ML

The Use of AI in Wealth Management: The Key to Scaling Your Business

Imagine a future where every financial transaction is a personalized journey, tailored to meet individual goals and aspirations. This vision is no longer a distant dream but a reality all thanks to the integration of Artificial Intelligence (AI) and Machine Learning (ML).

In particular, the world of wealth management, often associated with tradition and legacy, is currently undergoing a profound transformation with these new technologies. Although their prime application has to do with automating routine tasks, primarily to streamline and reduce expenses, there's much more that AI & ML technologies can do for the wealth management industry.

In this guide, we'll explore how Artificial Intelligence is reshaping wealth management, offering possibilities that go far beyond mere efficiency, and uncover the potential of AI in wealth management to elevate the client experience.

AI Wealth Management: A Catalyst for Transformation

In recent years, the world of wealth management has witnessed a seismic shift, driven by technological advancements.

First, almost overnight, the pandemic made digital communication the primary way clients contact and communicate with their wealth managers and advisers. Then, wealth business has become busy accelerating their cloud migration journeys, seeking intuitive data solutions to unlock advanced analytics and power up personalized client offerings.

What began as a response to the sudden shift towards digital communication during the pandemic has evolved into a journey towards cloud migration, data-driven insights, and the rise of AI-powered wealth management.

Read more about cloud computing in wealth management in this post.

But here's the real question: Instead of pondering what AI can do for wealth management, we should ask, "What can AI in wealth management do for you?"

The answer lies in advanced statistical models and the magic of machine learning, which enable AI to digest vast amounts of customer and market data. This not only enhances prediction accuracy but also streamlines back-office tasks and leads to increased client engagement.

Over the past decade, the wealth management landscape has burgeoned, with assets under management (AUM) soaring from $45.6 trillion in 2009 to a staggering $103.1 trillion in 2020, according to the Statista report. This growth can be attributed to the rise of low-cost products, the expanding affluence of the middle class, and a shift from addressing basic needs to fulfilling desires in developing economies. Moreover, even in the face of a global pandemic, the wealth management industry has demonstrated resilience, with an impressive 11% growth rate.

The Practical Aspect of AI in Wealth Management

The urgency for AI adoption in the wealth management sector has never been greater. With customers clamoring for digitized experiences and reduced fees, coupled with fierce competition and a constant influx of investment opportunities, industry leaders must find innovative ways to engage clients and remain competitive.

To make matters more challenging, the abrupt digital shift caused by the pandemic has left many businesses scrambling to retain existing clients and attract new ones. A report by Accenture reveals that 55% of wealth management firms anticipate decreased economic stability this year.

In this context, AI emerges as a powerful tool for wealth management businesses, capable of addressing sudden market shifts while maintaining a focus on long-term opportunities. As a bonus, AI empowers firms to deliver highly tailored and engaging client experiences while equipping wealth managers to make informed decisions at scale.

And here are the five key ways AI will enhance your performance without the need to dope.

1. Hyper-personalization

Bid farewell to the misconception that automation erases personalization. Machine learning-powered customer relationship management (CRM) now offers advisers unparalleled insights into clients' needs, preferences, and attitudes. This level of detail surpasses what one might glean through in-person interactions, enabling the creation of unique client personas and truly customized user experiences, right from the moment clients log in to check their portfolios.

2. Well-informed decision-making and recommendations

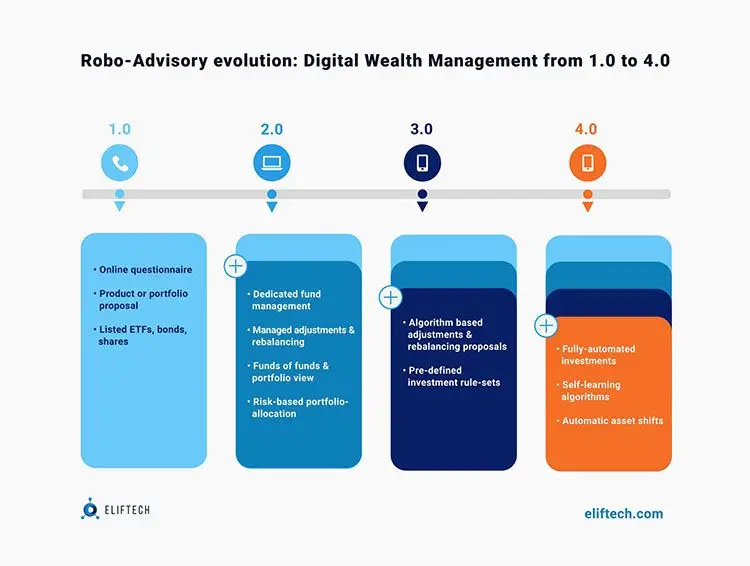

Robo-advisers are far from being a novelty but their previous iterations offered very limited personalization compared to what we get with machine learning. Now, advisers can provide "Next Best Action" recommendations tailored to individual client portfolios, ushering in a new era of personalized financial advice.

3. Level up the financial planning

Historically, areas like tax planning, trusts, and cash flow management demanded consultations with dedicated financial experts. These experts would furnish clients with extensive documents and, at best, suggest industry providers for implementation.

Today, digital planning engines adeptly handle these complex calculations. Clients can receive comprehensive end-to-end strategies complete with specific goals and tailored recommendations. Moreover, clients can access step-by-step micro-plans for various scenarios, not limited to retirement planning.

4. Enriched model portfolios

For decades, the wealth management landscape has relied on a handful of "one-size-fits-all" model portfolios. These portfolios aimed to cater to different risk profiles, customer preferences, and investment horizons. However, as environmental, social, and governance (ESG) considerations gained prominence alongside evolving investor priorities, these traditional portfolios fell short.

Read more: Transparent Portfolios: Asset Breakdown and Risk Control in WealthTech Solutions

ESG can encompass a myriad of priorities, from clean water initiatives to poverty alleviation and equality. The current "Model Portfolios" simply cannot accommodate such diverse individual preferences. Enter AI powered algorithms, poised to revolutionize wealth management by offering personalized portfolio options aligned with specific criteria, ensuring an optimal impact for each client.

5. Must-have of any modern business: real-time monitoring

In today's world, clients demand more hands-on involvement in their investments than ever before. Monthly portfolio updates no longer suffice; clients rightfully expect real-time access to their instruments and relevant market insights. This immediacy enables both clients and financial advisers to stay attuned to market shifts, detecting corrections and trading signals as they occur. It's a symphony of information exchange that keeps clients informed and advisers responsive to their needs.

Top 8 Benefits of AI for Wealth Management

AI is smoking hot tech for financial enterprises of any kind. Here are 8 key benefits of using artificial intelligence in wealth management business :

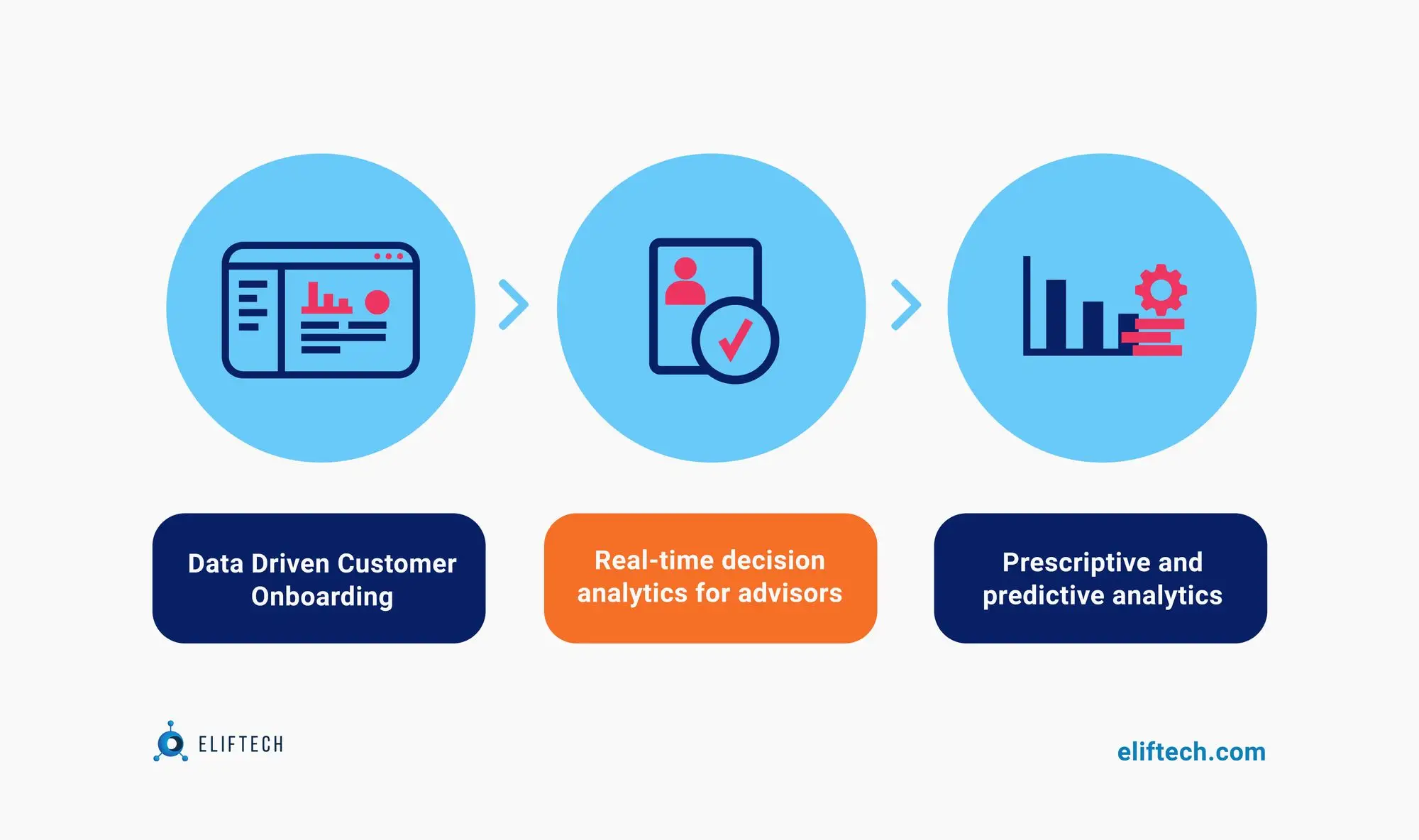

- Customer-centric solutions: Personalized, data-driven experiences for clients, starting with seamless digital onboarding. It is a serious selling point and a customer magnet. It aims to compensate for the lack of personal relationships with an adviser within the modern pace of life.

- Real-time intelligence for advisers (discussed above) aims not to exclude advisers but to help you and your Client make better-informed decisions by staying "on top of things" all the time without the need to fish out for info in the morning papers.

- Predictive analytics is the next hottest thing in tech, and it applies perfectly to investment advice. AI allows wealth managers to come closer to selling outcomes, rather than "model portfolios." not traditional investment products.

- Streamlined lead generation: With the power of AI, businesses can analyze vast amounts of publicly available data and accurately segment their prospects to have a better "palette" of new clients to service.

- Improved personalization: You can tailor your investment offerings based on the customer's unique needs. And AI will speed up sorting the data to pinpoint those individual needs. Plus, it will enhance customer engagement.

- Next-level automation wealth management: This point is not new, but it is very useful. Automate the time-consuming, routine tasks and processes to AI-powered systems, and your employees' time can be spent on cognitively demanding and more important tasks.

- Streamlined compliance management: To keep your hand on the pulse of rapidly changing industry regulations and legal requirements, AI systems will process every change in regulatory requirements from an unquantifiable number of sources at incredible speed.

- Improved decision-making: Wealth management businesses can utilize AI platforms to gain more profound insight into customer data and market fluctuations. This can enable a noticeable shift toward more effective decision-making.

Successful Use Cases for Wealth Management AI

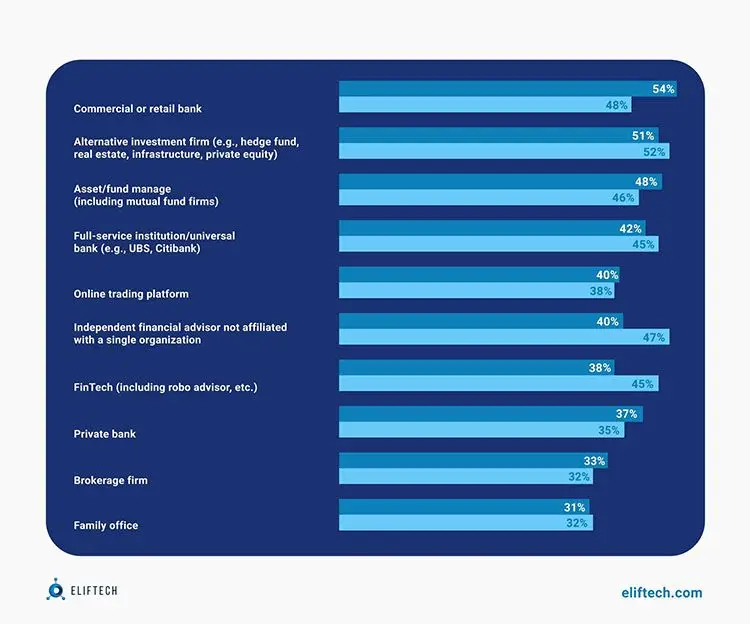

AI is a potent solution to a host of challenges faced by wealth managers, from automating manual tasks and detecting fraud using machine learning to offering personalized market forecasts. Currently, 78% of financial institutions and wealth management entities employ AI technology, a testament to its growing importance.

Let's explore some AI applications in wealth management through real-life examples and see how AI affects business workflow and revenue:

- Lead Generation

In the past, wealth managers relied on manual data analysis to identify potential clients, using traditional metrics like demographics and net worth. AI transforms this process by micro-segmenting prospects based on richer, more accurate data sources, including social media, niche news stories, and public data. This approach not only opens the door to robust leads but also enables tailored pitches. Additionally, well-calibrated AI systems can connect prospects with relationship managers who share similar interests, creating more meaningful connections.

EXAMPLE: Finantix, a California-based financial technology provider, developed an AI-powered technology (NLP) that mines LinkedIn data to identify potential leads and generate personalized pitch messages.

- Establishing Customer Relationships

Focusing on the client and their experience is the best invention of marketers and the best side-effect of the globalization and total digitalization of the world. Clients now demand a wider range of services, hyper-personalized financial guidance, and impeccable user experiences. AI-powered algorithms for robo-advisors enable wealth managers to meet these demands effectively.

EXAMPLES: Morgan Stanley's Wealth Management Unit designed the "Next Best Action" system, which helps financial advisors match clients' investment capabilities to their profiles. This AI algorithm streamlines the generation of investment offerings and enhances precision, all while identifying clients' areas of interest for improved customer engagement.

Another example is Robinhood, the renowned online trading platform, which distinguished itself through zero-commission pricing models. In the wealth management landscape, utilizing flat-fee models demands a granular understanding of clients' profiles and highly accurate return forecasts. Additionally, finely tuned predictive algorithms help detect clients with a high attrition probability, enabling proactive measures to retain them.

- Financial Advisory Automation Wealth Management

Amid the global lockdown in 2020, machine learning-infused stock market analysis tools and robo-advisory platforms took center stage, minimizing the need for physical interaction.

EXAMPLE: Wealthfront, an automated investment service, reported a remarkable 68% growth in account sign-ups during the pandemic. Wealthfront's robo-advisory platform offers digital-only investment management and financial planning services. Notably, Wealthfront's end-to-end decision-making automation in wealth management garnered attention, particularly after adjustments in 2021 that granted investors greater control.

- Back-office Automation Wealth Management

McKinsey's research reveals that wealth management relationship managers spend up to 70% of their time on non-advisory tasks, such as manual data analysis for risk, compliance, and lead generation. Embracing AI can help automate these time-consuming processes, freeing up valuable time for managers to focus on more meaningful client services.

EXAMPLE: KYC's traditionally manual research and compliance management checks approach is notoriously cumbersome and error-prone. They've turned to AI-powered data-extraction tool Magic Deep Sight to alleviate the inefficiencies. It gave KYC a 70% reduction in manual data analysis costs. In addition, AI tools can easily be applied to automate invoice processing, reconciliation, and even fund accounting.

- Compliance Management

Regulatory bodies continuously update rules, standards, and regulations within the financial sector. Compliance with these rules is crucial for financial institutions, including wealth management businesses. Traditionally, it involved manual sifting through numerous regulatory documents, a labor-intensive and largely ineffective process.

Modern digital technologies, such as AI, NLP (Natural Language Processing), and advanced data analytics, are now liberating asset managers from routine tasks, enhancing the efficiency of compliance management.

EXAMPLE: Ernst & Young developed a cloud-based AI solution that extracts vital information from governing contracts and automatically detects liabilities. While the system, known as "SARGE," isn't entirely automatic, it has reduced the time spent by compliance managers by an impressive 75%.

Implementing AI in Wealth Management: Challenges & Solutions

You've seen all the best AI in wealth management examples highlighting the best advantages of AI in wealth management. But here's what you should be aware of. Artificial Intelligence wealth management may come with a set of obstacles and you must consider them too when venturing into the AI adoption territory.

1) Data governance standard

A PwC study on AI in wealth management reveals that businesses are often reluctant to scale AI due to a lack of understanding and concerns about reliability. Data privacy and strict regulations further compound these reservations.

To mitigate risks associated with AI implementation, it's crucial to ensure data accuracy, accessibility, and regulatory compliance. The effectiveness of AI is directly linked to the maturity of data management infrastructure.

2) Workforce readiness

The readiness of the workforce to embrace AI technology is another significant concern. Given the novelty of AI, employee retraining and change management can be challenging during the adoption process.

To address this issue, consider early communication with your workforce about impending changes. Assembling multidisciplinary teams for AI projects can help clarify your strategic intent. Additionally, prioritize AI use cases that demonstrate real-life value.

Other vital things here are talent recruitment and reskilling efforts. Identifying roles early, acknowledging the shortage of AI talent, and developing a long-term talent strategy are essential steps for success in AI adoption for wealth management.

- Continuous risk framework updates

Operational and regulatory risks are not industry-specific, and successful AI adoption requires successful risk management practices. Regularly update oversight procedures, particularly in the IT department, to identify critical errors before they become issues. Continuous validation of AI models, looking for biases, checking input data, and modeling uncommon market scenarios are essential for ensuring reliability.

The Future of AI in Wealth Management?

The years ahead promise a thrilling era of innovation in wealth management, with approximately $78 trillion of assets on the move due to the expanding middle class, increasing female entrepreneurs, and growing business ownership.

However, capitalizing on this opportunity demands change, and the "AI revolution" represents the strategic shift that will shape the future. This marks a unique opportunity to harness more value through wealth management AI solutions (software).

It's now evident that wealth management Artificial Intelligence is the key to delivering the personalized online experiences that modern clients desire and require. Moreover, real-life examples demonstrate how AI can enhance business efficiency on a large scale, making it a worthwhile investment.

Exploring this shift's dynamics, the Accenture survey of 100 AI strategies within wealth management businesses reveals that most see a significant opportunity to adopt AI in the coming years. However, a considerable roadblock emerges, as approximately 80% of wealth management companies struggle to progress beyond the proof of concept stage. Scaling proves to be a profound challenge at this juncture.

To truly harness AI and wealth management together to gain a competitive edge, businesses must accelerate their efforts, drawing inspiration from real-life success stories where wealth managers seamlessly transitioned from theory to execution, reaping the benefits of scalability.

Looking for a tech partner to drive your AI initiative for Wealth Management business? Get a consultation with our experts!