FinTech

Payment gateways security testing: your ultimate checklist

Online payment methods are gaining popularity, becoming a must-have feature for online stores. With the evolution of payment gateways, fraud trends are evolving, too. Thus, it's always better to prevent such things from happening than to face them. In this article, we will discuss how security testing can help online businesses minimize many risks effectively, the most common online payment fraud trends, and solutions to prevent them.

What is Payment Gateway in short?

First of all, let us tell you the basics of Payment Gateways. The most important thing to know about payment gateway development is that it's a must-have solution for online businesses that perform highly secure online transactions. Payment gateways can accept debit or credit cards, cryptocurrency, e-Wallets, and many other payment methods that make them universal and user-centered. The most popular examples of payment gateways are PayPal, Stripe, Apple Pay, and Amazon Pay.

In the picture below, you can see how payment gateways actually work:

Let's Define Some Essential Payment Gateway Terms

Before we start talking about the security of payment gateways, let's get familiar with the basic terms of it:

- Merchant – this is a person or a company that any items or services to their clients. In our case, merchants can act as payment portals that allow customers to pay with different payment methods. For example, Amazon and eBay are merchants.

- Payment Service Providers (PSPs) – are third-party companies that provide payment services to businesses with online payment methods: credit cards, debit cards, e-wallets, cash cards, bank transfers, etc. For example, the most popular PSPs are Amazon Pay, PayPal, Stripe, and Square. Different PSDs have diverse payment system architecture, including the organization of hardware, software, protocols, and processes involved in managing payments.

- Transaction – The process of transferring funds from one account to another. In our case, the merchant receives funds from a customer.

- Acquiring bank – this is a financial institution responsible for the merchant's bank account maintenance and enables the merchant to accept and process debit and credit card transactions.

- Issuing bank – this is a financial institution that issues the debit or credit card of merchant's clients. The issuing bank has the capability to approve or decline the transaction based on the cardholder account standing and passes that information to the Acquiring Bank.

- Authorization – the process of confirming the cardholder's validity, the ability to pay for goods, and the presence of sufficient funds by the client's issuing bank. After the confirmation, the money is withdrawn from the customer's card but is not yet transferred to the merchant account.

- Payment Methods – ways how the customers can pay for goods at merchants. For instance, consumers usually use credit and debit cards or e-wallets as payment methods.

- Payment Instrument – a physical or virtual material that allows making a transaction. It can be a check, credit card, e-money, etc.

What are the main functions of a payment gateway for your business?

When we understand what the payment gateways are and defined crucial terms of payment services, let's define their primary functions:

- they securely validate the customer's card details and capture the data;

- they ensure the funds are available and enable merchants to get paid;

- they act as an interface between a merchant's website and its acquirer;

- they ensure that information is securely passed from the client to the acquiring bank.

What is Payment Gateway Testing and Why Do We Need to Perform It?

So, briefly, payment gateway testing is a necessary process that enables you to ensure that the payment gateway implemented in your store's website is well-secured, reliable, and provides smooth and seamless transactions.

The reason we need to test it is pretty simple and may seem obvious: to prevent many risks and ensure that your online payment service is safe for transactions and works appropriately. The data people enter to complete a transaction is considered sensitive, so by testing the system, you can protect both: your clients and your company from data breaches or leaks, and of course, it will help to gain the trust of your clients.

It is worth mentioning that testing has not only a preventive role but also can be an excellent tool for your business's improvement. While reducing technical issues, the payment gateway becomes more user-centered and provides your clients with a smooth experience.

Security Testing for the Payment Gateway: Effective Ways How to do It

Security testing for the payment gateway can be performed in various ways. Keep in mind that there are many aspects to check during this process, and the transaction's security is not the only thing to inspect. For example, such factors can be data security, cross-border transaction efficiency, and fraudulent activity avoidance.

There are four ways that will help you to perform security testing for your payment gateway:

Functional Test

Functional Testing can become a great tool for new and less established payment gateways. It is the act of testing the base functionality of the payment gateway, for example, whether the application behaves the way it was designed to behave. This type of testing is not obligatory for more established payment systems.

Integration Test

This type of testing consists of checking your system's behavior after and during the integration with the gateway. Basically, you need to check whether your clients can place their orders, whether the money is received in the merchant's account and bank, and check if the transaction is void or refunded. This type of Testing requires a card to complete it. You don't have to enter the details of your own cards. You can use the cards that are designed specifically for testing purposes. For example, PayPal has created its own list of cards that can be used for testing.

Security Test

This aspect of Testing is crucial for any system because security failure can harm the integrity and customer loyalty of the business and bring many inevitable consequences to you and your customers. This method consists in checking that all the sensitive data is transmitted after encryption and that the gateway is secure to use.

Performance Test

Performance Testing is crucial for online payment services. Essentially, you need to check how your payment gateway works and respond when many users are completing transactions simultaneously.

Most Common Online Payment Fraud Trends and Solutions to Prevent Them

First, let’s define the payment fraud term. It is stealing payment information from another person and using it to complete transactions that were not authorized by the cardholder. While online payment methods are gaining more popularity, cybercriminal activity is obviously growing actively.

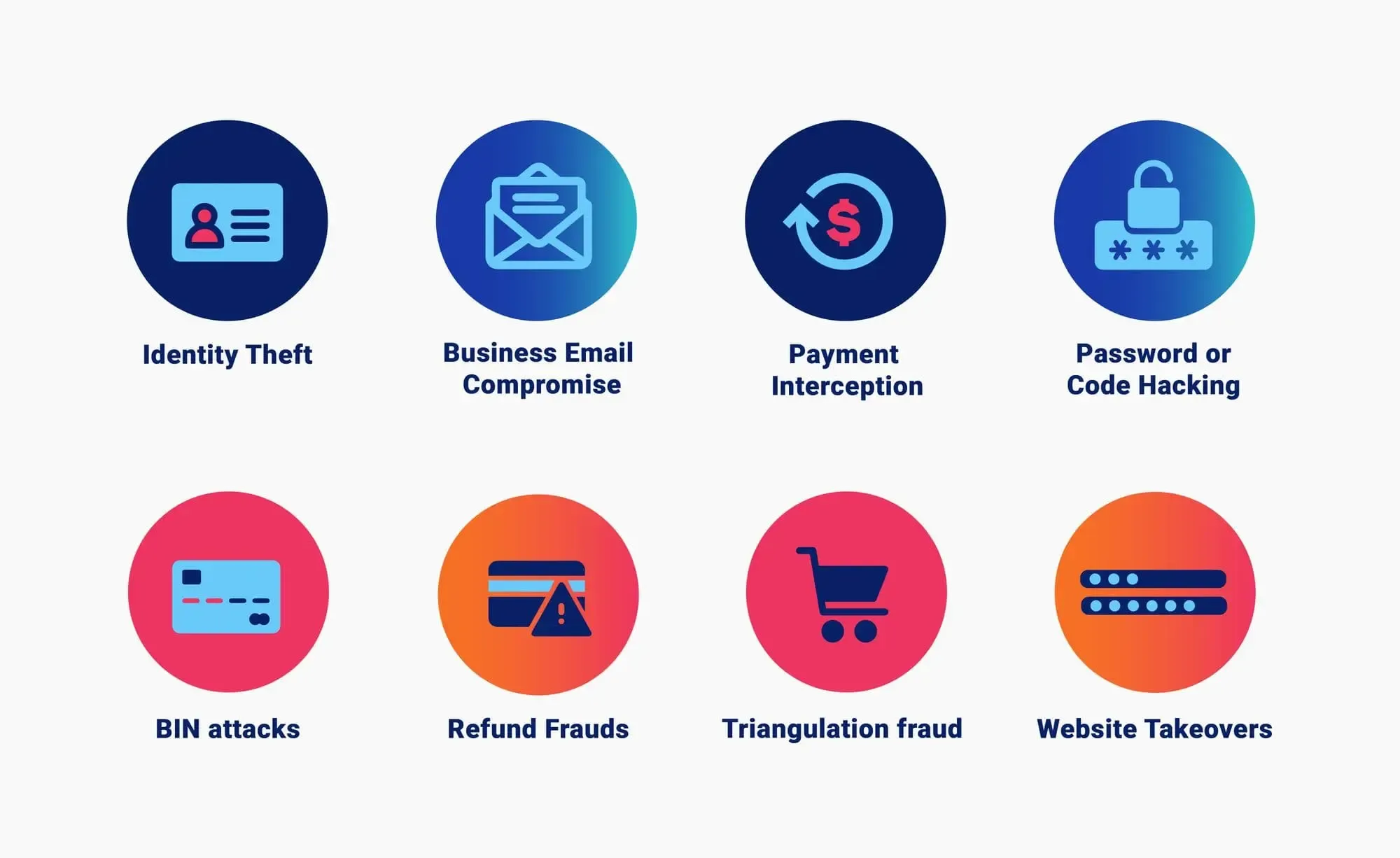

In the picture below, you can see the most common online payment fraud trends, so let’s find out more about them and the solutions to make your payment gateway secure and minimize the risks concerning data breaches.

Identity Theft

The first and most common payment fraud method is identity theft. Essentially, it happens when fraudsters obtain the card data and use it for their purposes: making purchases, transactions, etc.

The Solution to Prevent Identity Theft:

You can inform them about fake websites that can try to steal their data and remind them to check suspicious websites before entering any sensitive data. Many fake web pages have the same name as the original site, but their design can be performed poorly, or the website can have only one page.

Business Email Compromise

There are two main types of this payment fraud trend:

- cybercriminals perform business email compromise by luring their victims and impersonating a higher-up with a fake business email;

- invoice redirection: scammers change the payment information on legitimate payable accounts using social engineering. Then, they impersonate a supplier, ask for invoice fulfillment, and provide the fraudster's bank details instead of the original supplier.

The Solution to Prevent Business Email Compromise:

Companies provide a re-architecture of controls and use one centralized finance and payment app.

Also, they block suspicious incoming emails that can be sent from fraudulent accounts and implement technologies to detect them.

Payment Interception

Payment interception is a fraud trend where scammers take over a payment process. Scammers usually imitate the company representative, and after that, they lead to another fake website. Such websites often don’t allow for disputes or refunds.

The Solution to Prevent Payment Interception:

Inform your users not to enter their data into websites that don't allow for disputes or refunds.

Password or Code Hacking

Password and code hacking is usually performed by using unique algorithms so that a hacker can quickly attack a person.

The Solution to Prevent Password or Code Hacking:

Using secure passwords can prevent this type of fraud. Such passwords should contain many characters and a combination of numbers and symbols.

Tokenisationalso can be an excellent solution for this problem: it allows customers to make online payments on your website without transferring their sensitive data to your website by encrypting this information.

BIN attacks

A BIN is Bank Identification Number, and during BIN attacks, fraudsters attempt to use stolen card information for purchases. The primary tool for this type of payment fraud is bots that wrongdoers use to look for vulnerable websites to attack.

The Solution to Prevent BIN attacks:

Using CAPTCHA, risk management tools, and 3D-Secure authentication can prevent BIN attacks.

Refund Frauds

Here "buyers" persuade you that they didn't receive the goods and want a refund.

The Solution to Prevent Refund Frauds:

For Refund Frauds prevention, you can Create and publish a Return Policy, track all the shipments, add fraud prevention tools to your website, and require proof of purchase from such customers.

Triangulation fraud

Triangulation fraud is called that because three parties are involved in the transaction: the customer, the online store, and the stolen data. This type of scam consists of the following:

An actual customer purchases goods on a third-party marketplace (for example, eBay or Amazon), but the seller fraudulently purchases the product from another merchant. The customers will receive the ordered item, but at the same time, the authentic retailer (in our case, it is a merchant) processed a fraudulent transaction.

The Solution to Prevent Triangulation fraud:

The best way to solve such a problem is to be PCI DSS compliant. To build a secure custom payment gateway, make sure to learn payment services regional limitations. This prevention step will reduce opportunities for fraudsters to exploit cross-border transactions.

Website Takeovers

Here fraudsters are trying to take control of the store by hacking the website through plugins or different apps. Cybercriminals can change payment details and redirect all transactions from the official account of the store to fraudulent ones.

The Solution to Prevent Triangulation fraud:

You can use different security plugins to protect your account from takeovers. Also, performing regular audits of your website can be really helpful too.

The Most Effective Payment Fraud Prevention Tools

Well, it would be difficult to find one solution covering all types of fraudulent activity. The ElifTech team recommends using different systems to achieve a great level of protection. Here are some practical tools that will come in handy:

- API Integration

- Whitebox system

- Dynamic Friction

- Productivity Enhancements

- Pricing Model

Testing Checklist for Payment Gateways

Here is a payment performance checklist that can be helpful for your business:

- Collect data for test credit card numbers from different card providers to successfully perform the integration test.

- Check if different language options are available in your payment gateway.

- Check the regional limitations in different countries to ensure that clients can pay for your goods worldwide.

- Check the currency integration.

- Collect information for e-wallet transactions.

- Ensure that data regarding error codes has been documented for future reference.

- Test all the functions available on your payment gateway to ensure that everything is seamless and provides an excellent customer experience.

- Ascertain the pop-up notices are working correctly.

- Check the session expiry sequence and behavior during the interruptions.

- Ensure that your website and payment gateway integration is done correctly.

- Check the security and fraud preventive measures.

Test Cases for Payment Gateways

In order to provide a high-performance payment gateway, you need to test it and understand how it responds to different situations. Here are some test cases for your payment gateway:

- Test your payment gateway with different card numbers (use the card numbers designed specifically for this purpose).

- Check the behavior of your system when the payment gateway stops responding during payment.

- Try to change the payment gateway language during the payment process.

- Check if, in case of a successful transaction on the payment gateway, the update is sent to the customer by email, phone number, or in another way.

- Check what happens when the transaction is failed.

- Verify flow if the session ends and if the payment process fails

- Check what is happening with your payment gateway's backend during the transaction.

- Check error pages and security pages during the payment process.

- Check the confirmation page after a successful transaction.

- Inspect what happens when a pop-up blocker is on and off.

- See what happens when payment data is put incorrectly.

- Check all messages are sent to your customers.

- Inspect what happens after the transaction is completed.

- Check if you received an authorization receipt from the payment gateway after the transaction.

- Check if everything works correctly with different currencies and payment methods.

- Test how each of the payment options available on your website works.

- Verify the default option for debit card shows.

- Verify how the refund system works and if it is of the same amount, the transaction has been canceled or void.

- See how much time takes to refund costs with the different payment methods.

- Check what happens when the client cancels the translation at different stages.

- Inspect the transaction flow with different fraud protection settings.

Final Thoughts

Security should always be a priority, and testing for payment gateways is crucial to providing excellent services. To make this process more simple and effective, you need to understand the main terms of payment gateway, transaction flow, the purpose of testing, and how to do it. Also, it is essential to create a testing checklist and test cases and be aware of payment fraud trends and solutions to prevent them.

As an experienced fintech development company, we know the value of security and quality services in financial operations. If you want to build your own secure payment gateway or need any guidance on this matter - contact our dedicated team!