Digital Wallet

Best practices to integrate payment gateway into your business

Nowadays, payment gateway integration in websites has become necessary because of the popularity of different online payment methods. Every day the demands of your users are growing, and safety should be your priority.

ElifTEch team wants to help you find a secure solution for your business, so today, we will guide you through the essential points of payment gateway integration.

Table of contents:

- Why should you integrate a payment gateway?

1.1 Main methods of payment gateway integration

- How to choose the right payment gateway provider?

- Is it worth creating a payment gateway from scratch?

- How to build a secure custom payment gateway?

- Final thoughts

Why should you integrate a payment gateway?

Nowadays, offering a variety of ways to pay for the desired items is a must-have for any business, especially for those whose primary audience is purchasing goods and items online. For your already sophisticated users with high demands, the availability of preferable payment methods can often become a crucial factor while shopping. Many users abandon their carts when they can not find a preferred payment option.

Moreover, Baymard Institute research says that nearly 20% of clients abandon their shopping carts if they don't trust the security system. To minimize such risk, ensure that you have an SSL certificate and become PCI DSS compliant. We will talk more about it later.

And now, let's take a look at how the payment processing on the website work. So, previously, in our article "How To Develop A Payment Gateway: Your Hands-On Guide," we broadly explained the payment processing flow, defined essential terms, and Uncovered the critical components of a Payment Gateway. For a brief understanding of this complex process, take a glance at the picture below:

Main methods of payment gateway integration

There are many methods of integrating payment gateways into your website. And here, we will look through the most popular and effective ones, the principles of their work, and the pros and cons of each payment gateway integration type:

- Hosted Payment Gateway - This is a payment solution that takes the burden of processing transactions from your merchant account and places it into the hands of a third-party checkout system. This process works by the following principle:

- It brings the customer to a payment page (this page is hosted externally and still belongs to the gateway)

- After confirming the transaction, the customer returns to the web store.

- The checkout process is completed.

Hosted payment gateway integration has many advantages: security, simplicity, and customization. Also, you don’t have to worry about PCI compliance and fraud protection – it’s held by this payment solution.

Obviously, such an option has some disadvantages: limited branding options, no control over user experience, and, thus, redirection to an external site, which cannot be really comfortable for users.

- Direct Post Method – This type of payment gateway integration accepts the data of your clients posted directly from a form on your website. Actually, the data are sent to the secure payment gateway that handles the transaction. This means that the data of your customers is not handled on your website. Keep in mind that the main disadvantage of this method is that the transaction is not completely secure and could be compromised. But do not forget the advantages of such a system: you do not need a PCI-compliant website, and also, this method can be a great tool for improving the branding of your business in a transaction workflow.

- Non-hosted Method (Integrated Method) - These payment gateways are smoothly integrated into your website; they are completely customizable and allow you to have control of many things on your website. They work by the following principle:

- The payment data are collected directly on your website.

- This data is sent through HTTPS queries to process the payment (or by using APIs).

For these reasons, they allow you to provide a better user experience by keeping the user at your store or platform without redirections for completing transactions. Sounds perfect, right?

In fact, it is important to understand the disadvantages of each payment gateway integration method.

So, the main drawback of non-hosted payment gateways is that your company will have to handle the security. As we know, security is a really crucial aspect of any system, especially when this system is related to collecting, storing, and processing sensitive biometrical and payment data.

Basically, these gateways work on your server, and, as we discussed earlier, they store sensitive payment data of your clients. Therefore, the burden of provision fraud protection, secure cardholder information storage, and PCI compliance lies on you.

How to choose the right payment gateway provider?

Now that you are familiar with the main integration methods, let's see the determining criteria and key aspects for choosing the right payment gateway provider:

- The price

- Transaction limits for different providers

- The merchant account options

- Mobile payments

- Is your product type permitted by the chosen provider?

- Does the gateway support the necessary payment options?

These are basic and very general factors to consider while choosing a payment gateway provider, and, of course, many other questions can arise depending on your business needs and specifics. In any case, you need to determine the most critical factors for you, and on the basis of them, you should compare different providers to choose one that fits your requirements the best.

Is it worth creating a custom payment gateway from scratch?

After we covered the main methods of payment gateway integration, the question arises: is it worth creating a custom payment gateway from scratch? Well, it depends on many factors, such as the size of your business, its needs, and the budget.

Creating a custom payment gateway solution is an excellent way to completely control your website. With this powerful tool, you can modify and add new features and control security measures. But keep in mind that this process is time-consuming and definitely not effortless. You may think that it can be costly to develop a payment gateway. In fact, it depends on many factors, especially the country where the development team is based. If you choose a Ukrainian software development company– you can save up to 50% of the money for the same product quality just because the hourly rate of our professionals is lower than it is in the US, Canada, or Eastern Europe.

On top of that, adding a custom payment gateway to your business can help meet many business-specific requirements and goals. For example, it will help to cut the costs of recurring fees that external payment gateways always charge. Moreover, you can earn money on your payment gateway by charging money to other sellers that use its gateway, which basically will make your business a payment provider.

How to build a secure custom payment gateway?

As you understand, security should be a main priority for the custom payment gateway. In case of security is poorly performed, your client's sensitive data can leak and cause many problems for them and your company.

Also, online payment gateways have become a tool for fraudulent activity gaining popularity. In order to minimize such risks, ensure that the following things are implemented during the custom payment gateway development process.

Contracts with banks

Contracting with banks that will act as payment processors is a crucial moment. The banks will handle the actual processing for you. Keep in mind that different banks have different terms of the contract, obligations, and fees: they can provide you with varying rates for currency exchange and transaction fees for international transfers, etc.

Become PCI DSS compliant

Payment Card Industry Data Security Standards (PCI DSS) is a set of rules and requirements applicable to any business that stores, processes, or transmits cardholder data and/or sensitive authentication data. Those standards offer secure payment solutions and consist of three main parts: handling card data, secure data storage, and annual validation. Being PCI DSS compliant is a must for any custom payment gateways as this is an excellent and structured way to ensure security and trust to your clients.

Do not forget to be compliant with national privacy legislation

Now might every country has its privacy act (GDPR in the EU and CCPA and other legislation in the USA). Those acts aim at protecting both parties of the payment process: you and your client.

Develop an API

One of the most important aspects of payment gateways is APIs. You should develop an API for your gateway with the right documentation, as it is required by PCI DSS compliance.

Find a tokenization solution

Tokenisation is basically the process of issuing a temporary code or token to conceal sensitive data. It allows for protecting your users and your payment gateway from a data breach and many other issues.

It is important to keep in mind that when customers pay the order, they may have some concerns about giving access to their credit or debit card numbers and CVV codes. It is quite understandable because if this information could get into the wrong hands, the consequences could be inevitable. Tokenization creates an undecipherable, irreversible, and non-sensitive equivalent to entered data, while original sensitive data is stored in a secure token vault. If you use tokenization in your custom payment gateway, your users can stop worrying that their data can be stolen.

Integrate additional payment methods

Your users prefer different payment methods. Moreover, there are many limitations to payment options in different countries. It means that even if the consumers want to pay for goods and services they choose, they just can't do it because your payment gateway does not provide them with payment methods available in their countries or payment options they prefer. Thus, do not forget to include additional payment methods (for example, PayPal, Stripe, crypto-wallets, e-wallets, etc.) in your gateway by integrating them separately with their APIs.

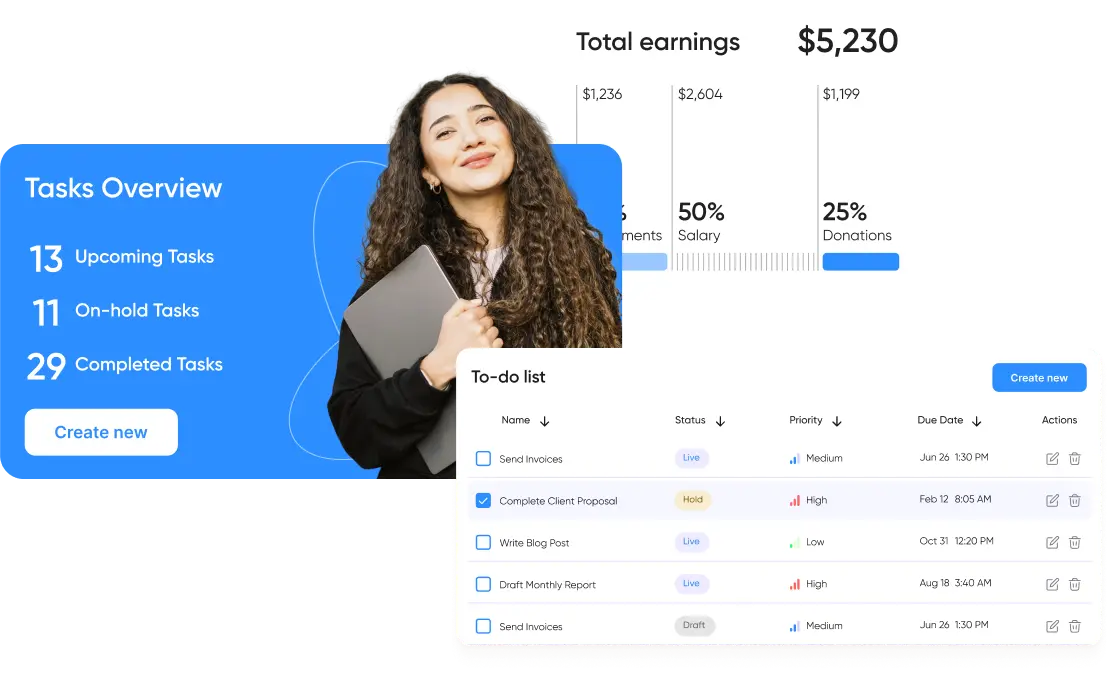

Develop management tools

In order to make the interaction process simple and enjoyable, we can help you to develop an admin panel in order to control and help customers with financial operations.

Final thoughts

Implementing unsuitable or unsafe payment gateway systems can turn off your clients. So, before integrating a payment gateway into your website or developing it from scratch, you need to understand how to choose the right payment gateway provider, whether it is worth creating a custom payment gateway solution, and how to build a secure custom system from scratch.

If you want to develop a custom payment gateway or need guidance on that matter – contact our dedicated team, and we will help you create the right solution for your business.

Browse our case studies and get actionable insights to drive your success

See more