ML

How banks deploy AI to monitor customer relations

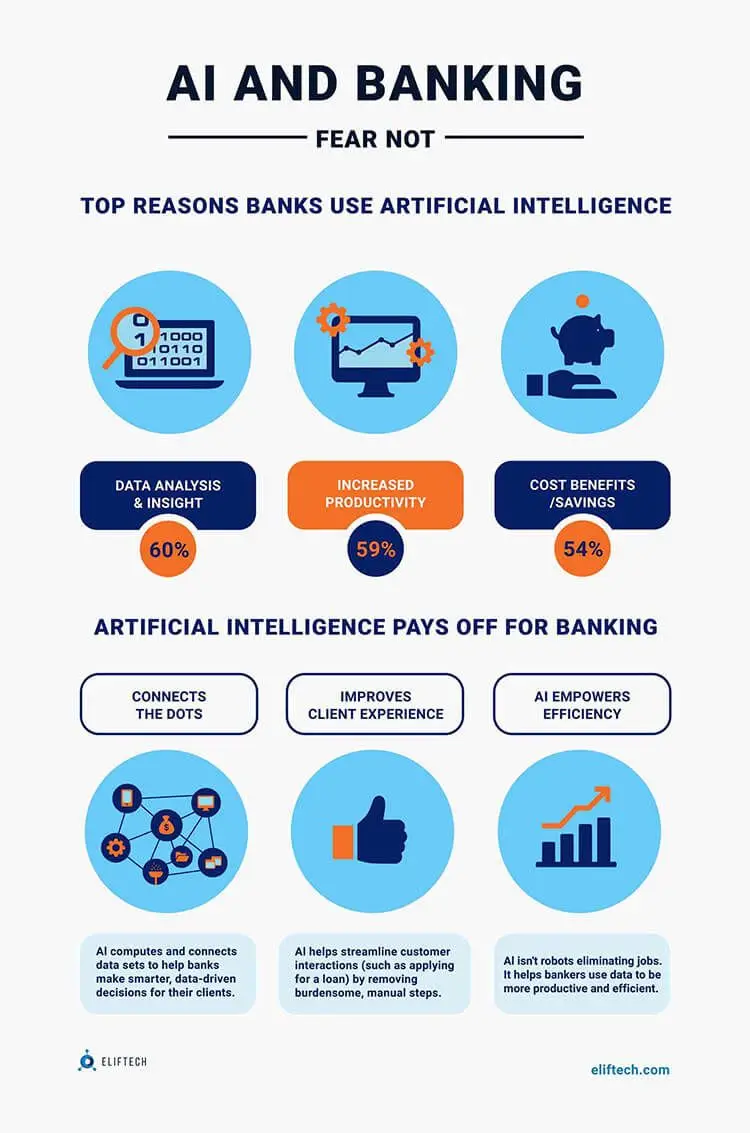

Artificial intelligence is an integral element of the digitalization of the economy. For banking, the application of artificial intelligence is a significant task. It affords better results: and allows internal processes to be faster, stronger, and cheaper, but it also makes for seamless and effortless services for the end user and gives a premise to completely human-centric banking. Understandably not all banks can deploy AI with such far-reaching plans because this requires radical changes in the management systems, risk evaluation, and investments.

How AI in banking customer services changes the industry by using NLP and “Spoken AI” to enhance the customer experience?

Proof that AI is the way for a bank to level up: Customer service use cases

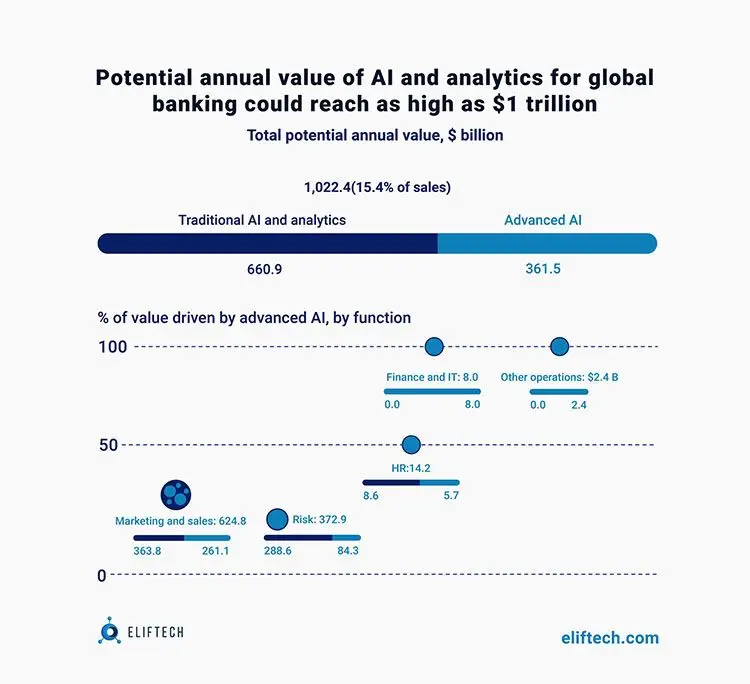

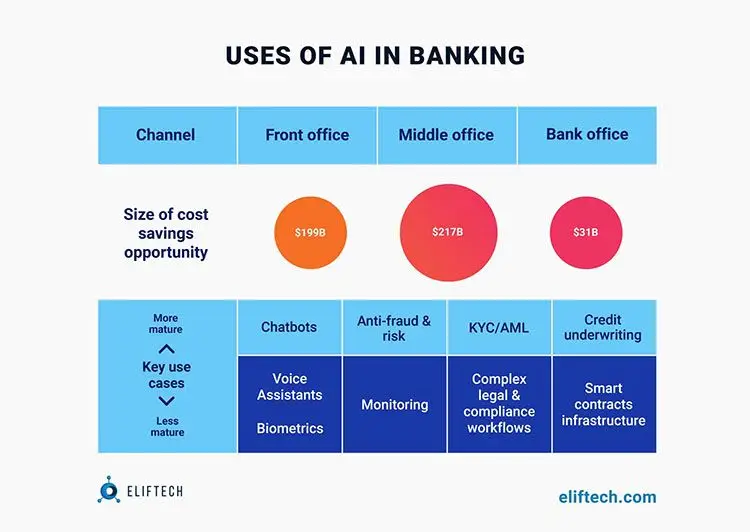

The financial sector is a platform where AI technologies help to solve many tasks. For example, thanks to AI in banking customer service systems, banks reduce the influence of the human factor on decision-making, analyze large volumes of data faster and more thoroughly, reduce costs and automate the process of communication with consumers. In addition, thanks to AI, clients of credit organizations receive better and more personalized services. In the picture below you can learn more about how artificial intelligence is used in banking.

The development of modern technologies has affected many areas of life. Globalization and digitalization remain among the key trends in world development. Inevitably, digital progress has also concerned the economic sphere since monetary transactions are carried out in the financial sector and related to storing, processing, and transmitting the information.

Communication and information technologies equip the financial sphere with technical progress tools, allowing you to use them in your activity. Information technologies provide advantages for operating large memory arrays, especially for banking institutions, insurance, and financial companies. Carrying out communications with clients, making management decisions, and automating basic operations without human factor influence allows for the implementation of artificial intelligence. The larger the information base, the more efficiently the artificial intelligence system works. Therefore, those financial institutions that postpone the process of implementing digital systems prone to the risk of lagging behind more knowledgeable competitors.

AI chatbots in banking customer service

Today, financial market participants increasingly use chatbots instead of traditional operators. Virtual assistants increase the quality of service and also help to reduce the costs of servicing call centers. Bots can answer various questions, discuss benefits, and connect with bank employees anytime. In addition, they can be used to transfer money from one account to another.

Security & Fight against fraud

Banks continue to fight against fraudsters illegally obtaining loans and tricking people into transferring money to their accounts. Artificial intelligence helps banks in this. AI in banking systems detects suspicious transactions and identifies customers who are more likely than others to fall into the trap of scammers. Also, AI in banking finds criminals thanks to biometric analysis. Yes, the bank offers consultations with the help of voice assistants: Google Assistant, Siri from Apple, and Alexa from Amazon. The technology is based on artificial intelligence. The bank collects data about customers and their transactions, and with the help of deep machine learning, it looks for patterns that will help identify unscrupulous customers, reduce the number of fraud cases and ensure cybersecurity.

Next-level AI Robo-advisors

As the long-term effects of Covid-19 force banks to (finally) shift their focus from customer acquisition to customer retention, artificial intelligence AI-based Robo-advisors are one of the most promising multi-functional bank solutions. In 2020, the AI robot advisors market was estimated at $17.17 billion; it will reach $102.29 billion by 2027. Also, with a projected CAGR of 34.75% from 2021 to 2026. Furthermore, according to Juniper Research, Robo-advisors will save banks up to $7.3 billion by 2023. For example, Bank of America's Erica AI Robo-advisors has helped more than 6 million users by 2019, handling 35 million inquiries — thanks to a personalized and proactive approach. So, let's consider the economic rationale for using AI-based banking Robo-advisors, their main functions, capabilities, application scenarios, and benefits for banks and customers.

Post-pandemic customer acquisition challenges

At the end of 2019, only 4% of mid-sized banks were using Robo-advisors, but in 2020 this figure increased to 13%. Such a jump was due to the pandemic — banks resorted to interacting with customers through self-service channels. The pandemic has provided an unprecedented impetus for digital banking transformation, yet 68% of executives, according to Financial Review, are seeing an exponential increase in customer engagement difficulties. Today, the customer acquisition cost (CAC) in banking is at an all-time high of $500. But often, a new client does not bring profit to the bank for two years. These problems are exacerbated by banks' rejection of the services of large technology companies that offer financial products. This forces banks to invest in improving the quality of customer service to increase their retention rate.

Reorientation on customer retention

Reducing customer churn implies minimizing the time it takes to respond to requests and find bank AI solutions, personalizing banking services, and creating a unified experience at all interaction points. There is also a constant need to optimize costs and improve employee efficiency. To achieve this, leading banks are completely overhauling their functionality to be AI-first. 81% of bank IT managers believe AI in banking customer service will clearly identify the winners and losers.

The paradox is that almost 81% of bank executives are concerned about the transformation's speed, complexity, and cost. Fortunately, combining Robo-advisors and AI gives financial institutions more opportunities to communicate with customers with greater reach and return on investment (ROI) than traditional Robo-advisors. Moreover, this tandem is a cost-effective way to join AI in banking customer service transformation, as AI Robo-advisors help achieve success in the short term across multiple lines and touchpoints.

Customer Experience is the Key! Everything Business does to make us happy

There is a vast number of practical applications of artificial intelligence in banking. For example, there are already a growing number of start-ups, such as Trussle and Habito, in the UK, which are looking to use machine learning algorithms to help customers find the best mortgage product on the market.

First-mover companies enjoy the greatest advantages and have a better chance of outperforming their competitors. Banks can now develop more products related to greater customer loyalty and lifetime value. At the same time, consumers can benefit from the convenience of working with a trusted organization that understands their individual needs. As AI in banking customer service decision-making tools proliferates, account managers can more accurately and consistently help clients with better personal finance products and services.

Account managers will also be able to analyze customer experience with banking services across existing channels. This will allow banks to determine how effectively their current processes are working, for example, whether there are any bottlenecks. They will then be able to model, and banks deploy AI process optimization across all their customer service channels and improve customer service.

Citibank has identified seamless interaction with the client as a priority area for using AI. For this purpose, the bank launched a new analytical platform that collects and processes customer data in real-time. With its help, Citibank can create relevant and timely personalized offers.

Personalization

The group has developed a comprehensive customer profile that shows their activity in real-time, for example, the frequency of use of applications or ATMs. API channels, artificial intelligence, and machine learning help the bank better understand customer behavior. This platform lets you see why the client calls the bank, improving service quality and shortening the conversation time. Citi uses AI in banking customer service at every level of the organization, enabling it to retain customers, cut unnecessary costs and increase revenue by understanding customer needs.

72% of banks consider personalization very important. Artificial intelligence chatbots personalize user experience, recognizing customer actions such as account registration, and automatically sending information about updates, transactions, cards, and services. This reduces paperwork, waiting for time, and calls to customer support.

Barriers and Limitations to AI in banking customer service adoption

Observing modern artificial intelligence systems, you can notice that despite their fantastic successes - as, for example, in the realm of chess, or the fact that a significant number of large companies operate chatbots that automate and speed up the processing of their clients' requests without the involvement of human operators - have important and fundamental limitations.

Here are some of them:

- Artificial intelligence systems successfully solve only a single type of problem - the one for which these systems were designed from the beginning;

- They can't "context switch," switching from one kind of task to another, as humans can.

- To perform their task, artificial intelligence systems need time to learn information about the "reference truth." A certain amount of reference data is required, on which the system is trained before being put into operation. And this applies even to state-of-the-art neural networks;

- At moments of significant changes in external conditions, when the input parameters for the artificial intelligence system cease to behave in the same way as observed at the time of its initial training, there is a need to temporarily remove the system from operation for re-training already under new conditions.

- All these limitations mentioned above hint at the existence of "demiurges" - those who determine the goals of artificial intelligence systems organize their training, form training data for them (the same "reference truth"), specify the rules and social norms for the use of artificial intelligence systems, and ultimately puts them into operation. That is, we are talking about people.

When banks deploy AI, the popularity of NLP in banking customer service, in particular, is expected to grow. Therefore, banks need to introduce this modern technology. Whenever banks deploy AI and use the proper implementation strategies so that customers can be satisfied, interested, and cooperation successful. This modern technology provides a wonderful and unique opportunity to understand customers better and deeper, meet their needs, and strengthen their team!

Looking for a tech partner to power your customer service efforts with AI? Contact our team for a consultation.