanding of your financial situation.

- Enhanced user experience. Our top priority is to deliver a superior user experience that keeps your users engaged and empowered. Our experienced UI/UX designers create user-friendly interfaces that guarantee easy navigation, attractive layouts, and seamless interaction. We deliver design services based on user-centered design principles to ensure optimal usability and satisfaction.

- Scalable and future-proof solutions. Scalability is an engineering goal of our wealth management applications. We implement cutting-edge technologies and robust frameworks to ensure your application can handle growing user demand and changing business needs. This future-proof method allows you to scale and integrate features as your organization grows.

- Data security and compliance. Data security and compliance with industry rules and regulations are paramount to ElifTech. To protect user data and comply with laws such as the GDPR, KYC, AML, PCI DSS, etc., we use best practices in security such as encryption, secure authentication, and rigorous testing.

- Cost-effectiveness. Although custom-built apps may require a higher upfront investment than off-the-shelf solutions, they can be more cost-effective in the long run. Moreover, our team knows the ins and outs of custom financial software development to suggest the most optimal solution for any pocket size.

- Ongoing support and maintenance. We prioritize long-term business relationships with our clients, so cooperation doesn’t end with the app’s launch. ElifTech offers ongoing maintenance and support services to guarantee that your wealth management app stays secure, efficient, and relevant. We provide routine updates, bug fixes, and proactive monitoring to keep your app functioning correctly.

Want to take advantage of a custom-built wealth management app with ElifTech? We’re always glad to become your trusted FinTech development partner. Share your needs with us!

Future Trends in Wealth Management App Development

The money management industry continues to evolve, so keeping abreast of development trends is essential to stay ahead of the curve. Our team has compiled a list of the top five trends to watch out for in 2023 and beyond.

- AI and ML technologies. Artificial intelligence and machine learning technologies will keep changing the wealth management industry. AI-based wealth products analyze vast amounts of data, identify market patterns, and provide personalized investment recommendations. Also, AI helps boost advisors’ productivity with the help of chatbots and virtual assistants, offering real-time support and custom advice to clients.

Read more: Use of AI to Scale Wealth Management Business

- Robo-advisory services. Deloitte predicts that robotic advisory services will be managing more than $16 trillion in assets by 2025. Robo-advisers are automated investment platforms that use algorithms to provide financial advice and portfolio management. So, we expect such platforms to gain more popularity, especially among Gen Z investors.

- Upgraded security protocols. Dealing with sensitive financial information requires continuous security improvement. As such, we expect more resources to be allocated to strengthen security measures with biometric authentication, blockchain technology, and advanced encryption techniques.

Read more: How to use speech and biometrics recognition for Fintech Security?

- Integration with IoT devices. By enabling seamless interaction with smart devices, the Internet of Things has the potential to revolutionize wealth management. IoT gadgets can automate processes and provide customized information and real-time financial data. For example, smart wearable devices can track user health information and change investment plans as needed.

- Personalization and customization. Numerous investors find customization the key reason to use wealth management apps. Thus, the ability to customize the interaction with the application depending on investment goals, acceptable risk, and user preferences will increase. Investment recommendations, as well as personalized toolbars and notifications, will be distributed more widely.

Why Choose ElifTech?

ElifTech creates the needed tools for financial success. With tailored features, seamless integration, and advanced security that WealthTech offers, our team can create a tailor-made solution that empowers businesses and individuals to take control of their financial future.

We are here to build an app that revolutionizes how you manage your wealth, empowering you to make informed decisions and secure a prosperous future. Contact us to get transformative FinTech application development services.