Digital Wallet

Payment services: Regional Limitations

Now, with modern technologies, any business can go global by accepting payments through digital wallets, websites, e-Commerce platforms, or other internet payment processing ways. There are many online payment methods with various features: from simple payments to buy now, pay later services. Previously we mentioned that they are fast, secure, and reliable.

Being a powerful tool for your business to grow, payment acceptance is also one of the biggest challenges to face because of different regional limitations. Besides many advantages, there are also challenges you need to consider.

In this article, we will pay attention to some regional limitations worldwide.

Table of contents:

- How does Online Payment Processing Work?

- What types of payments are processed?

- General Payment Services Limitations

- Payment Gateways Options and Limitations Worldwide

- Final Thoughts

How does online payment processing work?

Before choosing and creating a solution for your online business, you must understand the industry and principles in many aspects. So let's find out how online payment processing work.

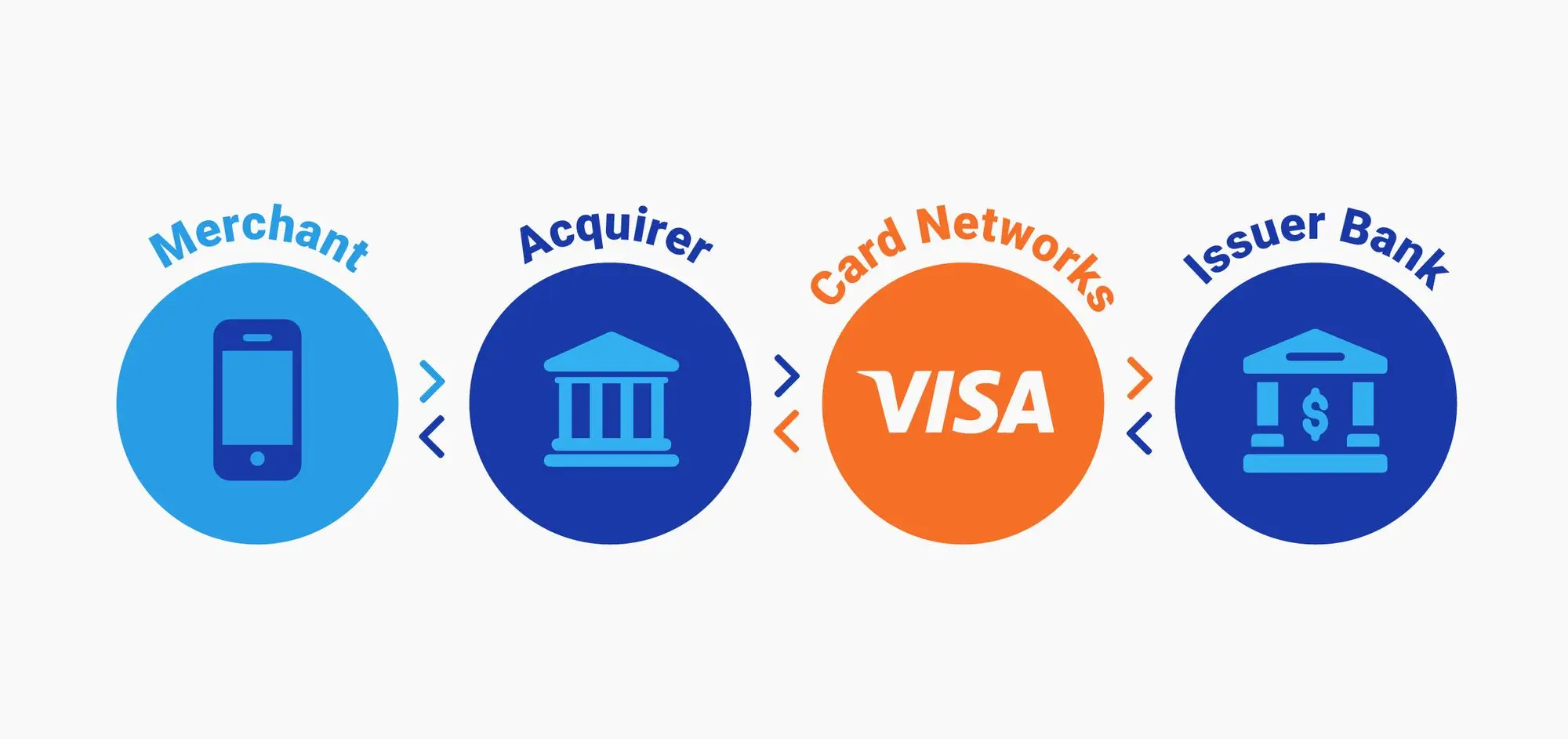

It is necessary to begin with the main players of this process. Typically, the payment chain includes four main parties:

In our article "How To Develop A Payment Gateway: Your Hands-On Guide," we defined those essential terms and uncovered some critical components of payment gateways.

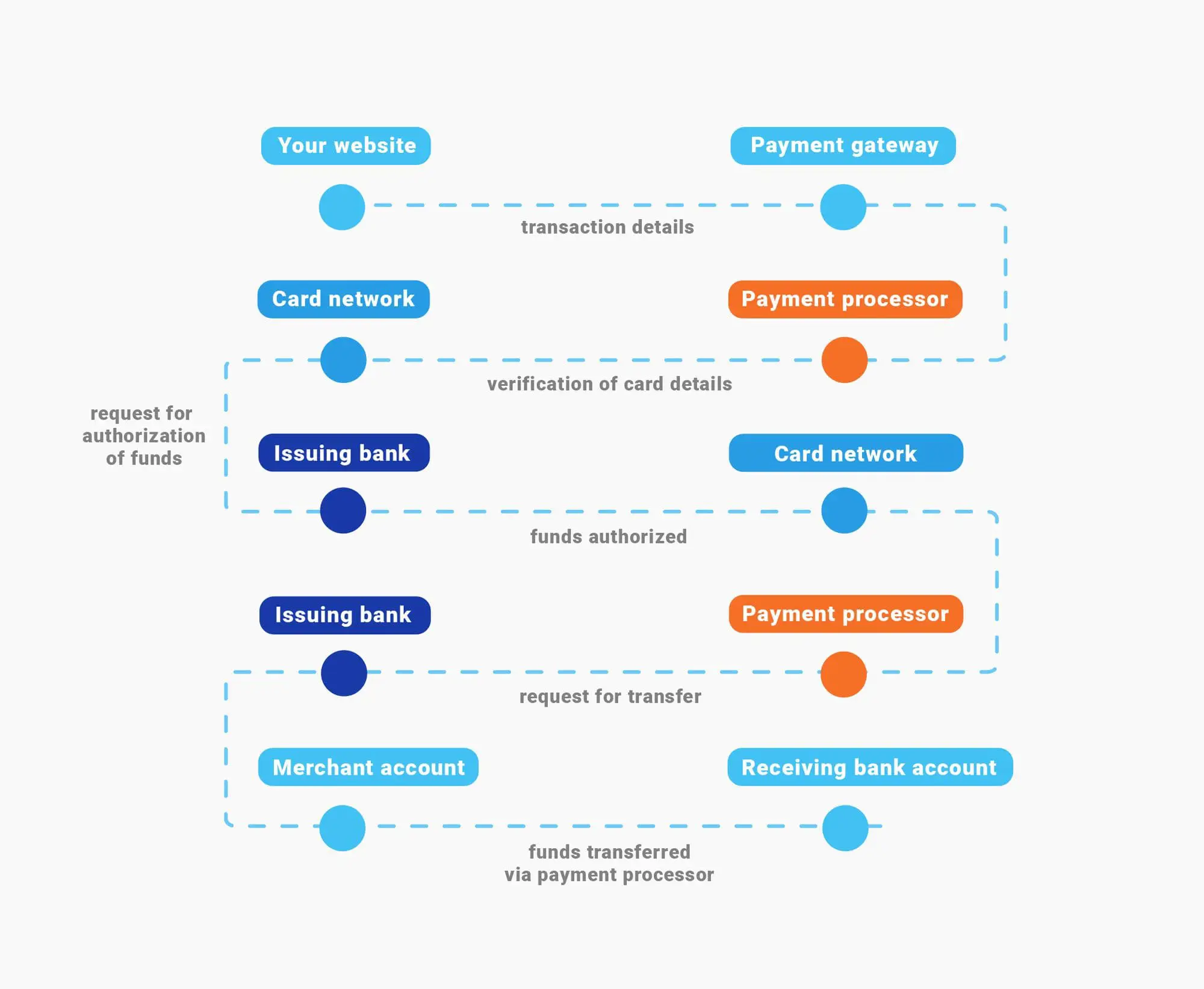

So, from the customer's perspective, online payment processing looks really simple and seamless. Indeed, from the technical side, there are many interesting aspects:

So, how does it actually work?

The client сhooses goods and selects payment method at checkout.

- The merchant submits a transaction.

- The payment gateway sends the transaction to the payment processor. The transaction is encrypted and secure.

- The payment processor verifies the transaction.

- The sale is authorized.

- The customer's bank sends the funds to the payment processor.

- The processor sends funds to the merchant's bank.

- The payment processor sends the transaction status to the payment gateway: approved or denied.

- The merchant receives the message about the status.

- The merchant receives money for the goods that were sold.

What types of payments are processed?

After understanding the main principles of online payment processing, we need to understand what payment options are available. Here are the main types of payments that are processed:

- Debit and Credit Cards: Debit card payments allow taking money out of the client's checking account immediately, and credit cards enable customers to borrow money from their bank. With credit cards, customers can pay the balance fully each month or pay the money back with interest.

- E-wallets allow customers to store money and pay for goods electronically using a phone, smartwatch, or other devices. Basically, digital wallets allow making transactions and securely by encrypting the sensitive data of your clients. The most popular examples of e-wallets are Apple Wallet, Google Pay, PayPal One Touch, Amazon Pay, and Samsung Pay. In our article “Step-by-step guide for digital wallet app development,” we explained in detail how e-wallets work.

- Bank Transfers directly transfer funds from one bank account into another.

- QR Codes and UPI: QR code payment is an excellent alternative to doing electronic funds transfers using a payment terminal. This is a contactless payment method that assumes scanning a QR code with a camera on a mobile phone. It is important for QR codes to accept all UPI (instant real-time payment system) applications to make the transaction smooth.

- BNPL (Buy now, pay later) allows clients to make purchases and pay for them later. Usually, this process is interest-free, that’s why it has gained popularity over the last few years. Examples: Afterpay and Klarna.

General payment services limitations

Despite many advantages of the payment services, there are some challenges you should keep in mind:

- Security of information is a key issue: many payment systems have security vulnerabilities if they are implemented not properly or do not comply with the regulations and requirements.

- They do not disclose the structure of the fees they charge: there are 2 categories of merchant processing fees:

- wholesale fees – interchange rates set by issuing banks and credit card companies (they are consistent regardless of the payment gateway type).

- markups – how the processor and payment service make a profit from your business.

Many payment systems make it nearly impossible for you to know how much markups you pay by using them.

3. Merchants can be mistreated during disputes and chargebacks in some payment systems. Moreover, they can impose a fee when chargebacks occur: a dispute for a certain online transaction raised by the purchaser who apprises the bank that has issued the card.

4. International shoppers may not have a payment option because of regional limitations.

Payment Gateways Options and Limitations Worldwide

There are many aspects that impact whether the payment option is available in a certain country or not. For example, such factors can be a failure of the payment service to comply with the country’s tax law, insufficient regulation, and security in a country's banking system. Here we identified payment options in different countries and their limitations.

Payment Services in the USA

There are many types of payment options in the USA, but these are the most widely used:

- Debit cards;

- Credit cards;

- Cash;

- Mobile payments;

- Electronic bank transfers;

- Checks.

Let's talk about a specific aspect of American payment methods – checks. Essentially, they are paper forms that the buyer fills and then gives to the seller. After this, the seller provides the check to the bank. Bank processes the transaction, and money is taken from the buyer's account in a few days.

With the popularity of other fast payment methods, checks are not popular anymore. Moreover, checks are rarely used or not used in other countries.

What are the payment gateways limitations in the USA? Actually, there are no specific limitations here: many functions and features work correctly.

Payment Services in India

Here are the most commonly used payment methods in India:

- Credit and debit cards;

- Mobile contactless payments;

- Cash;

- Bank transfers;

- Cash on Delivery;

- Direct Debit;

- Unified Payment Interface (UPI);

Talking about payment gateway limitations in India, there are rather limitations in certain apps than in features. For example, PayPal has closed domestic payment transactions in India, and now it serves businesses only for cross-border transactions.

Also, Apple Pay is not available in India. Apple has stopped accepting payments via debit and credit cards in India for subscriptions on the App store or other Apple services because of the Reserve Bank of India's (RBI) guidelines on data storage.

Payment Services in Eastern Europe

Here’s Europe’s choice of payment method when buying online, according to eCommerce news:

It is important to mention payment options limitations in some European countries. For example, in 2016, PayPal stopped its operations in Turkey because of a policy that required IT systems to be housed within the country. PayPal couldn't obtain the license. Now, customers cannot subscribe to My Private Network nor auto-renew their subscriptions with a Turkish PayPal account.

Payment Services in Western Europe

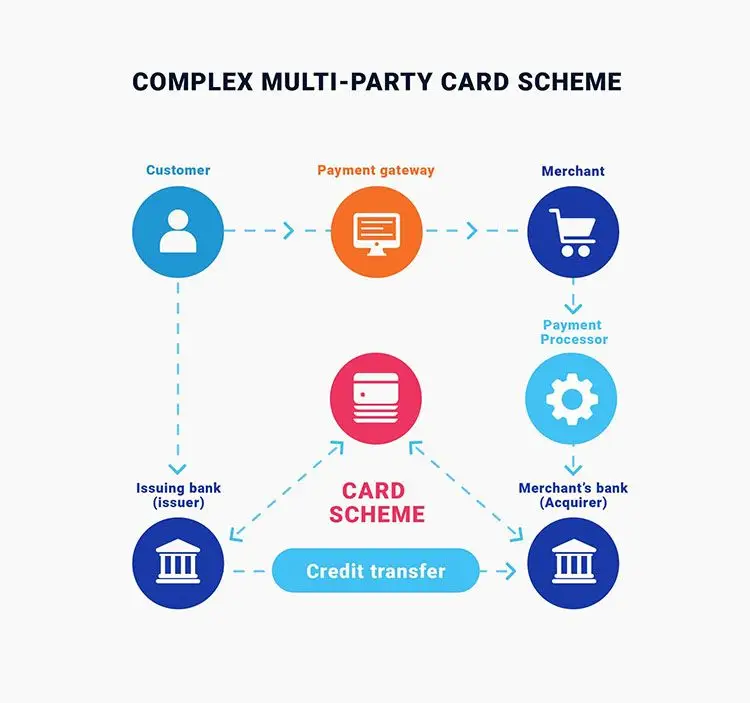

There are some limitations to payment gateways in Western Europe. For instance, the main issue in the United Kingdom surrounding card payments is multi-party card schemes in the payment gateways. Essentially, there are seven parties involved in every transaction processing:

- The customer

- The payment gateway

- The card scheme

- The payment processor

- The merchant's bank

- The merchant itself

- The customer's bank

In the picture below, you can see this scheme:

Such complexity leads to fraud and dispute management difficulties and adds costs to processing card payments.

Payment Services in Asia

The Asian market offers a wide range of payment options:

- E-Wallets (which are the most popular payment system in the region).

- Cash.

- Credit and debit cards.

- Bank transfers.

- Cash-on-delivery.

Statistica assures that Digital wallets are the most used payment method for e-commerce and point-of-sale (POS) payments across this region. Also, there is a forecast that digital wallet payments will amount to three-quarters of e-commerce payment methods and over half of POS payments in Asia by 2025.

Talking about payment limitations in Asia, we can mention that Stripe is unavailable in the majority of Middle Eastern and Asian countries.

Also, Apple Pay is not available in some Asian regions. For example, you can not use it in Thailand. However, merchants can accept Apple Pay from eligible international customers.

Final Thoughts

Any business that wants to go global and implement payment services must understand how online payment processing works, what types of payments are processed, and what limitations can bring the payment services generally and in different countries. Once you realize all the essential aspects, you have a holistic approach to finding a suitable solution for your business.

If you are interested in creating a custom payment gateway or need any guidance – contact our team!