FinTech

Frictionless Payments: Why Should We Redefine Payment Solutions in the Travel Industry?

As our world becomes increasingly digital and interconnected, the travel industry is also evolving to meet the changing needs of its customers. For the last few years, it has undergone a significant digital transformation, with travel payments being a major area of focus.

The key driver of such digital transformation in travel industry is the rise of digital travel sales:

“The market size of the online travel industry worldwide was expected to increase in 2023 over the previous year. As estimated, the global online market size totaled approximately 475 billion U.S. dollars in 2022. This figure was forecast to surpass 521 billion U.S. dollars in 2023 and rise to over one trillion U.S. dollars by 2030.”

To meet evolving customer expectations, travel businesses must adapt to these changes by offering next-gen payment solutions particularly frictionless payments.

Implementing digital wallets, contactless payments, and mobile payment solutions enhances the customer journey, streamlines payment processes, and reduces costs. It allows the travel industry to seize opportunities in the digital age and ensure sustainable success.

Frictionless Payments as Next-Gen Technology in the Travel Industry

Frictionless payments refer to payment solutions that streamline and simplify the transaction process, making it easy and efficient for customers to complete their purchases.

These payment methods often leverage advanced technologies, such as contactless payments, digital wallets, and mobile apps, to offer a seamless and secure payment experience that requires minimal effort from the customer.

The primary goal of frictionless payments is to remove any barriers or obstacles that might prevent customers from completing their transactions. Those would be:

- lengthy checkout processes;

- complicated payment interfaces;

- or the need to enter sensitive payment information manually.

The Evolution of Frictionless Payments in the Travel Industry

Frictionless payments have become essential in the travel industry, driven by the need for convenience, security, and personalization. As technology advances and customer preferences change, travel businesses must remain agile and innovate to meet the ever-changing customer demands.

The Rise of E-Commerce

The rapid growth of E-commerce is a major driver of frictionless payments in travel. As more customers turn to online platforms for bookings, businesses have no choice but to adjust their payment strategies to serve digital-savvy customers.

This has led to the development of various online payment solutions, such as credit card processing, digital wallets, and online banking. They provide seamless transactions and valuable insights for businesses to enhance their customer experience.

The Dominance of Smartphones and Mobile Devices

The widespread use of smartphones and mobile devices has also fueled frictionless payments in travel. Businesses kept investing in mobile-friendly payment solutions as soon as billions of people started to rely on smartphones for internet access and financial management.

According to Statista Mobility Market Insights, over two-thirds of the revenue in the global travel and tourism market now comes from online sales channels. In 2017, online sales accounted for approximately 60% of the income, but now, they are expected to make up 69% of the market's revenue worldwide in 2023.

Shifting towards online sales has driven the rise of mobile payments and the increasing popularity of mobile wallets like Apple Pay and Google Pay. They offer convenient and secure transactions, and extra features, such as loyalty programs and personalized offers, further enhancing the customer experience.

Read more: How Digital Wallet App Impact the Cruise Industry Growth in 2023

The Growing Demand for Personalized and Convenient Customer Experiences

As consumers become increasingly discerning and demanding, travel businesses have been forced to innovate and adapt their payment strategies to cater to the needs of these customers.

That’s why most frictionless payment solutions help businesses differentiate themselves and build long-term loyalty. Not only do they make it easy for customers to complete their transactions but also provide businesses with valuable data and insights.

Streamlining Operations and Reducing Costs

Digital payments will bring operational efficiency and cost reduction for travel businesses. Automated processes like invoicing and reconciliation save time and reduce administrative expenses. Additionally, advanced security features like tokenization and encryption in digital payments help prevent fraud and chargebacks, ensuring financial safety and maintaining customer trust.

Benefits of Frictionless Payments in the Travel Industry

Frictionless payments offer several benefits for businesses in the travel industry, including:

Global reach

Frictionless payments have a significant impact on the global reach of travel businesses. They offer a diverse range of payment options for consumers while simplifying transactions for businesses through built-in currency conversion features.

Customers can use their preferred methods, such as mobile payments and digital wallets. Frictionless payment solutions often include built-in currency conversion features, allowing customers to pay in their local currency while businesses receive the payment in their preferred currency. This simplifies transactions for both parties and eliminates the need for customers to calculate exchange rates manually.

Competitive advantage

Implementing frictionless payment technologies gives travel businesses a competitive edge by offering a superior customer experience. Streamlining the payment process improves customer satisfaction, loyalty, and conversion rates as well as helps reduce cart abandonment rates, ultimately leading to higher revenue.

Also, frictionless payment solutions enhance payment security with advanced technologies like biometric authentication and AI-driven fraud detection.

What’s more, it enables businesses to collect valuable data on customer preferences and behaviors for future marketing campaigns, and customized promos. That’s how travel businesses can cater to a broader audience, expand their market presence and gain a competitive edge in the global market.

Dynamic pricing

By implementing dynamic pricing, travel businesses can adapt their prices in response to real-time demand and market conditions. This pricing strategy offers several advantages that contribute to the overall success of the business:

- Optimized revenue: Adjusting prices based on demand helps maximize revenue and profitability by capitalizing on high-demand periods and avoiding losses during low-demand periods.

- Increased customer satisfaction: Offering competitive prices aligned with market conditions attracts more customers and enhances overall satisfaction, leading to repeat business.

- Better inventory management: Dynamic pricing helps manage inventory effectively by adjusting prices to encourage bookings during low-demand periods and prevent overbooking during high-demand periods.

- Data-driven decision-making: Collecting and analyzing customer behavior and market data enables informed decisions on pricing strategies, marketing campaigns, and business operations.

- Personalized pricing: Utilizing advanced analytics and customer data allows businesses to offer customized pricing based on individual preferences, leading to higher customer satisfaction and loyalty.

Enhanced customer experience

By simplifying and streamlining the payment process, businesses can provide customers with seamless, convenient, and secure transactions, resulting in higher satisfaction and loyalty.

Frictionless payments save time and effort for customers by offering options like contactless cards, mobile payments, and digital wallets. This eliminates the need to fill out lengthy forms or repeatedly input payment information, which makes the payment experience more efficient and enjoyable. Such convenience fosters a positive overall experience and encourages customers to choose the business for their future travel needs.

Furthermore, frictionless payments prioritize security by incorporating advanced features like biometric authentication and AI-driven fraud detection. The trust and credibility established through a secure payment experience further enhance the overall customer experience.

According to a 2022 study by Paysafe, consumer concern about falling victim to fraud increased by 59% compared to the previous year. Almost half of the respondents prioritize secure payments over convenient ones. Speaking about authentication methods, 45% said they trust passwords more than biometric authentication methods (an 8% uptick over 2021).

Examples of Frictionless Payments in the Travel Industry

There are several examples of frictionless payments being implemented in the travel industry, including:

Contactless payments

Regarding contactless payments in the hospitality industry, users prefer making payments with contactless credit cards and mobile wallets. With a simple tap of their card or smartphone on a contactless payment terminal, customers can complete transactions without swiping, inserting a card, or entering a PIN or signature. This convenience extends to public transportation systems, where travelers can easily pay for fares without physical tickets or tokens.

Digital wallets

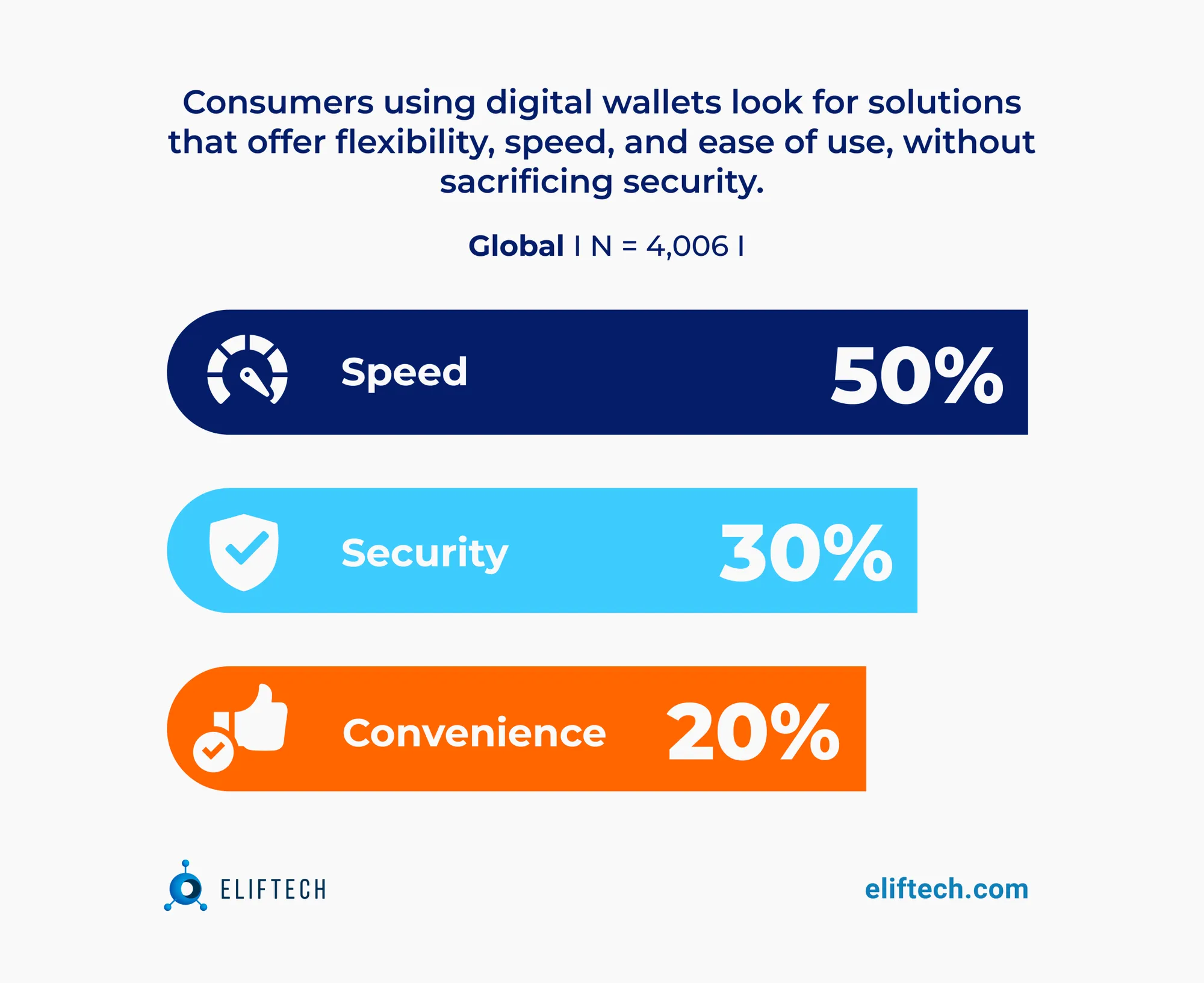

Leading digital wallets like Apple Pay, Google Pay, and Samsung Pay allow customers to store their payment information on their smartphones and make secure transactions using their mobile devices.

By integrating digital wallet solutions, travel businesses offer customers a seamless and protected payment experience. For instance, a hotel booking platform may integrate Apple Pay into its mobile app, enabling customers to pay with their iPhones or Apple Watches, which streamlines the payment process and reduces costs.

In-app payments

In-app payments allow customers to complete transactions directly within a mobile app, eliminating the need to exit the app or manually enter payment details.

By providing in-app payment options, travel businesses create a frictionless experience and increase the likelihood of completed transactions and repeat business. An example is the ride-hailing service Uber, where customers can conveniently pay within the app without the need to carry cash or physical payment cards. This helps the company streamline its nextgen payment processing and reduce transaction costs.

The Future of Frictionless Payments in the Travel Industry

The travel industry continues to evolve and adapt to changing needs and preferences. This means we will also see the continued growth and development of frictionless payment solutions.

“Apart from trivial trends like the adoption of contactless payments, we also see an increasing demand for flexibility of nextgen payment systems and automation of refunds and chargebacks” – Andrew Oleksiyuk, CTO at ElifTech.

Some of the key trends and technologies that are likely to shape the future of frictionless payments include:

Cryptocurrency payments

With the growing popularity of cryptocurrencies like Bitcoin and Ethereum, more and more travel businesses are embracing the idea of accepting these digital currencies as a payment option. These methods provide such benefits as low transaction fees, fast processing times, enhanced security, and privacy.

For example, a hotel chain might accept cryptocurrency payments for room bookings allowing customers to pay for their stay using digital wallets. Accepting cryptocurrency payments can reduce payment processing costs for businesses. What’s more, it’s a great way to attract a new segment of cryptocurrency-savvy customers.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning technologies will have a big impact on analyzing customer data to provide personalized payment experiences. These advanced technologies can process a large amount of data, helping businesses better understand their customer's preferences, behaviors, and payment habits.

Furthermore, AI-powered chatbots can provide real-time support for payment queries, reducing customer service costs.

The Internet of Things (IoT) and Connected Devices

Connected devices like smartwatches and fitness trackers enable seamless payment experiences. Customers can store payment information on these devices, eliminating the need for physical cards or smartphones. For instance, a cruise ship may allow passengers to pay for onboard services using their smartwatches, which streamlines the payment processing for the travel industry and reduces transaction costs.

Summary

With the rise of E-commerce, the dominance of smartphones and mobile devices, and the growing demand for personalized experiences, frictionless payments have placed their special role in digital transformation.

They enable global reach, provide a competitive advantage, optimize revenue through dynamic pricing, enhance the customer experience, and streamline operations while reducing costs.

Travel technology providers like ElifTech play a crucial role in implementing frictionless payment solutions. Discover how to unlock new opportunities, enhance customer experiences, and drive business growth with nextgen payment solutions, such as digital wallets, and other mobile payment solutions with multiple travel payment gateways.