FinTech

The Growth of Embedded Finance: Transforming the Travel Industry

As more and more businesses look to diversify their revenue streams and meet the demand for personalized customer experiences, embedded finance has emerged as a key driver of innovation in the sector.

In this article, we explore the factors contributing to the explosive growth of embedded finance in the travel industry, and its role in driving value creation for businesses and consumers alike.

Unlocking New Possibilities: How Embedded Finance is Reshaping the Travel Sector

Embedded finance is, at its core, a way to offer financial services and products within non-financial applications. In the travel industry, this means travel providers can now offer their customers a wide range of financial services that are embedded within their travel experience. This includes:

- in-app travel insurance;

- personalized financing plans for travel bookings;

- and other services that enhance convenience while traveling.

Embedded finance is set to transform the finance industry in a big way and is expected to drive $230 billion in revenue growth by 2025. This presents an excellent opportunity for businesses in the travel industry to tap into the growing demand for financial services that are seamlessly integrated into their travel experience.

Moreover, the use of embedded finance contributes to a more significant shift within the finance industry towards a platform-based approach, which has been identified as a fundamental trend by McKinsey & Company.

Businesses that fail to embrace embedded finance are at risk of being left behind in a rapidly evolving industry. On the other side, by offering financial services integrated into customer travel experiences, travel providers can establish stronger relationships with their customers and differentiate themselves from their competitors.

Click to learn major embedded finance trends 2023 and how embedded finance revolutionizes financial services.

Personalized & Seamless Customer Experiences

The rapid growth of embedded finance in the travel industry can also be attributed to the rising demand for personalized and seamless customer experiences, the increase in digital platforms, and the growing need for businesses to diversify their revenue streams.

Today's travelers demand flexibility and convenience when it comes to financial transactions. By incorporating embedded finance services into their platforms, travel businesses can offer customers the ability to book reservations, pay for services, and obtain financing without having to leave the platform. This streamlined experience offers greater flexibility and convenience to the customer.

Embedded finance is also helping to foster greater financial inclusivity within the travel industry. By offering point-of-sale loans on travel bookings, businesses can enable travelers who may not have the immediate financial resources to book their trips to still enjoy their travel experiences. This has the potential to make travel experiences more accessible and affordable for everyone, regardless of their financial circumstances.

With embedded finance services making a significant impact across multiple industries, the future looks bright for businesses that incorporate this new approach to finance into their travel services.

The Rise of Digital Platforms

The widespread adoption of digital platforms, such as mobile apps and online booking websites, has played a significant role in the growth of embedded finance in the travel industry. These platforms provide businesses with a powerful channel to engage with their customers and offer a wide range of financial services.

Furthermore, digital platforms enable businesses to leverage advanced technologies, such as artificial intelligence (AI) and machine learning, to analyze customer data and offer personalized financial services. For example, a travel booking platform might use AI algorithms to analyze a customer's booking history and offer tailored insurance products or credit options based on their risk profile and preferences.

Diversifying Revenue Streams

Embedded finance offers businesses in the travel industry an opportunity to diversify their revenue streams and reduce their reliance on traditional sources of income, such as commissions and advertising fees. By integrating financial services into their platforms, businesses can generate additional revenue through fees, interest, and other financial charges.

Moreover, embedded finance can help businesses in the travel industry create more sustainable and resilient business models, as they can benefit from the recurring revenue generated by financial products and services. This is particularly important in an industry that is characterized by seasonality and fluctuating demand.

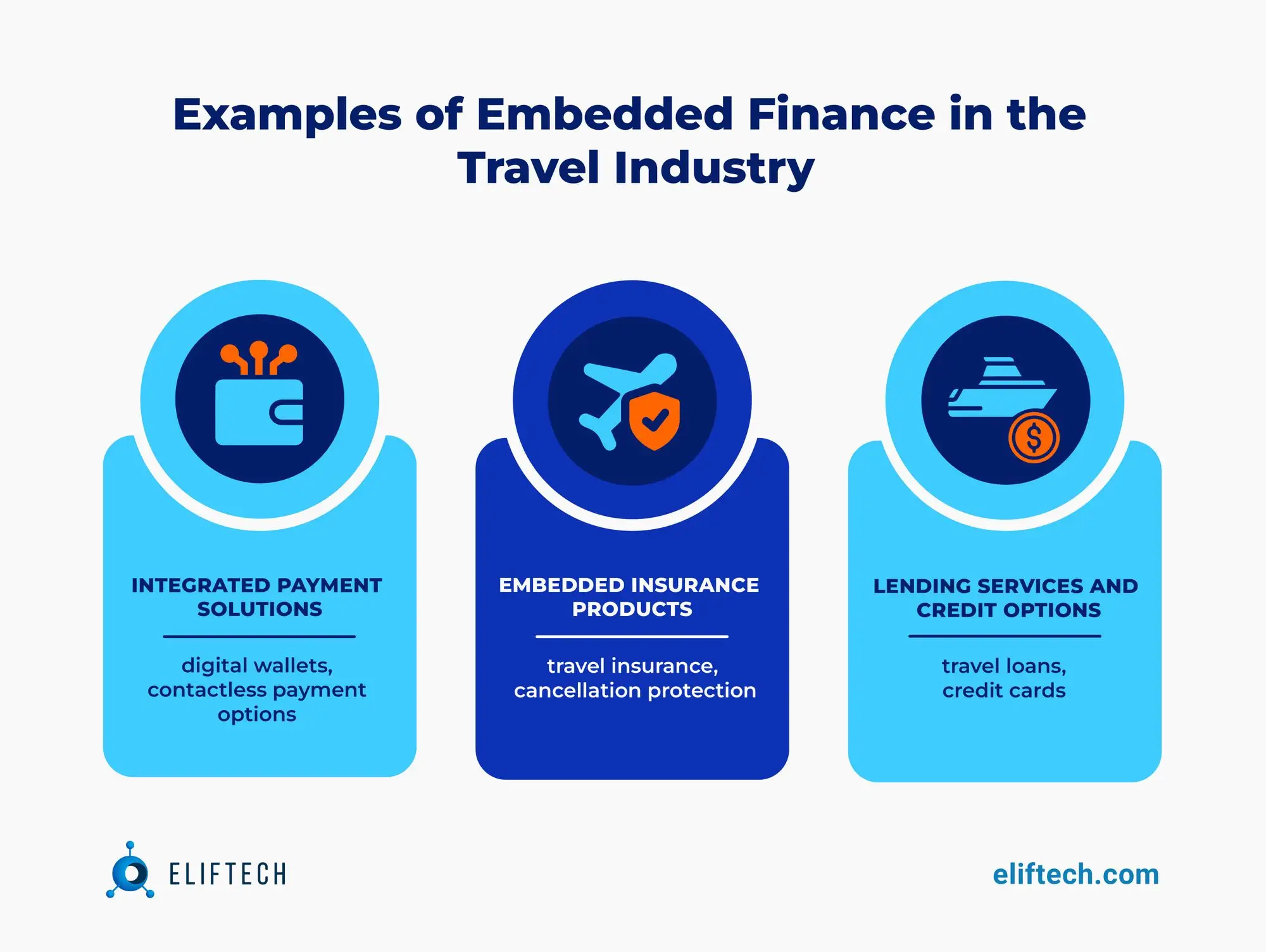

Examples of Embedded Finance in the Travel Industry

There are several examples of embedded finance in the travel industry, ranging from integrated payment solutions to insurance products and lending services. These examples demonstrate the potential of embedded finance to create value for both businesses and consumers in the travel sector.

Integrated Payment Solutions

Integrated payment solutions, such as digital wallets and contactless payment options, are becoming increasingly popular in the travel industry. These solutions enable businesses to offer their customers a seamless and frictionless payment experience, simplifying the booking process and reducing the risk of abandoned transactions.

For example, a hotel booking platform might integrate a digital wallet, such as Apple Pay or Google Pay, into its mobile app, allowing customers to make payments using their smartphones. This not only improves the customer experience but also helps businesses streamline their payment processing and reduce transaction costs.

Embedded Insurance Products

Embedded insurance products, such as travel insurance and cancellation protection, are another example of embedded finance in the travel industry. By offering these products directly within their platforms, businesses can provide added value and convenience for their customers and generate additional revenue.

For instance, an airline might offer customers the option to purchase travel insurance during the flight booking process. This not only simplifies the insurance purchasing process for customers but also enables the airline to earn a commission on the sale of the insurance product.

Lending Services and Credit Options

Embedded lending services and credit options, such as travel loans and credit cards, are becoming increasingly popular in the travel industry. These services enable businesses to offer flexible financing options for their customers, making it easier for them to afford their travel expenses.

For example, a travel booking platform might partner with a financial institution to offer customers the option to apply for a travel loan during the booking process. By providing this service directly within their platform, the travel booking platform can enhance the customer experience and generate additional revenue through interest and fees.

Challenges and Opportunities in Embedded Finance for the Travel Industry

While embedded finance offers significant benefits for businesses in the travel industry, there are also challenges that must be overcome to fully capitalize on these opportunities.

Regulatory Compliance

One of the primary challenges associated with embedded finance in the travel industry is regulatory compliance. Businesses that offer financial services, such as lending and insurance, are subject to a wide range of regulations, such as anti-money laundering (AML) and know-your-customer (KYC) requirements.

To overcome this challenge, businesses in the travel industry must invest in robust compliance systems and processes, as well as partner with reputable financial institutions and service providers. This helps businesses mitigate the risk of regulatory fines and penalties but also helps maintain customer trust and loyalty.

Data Security and Privacy

Data security and privacy are critical concerns for businesses in the travel industry, particularly when it comes to embedded finance. To protect their customers' data and maintain their trust, businesses must invest in advanced security measures, such as encryption, tokenization, and secure authentication methods.

Furthermore, businesses must comply with various data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States. This requires businesses to implement strict data protection policies and procedures and obtain explicit consent from customers before processing their personal data.

Integration and Interoperability

The integration of financial services into non-financial platforms can be complex and challenging, particularly when it comes to ensuring interoperability between various systems and devices. To overcome this challenge, businesses in the travel industry should consider adopting open banking and application programming interface (API) technologies, which can facilitate seamless integration and data exchange between different platforms and services.

Innovating Embedded Finance with ElifTech

Embedded finance plays an important role in the travel industry by significantly benefiting both businesses and consumers. To capitalize on these opportunities, businesses in the travel industry must prioritize innovation, invest in advanced technologies, and overcome the challenges associated with regulatory compliance, data security, and integration.

ElifTech has extensive experience in developing embedded finance solutions for the travel industry, including:

- payment gateways;

- digital wallets;

- lending platforms;

- insurance systems, and more.

We know how to work with advanced technologies like blockchain, AI, and big data analytics, while integrating these technologies into financial platforms for better customer experience and satisfaction.

If you're looking for a reliable partner to help you develop embedded finance solutions in the travel industry, ElifTech's expertise and experience make them an ideal choice.

Give us a note on your project and we’ll give you a solution!